|

Spring is here. As the son of a western Washington vegetable farmer, I became acutely aware of seasons, cycles, and the monthly calendar.

Spring was more than blooming flowers and green grass on our farm. Spring meant extra chores and weekends full of long hours of work; de-winterizing farm implements, field preparation, spreading fertilizer, and of course plantings.

Another event I could count on like clockwork was seeing my father in a suit.

My father was fiercely religious, but he only went to church twice a year: Christmas and Easter. It wasn’t that he lacked faith; there was just too much farm work to feed his family of five.

My father wore dungarees and threadbare flannel shirts 363 out of the 365 days of the year. But he proudly wore his only suit when he went to church. My siblings and I hardly recognized him in that suit, but we knew it meant it was an important occasion.

I distinctly remember one spring when I was eight or nine years old. I saw my father in his suit, but it wasn’t Easter and it definitely wasn’t Christmas.

“Why are you all dressed up, Daddy?” I asked.

He said he was going to the bank.

The bank?

Every spring, my father would shave, dab some Vitalis in his hair, put on his church suit, and go to our local bank to ask for a loan. He needed the money to buy seed, fertilizer, and fuel.

My father struggled with the low wholesale prices, the rising cost of seeds and fuel, and with the negative cash flow between spring planting and summer harvests. But if the weather and crop prices cooperated, he would return proudly in the fall to pay back the loan in full. If not, he’d ask for an extension, his head hanging in shame.

Unfortunately, the bad summers seemed to outnumber the good ones, so my father never made a lot of money.

I am sad to say my father died 11 years ago, at the ripe old age of 93, but he lived a long, healthy, admirable life and saw all three of his children become successful professionals. My younger brother is a top executive at Nordstrom and my baby sister is one of the most respected occupational therapists in the country.

And me? My career was a mystery to my father, who always said my hands were as smooth as a woman’s. He never owned a share of stock in his life, but life on a farm taught me a lot about investing

Crops and farm life aren’t the only things that follow a regularly recurring calendar. For example; the following market-moving announcements will take place in the last half of the month.

Market-Moving Event #1: Existing Home Sales

Don’t make the mistake of following new home sales, which make up less than 15% of home sales. That is why existing home sales is a much more important data point.

Thanks to the proliferation of sector-specific ETFs, investing ahead of the announcement is easy and potentially very profitable.

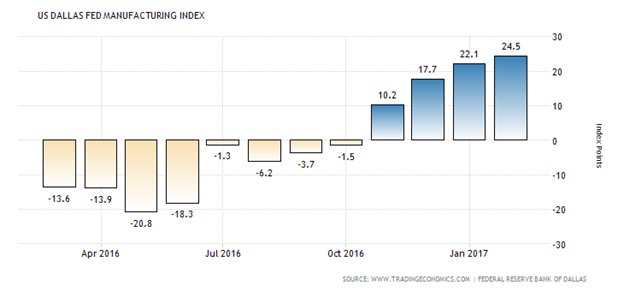

Market-Moving Event #2: U.S. Dallas Fed Manufacturing Index

The financial media pay way too much attention to high-tech darlings like Snapchat, Tesla, and Facebook. But the root of any economy is manufacturing and transportation, or what I like to call the “makers and takers.”

Page views, clicks-throughs, eyeballs, and unique users don’t mean squat to me. Factory orders, factory utilization, durable-goods orders … those are the types of things that tell me where the economy is headed. And as the above chart shows, U.S. manufacturing is steadily improving and there are big profits to be made.

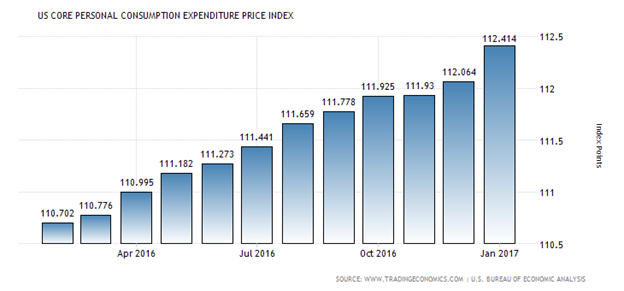

Market-Moving Event #3: U.S. Core PCE Price Index

The Wall Street crowd overanalyzes every syllable that comes out of Janet Yellen’s mouth. However, the simple reality is that this obsession over linguistics is dumb. Real dumb.

If you’re a fixed-income investor, you had better be paying attention to inflationary trends; particularly the U.S. Core Personal Consumption Expenditure Index. Recent data suggest a profound shift, and therein is a great trading opportunity.

Even after all these years, I still associate that church suit of my father’s with springtime as much as I do blue bonnets, baseball spring training, and the green shoots of radish sprouts on our family farm.

Similar cycles are played out on Wall Street every month of the year. And following those cycles is one of the most profitable moves you can make.

Best wishes,

Tony Sagami

{ 2 comments }

I agree personal consumption goes up when people feel good about the economy but demographis also plays a big part as the discretionary money is shrinking daily.

I was expecting to see a list of the answers to the questions…

Instead I had to search for my choice somewhere in the paragraphs of the explanation…

I have read the answers about 4 times and am still not quite sure where the reply to the recession of the 70s question is located

My guesses are as follows: How did I do…. folks?

1 b

2 c

3 c

4 b

5 a

6 Bonds