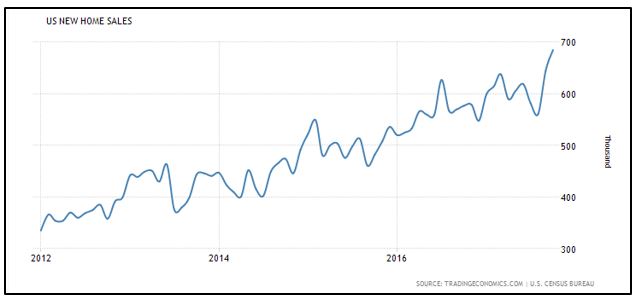

Last week, the October new home sales report was released. The results may have been surprising to some. Housing market growth continues to march forward.

After a very strong September, sales were expected to dip a little bit. But sales ended up beating the forecast by about 10%, or 60,000 homes.

The 685,000 new homes sold in October are also the highest since January of 2007.

October new home sales ended up beating the forecast by about 10%. And these two companies will benefit from the growing housing market.

It’s very unusual for the highest number of homes to be sold in October. That hasn’t happened since 2002, as most homebuyers tend to go house hunting in the spring or summer.

Growth in the housing market looks like it will keep trending upward for now. This has created some investment opportunities among ETFs as well as individual stocks.

When looking at stock returns across all industries over the past year, the iShares U.S. Home Construction ETF (NYSE: ITB) has been the most consistently profitable. The exchange-traded fund is up over 25% in the past three months, and up about 51% over the past year.

There are also some good investment opportunities out there with individual companies. One of these opportunities is PulteGroup Inc. (NYSE: PHM).

PulteGroup has a presence in 27 states, and is set to see double-digit revenue growth for the second straight year in 2017. Looking ahead, it’s expected to continue to grow its revenues by over $1.7 billion, or 32%, through 2019.

Another good opportunity in the homebuilding industry is Lennar Corp. (NYSE: LEN). Lennar is only in 18 states right now, but it is actually expected to bring in almost $4 billion more than PulteGroup this year.

However, it’s expected to grow its revenues by only 25% over the next two years. So, while Lennar is the bigger company, its growth projection is slightly smaller.

Either way, both of these companies will benefit from the growing housing market. And right now, the future is looking bright.

Regards,

Ian Dyer

Internal Analyst, Banyan Hill Publishing