Money and Markets TV

Investing Insights

Our Experts

Money and Markets

-

A Great Change at Weiss Research!

by Martin D. Weiss, Ph.D. | Monday, January 8, 2018 at 8:30am

I'm announcing a great change at Weiss Research. It's a big milestone in my life, perhaps bigger than all my others combined. And it's one that will greatly benefit you. … -

Here’s Why You Should Buy Gold Now

by Matt Badiali | Friday, January 5, 2018 at 4:00pm

Gold is a happy metal. Unlike silver, zinc, copper or iron, which want to join with oxygen to get extra electrons, it doesn't rust. And investors are happy to own it for a long time. … -

It’s the Perfect Time to Buy This Overlooked Industry

by Joe Hargett | Friday, January 5, 2018 at 4:00pm

Generation Z could be even more into video games than millennials. That means considerable prospects for the video game industry for 2018. Here are three to play today. … -

The Dow Hits 25K to Start the New Year. Now What?

by Bill Hall | Friday, January 5, 2018 at 7:30am

The 10-year Treasury yield should be the cornerstone of your investment research process. This "magic metric" tells you whether stocks are going up or down with just one glance. …

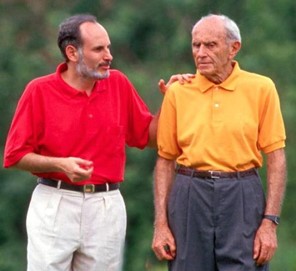

Martin D. Weiss, Ph.D.

-

A Great Change at Weiss Research!

by Martin D. Weiss, Ph.D. | Monday, January 8, 2018 at 8:30am

I'm announcing a great change at Weiss Research. It's a big milestone in my life, perhaps bigger than all my others combined. And it's one that will greatly benefit you. … -

Great News: 4 New Experts Join Money and Markets!

by Martin D. Weiss, Ph.D. | Thursday, January 4, 2018 at 4:30pm

Grow your wealth in 2018 with brand-new ideas from these four fresh new expert voices on the Money and Markets team. … -

The Biggest Investor Scam, Part II

by Martin D. Weiss, Ph.D. | Monday, January 1, 2018 at 7:30am

When average investors are ripped off by fly-by-nights, it’s bad enough. When they’re ripped off by the giants of the financial world, it’s much worse. Martin Weiss shares the best way to avoid the rip-offs and beat the market. … -

Thank you for one of the greatest gifts of all!

by Martin D. Weiss, Ph.D. | Monday, December 25, 2017 at 7:30am

Please accept our warmest wishes for you and your loved ones during this holiday season. The rest of the year, my team and I focus on opportunities to help you ... …

Bill Hall

-

The Dow Hits 25K to Start the New Year. Now What?

by Bill Hall | Friday, January 5, 2018 at 7:30am

The 10-year Treasury yield should be the cornerstone of your investment research process. This "magic metric" tells you whether stocks are going up or down with just one glance. … -

The Leading Man for Your Financial Well-Being

by Bill Hall | Friday, December 29, 2017 at 7:30am

As we close out 2017 and look forward to a new year, in this article, I am going to tell you who the most important person is for your financial well-being and the performance of your portfolio in 2018. … -

Forget the New Tax Bill

by Bill Hall | Friday, December 22, 2017 at 7:30am

President Trump was finally able to flex his party’s majority muscle, overcoming internal dissent to accomplish some long-sought political goals. Bill Hall gives his take on the so-called Tax Reform. … -

The Big Paradox That Is Sending Stocks Soaring

by Bill Hall | Friday, December 15, 2017 at 7:30am

This is indeed a rare time in stock market history. That’s because U.S. stocks, as measured by the bellwether Dow Jones Industrial Average, haven’t just been hanging out near all-time highs. They’ve been printing new highs almost daily. …

Mike Burnick

-

Keep a Wary Eye on Plunging Junk Bonds!

by Mike Burnick | Monday, November 13, 2017 at 3:00pm

The red-hot junk bond market just sent up a red flag for stocks. The last time stocks rose and bonds fell like this, the S&P 500 fell 14% in three months. … -

Tax Reform: Be Careful What You Wish For

by Mike Burnick | Monday, November 6, 2017 at 4:00pm

Tax reform's been the big prize the Trump administration has promised since day one. Now, it's not looking that great for big business, or therefore some stocks. … -

Is the Line in the Sand for Yields about to be Crossed?

by Mike Burnick | Wednesday, November 1, 2017 at 7:30am

There's a tug-of-war in the 10-year Treasury yield. If the 2.5% line in the sand gets crossed, stocks may stocks trade higher. But at 3%, we might see a very different result! … -

This is What Could Finally Pull the Rug Out from Under the Market

by Mike Burnick | Monday, October 23, 2017 at 4:00pm

Don't get fooled into thinking the stock market will continue to go up forever. Any one out of dozens of potential catalysts could trigger a sharp correction in this overbought market. …

Mandeep Rai

-

What Are the Warning Signs?

by Mandeep Rai | Friday, July 24, 2015 at 7:30am

The official Bull Market is still alive, although as you can tell by this week’s market activity, the euphoria many felt over the past couple of years is in a bit of …

-

New Products, Services, Gadgets –

Knowing What’s for Realby Mandeep Rai | Thursday, June 25, 2015 at 7:30am

(Mike Burnick, associate editor of Martin’s Ultimate Portfolio and editor of Ultimate Stock Options, is out today. Mandeep Rai, editor of Top Stocks Under $10, is filling in.) One of the exciting …

