|

Goin’ places that I’ve never been

Seein’ things I may never see again

And I can’t wait to get on the road again

-Willie Nelson

I am a big country music fan. But I didn’t bring up the lyrics from Willie Nelson’s big hit “On the Road Again” because I feel like two-steppin’.

Rather, I’m excited because I am off on another great international treasure hunt.

I love my research trips. I get to see new, fascinating parts of the world, meet interesting people and, most importantly, discover incredible investment opportunities that the Wall Street crowd completely misses.

These research trips are extremely productive. My last trip led me to recommend a rapidly growing military contractor that delivered an over-100% gain.

This time I’m traveling to the Netherlands and Belgium, home to two of the hottest stock markets in the world and to some of the most stable, growing companies in the world.

|

|

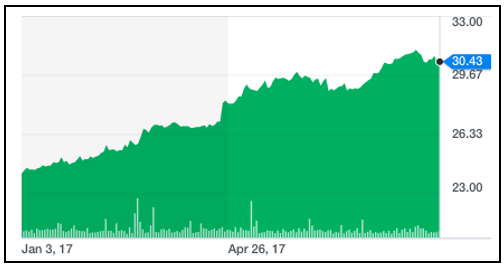

| Through last Friday, I was tracking the iShares MSCI Netherlands ETF (EWN) as 28% up for the year. That’s hot! |

So, who are these companies? Well, you already know a lot of them, such as Unilever N.V, Royal Dutch Shell, ING Group, ASML Heineken, and AB InBev to name a few.

By the way, every one of the above stocks (and many more Netherland and Belgium stocks) are trading on the NYSE or Nasdaq. So, you can buy their shares just as easily as General Electric or General Mills.

|

|

| Through last Friday, I tracked the iShares MSCI Belgium Capped ETF (EWK), as an impressive 20% up for the year. |

I’ve got my eye on a couple of little-known (at least by U.S. investors) Benelux tech companies.

One of them has developed groundbreaking technology that could make it the king of driverless cars. And make zillions of dollars to boot!

Hold on! I want to check it out with my own eyes before I get too excited. I’ve had my share of stocks blow up in my face. So, I know that looking good on paper can be very different from looking good face-to-face.

The Netherlands stock market may be poised to add to its already super-size gains. That’s because its economy is really taking off.

The Netherlands Bureau for Economic Policy Analysis expects the Netherlands economy to expand by 3.3% in 2017, the fastest growth rate in more than a decade.

“We are the fastest-growing economy in the Western world,” bragged outgoing-Dutch Prime Minister Mark Rutte.

Outgoing-Dutch Minister of Economic Affairs Henk Kamp, added: “The growth in the second quarter more than doubled the growth in Europe and the United States.”

I will be meeting with both government and business officials during my trip. And, I expect to have lots of stories, observations and actionable investment ideas to share with you.

I hope that you’ll vicariously join me on my trip by joining my newsletter family. I am confident that you’ll be very happy with the results.

Lastly, you might find this interesting if you are an Apple investor.

Here’s a photo of Amsterdam’s Apple store, which is located in what I was told is the best and most expensive retail space in the entire city.

Most expensive or not, the Apple store was dead as a doornail on what should have been a very busy Thursday afternoon. I asked one of the clerks if this was normal. And he said that everybody is waiting for the iPhone 8 to come out.

Of course, this is just one store. But I think it suggests that Q3 could be below Wall Street expectations while Q4 could be a grand slam quarter.

Best wishes,

Tony Sagami

{ 2 comments }

Good Afternoon Mr. Sagami (and the moneyandmarkets crew)

Great article. I am employed on an American-flagged container ship. Antwerp and Europort (Rotterdam) Are two of several ports of call along the coast of Europe. I can attest first hand that Tony Sagami is right on the money. Both ports are busy and the countries in general are clean and organized. Did you try the Gouda? You can actually find 12-15-25 year old cheese’s. (Old Amsterdam is pretty good too). Keep up the excellent work.

What is the debt picture there, and what are problems with emigrants. these seem to be big problems for the future.