|

Wow! Martin Weiss and Sean Brodrick were right on!

Just as they warned, we are passing through a critical threshold from an era when governments could borrow and print money with impunity … to a new era in which those governments will pay a tall price for their orgy of debt and money printing.

Just as they warned, sovereign debt values are going DOWN in every highly indebted country or region of the world, including Japan, Europe and the U.S.

They were also spot on regarding the continuing bull market in stocks, driven by flight capital and fear money. The mainstream media missed this. So, did millions of investors. Plus …

Here’s what else the media is missing …

Right now, the media devotes so much coverage to Donald Trump these days that it largely ignores important political developments around the rest of the world.

I’m not just talking about North Korea and Lil’ Kim Jong-un. There are plenty more significant issues we aren’t hearing much about, like:

The drama unfolding in the Spanish region of Catalonia.

The European Central Bank’s extension of its never-ending quantitative-easing program.

The re-election of Argentina’s pro-business president. Mauricio Macri.

China’s ballooning 300% debt-to-GDP ratio.

And the election of populist, far-right-candidates in Austria and the Czech Republic.

That’s a mistake because there are a lot of political changes — some good and some bad — happening around the world. And they are creating both peril and opportunity for investors.

One global event that is creating significant opportunity for investors is the re-election of pro-business, pro-growth Prime Minister Shinzo Abe in Japan.

Heck, if you think the U.S. stock market is on a roll, you should take a look at the Japanese stock market. The Nikkei went up for 15 straight days leading up to the election. Then it reached a new, 21-year high on Abe’s resounding victory.

Yes, a 21-year high!

It wasn’t a surprise that incumbent Abe was re-elected. But the size of his victory was larger than expected. This was a clear endorsement of Abenomics as well as the Bank of Japan’s gargantuan monetary stimulus plan.

Japan is going to get a LOT MORE of the same going forward. And that is going to propel the Japanese stock market even higher.

You see, Japanese inflation has remained stubbornly low and well below the Bank of Japan’s 2% target. This, combined with Abe’s victory, gives the BOJ the green light to keep interest rates in negative territory, to buy every government bond it can get its hands on and to buy Japanese ETFs like there’s no tomorrow.

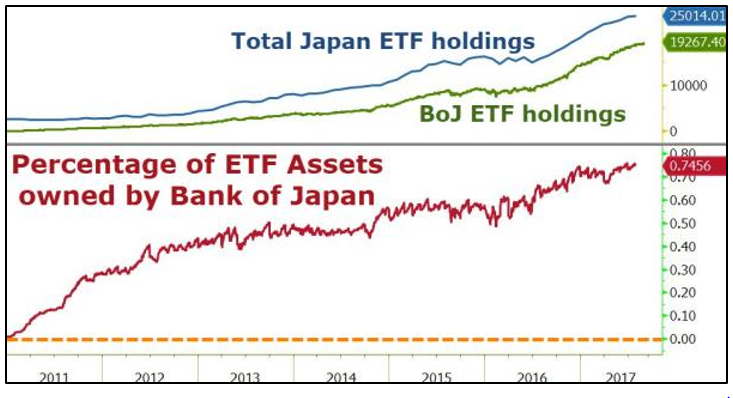

is almost hard to believe, but the Bank of Japan now owns about 75% (see accompanying chart) of all the Japanese equity ETF shares on the market.

|

|

| The Nikkei is the place to be for investors who want big profits fast. |

Sure, it is insane for any central bank to wade that deep into its own stock market. But Abe’s election essentially guarantees that we’ll see more of the same.

That means even higher Japanese stock prices and therein is an opportunity.

The Bank of Japan released its next policy statement today.

And it was consistent with Abe’s re-election. The board voted 8-to-1 to stay the course with massive quantitative easing (QE).

It will keep the policy rate at -0.1% and keep the yield on 10-year Japanese government bonds at 0.0%. Plus, it plans to keep buying trillions of dollars of Japanese government bonds, Exchange-Traded Funds, and real estate investment trusts.

In fact, the newest BOJ board member, Goushi Kataoka, pushed for even more negative interest rates and even more quantitative easing. But the board disappointed him.

Frankly, I didn’t expect any changes from the BOJ. But I do expect Japanese stock prices to shoot even higher on the friendly language from the central bank.

To be far, I need to tell you that my Calendar Profits Trader subscribers are already riding the Japanese stock-market wave. But I think we’ve only seen the tip of the Japanese bull market iceberg.

There is no shortage of easy ways for U.S. investors to invest in Japan:

Japanese ETFs such as iShares MSCI Japan ETF (EWJ), WisdomTree Japan Hedged Equity Fund (DXJ), and ProShares Ultra MSCI Japan (EZJ).

Japanese stocks that trade on the NYSE such Toyota Motor Corp. (TM), Kubota Corp. (KUBTY), and Sony Corp. (SNE).

How you do it is up to you, but I recommend that you give your portfolio significant exposure to the Land of the Rising Sun.

Warning: Today’s the very last day to join Sean and Martin. ALL enrollment in their Supercycle Investor service ends today. Tomorrow, it will be impossible to join at any price. Click here.

Best wishes,

Tony Sagami

{ 10 comments }

I thought that Japan was going to implode soon…..?

I just enrolled in Supercycle. Why would I ever invest in the Japanese market when according to what Sean & Martin say they are close to imploding in the Bond market. If the bond market starts to collapse the Nikkei should be sure to follow(?)

So which way is Japan going?

Does the Weiss organization make sure that they cover all the bases so that it can at least say somebody got it right there?

In the past, I always thought dear old Larry took opposite extremes of everybody else too – and sometimes then being the only one to get it right.

Hew does the cash in the bank look like it will make it for a while yet?

The ups and downs make’s it tough to jump in or jump out?

What’s gonna happen to the solow steady state residual? What about the cobbe Douglas production function? Are there gonna be economies of scale? What about the advantages of large scale production? Do the advantages of large scale production outweigh the disadvantages of large scale production? Are we in for another boom, in this prosperity, recession, depression, improvements economic cycle that we live in. Maybe this is just a problem of hemispheres that we live in the world. Northern hemisphere versus southern hemisphere, see which one is more prosperous. We do know that we are in a boom, recession, depression, recovery and growth economic cycle. We might be in a kondratieff cycle, a 45 to 60 year cycle, in which booms last for up to 15 years, whereas recessions last for ten to fifteen years. I guess we have to accept that economic cycles just like human beings don’t last forever. They change constantly.

It’s Japan’s credit market that’s headed for the toilet. Its stock market has entered a new bull era.

All manulipation a false economy

This will end badly

Might be 5/10 years but there is no way out now for Japan

Anyone with an ounce of sense can figure this out

Abe is no economist

I do not have a PHD in economics

But anyone can do what Abe has done

It takes someone with smarts to figure out a better way

With the massive spending by the government of Japan do you expect the value of the Yen to drop?

With govt. debt the so high is this a time for individuals to have debt or be out of debt. Is this a time for individuals to own property with or without a mtge. or to be free of owning property.

Thanks.