-

Overcoming Those Knee-Jerk Reactions!

by Mandeep Rai | Monday, March 16, 2015 at 4:30pm

Markets are volatile — any hint of a rate increase sends shudders through the investment community and sends stocks tumbling. … -

3 Reasons Why Growth Will Stagnate and Stocks Will Follow

by Mandeep Rai | Friday, September 12, 2014 at 5:00pm

Markets were taken by surprise with the recent growth in GDP that reflected a 4.2 percent increase for the 2nd quarter, coming after a 2.1 percent decrease in the first quarter. Remember, that over time, stock market growth has to be reconciled with overall economic growth. It's rare that the two decouple, or move separately. So what can we expect going forward? If growth in production stagnates, you can bet the stock market will follow suit. …

Jon Markman

-

The Real Reason Why Amazon is Packaging Up Profits

by Jon Markman | Thursday, November 30, 2017 at 7:30am

Many people may think Amazon's wasting time by waging war on clear clamshell packages. But the move reflects a deeper philosophy: Put the customer first. … -

Don’t Hitch Your Fortunes to Tesla’s Electric Truck

by Jon Markman | Tuesday, November 21, 2017 at 7:30am

Elon Musk has dazzled Tesla stockholders with magical street machines that run on electricity and think for themselves. But where are the profits!? … -

Apple Will Lead the Augmented Reality Revolution

by Jon Markman | Thursday, November 16, 2017 at 7:30am

Apple is developing a new augmented reality (AR) headset that could hit the market as early as 2020. Tim Cook, Apple's CEO, says AR is going to change the way we work, play, learn and connect. Investors should take note. … -

Laser Weapons Set to Boost Military Might at the Speed of Light

by Jon Markman | Thursday, November 9, 2017 at 7:00am

The military is testing laser weapons for deployment on the land and the sea and in the air. In tests, the weapons have melted pickups from a mile away... …

Tony Sagami

-

Invest in Your (or Your Parents’) Long-Term Care Today

by Tony Sagami | Wednesday, January 3, 2018 at 7:30am

The "Pension Protection Act" makes it possible for Americans to cover the costs of long-term care. $50,000 of cash can create up to $500,000 of LTC coverage! … -

Goodbye 2017; Hello 2018!

by Tony Sagami | Wednesday, December 27, 2017 at 7:30am

Tony Sagami believes many investments will be cheaper in 2018 than they are today. And he suggests investors have some cash on hand to buy them when the time is right. … -

Economics: Millennial Style

by Tony Sagami | Wednesday, December 20, 2017 at 7:30am

Have you spoken to a 20-something Millennial about economics lately? You really should. But I want to warn you; you may be VERY surprised at how they feel about capitalism, communism and socialism. … -

Are you Prepared for Retirement?

by Tony Sagami | Wednesday, December 13, 2017 at 7:30am

How much do you have saved for retirement? Most financial planners recommend a nest egg that is 10 times your annual salary. However, numbers can be deceiving. Here's why ... …

Sean Brodrick

-

Our Outlook for 2018: Stocks, gold, oil and more.

by Sean Brodrick | Wednesday, January 3, 2018 at 4:30pm

What's in store for stocks, gold, oil, copper and stocks this year? Discover that and more in The Edelson Outlook for 2018. … -

The One Webinar You Should See Before 2018

by Sean Brodrick | Wednesday, December 27, 2017 at 4:00pm

Some of my colleagues and I put our heads together in a webinar to talk about our outlooks for mining and metals markets in 2018. We shared our ideas in gold, silver, lithium and more. Be sure to watch it. … -

Is This the End of the Line for Cobalt?

by Sean Brodrick | Thursday, December 21, 2017 at 3:00pm

Do you think the cobalt miner rally is done? Or it is just getting its second wind? That depends on if you believe the big banks or your own lying eyes. … -

Cannabis 2018 Preview

by Sean Brodrick | Thursday, December 14, 2017 at 4:00pm

Sean Brodrick has written a lot about cannabis in 2017. He's guided his subscribers to heaps of money. So listen to him now, when he says 2018 could be the most awesome year yet for cannabis investors. …

JR Crooks

-

Is 3D Printing on the Verge of Its Next Breakout?

by JR Crooks | Wednesday, November 8, 2017 at 7:30am

Invest in 3D printing before a new wave of innovation brings it back into the spotlight. One company is ready to expand immeasurably. … -

Oil Bears Are on the Prowl

by JR Crooks | Wednesday, October 25, 2017 at 7:30am

Just when the bulls began snorting and kicking their way into crude oil, the bears capitalized. The price of crude oil fell more than 5% from Sept. 28 to Oct. 6. Since then, the bulls have taken back the ball. Here’s how to play it… … -

The Fed and Even More Debt

by JR Crooks | Friday, June 23, 2017 at 4:00pm

The Fed is entertaining a disaster: Unwinding its $4.5 trillion balance sheet is expected to become part of its normalization efforts. That’s a bad idea. Here’s why … … -

Dancing with Crude Oil

by JR Crooks | Friday, June 9, 2017 at 4:00pm

Despite the long-term bearish fundamentals, crude oil looks set to rise near term, to $53 per barrel and then to $58. Put your dancing shoes on! …