(Mike Larson, editor of the Safe Money Report, is on assignment in Europe. Jon Markman, editor of the Tech Trend Trader, steps in to examine the latest trends in technology.)

After a tough 2014, Amazon (AMZN) has been on a roll all year. The company just announced its second surprise quarterly profit last week. The stock price has nearly doubled for the year to date. Founder and CEO Jeff Bezos is now the third-richest American.

Market Roundup

Despite flops like the Fire Phone, with its overhyped but underwhelming “3D screen” feature, the company is laying the groundwork for continued success as it continues to evolve.

From books to the dominance of online retail via scaled warehousing and logistics, to rolling its online presence into its wildly successful Amazon Web Services cloud platform, the next step is harnessing its cloud-based computing infrastructure to become the dominant platform for the Internet of Things (IoT).

And among the many companies fighting to become the ecosystem provider for connected smart devices — as Microsoft (MSFT) did for PCs and Apple (AAPL) did for mobile computing — AMZN has a head start thanks to its proven and inexpensive offering.

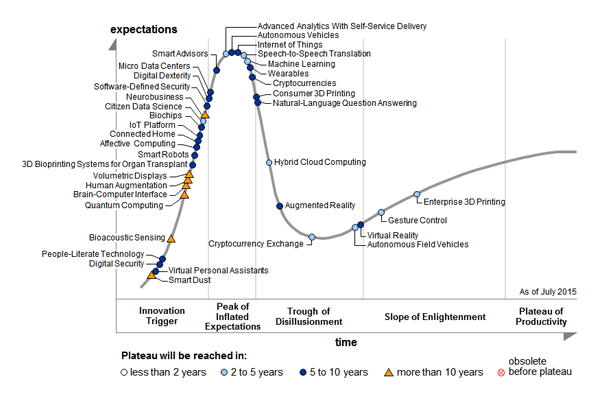

Now’s the time to act: As shown in the chart below, taken from the latest “hype cycle” analysis from researchers at Gartner, IoT platforms are still in the first “Innovation Trigger” phase. The battle for dominance still has, in their estimation, another five to 10 years to run.

|

|

| The Hype Cycle |

Earlier this month, AMZN announced a partnership initiative to create an IoT platform with relevant supply-chain, hardware and semiconductor companies, giving them access to cloud-based AWS (Amazon Web Services) processing horsepower. These services operate from 11 geographical regions across the world. Companies in the partnership include Arrow (ARW), Avnet (AVT), Broadcom (BRCM), Intel (INTC), Marvell (MRVL), Microchip (MCHP), Qualcomm (QCOM), and Texas Instruments (TXN) among others.

Amazon’s existing in-house experiments with IoT are well known, such as the “Dash Button” that automatically reorders your baby food or paper towels at a press.

But this AWS IoT initiative is much bigger and bolder, trying to dominate the next phase of technology growth by harnessing its computing resources along with efforts like Amazon Machine Learning to make connected devices smart, fast, and secure. A feature called “Device Shadows” will allow users to control their devices without having specific knowledge of how to communicate.

|

|

| Cloud-based computing and the Internet of Things. |

Pricing for this service is based on the number of messages connected devices have transmitted: $5 per million messages in the United States and Europe, $8 per million in Asia Pacific. This is incredibly cheap. And will encourage and enable product designers and programmers to connect more everyday items and increase the rate at which they communicate.

Want to give this IoT thing a try for yourself? A number of starter kits offered by Amazon encourage tinkerers to give it a go, and it explains more about its new initiative on its blog post.

It all marks the fast pace of change in the technology sector and highlights the need to keep up on the latest developments if we are to turn knowledge into investment profits. Amazon shares continue to rise toward their 52-week high.

Are you an Amazon investor? Or do you feel the upside has played itself out? Many people watch for technology developments to know what products to buy this week. But do you watch developments to determine what investments will pay off in the future? Know of any great under-the-radar developments that could become the next Amazon, Facebook, Google, etc.? Let us know by clicking here and adding your comments to the website.

Best wishes,

Jon Markman

(P.S. This industry is about to explode from $32 billion today to $163 billion by 2020! Find out how to grab your share of the enormous profits in Jon’s report “The Coming $19 Trillion Internet Shockwave.“)

|

Yesterday’s column revolved around mega-mergers and the issue as to whether they reduce competition to the detriment of consumers. The majority of commenters expressed concerns about the trend and some called for regulators to prevent the moves.

