|

With less than three weeks remaining in 2013 — and just a dozen trading days left — I’m already focusing on what lies ahead for markets in 2014.

There are plenty of fearless forecasts for the year ahead circulating in the media. Most will be proven wrong before April Fool’s Day, but that sad fact will do nothing to stop the endless parade of year-end predictions.

Instead, let’s look at the actual market data from a historical perspective to determine what the future may hold.

The S&P 500 Index is closing in on a 30 percent gain for 2013, an unusually strong performance for stocks. So what does history have to say about what might follow such a strong showing? Can we expect a downside reversal in 2014, or more of the same?

|

| Basic materials is one sector that looks attractive in the year ahead. |

According to the venerable Stock Trader’s Almanac, the S&P 500 has gained 25 percent or more in a calendar year only 12 times in the past 63 years. And the blue-chip stock index has gained 30 percent or more just five times.

After such big gains … drum roll, please … stocks typically keep trending higher in the following year.

* Whenever the S&P 500 rises 20 percent or more in a calendar year, the next year has been positive nearly four out of five times, logging average gains of 10 percent.

* And when stocks have posted an advance of 30 percent or more in any year, the S&P 500 returned an additional 14 percent, on average, the following year.

* These gains compare quite favorably with the average annual return of just 7.3 percent for all years since 1950.

So the evidence shows that big gains in one year tend to beget more gains in the next.

Of course there is a laundry list — as always — of things that could go wrong in 2014, derailing the stock-market express in the process. This includes (but is by no means limited to) the Federal Reserve’s 2014 tapering timeline — elevated market valuation and lack of profit growth — and the very real possibility of another federal budget battle early next year.

On the valuation front, here’s a cautious observation to keep in mind: The S&P 500 Index is up 27 percent this year, but almost all of the increase is accounted for by an expansion in the market’s price-to-earnings (P/E) ratio, which is up 24 percent since the beginning of the year. Meanwhile, S&P 500 earnings are on track to grow just 3 percent to 4 percent in 2014.

The S&P 500 now trades at more than 16 times expected 2014 earnings. That’s not a sky-high valuation, according to history, but it’s the highest P/E ratio since December 2009.

What’s more, a survey of Wall Street’s fearless stock-market strategists predict the S&P 500 will climb only 4 percent in 2014, with a mean target of 1,880 on the index, up from 1,802 today. That’s not much upside. As for profit growth, the same strategists see S&P 500 earnings growing just 6 percent, and typically these early estimates get cut, not raised, as the year goes on.

In this environment, stock investors must tread carefully and be more selective than ever in 2014. For me, this means demanding a built-in margin of safety for any stock or sector I consider for investment.

Last week in Money and Markets, I briefed you about why the energy sector in particular looks undervalued heading into 2014. With improving fundamentals, and America’s domestic energy boom in full swing, I find a comfortable margin of safety in select energy stocks and ETFs.

Another sector that looks attractive in the year ahead is basic materials. Precious metals and other commodities have been among the worst-performing assets in 2013, and appear to be both oversold and historically undervalued compared with other market sectors.

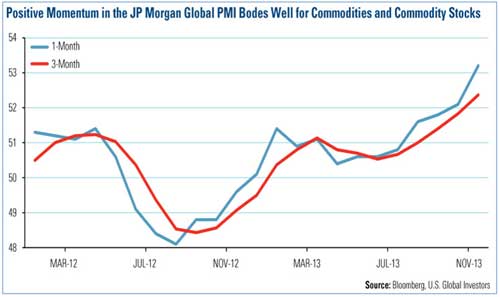

These stocks are globally oriented cyclical companies. They are highly geared — or leveraged — to worldwide growth. As you can see in the graph above, the JPMorgan Global Purchasing Managers’ Index (PMI), a key measure of worldwide manufacturing growth, has been surging higher in recent months, to the highest level in 2 ½ years.

This is a very bullish sign for commodity stocks, because the global PMI is a key leading indicator for energy and materials stocks in particular. Materials stocks in the S&P 500 earn more than 45 percent of sales in overseas markets. So a further uptick in economic prospects worldwide and especially for emerging markets (another favorite asset class for 2014) could send materials stocks soaring much higher in 2014.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.