|

All of us have enduring childhood summer memories.

I remember the sweet taste of fat, wild blackberries we picked by the Puyallup River … the neighborhood pickup game of baseball in the cow pasture … family picnics at Surprise Lake … clam-digging in Hood Canal … and the summertime stink of rotting cow blood.

Wait, rotting cow blood?

Longtime readers know that I was raised on a vegetable farm in western Washington. Our main crops were radishes and green onions.

Our family farm was small, and my parents worked like the devil to scratch a living out of its soil. Life wasn’t easy, but we never went hungry. And with hard work and frugal spending, my parents found a way to send all three of their children to college.

One way my father stretched a dollar was to avoid what he called “store-bought” fertilizer. Instead, he used cow blood from a nearby cattle slaughterhouse.

So, I remember being unable to fall asleep in August thanks to the combination of the summer heat and the horrible stench of farmland drenched in cattle blood.

Heck, my father would have probably told us to poop in the fields if he thought it was sanitary and would have saved him a couple bucks!

Smelly or not, every farmer needs to use fertilizer. And the most-used and most-important fertilizer is potash.

Potash is important because crops treated with it are extremely high-yielding. Potash also improves food crops’ water retention, nutrient value, taste, color, texture, and disease resistance.

Related story: Are You Investing in This Liquid Commodity?

It is used for fruit and vegetables; rice, wheat and other grains; sugar, corn, soybeans, palm oil and cotton.

Potash is extracted from sedimentary salt beds formed by the evaporation of ancient seas. It is an essential element for all living organisms.

Now, potash is not your typical fertilizer. It is mined — just like metals are — and looks like a crystallized rock before processing.

Plus, there is no substitute for potash. That’s why even my frugal father bought some to supplement the cattle blood. That is also why potash is one of the commodities that I am the most bullish on.

Global Population Growth

The world’s population is growing. There are approximately 7.6 billion people on our planet. And that number could reach 8.6 billion by 2030, and 9.8 billion by 2050, according to United Nations estimates.

That is a lot of mouths to feed. And the amount of food each mouth is eating is also increasing …

|

|

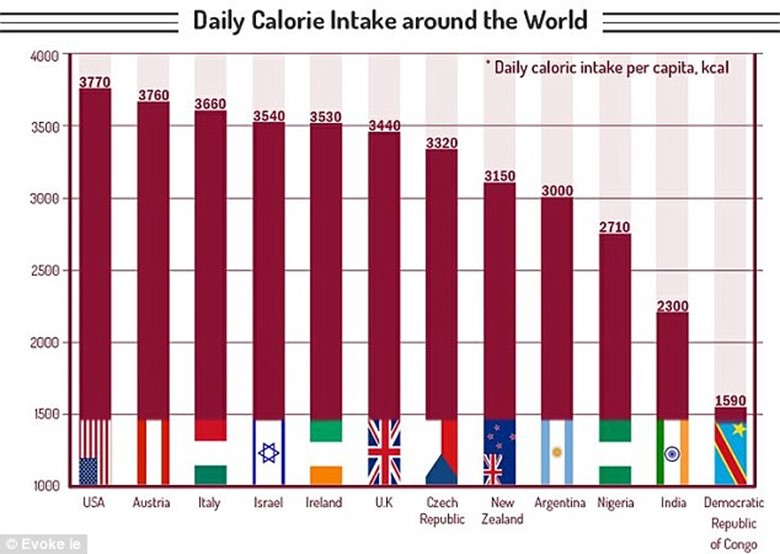

| In the U.S., the average person consumes 3,770 calories a day. Image credit: Evoke.ie |

And we can’t keep feeding the world without fertilizer.

Now, investing in the fertilizer business may not sound sexy. But the dynamics and fundamentals of the food business will turn it into one of the most-profitable sectors you could find.

Rising Incomes = Higher Protein Consumption

Along with population growth, global incomes are also growing. This is especially true in China.

The Chinese are quickly becoming more affluent. In 2004, the average China’s Gross Domestic Product per capita was just $1,000. By 2016, it surged above $8,100, according to the International Monetary Fund.

What’s the first thing you would buy if your income went from subsistence to middle class? A Mercedes? A Rolex?

For most people, the first thing they do is upgrade their food.

And if you’re truly hungry for profits, you can look squarely at the world’s growing appetite for protein.

Rising incomes are driving a dramatic change in Chinese eating habits. The middle class is no longer content to eat bowls of rice and cabbage with an occasional pig knuckle or chicken foot as a treat. They want fruit, candy, dairy products and particularly meat.

FACT: Since 1980, per-capita meat consumption in China has nearly tripled. Health minsters there say citizens should aim to consume between 40 grams and 75 grams of meat per day.

The wealthier a nation becomes, the more calories it consumes. That translates into more fertilizer demand to produce that food.

China’s population is close to 1.4 billion, and its arable land is less than 1 acre per household vs. 100 acres in the U.S.

