I recently turned 61, although I don’t plan to retire anytime soon. In fact, I enjoy what I do so much that I plan on working right up until the day I physically can’t.

That is exactly what my vegetable farmer father did. Since my father lived until 93, it’s likely I have a lot of work ahead of me.

I am sad to say that my father is no longer around. But I’ll always remember how fiercely proud he was of his three children.

While I have had a long, successful career in the investment business, my siblings are just as — if not more — accomplished than me. My younger brother has worked at Nordstrom for over three decades and is one of its top executives. And my baby sister is one of the most skilled and respected occupational therapists in the state of Washington.

My sister’s specialty is helping people to recover from strokes and develop the skills they need for daily life. She almost exclusively works with patients over age 60 at nursing/assisted living homes. I am very proud of her, as she has improved the lives of thousands of people. She is one of the most devoted healthcare professionals I have ever known.

Over Thanksgiving, my sister told me about one of the most-common complaints she hears from her assisted living/nursing home patients …Â

That is, how unpleasantly surprised they are to learn what Medicare pays toward the cost of their care.

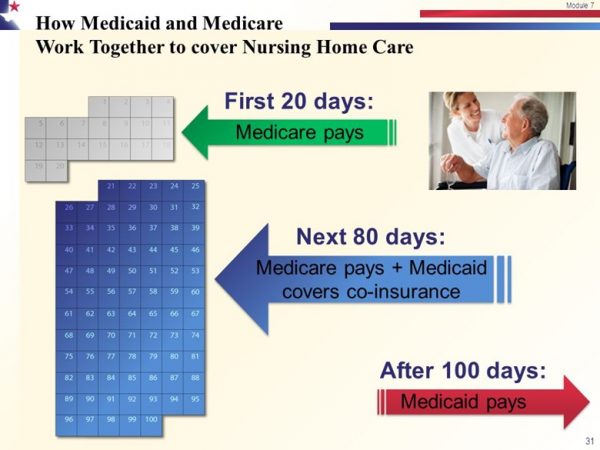

The sad truth is that Medicare covers very little of the cost of nursing home care.

Medicare Part A will pay for up to 100 days of “skilled” nursing home care. But after 100 days, you’re on your own. That is, unless you are dead-broke and qualify for Medicaid (social medical welfare).

Worse yet, Medicare pays ZERO toward the costs of assisted living care. Yup … ZILCH!

Worse yet, not only does Medicare cover woefully little of the cost of a nursing home …

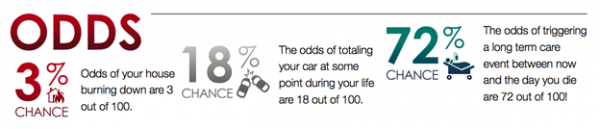

But the odds are extremely high that you and I will require some long-term care in our lifetime.

Hard Truths About Long-Term Care

You don’t need to panic. But you do need to know the hard truths about the long-term care crisis.

- If you are 65 years or older, there is a 72% chance that you will require some type of long-term medical care in your lifetime.

- Moreover, if you’re a woman, the odds get even worse. Eight out of 10 women will need long-term care.

- And if you’re married and over 65, there is a 91% chance that one of you will experience a long-term care event, according to USA Today.

Warning: Long-term care isn’t cheap! The national average cost for a Nursing Home Private Room in 2016 was $102,696.

This is just the average cost, with average accommodations. One can only imagine the increased future costs that will break most everyone’s bank account.

While all of that sounds pretty dire, there is a new solution that everyone over the age of 50 should consider as a core part of their retirement security plans.

I’m talking about 844 Long-Term Care Insurance.

Would you like some extra cash — a LOT of cash — to pay for your (or your parents’) long-term care expenses?

As I mentioned earlier, Medicare covers a woefully small amount of the cost of long-term care. The government knows this.

Moreover, our elected officials were so worried about the tidal wave of aging baby boomers that it passed a piece of legislation called the “Pension Protection Act,” which makes it possible for Americans to cover the costs of long-term care for mere dimes on the dollar.

Yes! Dimes on the dollar. In some cases, for as little as 10 cents on the dollar using 844 Long-Term Care plans.

Don’t feel bad if you haven’t heard of 844 LTC plans, because most people haven’t.

844 LTC plans are largely an unknown IRS-approved financial instrument. One that allow you to pre-pay for long-term care expenses at a highly discounted rate.

The ratios vary, based on your health and age. But every dollar you deposit into an 844 LTC plan will immediately explode by 300%, 400%, 500% or even more into long-term care dollars.

- $25,000 becomes $75,000 to $250,000.

- $50,000 become $150,000 to $450,000.

- $100,000 becomes $300,000 to $1 million.

Not only do you pre-pay for care — in your home, an assisted-living facility or a luxury nursing home — for mere dimes on the dollar …

|

It’s Time to Sell Our list of 25 toxic stocks to sell now, including write-ups on the 10 that are the most widely held is available now. A quick glance will show it contains many household names. The stocks on the list sport a combined market capitalization of more than $373 billion. Read more here … |

But your spouse or your heirs will also receive up to 200% of your money back as a life insurance benefit if you don’t require any long-term care in your lifetime.

