|

You’ve just arrived at the airport parking garage after a grueling flight. It’s late. It’s cold and raining. You’re tired and hungry. Home beckons.

Since it’s the year 2020, you’re paying for things with your bitcoin wallet. Naturally, the parking machines take the cybercurrency. Good thing, too … you lost your real wallet, so no cash or cards.

You pay the fee. Nothing happens. A minute goes by … then two … then five. No ticket.

Twenty minutes later, your transaction goes through.

That’s exactly what’s going to happen if bitcoin’s underlying technology doesn’t change. In fact, if things carry on as they are now, bitcoin isn’t going to happen … at least not as a currency.

But there’s a fix in the works … one from which you can profit if you play your cards right.Â

Decoding Cryptocurrency

Bitcoin is a cryptocurrency that exists only within a network of computers. This network is decentralized; it exists on computers all over the world. That decentralized approach is what makes bitcoin private, secure and free from government manipulation.

As I explain in the December issue of The Bauman Letter, when new bitcoins are created — a computer-intensive process called “mining” — bitcoin transactions are processed at the same time. Anybody who is trying to send or receive bitcoins must wait until the mining process has been completed to have their transaction processed.

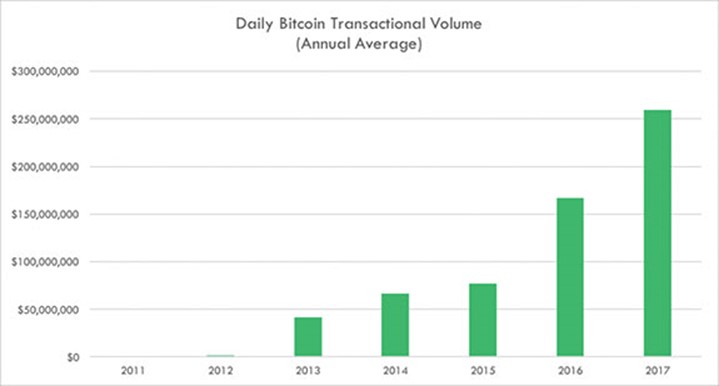

That can be really slow … especially compared to credit card transactions. Visa, for example, processes 150 million transactions per day, or roughly 1,700 transactions per second. It could do up to 24,000 transactions per second.

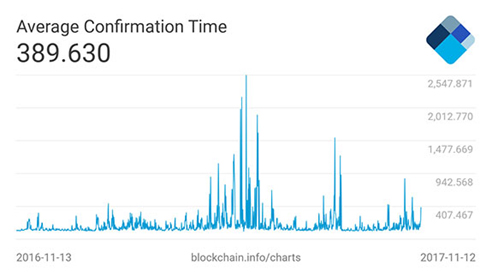

The bitcoin network can only process about 6.5 transactions per second. The average transaction takes about 10 minutes to process. On some days over the last year, bitcoin transactions have taken more than 42 minutes.

As bitcoin use grows, waiting times are getting longer because there are more transactions to process.

Stick a Fork in It

Because it is ultimately nothing more than a currency, bitcoin will never succeed if it can’t do what a currency needs to do: allow people to transact. Long wait times make this impossible. Until this problem can be solved, bitcoin is nothing more than an unstable, speculative play.

There are two possible solutions: Make the amount of data processed in each bitcoin mining block smaller; or make the blocks of data bigger, so that more information can be processed at one time.

To try to reduce the size of the bitcoin block and speed things up, a majority of the world’s bitcoin miners voted to adopt a technology known as a segregated witness, called SegWit2x. SegWit2x reduces the data in each block by removing some of it from the current block and moving it to an extended block that isn’t verified every time.

But moving some data out of new data blocks potentially makes bitcoin less secure. Unless every bit of data is verified every time a block is mined and transactions are processed, it may be possible to forge or otherwise alter the data trail. That would make bitcoin useless.

