|

Well, it’s official.

Last week Ben Bernanke passed the buck, handing over leadership of the Federal Reserve to Janet Yellen, the new Federal Reserve chief.

But in the interests of accuracy, Bernanke passed much more than just one buck: $4.1 trillion of them to be exact. He also passed along a legacy of a Federal Reserve interventionism in financial markets, the ultimate consequences of which are still unknown.

More than five years have passed since the worst financial crisis since the Great Depression. Of course, this was the pretext for the Fed’s massive and unprecedented intervention.

At the start of Bernanke’s tenure, the Fed’s balance sheet was $834.6 billion. On his watch, assets ballooned to $4.1 trillion, thanks to multiple rounds of quantitative easing (QE). Janet Yellen, from her perch as Fed vice-chair, aided and abetted these unprecedented actions that were never part of the Fed’s mandate.

|

| The ultimate consequences of Bernanke’s Federal Reserve interventionism in financial markets are still unknown. |

Five years post-crisis, investors are still uncertain about the ultimate impact of the Fed’s monetary intervention, but my colleague Charles Goyette has a pretty good idea. Charles has written extensively about the Fed’s interventionist monetary policy, and the unintended consequences for markets and our economy.

Recently he talked about how the Fed has strayed far from its official mandate.

In the 1970s, Congress amended The Federal Reserve Act, clearly stating the Fed’s mandate: “to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

It doesn’t say anything about printing an additional $3.3 trillion out of thin air!

When judged against its official mandate, Charles asserts that “the Fed has been a dismal failure. The Fed has destroyed 97 percent of the dollar’s purchasing power … and it has engineered an almost endless series of booms and busts” in our economy. So much for stability.

Now Bernanke is getting out of town just in the nick of time, “before the consequences of his policies hit home.” And he is leaving Yellen to deal with the fallout.

Historically, when the baton of leadership at the Federal Reserve is passed, unexpected market volatility is often the result.

When Alan Greenspan exited stage-left, turning over the reins to Bernanke in 2006, the housing market soon went bust, and the financial crisis followed in short order. Another changing of the guard at the Fed last month and the S&P 500 Index responds with a 3.5 percent nosedive in January. Coincidence?

The last act of the Bernanke-led Fed was to initiate the process of reducing quantitative easing, aka tapering. Under the Yellen-led Fed this process continues. So far, we have witnessed a tapering two-step; with the Fed’s bond buying marginally reduced by $10 billion at each of the past two FOMC meetings.

It’s too soon to say whether financial markets will take well to continued tapering, but volatility is likely to remain on the rise.

So which markets and asset classes will be among the winners despite, or perhaps because of, the Fed’s interventionist monetary policy?

Gold and gold mining stocks are a great place to start.

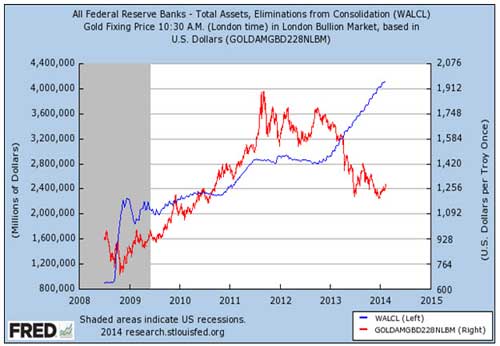

Until the last round of QE was launched in late 2012, gold’s multi-year bull market was very highly correlated with the Fed’s ballooning balance sheet, as displayed in the chart above.

The price of gold moved higher almost perfectly in tandem with Fed money-printing. But with gold falling 28.7 percent last year, this long-standing relationship appeared to break down … or did it? Perhaps after 10 straight years of rising prices, gold simply needed a well-deserved breather.

So what could rekindle this relationship between gold and the Fed’s bloated balance sheet? How about unexpected inflation?

After all, besides reducing unemployment, the Fed’s stated purpose for QE is to inspire more inflation. There is simply too little to go around in today’s economy, at least according to the flawed “official” measures. So the Fed seeks more inflation, but they should be careful what they wish for.

The rocket fuel to ignite inflation is sitting there already on the Fed’s balance sheet. Any unexpected acceleration in consumer prices, and further decline in the dollar, would also light a fire under the price of gold.

Another reason for gold to get back in gear to the upside is confidence … or lack thereof.

Confidence is a fragile commodity, and once lost it can be difficult to regain, with devastating consequences for markets. But gold is, and has always been, a haven against unexpected risks of any kind, including a loss of confidence in the Fed as an institution.

Charles may have said it best: “At some point the Fed’s policies will have no effect, just as money printing on steroids couldn’t stop the popping of the housing bubble in 2008.” Confidence in stocks, bonds, the dollar, etc., is secured by nothing more than “the full faith and credit” of Uncle Sam.

Well, the USA’s credit rating has already been downgraded once, and investors are beginning to lose faith in Washington’s ability to address our problems. In this case, investor’s faith in gold will ultimately be restored.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 1 comment }

You don't know,the ultimate consequences,of the Fed,creating unlimited fiat Dollars?You should read some history on the consequences of 100% fiat currencies.Then you wouldn't need to wonder,what the results will be.