The bullish post-election Trump trade has carried all the major U.S. stock market measures to new highs.

Many investors who got left behind by the sudden surge in stocks are now scratching their heads wondering if they should hop aboard this speeding freight train before it gets any further down the tracks.

Others are convinced the rally is simply a knee-jerk reaction that may soon get derailed. Who’s right, who’s wrong and what’s at stake?

The week prior to Election Day, the Dow Jones Industrial Average closed at 17,888. Since then it’s been on a rocket ride to the upside, gaining 18 of the last 22 trading sessions while racking up gains of 9.3%. The small-cap Russell 2000 Index has performed even better, up 18.2% over the same stretch. Wow!

Is this upside surge in stocks sustainable? Historically speaking, the answer is yes.

Gains like these in such a short time frame indicate a lasting uptrend is in place, but not without short-term pullbacks along the way.

There are several fundamental factors that support higher stock prices ahead …

#1: Market Breadth: Was weak heading into the election with too many stocks languishing below their 50-day price moving average. That’s the definition of a stock trending down, and it’s bearish for the overall market.

But since Election Day, we’ve seen many more stocks participating in the rally.

Nearly 70% of stocks in the S&P 500 are now trending above their 50-day moving averages, a bullish turnaround. Plus, the number of stocks hitting new 52-week highs has expanded too; another positive.

#2: Credit Markets: When stocks sold off in mid-2015 and again to start this year, rising credit-market stress was a big bearish factor.

Recall last year, the worry was that over-leveraged energy stocks would default in droves as oil prices plunged. Early this year, investors feared that credit stress was spreading to other sectors, including healthcare and industrials.

But take a look at the chart above. This is the Merrill Lynch U.S. High Yield Bond Index. You can clearly see how this key measure of credit stress led stocks down in 2015, which continued early this year.

The index bottomed in February, about the same time oil prices did. Since then, high-yield bonds have rallied all the way back to new highs, indicating no more worries about spreading credit stress.

Trump’s promise to cut corporate taxes could sustain the rally in high-yield bonds, but keep a watchful eye on this index. If it rolls over again from recent highs, stocks could easily follow to the downside.

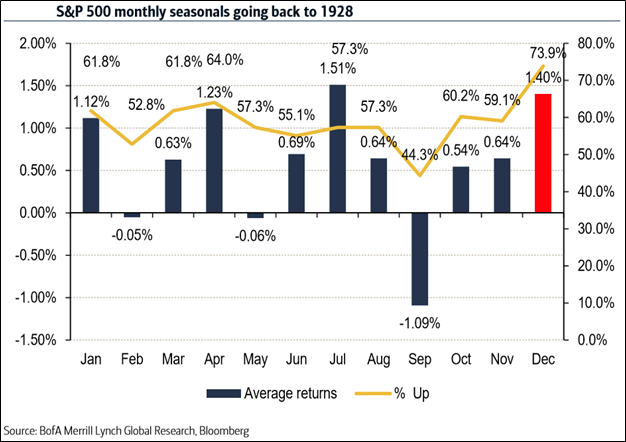

#3: Bullish Seasonality: Finally, stocks are now in the sweet spot in terms of seasonal trends. The best six-month period for stocks started in November and runs through next April, as you can see in the chart below.

On average, stocks gain 1.4% in the month of December alone (up 74% of the time) and another 1%-plus in January. In spite of minor pullback potential in February, stocks are in the midst of a very favorable period for more gains in coming months.

Bottom line: The recent breakout to new highs in multiple indexes, supported by these bullish factors, tells me this rally could sustain itself well into 2017. But the market is clearly overbought after this straight-up Trump rally and a correction is likely at some point.

Consider this: The S&P 500 experienced a very similar bullish breakout with a rapid run to new highs early in 2012. But then stocks peaked in April 2012 and suffered a correction of 11% before rebounding to new highs.

Late that year, stocks slipped again, falling about 9%, before ultimately notching a series of new highs that saw the S&P 500 climb 30% in 2013.

