How was your holiday? Mine was spectacular.

I am much too old to sit on Santa’s lap. And the meaning of the holiday season has dramatically changed for me over the years.

As a child, the holidays meant presents and time off from school. But now that I am older (and hopefully wiser), the holidays are no longer a time, a season, or even a celebration.

To me, the holidays are more of a state of mind.

Instead of opening presents, it is about opening our hearts to the important people in our lives.

And now that I’m an AARP-aged adult, I have come to believe that the reason we spend so much money on Christmas presents is that we use them as a substitute for the words of love and appreciation that are unfortunately spoken too infrequently to the important people in our lives.

And I want to let you know that you are one of those important people. Because without your support, I would not have the opportunity to pursue my great professional passion of searching the globe for unique investment opportunities.

|

Where are the markets headed? Have you ever wondered what the pure, unbiased, DATA is showing? I know I’m constantly thinking about that, and it’s why I get so much use out of the Weiss Ratings website. My colleagues over there have a completely independent, unbiased, and proven analytical model that covers more than 14,000+ stocks, ETFs, and mutual funds trading in the U.S. or Canada. Best of all, they publish a free daily email newsletter that tells investors what they’re data is showing about trends in all of those investments. You can sign up to receive that critical intelligence here. |

That passion was inherited from my father. He was a vegetable farmer who worked his fields with an unwavering dedication to deliver the best product he could to his customers. In fact, my father’s produce was so perfect that generations of families would drive to our remote farm in western Washington to purchase his delicious vegetables.

I don’t have any dirt under my fingernails like my father did. But I share the same passionate commitment to my customers. And that is why I so truly value your interest in my work.

|

Thank you, thank you from the bottom of my heart.

Lastly, this holiday season is an extra special one for me as I welcomed my first grandchild, Anderson Sagami-Sullivan. I have to admit; my adorable granddaughter has sent me into grandpa heaven.

Other than the poopie diapers, I can honestly say that being a grandparent is the most enjoyable experience I have ever had in my life … second only to coaching my children’s basketball teams.

Speaking of poopie diapers, I want to warn you about some investments that I think are going to stink in 2018. Like what?

- Bitcoin, Litecoin, Pizzacoin and all the other dizzying cryptocurrencies. Yes, there really is a cryptocurrency called Pizzacoin. There are more than 1,100 known cryptocurrencies at this time. And given all the buzz around them (and with a few hundred billion dollars flying around this market as we speak), we can expect even more in the near future.

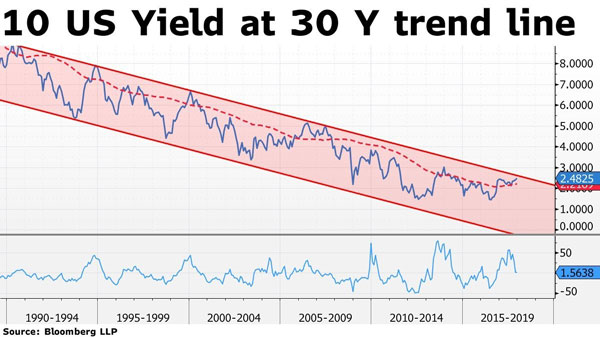

- Bonds and bond funds. The three-decade-long bull market in bonds is about to die. After four interest-rate hikes and the promise of more to come, bond investing looks quite dangerous to me.

|

- Return of volatility. The stock market was shockingly calm in 2017, with nary a significant correction. In fact, the S&P 500 has gone up a record 13 straight months (14 months if the December gains hold). That won’t last. And the forthcoming roller coaster ride is going to make a lot of investors sick to their stomachs.

|

I could go on about things that worry me: the new Federal Reserve chairman … the rise in auto loan and credit card defaults … extreme investor bullishness … an overall dividend payout ratio in excess of 100% of profits … the rapidly flattening yield curve … $20 trillion of global QE … and historically high, nosebleed valuations. Just to name a few.

In short, I believe a lot of things — stocks, bonds and real estate — will be much cheaper in 2018 than they are today. However, you won’t be able to take advantage of longer-term price drops unless you have the cash to buy them.

Don’t think of cash as a boring, unproductive place to hide your money. Cash is an option to buy something cheaper in the future. And unfortunately, that is what most of the investors I talk to have none of.

Don’t be one of them.

Wishing you a healthy and prosperous 2018,

Tony Sagami

{ 15 comments }

Welcome to the grandpa club!

Tony Followed you for many years & I am ideally positioned in accordance with your current view. Boy, I hope you are right! Have a great New Yearâ€¼ï¸ LS

Thank for your insights for 2018, and congratulations. Precious metals ?

Congratulations on your lovely grand daughter !! And thanks for your comments. I look forward to following your thoughts next year :)

Cool article Toni. When I was 10, God came to me real strongly. And in that, I asked Him what I’m here for, and He said I’m here to help people. We are a special group who are like this. More need to join !

Congratulations for your granddaughter!!! She is so cute. God bless her. and as we say here, may God send her wonderful days to come!

Tony,

I agree with you, investing in crypto currencies is soon to be a dead end or major loss.

However, BLOCKCHAIN is the future of banking, healthcare files, government files, cloud computing/storage and on and on. Why?? Main reason….cannot be cyber attacked!!

Do some research and report on that. You’ll be glad you did.

Bob H.

Tony – Thank you for your guidance for 2018! I have found your advice both sound and forward thinking.

I am reassured by your roots and hard working family from western WA. Your parents should be proud. Welcome to grandparenthood. It is the most rewarding, especially since you can see your child as a parent! You can take pride in successfully raising them!

. A piggy bank, especially a mechanical one is a big hit for their first birthday. Your granddaughter is precious!

Keep your well thought out advice coming as I am armed with cash for after the correction!!! There will be a black swan event…

TONY Where is the most secure place to hold your cash while you wait to re-invest?

Congratulations on your first grandchild, Grandpa. :)

Hi Tony, I understand the bond price declination with rising interest rates. Yet what about a long term fund such as NAC California paying approx 5 percent?

Congratulations on the new addition to your family!

As you said you need the cash to buy things up. After a ten year battle after my house burnt down I finally won my case and now have 200k. I really need some advice on how to capitalise on it for my two teenagers and wife. Kind Regards Rob.

Tony: According to Wyatt Investment Research, “The average S&P 500 payout ratio is only around 35%.” You state above, “I could go on about things that worry me…an overall dividend payout ratio in excess of 100% of profits.”

What do you mean?

Buy Alibaba