How much do you have saved for retirement? Most financial planners recommend a nest egg that is 10 times your annual salary.

With the median income in the United States around $57,000 a year, that means the average American needs to save about $600,000 (not including your home’s value) to comfortably retire.

Unfortunately, the “average” American falls woefully short of that recommended amount. The average retirement account balance is $95,000 today, way below the $600,000 target. And surely insufficient to finance a comfortable retirement.

Averages, however, can be deceiving. I say that because:

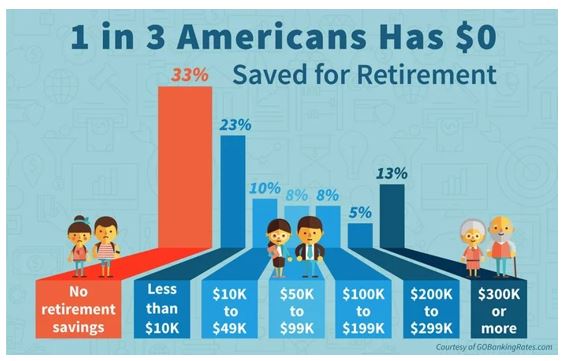

One out of three Americans has ZERO set aside for retirement. Zip. Nada. Zilch.

- Due to the high cost of living, an astonishing half of those who did save will have no funds left by the time retirement rolls around.

And don’t count on Social Security to bail you out. As of August 2017, the average Social Security check was $1,413 a month. And don’t get me started on the solvency of the Social Security system!

Moreover, a growing number of older Americans are being forced to delay retirement or to keep working just to make ends meet. Indeed, 20% of Americans say they can’t afford to give up work while nearly three in 10 have insufficient income from pensions and savings.

Moreover, a growing number of older Americans are being forced to delay retirement or to keep working just to make ends meet. Indeed, 20% of Americans say they can’t afford to give up work while nearly three in 10 have insufficient income from pensions and savings.

Worse yet, a BankRate survey showed that only four out of 10 Americans have enough in savings to cover a surprise $500 expense. Another 21% said they would rely on a credit card, while 20% said they’d cut back on other expenses. Another 11% said they’d turn to family or friends for the money.

Remember, the typical American will spend about 20 years – maybe much longer — in retirement, so you better prepare for the last third of your life.

Of course, talking about saving is easy. Doing so, not so much. This is what I tell my four children:

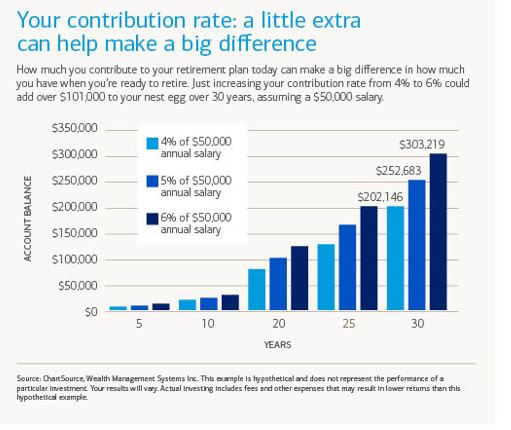

- Save at least 10% of your income by putting 4% in a regular savings account and 6% in your company-sponsored 401(k). Why 6%? Most companies match 50 cents on the dollar up to the first 6% of employee savings.

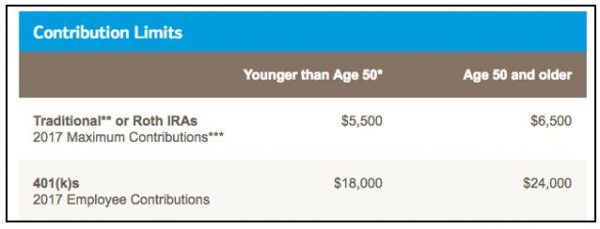

- If you can save more than 10%, do it! Contribute as much of your income as you can to your 401(k). The maximum contribution for 2018 jumps next year from $18,000 to $18,500 for workers under 50 years of age. But that rises to $24,500 if you are over 50 thanks to a “catch up” contribution limit of $6,000.

- Don’t buy a new car! Not only do new cars cost more, they rapidly depreciate as soon as you drive them off the car lot. The average new car loses 19% of its value in one year.