Reader Gloria came out against the deals. “I am against the mergers of large companies buying up smaller companies of the same ilk. Like Walgreens merging with Rite Aid. What I believe is that though the companies purchasing smaller companies say it will reduce prices for consumers, I have not found that to be the case. I believe the larger company will allow for the CEO’s to come away with millions while the workers have almost nothing by comparison.”

Reader M. Evans points out that “The banks have merged and installed ATM’s with charges for using them, saying that they would save the consumer money by not needing as many tellers. What have they done with the savings?”

Reader Ira asks: “Does anyone really believe that the drug and beer mergers are being done for the benefit of consumers? And that big business has our interests at heart?”

But some readers said the mergers were the only solution in the face of increased government regulations.

Reader Norman said: “Regarding all the mergers: The flood of regulations coming out of Washington is creating a lot of extra work for companies. Because they are so complicated, an army of workers is required to understand and respond to them. So only big companies can support this overhead — small companies are out of luck. But when 2 big companies merge, it cuts the army in half. A big cost savings. And then there are the tax inversions. These get a double bang for the buck. Not only do they gain efficiencies in handling regulations, they also escape from double taxation.”

Click here to join the conversation on this or any other issue.

|

![]() What would you do with $206 billion? That’s a matter Apple Inc. (AAPL) will have to deal with. According to USA Today, the tech giant’s cash and investments surged 33% from a year earlier to $206 billion. The paper points out that would be enough to give every American $646 apiece — relatively the retail price of an iPhone. The cash is mounting despite efforts by Apple to return it to investors — some $17 billion during the quarter in the form of stock buybacks and dividends.

What would you do with $206 billion? That’s a matter Apple Inc. (AAPL) will have to deal with. According to USA Today, the tech giant’s cash and investments surged 33% from a year earlier to $206 billion. The paper points out that would be enough to give every American $646 apiece — relatively the retail price of an iPhone. The cash is mounting despite efforts by Apple to return it to investors — some $17 billion during the quarter in the form of stock buybacks and dividends.

![]() It was a big day for data, and it was a mixed bag: The government said that the American economy slowed last quarter, with the gross domestic product hitting an annualized rate of 1.5%, in line with analyst expectations but a big drop from the 3.9% pace of the second quarter. Meanwhile, contract signings to buy previously owned homes unexpectedly declined in September by the biggest amount since late 2013, indicating that the real estate market is cooling off from its possibly overheated levels of earlier in the year. And new jobless claims were little changed, remaining near a 40-year low and indicating that the labor market continues to improve. All in all, there were no major indications to help us determine whether the Fed will raise interest rates at its December meeting.

It was a big day for data, and it was a mixed bag: The government said that the American economy slowed last quarter, with the gross domestic product hitting an annualized rate of 1.5%, in line with analyst expectations but a big drop from the 3.9% pace of the second quarter. Meanwhile, contract signings to buy previously owned homes unexpectedly declined in September by the biggest amount since late 2013, indicating that the real estate market is cooling off from its possibly overheated levels of earlier in the year. And new jobless claims were little changed, remaining near a 40-year low and indicating that the labor market continues to improve. All in all, there were no major indications to help us determine whether the Fed will raise interest rates at its December meeting.

![]() The bid by Walgreens Boots Alliance (WBA) to acquire Rite Aid Corp. (RAD) is expected to draw heavy antitrust scrutiny because the company would grow to 12,700 and leave only big players, along with CVS Health (CVS) in the sector. But Bloomberg reports that the U.S. Federal Trade Commission will look closely at whether the merger will lead to higher prices for prescription drugs. “The FTC has taken an aggressive stance against consolidation in the health-care sector, particularly with hospital mergers,” Bloomberg reports.

The bid by Walgreens Boots Alliance (WBA) to acquire Rite Aid Corp. (RAD) is expected to draw heavy antitrust scrutiny because the company would grow to 12,700 and leave only big players, along with CVS Health (CVS) in the sector. But Bloomberg reports that the U.S. Federal Trade Commission will look closely at whether the merger will lead to higher prices for prescription drugs. “The FTC has taken an aggressive stance against consolidation in the health-care sector, particularly with hospital mergers,” Bloomberg reports.

