Mandeep Rai

Mandeep Rai, who has more than 13 years of investing experience, is the editor of Top Stocks Under $10.

Working at Weiss Research, Mandeep manages the portfolio of the best-valued lower-priced stocks. He researches and evaluates financial and economic themes and makes decisions on when to buy or sell specific shares for the Top Stocks Under $10 portfolio. He brings a wealth of trading, research and capital markets experience to the Weiss team.

Mandeep started his career on Wall Street working on the New York Stock Exchange Trading Floor. Since then, he has earned his Master of Business Administration (MBA) from University of Florida’s Warrington/Hough School of Business and worked as a stock and credit analyst and helped determine company valuations for private equity and venture capital firms.

He led his CFA Chartered Equity Analyst Team to the state finals with their in-depth sell-side style research, with extensive analysis on companies in the specialty retailing space. Mandeep likes new technologies and gadgets, and you can always find him searching for the next best idea and investment opportunities.

He enjoys spending time with his family, planning health fairs and volunteers making meals at local outreach organizations. Mandeep resides in Jupiter, Fla., with his wife, Charan, and twin boys.

Recently by Mandeep Rai

What Are the Warning Signs?

The official Bull Market is still alive, although as you can tell by this week’s market activity, the euphoria many felt over the past couple of years is in a bit of

New Products, Services, Gadgets –

Knowing What’s for Real

(Mike Burnick, associate editor of Martin’s Ultimate Portfolio and editor of Ultimate Stock Options, is out today. Mandeep Rai, editor of Top Stocks Under $10, is filling in.) One of the exciting

Overcoming Those Knee-Jerk Reactions!

Markets are volatile — any hint of a rate increase sends shudders through the investment community and sends stocks tumbling.

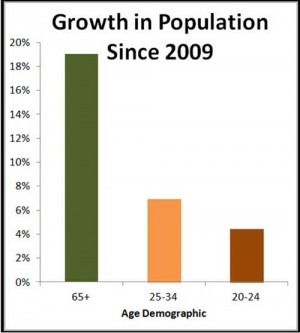

3 Reasons Why Growth Will Stagnate and Stocks Will Follow

Markets were taken by surprise with the recent growth in GDP that reflected a 4.2 percent increase for the 2nd quarter, coming after a 2.1 percent decrease in the first quarter. Remember, that over time, stock market growth has to be reconciled with overall economic growth. It's rare that the two decouple, or move separately. So what can we expect going forward? If growth in production stagnates, you can bet the stock market will follow suit.

Buying on Margin? Here’s the Risk/Reward

(Columnist Jon Markman is away this week. Mandeep Rai, editor of the Top Stocks Under $10 portfolio, is filling in.) What do you do when you hear about a hot stock but