To deal with this, a group of bitcoin miners with reservations about segregated witness technology initiated what is known as a “hard fork.” This involves taking the existing chain of previous bitcoin transactions — called the blockchain — and starting a new branch of transactions using a new system. This new system implemented an increased block size of 8 megabytes. That accelerates the verification process.

But the new branch of transactions can’t be called bitcoin, because it uses a different technology. So, the renegade group of miners decided to call the new cryptocurrency “Bitcoin Cash.”

And because every bitcoin that existed before the “fork” is also included in the new branch of the blockchain, bitcoin owners got a free Bitcoin Cash for every bitcoin they own.

Money for Nothing

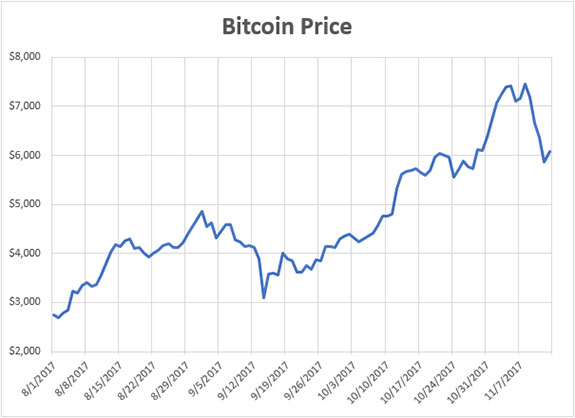

The price of bitcoin has been on a tear recently, but declined rapidly last week:

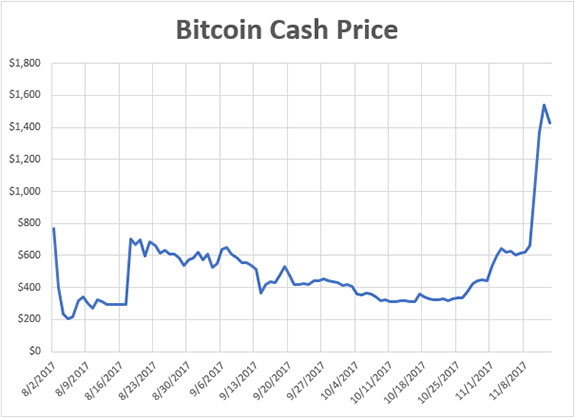

But look at Bitcoin Cash:

A coin that had no value at the beginning of August is now worth over $1,400 each.

And as you can see, Bitcoin Cash’s gains last week seem to have come at the expense of … bitcoin.

Things Are Getting Really Weird … But There’s Money in It

The SegWit2x initiative to modify bitcoin’s blockchain was canceled last week. That’s why bitcoin tanked, and Bitcoin Cash took off. With bitcoin’s underlying speed problems unresolved, sellers panicked and turned to Bitcoin Cash.

For now, it is the only game in town. But it is only a matter of time before there is another fork, since there doesn’t appear to be any way to fix bitcoin’s underlying code that will satisfy everyone.

That means owning bitcoin could give you an equal amount of whatever new currency forks off next. Depending on how it is received by markets, that could be money for nothing … literally.

I’m a bitcoin skeptic, and I wouldn’t bet the farm on this sort of bizarre play. But money for nothing?

If you’re careful, it could be a lot more than just a line from a song.

Kind regards,

Ted Bauman

Editor, The Bauman Letter

Ted Bauman specializes in asset protection, privacy, international migration issues and low-risk investment strategies. He serves as the editor of The Bauman Letter, Plan B Club and Alpha Stock Alert at Banyan Hill Publishing. This article originally appeared here.

{ 7 comments }

Firstly SegWit and 2x are actually 2 different things.

The price rise/fall after Segwit2x was canceled, looks like a major pump and dump.

During this time the bitcoin network was being spammed by tiny transactions, basically designed to slow the bitcoin network to a crawl.

So this is manipulation.

SegWit though brings additional flexibility into Bitcoin that will take some time to bear fruit.

But that flexibility for example Layer 2 solutions and sidechains, smart contracts, will be much more useful than bigger blocks and provide much more scaling.