- Whatever car you buy, finance for no longer than three years. If you need to stretch out the loan longer than that to afford it … you can’t afford it.

- And my most important No. 1 recommendation? Avoid debt at all costs! I am proud to say that I don’t owe a dime to anybody in this world. Nothing! And I am teaching my adult children to avoid debt as well. In fact, the only debt that I tell my children they should ever take out is a home mortgage. And yes, all four of my children own their cars free and clear.

Related story: You Did WHAT With Your College Money?!

At 61 years old, I’m not that far away from the traditional retirement age of 65. So these aren’t hypothetical, classroom concepts that don’t affect me.

Fulfilling, comfortable retirements don’t happen by accident. They are carefully planned for. And the above steps are a great way to help you get there.

Best wishes,

Tony Sagami

{ 9 comments }

Great advice! I’ve been a supporter of debt free living, paying down the mortgage as soon as possible to the point you can feel a bit of pain with increased principal payments. As for cars / toys you can have all that you want providing you are willing to pay for them with cash on hand. No long term car payments allowed or trading for a new ride just to impress others, and no leasing allowed. Save and invest for your future, and never try to live paycheck to paycheck.

The statistics you quoted here are truly scary for the future of our citizens and our country. With the medical discoveries we are seeing these days we will live longer but without retirement savings that will not be a blessing for those who†live for today†and the heck with tomorrow. If your retirement plan is to be a burden or your kids good luck since they may be following the example you taught them about saving for the future!

Unless your income is in excess of $200K/year, I don’t think a nest egg that is 10X salary is large enough to retire on for many people.

You are wrong…..Reasonable college, community college& 2 at Univ….Health care…..andmortgage

Well, you nailed my wife and I! I am 61 years old, and lost my entire retirement when I was unemployed for 8 years. Now employed again (at half my 2007 wage), I expect to be in the workforce for another 9-10 years and will have saved an estimated $90K by then. Just below your average.

We’ll put together a portfolio of rental income property and manage them for our source of income initially, using the savings and the equity in our home. In time, we will hire the managment out as well.

We can do all this because we are for the most part, debt free. My point is, even broke at 60 like we were, preparing for retirement is doable and achievable if you put the effort in and cut your lifestyle to the bone. Now, you may not be advocating eliminating almost all of one’s disposable income like we have (almost) done, but we have to be able to sock away that 10% or more every month no matter how small or large our earnings are.

And everything else gets cut or eliminated until we do. Thank you for the words, they are an encouragement.

I say that the most important thing in retirement is to have a home paid for. That in itself reduces your expenses immensely.

great advice! I’ve been blessed to be able to save 9 times my annual earnings. I plan to continue working until my wife is eligible for Medicare. We have been shore to put both of our children through college with only a little student loan debt. Had it not been for amazing employment situations I would not have been so fortunate. My former employer provided a 4 1/2% match on a 6 % contribution to their 401k. As I was given raises I increased my contribution to the 401k by one percent every raise ending up at 12%. I have been so blessed.

The chart is quite misleading. What the “American” means here,?

1) All Americans, including new born baby?

2) Work age Americans, from 16+ ?

3) Old age Americans, from 50+ ?

If the definition is case 1 or 2, we don’t need to worry much, because those so called “no retirement savings” or “Less than” groups are just children or teens.

If “Americans” here means old aged Americans at 50+, then this is a serious problems.

My guess is when they say “Americans” they actually mean case 2, work age Americans. If this is the case, of cause there are many young people at their early working stage, have no or little retirement savings.

Dchen has a point. Surveys and polls are often misleading for numerous reasons. Often the “real” answer is not listed. Some polls will let you skip, some have “none of the above” as options, but many require selecting an answer of the surveyor’s choice, not your choice. Savings doesn’t tell the whole story. Many have income from other sources than SS such as retirement programs but one most interesting is a recent case. The young man did work but had no savings or retirement program. Suddenly he is a millionaire with more to come. Inheritance!

Your advice is good advice about savings and no debt. You are right that many haven’t prepared. Contrary to the studies claims, we don’t know the extent of the dire circumstances. There are people who are living well in retirement with no pool of funds. We don’t know why.