![]() Republican candidates took a break from attacking each other in last night’s debate and took on the media, and especially CNBC, accusing it of making “rude,” “nasty” and “biased” comments. It’s always difficult to pick winners and losers in a debate, but NBCnews.com says, “Jeb Bush’s Campaign on Life Support After Rough Debate,” while the Washington Post says, “The agony of Jeb Bush” and Huffington Post claims, “Jeb Bush’s Comeback Strategy Backfires at GOP Debate.”

Republican candidates took a break from attacking each other in last night’s debate and took on the media, and especially CNBC, accusing it of making “rude,” “nasty” and “biased” comments. It’s always difficult to pick winners and losers in a debate, but NBCnews.com says, “Jeb Bush’s Campaign on Life Support After Rough Debate,” while the Washington Post says, “The agony of Jeb Bush” and Huffington Post claims, “Jeb Bush’s Comeback Strategy Backfires at GOP Debate.”

What’s your take on the debate? Did Jeb Bush really do that poorly? Is the media really the problem? Were the questions that bad, or should presidential candidates be able to handle all questions, nasty, combative or otherwise? Have comments on any other issues to share with your fellow readers? Click here to join the conversation.

Best wishes,

The Money and Markets team

{ 38 comments }

The debate moderators did such a poor job that I turned it off. I wish both parties would eliminate the moderators and just let each candidate present their solutions to the issues. Eliminating the moderators would give more time for each of the candidates. Thank God for YouTube.

The questions are that bad. The Democratic press corps (they don’t hire conservatives) attempt to bait the Republicans to fight with each other; meanwhile, they ask almost no foreign policy questions to a woman who was Secretary of State, despite the fact the world is in a lot bigger mess than when she started. Can’t even watch the Today Show these days without noticing the bias.

Amazon is one of capitalism’s great monstrosities. Bezos is a poster boy for avarice.

When you have created tens of thousands of direct and even more indirect jobs as Bezos has, I will listen to you. When you provide a cheaper, faster, more efficient service to millions of customers every day, than Amazon does, you too will become mega wealthy. If Bezos is the poster boy for avarice, it simply proves Gordon Gekko’s claim: Greed is good. I remember when Bezos started and all the know-alls laughed at him because they couldnt understand what he was on about. You clearly still dont.

The condescending attitude of last nights debate moderators was a perfect example of why I don’t like Liberals. They simply aren’t nice people. Jim

I’m sure Larry Kudlow would be surprised to be called a Liberal. Ditto for the rest of the business oriented Republicans on CNBC.

I should have specifically referred to Harwood, Quick, and Quintinilla. I like Kudlow and Santelli, but then they aren’t Liberals are they? Jim

Phil has given me cause to pause and reconsider. In that things are rarely what they appear to be, what if this debate was one very clever ruse? After all, this is the business channel. What if the moderators are all clandestine hardcore Conservatives? Is there anything they could have done that would give the Republicans more credibility? The candidates even seemed to be prepared and had an agreed strategy. If it was a setup it was brilliant. Jim

It seems to me that to become POTUS you simply must join a major party. That said, the US needs a working team of non Politian’s to run and clean the place out so we can fire our country up again. We need to become reunited. There’s two people you can’t ignore here and they would make a great team. One is a successful businessman and the other is a successful surgeon. Both have a lot to offer that not many others can match, particularly existing Politian’s from Washington.

Is the media really the problem?

Does the sun rise in the east?

Mega mergers do nothing for the consumer in terms of pricing or product performance. Competition increases the price/benefits ratio through new product development. The price may increase but I am willing to pay more if I get more. There are efficiencies gained by consolidation but only to a point, since the same amount of product needs to be handled often in different ways for regional differences. I have seen companies buy smaller ones to smother their tech so they can grow market share by buying their customers. If there is no threat of competition product development stagnates and prices increase. The economy would be better if the government capped company size forcing smaller companies to emerge.

Ed, you may be willing to pay more to get more, but just like in big government, big companies develop bureaucracies, and bureaucracies add costs without producing benefits. They make the big companies less efficient, so they will return less to the stockholders – the owners. Of course the biggest bureaucracies are at the top, where CEOs, CFOs, Chairmen and such, draw compensations that are nearly always far more than the value they add to the company. An honest CEO will tell you that. He or she knows that the real value of the company comes from those in product or service development, operations and sales, That is where the money should flow, but it almost never does.

