|

The Dow Jones Industrial Average rose for the 12th-straight trading session on Monday. That’s a rare feat the Dow hasn’t achieved in three decades. The last time it happened was, gulp, 1987!

Also, the S&P 500 Index is nearly 10% above its 200-day moving average, more extended in price than at any time in the last four years! Does this mean stocks are cruising toward another crash just like 1987?

Perhaps, but history suggests the odds are in favor of further gains.

The comparison with 1987 may send chills down investors’ spines, but it’s worth noting the Dow’s 12-session winning streak that year happened in January. And the Dow went on to gain another 30% before the fateful peak in August 1987.

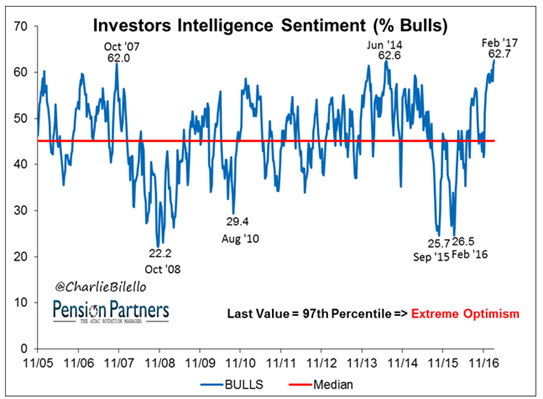

Granted, investor sentiment is exuberant these days, as you can plainly see in the chart above, and you could even argue that it borders on the irrational. However, the stock market is showing powerful upside momentum, with year-to-date gains of 5.9% already in just the first two months of 2017, and a 300-point surge in the Dow yesterday!

Historically, such strong momentum has been an indication of robust gains over the rest of the year.

In fact, the S&P 500 gained 1.3% over the first five trading days of 2017, and it rose 1.8% for the full month of January. This gives investors a green light from the so-called January barometer.

In the past, whenever this bullish combination – a positive January plus strong gains in the first five days – occurred together, stocks went on to post well-above-average gains of 14.6% for the full year.

That’s nearly twice the average annual gain of 7.5% for stocks in any given year.

Also, this is the first year of a new presidential cycle, and when stocks start the year strong with a new president in the White House, the market performs even better, with average gains of 18.5% for the full year!

So according to this gauge, the Trump bump for stocks may just be getting started.

And while this bull market is certainly long in the tooth at eight years old, history also shows the biggest gains are achieved in the last two years of a bull market run. In fact, the S&P 500 has historically surged almost 60% higher on average during the final 24 months of bull markets!

Bottom line: The stock market is overbought, and hasn’t suffered anything close to a 20% correction in nearly six years now, so we’re certainly overdue for another. However, history suggests the momentum behind this rally is strong enough to propel stocks even higher, delivering above-average gains this year. Any correction along the way would provide a good buying opportunity.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 10 comments }

Here come the falling daggers. Actually they have been falling for several weeks masked by the strength in the indices. Here comes massive volatility too.

I admit I do not understand the whole stock market routine but am trying to learn now. So what do these Stock Market Corrections mean? If I have $25,000 to invest, what is the best move for me now?

buy gold and silver coins or bullion, stay out of the stock market and your cash OUT OF THE BANK- just my very small opinion

Think I’ll just go in the alley and shoot craps. Odds may be better

Yeah, but the put/call is still running in the 0.8’something to 0.9’something. It’ll need to get down into the 0.6’somethings or less for a week or two to give a sign that the bears have capitulated. It is entirely possible that what is happening here is very much bigger than the 1929 and 1987 end-game rallies. It might end very much higher in the next month or two; or, a mega-top isn’t coming for another year or few. This is all just a little firmer than wild speculation on my part. But the fact is that sentiment really isn’t all that askew.

One thing I have learned over many years: “What goes up, MUST come down”! The fundamentals are simply NOT supporting this crazy bump into new heights that we saw this week! The current budget is funded only until 15 March this month. Treasury will have only about 3 months cash-flow to finance the Government. (Until about June), then the debt ceiling of 20 Trillion USD are locked in, WHAT THEN??

That was the best version of double talk, or talking about a huge move up or a huge move down that I have heard so far in 2017!

I have a 27 year old Grandson that want to invest in silver. What outlook do you have.?

I say go for it!

Novice Ann & Ken – I subscribe to Larry Edelson’s Real Wealth Report & Super Cycle services. Larry understands deep historical market cycles and his guidance has been really valuable. He isn’t “spot on” right all the time, but no one is and he freely admits it when he does miss, but he never leaves you hanging. I’ve made a considerable amount of money with Larry, and if you really want professional guidance in terms of precious metals and other investments, your subscription fees will be money well spent. I recouped my subscription fees in about 3 months, and I could have done it sooner but was initially more conservative than necessary. IMHO Larry’s services are excellent and I am very happy with the returns.