Consider, too, that China is building more cities, which chips away at arable land. At the same time, its expanding urban population’s appetite for grains, dairy and meat grows along with its income.

As China’s diet becomes more westernized by eating more protein, China has gone from being a net exporter to a net importer of food.

China’s agricultural technology is far behind that of the U.S. And one of the keys to improving its agricultural productivity is to use more fertilizer.

Potash makes it possible to supply more food to consumers and help farmers grow more and better food.

China is a Potash Pig

China is the world’s largest consumer of potash, according to Canpotex, a North American fertilizer trade group.

In fact China imports about 12 million tonnes of potash a year. That accounts for roughly 21% of world demand.

And this year, most of it will come from Canada.

Why Canada?

Potash is only found in significant quantities in Canada, Belarus and Russia, which means that the only stable supply for China is from Canadian producers.

Plus, it just makes economic sense for China to buy from Canada. Our neighbor to the north is home to almost half of the world’s potash reserves.

According to Canoptex, 225 million tonnes of Canadian potash are sold and shipped to 60-plus countries.

And Sanford C. Bernstein & Co. said in a note earlier this year that a potash recovery is in “full force” after a decade-long downward trend. And that’s thanks to steady-to-growing demand from China this year.

|

|

| Potash spot prices are rising from a nine-year low set in July. |

How can you invest in potash?

The Potash Corporation of Saskatchewan (POT) is the world’s largest crop-nutrient company, and produces fertilizer and animal feed products. The company produces three primary plant nutrients: potash, phosphate and nitrogen. Potash is, however, the main focus of its business.

Calgary-based Agrium (AGU) makes a wide variety of agricultural nutrients. Their specialty product list includes nitrogen, phosphate, sulphur and potash as well as herbicides, fungicides, adjuvants and insecticides.

Note: Potash and Agrium are currently seeking regulatory approval for a “merger of equals.” The merger promises significant cost savings for the new $36 billion entity, to be called Nutrien upon deal completion.

Mosaic Co. (MOS) isn’t Canadian, but it is close by being based in Minnesota. Mosaic produces phosphate, nitrogen, and potash nutrients for use in crops and feed.

I’m not suggesting that you rush out and buy any of these stocks today. You need to do your own homework and decide whether any of them are appropriate for your personal situation and financial goals.

However, if feeding the world’s growing appetite is a sector that you want to include in your portfolio, these are three stocks very worthy of your attention.

Best wishes,

Tony Sagami

{ 7 comments }

a fan of yours for over a decade, been a POT stockholder for the last 6 years, just gave up on feeding the world, technology is deflationary, and the kids are concerned about the climate cost of rich diets.

but still value your observations

thanks

Wherw can I buy these stocks?

It is coming back with the large influx of pot growers too. Just look at Scott’s stock.

Source:

Nick Hodge, Outsider Club

A few weeks ago, a shipment of 54,000 tonnes of phosphate was seized in South Africa. Officials say it was illegally mined in the Western Sahara and was on its way to New Zealand.

The single shipment accounts for 13% of New Zealand’s annual phosphate needs. To make up the difference it will bring in other phosphate shipments to keep farmers supplied.

Right after that, another phosphate shipment was seized. That one was headed to Agrium (NYSE: AGU) in Canada. The Danish vessel carrying it was seized in the Panama Canal under suspicion of being mined by the Moroccan government in the Western Sahara, which it has under military control.

It’s long been known that large fertilizer companies like Agrium and Potash (NYSE: POT) have sourced phosphate from the geopolitically sensitive Western Sahara. It seems that situation may now be coming to a head.

Make no mistake: This area of the world is 4X more important to phosphate than Saudi Arabia is to oil.

And yet you hear nothing about it.

Serious supply and jurisdictional challenges are mounting in the phosphate industry. Two shipments have been seized. More seizures are likely.

There will be reverberations. And I expect them to be positive for Arianne Phosphate (TSX-V: DAN)(OTC: DRRSF), which has a fully permitted, high-quality phosphate project right here in safe North America.

Arianne’s world-class, fully-permitted phosphate project is in mining-friendly Quebec.

It will be a mine because the world needs to eat

Very good analyses where their are ingenious rocks in the world response is less to Potash but worldwide it is essential nutrient so very important for food production

have lot of scope for investment

awesomeness

Potash is NOT the fertilizer you should be investing in. In 2008-09, when the price shot up, the world started looking for more potash; and they found it, lots of it.

It has been found all over the world including China, England, Brazil, etc. Since 2009, potash was even found in Ethiopia were a mine has been built and is now in production. The potash deposits in Argentina are so large they probably cover around a third of the entire country.

Also, this article doesn’t mention the different kinds of potash (potassium chloride and potassium phosphate). They are used for different purposes, giving one salt a greater value that the other.

Anyone wanting to invest in fertilizer had better do a little more research for themselves. Do not simply take the information from the above article and go with that.

Hint: Phosphorus is much rarer that potassium fertilizer and the world’s biggest phosphate exporters are all very unstable countries. (That’s the “P” of the NPK fertilizer)