Ask yourself, who provides the pipes that will handle all of the data? Amazon may do well, but the application providers will mostly come and go, while the data transmission/store & forward, and data capture service providers will remain making money hand over fist. Competition? Nearly nonexistent, and the cost barriers to entry are beyond nearly every player out there.

People want answers to the important issues so they can assess who to vote for. It’s disgusting how the media is so biased and influencing the masses with lies and half-truths.

Since I am extremely new to tradinfing, I have absolutely no idea what to invest in. I have done some research and have seen the three. video’s put out on ” The Internet of Things ” which was enlightening, as well as informative. In the video Mobileye and Ambarella were mentioned as investment opportunities. Unfortunately, what is left my funds is all tied up in a binary company where I lost approximately fourteen thousand dollars and that’s with the experts picking what they feel is the best investments. I would have lost it all cause I have very limited knowledge with regards to trading. Any thoughts or suggestions are appreciated.

Char, if you give your money to someone else to invest, do you really think they have your interest at heart nearly as much as you do. Learn as much as you can, and invest mostly in blue chips that have a record of gradually increasing dividends, fully covered by earnings, as company fortunes improve. If you want to put a little in the latest fad, fine, but know that it is a gamble, at best, and regard it as a gamble you are prepared to lose. And if even a blue chip begins to have trouble, get out, before a possible small loss becomes a big one. An example is some of the big oil companies, like XON, RDS, CVX or BP. They are hurting badly, with the low price of the oil their drilling divisions produce. All of these are having to reduce CAPEX, sell assets, lay off personnel and borrow money, usually as long term debt, just to keep from reducing dividends. That can only go on for so long before they get into big trouble, as RDS has done, largely because of spending billions to buy a British company, even during these hard times in the industry. So look for companies that are prospering, even in bad times, and look to keep doing so.

Char

I have being trading for a while and the market frightens the crap out of me sometimes. If I could add to what Chuck has offered, what works for me is researching 6 to 8 stocks with which you are comfortable, with high yields and dependable blue chip backgrounds and be careful of risk.

Char, I hear you man, went through some of what you are going through. Suggest you look at these solid co’s…. ARR, BHP, MO,RIO, SCHD,O, VANQ.

In addition to growth they pay divy’s 0f 2.95% to 7.22%.

I own MO and look to buying others.

The commentators of CNBC asking the questions of the Republicans vying for office, has

to be one of the ALLTIME worst series of questions that I have ever witnessed. They continued to cut off the candidates, not letting them finish speaking. It was as if they had a bias in the the questions they asked. Glad to see several of the candidates actually had the

b—s to reach out & speak up!!!

Agreed. They should refuse to answer these inane questions in the future and talk about whatever they want.

All companies exist to make money and benefit the owners. They should act to save consumers money only if they increase sales, and profits, by doing so.

The debates are only money makers for the Media and Television Networks and the Moderators are the biggest jokers of the century. Yes, the American people have finally woke up and now realize just what a scam they all are thanks to the likes of The Donald.

Jeb Bush needs to pick up his marbles and go home. He should have taken his mother’s advise which was America don’t need another Bush! Take Marco with you when you leave and that recent fiasco in the House of Representatives with the New Speaker is another total joke. When the American people finally revolt and it’s coming, all those 545 morons will be running for the hills. It will be like another Bastille Day. Can’t wait.

I Think the media and the public should recognize what a debate is! Topics are raised by moderators and participators are asked to provide their responses. This was no more a debate than a schoolyard brawl. I am obviously biased against the mainstream media as they not only do not bring us the news but they are not able to engage in any topic on a factual and unbiased basis. We re not privy to world affairs or an enlightening and informative information on what is now a global world. Facts and substance have become secondary to sensationalism.