A similar pullback this time around, perhaps closer to Inauguration Day, could be a terrific buying opportunity for those who missed the first leg of the Trump express to the upside.

Good investing,

Mike Burnick

Director of Research

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 18 comments }

I doubt it…… The markets under Democratic Admistrations have done 300 TIMES better than under Republican ones since 1929….. There is a slogan: “America does better when ALL Americans do better”….. Only the wealthiest 3% do better during Republican Administrations and looking at the cabinet, it looks like that will continue under Trump….

oh please eagle495 enough of your b/s quit whining that liberal progressive nonsense it sure wasnt working with OBAMA you took your figures from the HUFFINGTON POST and they have quite a history of distorting the facts. but here is some facts you need to realize you were promising everyone it was going to be a progressive liberal landslide democrats were going to control the senate the congress and the presidency after the november election . BUT what really happened the republicans now control the senate the republicans now control congress and the republicans now control the POTUS A

And you need to realize EAGLE495 that TRUMP WON so quit your whining and get over it

Hawk,

Do YOUR OWN RESEARCH and you will find that what I have told you is 100% true…. What, no guts? You are buying into a delusion… Go back to 1929 and add up the gains and losses during each Preesidential administration and you will know the TRUTH…. Oh, you hate the idea that you’ve been snookered? Not my problem. Quit being lazy and gullible, aye?

You might want to look at who was in control of the other bodies of government. For example, do you thing Newt Gingrich deserves a lot of credit for the economic numbers of the Clinton Administration? You should split your analysis between Presidents who had legislative majorities and those who did not. Also, Democrats who not always the raving leftists that they are today.

There’s a time lag,between what govt does and the effects.So,saying a Democrat or Republican President is in office when the stock market goes up or down doesn’t mean much.I believe that during Obama’s administration he borrowed $trillions and got very little for amount spent.He only was able to do this borrowing,without causing soaring interest rates and a recession,because the Fed bought much of the debt.I’m thinking we will pay for this huge increase in debt,in the future.If that pay back comes during a Trump administration,most will blame Trump,even though he wouldn’t be the cause.

jrj,

Are you a history denier? This is an ivestment site. We make choices based on historical data. This is historical data. Two BIG examples in the last 100 years:

1) Under Republican Hoover, 1929 occurred and the Markets lost 90 % of their value. In 1932 Democrat FDR was elected and he regained all those Republican losses and took the markets to new highs.

2) Under Republicans Cheney/bush the stock Markets lost 60% of their value. In 2009, Democrat Obama was elected and recovered all those Republican losses and took the stock markets to new hights.

Both 1929 and 2007 came after periods of Republican Domination… Lag time? Yep, at the hands of Republican Administrations and Republician Majority Congresses…

Or you could deny and get caught with your Republican pants down again when the next Republican Crash occurs, aye?… 300 TIMES better when led by Democrat Presidents and the Electrol College (Not the Popular vote), just elected another Republican President….. Like I said before, Buyer Beware…. Or in your case, not. :(

Thanks for the insight Mike, it helps to have this type info for operational purposes.

Hi Mike

Consider this as a stock holder. Lower corporate taxes, infrastructure rebuild, more workers with jobs to buy stuff, increased growth and cash and bond markets showing little returns. etc. etc. It’s a winning formula for stock holders.

Howard,

I was once a dirt poor kid who had no choice but to volunteeer for military service in the 60’s (U.S. Army-Special Forces)… After surviving my enlistment with not too many injuries, I went to College and earned degrees in Business and International Economics.

Now I am wealthy by investing in the markets and I have been retired since I was in my early 50’s… I now live a life of leisure and travel the world over….

One of the great rules I learned was, when led by Democrates, Income Inequity falls and the Velocity of Money Increases because the 97% have more money to spend and jobs are created to manufacture those products. When that happens, the Stock Market soars and that explains the 300 TIMES better performance of the DJI when the country is led by Democratic Presidents since 1929.

