|

As we close out 2017 and look forward to a new year, in this article, I am going to tell you who the most important person is for your financial well-being and the performance of your portfolio in 2018.

And it’s probably not who you think.

Can you guess who it is?

No, it’s not the president of the United States, Donald Trump; iconic investor, Warren Buffett; or Jamie Dimon, CEO and Chairman of JPMorgan Chase.

It’s a man named Jerome Powell.

Why do you need to know about Jerome Powell?

It’s because — after being nominated by President Trump as the next chair of the Federal Reserve and confirmed by the Senate earlier this year — Powell will replace Janet Yellen and begin serving as chair of the world’s most powerful central bank in February.

For Safe Money investors, the changing of the guard at the Fed is a big deal.

That’s because, as I have been hammering home in my previous Money and Market’s articles, it’s the magic-money machines at central banks all around the world that are propelling the stock market to all-time highs.

And since it’s our own Fed that leads the global easy-money band, today we are going to take a close look at who Mr. Powell really is.

That way, we’ll know what to expect from him.

And more importantly, you’ll be able to successfully position your portfolio to protect your wealth and maximize gains under his regime.

|

Where are the markets headed? Have you ever wondered what the pure, unbiased, DATA is showing? I know I’m constantly thinking about that, and it’s why I get so much use out of the Weiss Ratings website. My colleagues over there have a completely independent, unbiased, and proven analytical model that covers more than 14,000+ stocks, ETFs, and mutual funds trading in the U.S. or Canada. Best of all, they publish a free daily email newsletter that tells investors what they’re data is showing about trends in all of those investments. You can sign up to receive that critical intelligence here. |

Powell is no stranger to the Fed. He’s been serving on the Board of Governors since President Barack Obama nominated him for the role in 2012.

But now Trump has elevated Powell to the marquee post. As the leader of the world’s most powerful central bank, Mr. Powell will play three major roles:

- The public face of the Fed.

- The overseer of bank regulation.

- The primary determiner of monetary policies.

That means he’ll take the lead on setting interest rates and on setting targets for the size of the Fed’s balance sheet.

So exactly who is Jerome Powell?

He’s a former executive from The Carlyle Group, which is one of the world’s largest and most successful hedge-fund sponsors and private-equity firms. Powell would be the second Carlyle Group veteran appointed to the Fed board by President Trump.

Earlier this year, Trump nominated Randal Quarles, another Carlyle Group alum, to a Fed board seat that oversees bank regulation.

Powell is a lawyer, not a Ph.D.-trained economist like Yellen and the two prior holders of the top Fed post before her — Ben Bernanke and Alan Greenspan.

Powell’s degrees are from Princeton and the Georgetown University Law Center.

All-in-all, Powell, who goes by the nickname “Jay,” fits the mold of a typical Trump pick for a premium post.

He’s a Republican who built a vast fortune as a businessman. His net worth has been estimated at between $19.7 million and $55 million.

According to reports by The Washington Post, if Powell indeed gets the job, he will be the richest Fed chair since Marriner Eccles.

Eccles, a banker and economist, held the position from 1934 to 1948.

Trump bucked tradition when he picked Powell instead of keeping Yellen as the current chair.

Most presidents have typically re-nominated the sitting Fed chair, especially when the economy was performing well.

Trump could have also gone in a sharply different direction by tapping Fed critics like John Taylor, a Stanford University economist, or Kevin Warsh, a former banker and ex-Fed governor.

But for Trump, it was imperative to find someone who would keep the current easy-money machine cranking along and who would not raise interest rates too quickly.

Here’s why:

Beginning in February, Trump has repeatedly used Twitter to take credit for the stock market’s rise. This, he says, shows how successfully he is performing as president of the U.S.

If a picture is worth a thousand words, then this recent series of tweets coming from President Trump earlier this year was priceless.

That’s because it gave the markets a big hint that he wouldn’t want anyone running the Fed who would change course and risk sending the stock market into a freefall.

Here’s his first tweet about the stock market in February.

|

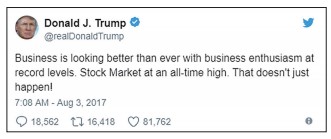

This summer, he followed with this one:

|

And in the fall, he double-dipped and sent out two tweets about the stock market’s meteoric rise.

|

So there you have it …

You now know why President Trump appointed Jerome Powell as the head of the Federal Reserve.

It was to keep, and perhaps expand, the experimental monetary policies that have put stocks on a roll and fueled the market’s huge rally since the end of the 2009 financial crisis.

Followers of Trump’s Twitter feed have known the real reason for months: Trump has doubled down on the stock market and isn’t willing to take the risk that the stock market would drop.

Powell is widely expected to keep most of Yellen’s casino-based, Las Vegas-, Macau- or Monte Carlo-like monetary policies.

Indeed, she and other central bankers have bet an unlimited supply of credit in an attempt to reinvigorate GDP to low-but acceptable levels.

I’m looking for Powell to give the game a Wall Street touch. As a result, stocks will continue to zoom higher in 2018 as long as he continues to continue to roll the easy money policy dice.

Happy investing in 2018!

Bill Hall

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 7 comments }

I must have missed something. Isn’t all this a good reason to have kept Janet Yellen.

You’re probably right.Doesn’t matter who they put in there.Of course,they want the best salesman(or woman) to convince investors everything will be OK.

‘Trump has doubled down on the stock market and isn’t willing ‘ Hi Bill,What exactly does this mean?Thanks,Paul

Thanks

Do you really think he has much of a choice?Basically the Fed is just trying to keep the Titanic afloat.They talk tough on inflation,while keeping interest rates well below the actual inflation rate.With massive govt debt,they can’t raise interest rates to reasonable levels,without the interest on the debt growing too large to service.So,until the Dollar,which has been weak this year,goes into freefall,it’s easy money.

Hi Bill, excellent article!

How high would you expect the index to go in 2018, 30,000 or more?

The recent changes are focused on a growth plan not a “Hold On Plan” as the USA needs to get back on top of all aspects of the economy. The Central Bank is very important to any National Financial Planning as they do operate independently and “we the people” must live with their policies wheather we like themor not. It will be interesting to watch what will happen but a plan that helps the great majority must be implemented now. Wish us all the best.