A follow up on last nights oil discussion. Royal Dutch Shell has historically been one of the best managed companies in the business. Their last quarter was a. complete disaster. They lost $2 billion on one Arctic dry hole. Many billions on write downs. They had to,issue shares and borrow to cover their dividend. I have always felt safe in the big blue chip dividend payers, but I can’t help but think that is dangerous thinking. They will have to cut the dividend no matter what they are saying. The others are probably in the same boat. If the oil business is so great how is it that after four years of $100 oil virtually every one if them is in debt up,to their eyeballs. I’m selling. Jim

On another contrary note, Barricks quarter wasn’t all that bad. I’m not much of a technical player but the GDX and GDXJ don’t look so bad either. I stand to be corrected? Jim

Gold, and miners seem to have three things going for them:. Most people no longer trust gold, at least in the West, it has had a big slide, and it seems to have begun rising, though It hasn’t broken the major downtrend from 2011 yet. It might be worth a small gamble, but it still seems early for anything major. Of course, Larry says it has another drop coming. Take that as you will.

hey jim ;;;;;

the royal dutch shell doesnt own that company any more as its owned by the RBS —–royal bank of scotland as this used to be a family affair of crude ut since going to new zealand i was told that i am no longer involved with this crude issue any more as told to me from ANZ BANK SOUTH DUNEDIN NEW ZEALAND and thats a very serous warning to alot of traders internationally is to watch out for banks like ANZ BANK ,,WESTPAC BANK ,,,KIWI BANK ,,,BNZ BANK NEW ZEALAND and NEW ZEALAND has some of the worst banks in the world ,,,but in sayingthat as there are some banks in NEW ZEALAND that are good to trade with but we got the biggest shock of our lives in NEW ZEALAND as the loss runs away into the billions and billions of dollars as we wont see that again in our lives but this is what i am telling you people is to be very careful of whom and where you trade with in todays society

The debate reflected the Republicans at odds on a number of issues which was good because it gave rise to a number of ideas. By contrast the Democrats offer no solutions, only more “stuff” to give away. This administration is stridently anti-business for ideological reasons and then wonders why $2T in US company earnings sit overseas. On top of it all, the US economy is now project to grow at 1.5% per year for the next five years. The debt will be paid HOW??

There are only two ways the debt can ever be paid, and anyone with a brain knows it. – run the printing presses, or simply repudiate it. Sooner or later, the politicians will choose one way or the other. The first way will hurt mostly the ordinary people – the second will hurt the big money. Which do you think they will choose?

The debate moderators confirmed my decision to never view MSNBC. They were an embarrassment to reasonable journalism.

I have to agree with Dan, kick the so called moderators to the curb. Lets hear what these brave candidates have to say, and how they hope to move our great country forward.

As the large corporations merge to survive the onslaught of Govt regulations brought on by the Liberals, it is the only solution to survival.

In relation to the Oil drop which is controlling the internet and telephone service as the price of crude doesnt match the out going for the future of internet and telephones world wide as the future of the owners of the internet are making a 19 billion loss now as now with crude at 14 cents well this international crisis has hit home and back in the days when west texas crude was starting up we it got $USD180 bucks a barrel well nothing like this today

8

I’ve seen the same thing for decades and experienced it re: mergers/acquistions and one must be blind not to see it. Our government pretends we’re too stupid to see it:

1. Stockholders win.

2. Seller CEO gets a golden parachute. Buyer CEO gets a raise.

3. Worker’s of the acquistioned company lose their jobs or 25% of their salary.

4. Workers of the acquisitioning company have to do the work of 2 or 3 more person’s jobs now without a raise.

5. The tech workers get fired and the company hires with the government’s blessing, foreigner’s under the legal code of H1B who get paid 30% less.

6. Prices go up for the consumer, or choices of products go down, or both. Mostly quality goes down.

7. Acquistioning company gives more $ to the goverment to do what they want them to do. This has been going on since Lincoln and his corporate welfare plans.

My feeling is that the “Internet of Things” is a misnomer; it should be called the “Internet of Regulations”, especially in consideration of the time frame presented in the chart.

The Internet of Things is composed mostly of Beaurocrats’ Kingdom Building Blocks; another Legos of Things paid for by taxpayers.

John Harwood and CNBC were the biggest “losers” of the debate. Harwood’s partisanship and venom…was beyond disgusting. Being White House correspondent for CNBC has infected him with “defend Obama and Hillary” at all costs…including being an objective and unbiased journalist. He has no credibility outside of being a demagogue for the progressive left.

October was the best month for the Dow in four years! Jim

Carly Fiorina gave us the scoop on M&A and what’s happening to the small companies during the last debates. She so much as told you everything the government and big companies are telling you are lies. Pay attention!