The problem with bigger blocks is that they require bigger and more space to run Full Nodes and Full Nodes is what keeps the network decentralized. Ergo making bigger blocks leads to more centralization and that makes bitcoin less secure, more subject to say, government shudown.

Oh, you don’t need to ‘wait’ for a block to be mined, you only wait for Confirmations.

Confirmations are done by Full Nodes, (not necessarily miners and most of the time, not by miners).

Miners write the transactions onto the blockchain. The entire network is probabilistic. In general terms after say 6 confirmations the probability of your transaction not being written into the longest blockchain becomes a near impossibility.

‘Money for nothing?’ you say. Well let’s bare in mind the the shocking facts of our fiat currency-ponzi scheme.

Bare in mind that fiat currency such as dollars is ‘money’ produced by banks out of thin air. Bare in mind that each time new ‘money’ is produced the existing money gets inflated accordingly. Bare in mind that fiat currencies are not really money, but is described as currency. Bare in mind that all the fiat currency created out of thin air by banks, is charged with interest. Bare in mind that all ‘money’ issued is equal to the debt of the world that we all owe to the banks! In other words. All the fiat currency in circulatioin is not yet paid off debt to the banks. The ponzy scheme is that the interest to be paid on this debt has never been created! When the interest paid to the banks accumalates till certain hights a shortage of money occurs in the economy. That’s why a financial crises occurs. What follows is that people and companies get bankrupt. Not all people can get enough money then, to pay off their debts. The assets left go all to the banks. This is why the banks not only own all money but also own the world. The more debt (money) they create the richer they become (interest) and the poorer people will get (inflation).

So do you think Ether crypto will overcome bitcoin by the way it work.

This post makes me question Mr. Bauman’s knowledge of crytpos. First, who would ever use Bitcoin to pay a parking fee? It would be as silly as using a gold coin to do that. Bitcoin is a store of value, not something to use for day to day expenses. Yes, the transaction time is long so you liquidate some bitcoin into fiat currency and use that for expenses. He is also overlooking other cryptos that have shorter processing times.

Folks in Cyprus, Greece, Argentina, Zimbabwe and Venezuela probably aren’t too upset with a long transaction times for Bitcoin! What’s not to love about a currency that can’t be destroyed by governments, can’t be “bailed in” by a corrupt banking system, is private, highly portable and easily divisible? The lessons from these countries are all arguments for having some wealth in cryptocurrencies as well as gold and silver. The experience of ordinary people in those countries will soon be ours. He is right to say don’t bet the farm on Bitcoin but that can be said for any financial instrument, stocks, bonds, commodities, etc. Having some cyptocurrency is just part of being diversified.

Jim wrote: “Bitcoin is a store of value, not something to use for day to day expenses.”

(1) Please identify the INTRINSIC value of BITCOIN.

(2) One of the reasons BITCOIN has skyrocketed is precisely because big-name companies have begun to explore the possibility of BITCOIN being used for transactions.

Now, let’s assume a worst case scenario–total collapse of current markets for stocks, commodities, bonds, and even cash. Let’s assume the U.S. Government is still standing. Does anyone think that, given NSA’s access to every American’s email, social media, and telephone, it does not have access to every aspect of BITCOIN? Give me a break. In the worst case scenario (or, frankly, whenever it wants to do so), the U.S. Government can either make BITCOIN the zeros and ones numbers scheme that it truly is or can take it over and operate it as U.S./Global currency. Does anyone doubt this?

Doesn’t the latest price surge negate a lot of this analysis? https://www.express.co.uk/finance/city/880828/bitcoin-price-USD-bitcoin-cash-latest-news

I like all the above comments. Some points may apperar contradictory, but I consider them complementary.

One question I have, which is rarely addressed and never answered is how do you finally redeem your bitcoin when fiat currrency has crashed to worthless – or in the interim undergoing hyperinflation?

How is the value of bitcoin measured then?