Yes, you read that right.

Sounds great, doesn’t it?

Well, it is but you need to decide quickly if an 844 LTC plan is right for you. With a $20 trillion national debt and exploding budget deficits, President Trump and Congress are aggressively looking for new ways to balance the budget. These 844 pre-paid LTC plans are so good that I fear that they may soon go the way of the dinosaur.

844 LTC plans are a lot like 529 pre-paid college tuition plans. You invest a lump sum of money ($50,000 to as much as $500,000) into an 884 LTC plan and immediately create an account that is three, four, five — even as high as 10 times higher should you experience a long-term care event.

That’s right. $50,000 of cash can create up to $500,000 of long-term care coverage!

Moreover, if you have the good fortune of dodging the long-term care bullet, you can either ask for a full refund OR have a tax-free life insurance benefit payable to your beneficiaries that is, at a minimum, equal to your deposit.

Here’s how it works …

844 LTC plans are insurance contracts that include an IRS-approved long-term care benefit that allows you to access the contract value to pay for qualifying long-term care expenses.

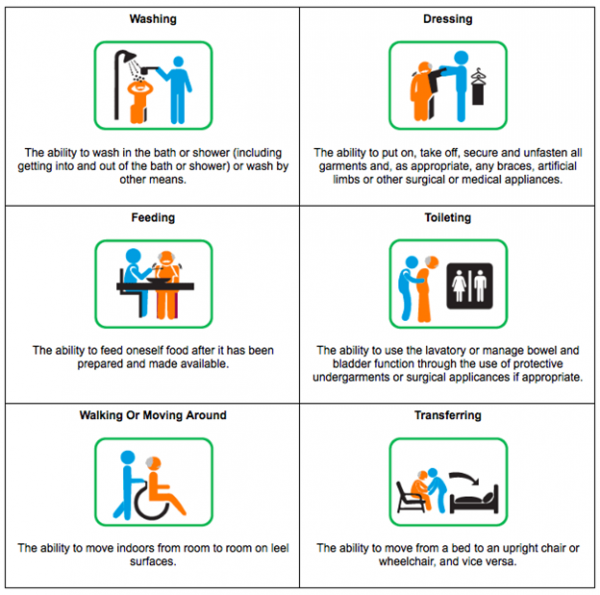

Once you trigger the LTC provision by not being able to perform two of the six Activities of Daily Living … or you become cognitively impaired … your 844 LTC Plan will pay out a monthly benefit equal to at least 300% and up to as much as 1,000% of your deposit.

The six Activities of Daily Living.

Image credit: Singapore Ministry of Health

Now, 844 LTC Plans are more detailed than I can cover in this column and vary widely. So you need to do your homework before investing any money.

I know what you are asking: “Because the 844 LTC plans are relatively new, where can I go to set up my plan? Can I qualify?”

One of my good friends and Weiss Ratings contributor, David Phillips, has prepared a free, detailed Special Report on 844 LTC plans that I highly recommend you read. Go to https://www.epmez.com/844LTC.

I’m 61 years old and I sometimes wonder where all the years have gone. But one thing I’m sure of is that I don’t want to worry about the high cost of long-term care ruining my well-laid-out retirement plans.

Unless you are very poor 844 LTC plans are likely the best the solution to a very costly retirement problem that all of us will eventually face.

Best wishes,

Tony Sagami

{ 9 comments }

Tony,

Thanks for the info on the 844 LTD program. My in-laws had long term care policies and my father-in-law died from a massive heart attack at age 84. He paid into the policy for years and never used a dime of it–lost all the premiums. My mother-in-law used her’s for two years of in home care before passing.

I am 72 and my wife is 65 and both in good health so this 844LTC is what we have been looking for.

Thanks,

Tom Zentz

Me thinks the phrase “… your 844 LTC Plan will pay out a monthly benefit equal to at least 300% and up to as much as 1,000% of your deposit.†Needs to be revisited…I assume you meant something like “annual benefit†or a total amount equal to…??

Solution? Simple, move to Canada when you’re young enough to make a real contribution to those that will look after you when you can’t look after yourself.

Are there any age restrictions?

Happy New Year! Looking forward to hearing from you soon. Derrick.

When I have worked all my life to skimp and save now that I my go into a nursing

Home it may cost me all my savings ..Now it may cost me everything I own,

The only good to come out of this is the longer we live the more money they

can squeeze out of us…..Why is it so costly??

Are these only available to Americans? Are these available to people outside of U.S. to use in their own country, ie. Canada?

What is the cost structure? Who is an agent for Nebraska? Thanks

My retirement investment along with everyone else is at great risk with this uncontrolled bull market. The indicators are purposely telling us that a pull back is not only imminent but late. Where do we go from here?? Cash?