Eagle 495

Firstly, thank you for your service. I’ve heard your debating points before and on paper there is some reason to believe this. However you and I approach this a little differently because of other contributing factors. DJT faces a monumental task because of high debt levels and low participation rates. There are many other issues but I’m prepared to give him a chance. Politicians on both sides have failed this country.

eagle495 likes to blame the woes of the world on republicans but why is that ….. he blames George bush for accruing all the national debt George bush for the recession of 2007-2008 but as we look a little deeper its evident the democrats had control of the senate from 2004 – 2014 and the democrats had control of congress from 2004 – 2010 it was their policys that nearly destroyed this great nation of ours as we look closer we see that barack Obama promised hope and change with his win of the presidency in 2008 he promised 6% or more growth in the economy for every year he was in office as POTUS BUT AS WE LOOK CLOSER WHAT DID WE GOT LIES AND DECEIT …… BARACK OBAMA INCREASED THE NATIONAL DEBT OVER TO OVER 20 TRILLION DOLLARS HE HAS SPENT MORE THAN THE LAST 243 PRESIDENTS COMBINED so what did we get for trillions wasted on special interest programs nothing a economy of little to no growth

Oh Hawk,

Still haven’t done your homework have you…. FDR had to do the same thing after Republican, Hoover’s 1929 Crash…. It takes A LOT of money too turn the economy around…. Had BOTH Democrats not done what they did, the U.S. would have collapsed economically, along with the rest of the world…

Howard,

Just remember how and when those Debt Levels began to explode and that was with Reagan. If he had only had the guts to cut spending to match those HUGE tax cuts he gave the wealthiest 3%, we would not have the deby problem we have today…

Of course, the Republican supported and brought measures to remove Glass-Steagall and implement GATT and NAFTA sure would have helped, if they had never been passed by the Congresional Republican Majorities, also…

I think your choice of time periods are a bit biased. First, the 29 crash followed a run on banks, and the Dow recovered, before ultimately heading down into the 30s. Would we have recovered on Roosevelt’s watch, had it not been for WW2?

Can you really blame Bush for 9/11? Also, while the mortgage packaging was bad, many of those bad loans were triggered by Clinton letting credit standards for Fannie and Freddie. Worked at first…made him look good, but ended poorly. Is what really triggered the overheated housing market in early 2000s, followed by inevitable crash.

farmergirl,

You need to get your “facts” from legitamate sources, girl… 1929 was casud by highly leveraged trading… The Democrat brought Glass-Steagall Act of 1933 stopped those pratices until the Republican Majority Congress removed it in 1999. Once those highly leveraged and highly dangerous trading practices were allowed again, the Crash of November 2007 occurred within 8 years…

Also, the Housing Crash of 2006 was brought by the Republican Majority Congressional move to remove the “Inner City” restriction from Barney Frank’s Inner City housing bill. That made the Big Banks (Republican donors) billions and let the “liar loans” go nationwide which brought the collapse in 2006… Google it girl… Incidentally most of the still function loans under that program are in the “Inner Cities”. It was a good idea that if inner city dwellers owned their homes, they would take good care of them and stop inner city decay…

Apparently you guys aren’t aware of the real determinant of good times and bad as cited by Larry Edelson: cycles, cycles, and cycles. Wake up and read Real Wealth Report. Or if you don’t believe Larry take a look at the books on cycles by Dewey.

Jim,

Put the Political Admistrations and Congressional Majorities alongside those cycles and you will find there is a strong correlation… Note: Lincoln was a Progressive Liberal. In those days, the Southern Slave holders were the Conservatives and they were called Democrates and the Republicans were the Liberal Progressives…

The cycle tops mostly came during times of Conservative Domination and the rallies came during mostly periods of Libral Progressive leadership… It has to do with something called Income Inequity and the Volume of Money.

Conservatives: Income Inequity goes up (Rich people have more and the average citizen has less) and the Volume of Money goes down along with the economy… Just the opposite happens during periods of Liberal Progressive leadership and that is why those periods are times of such economic success…