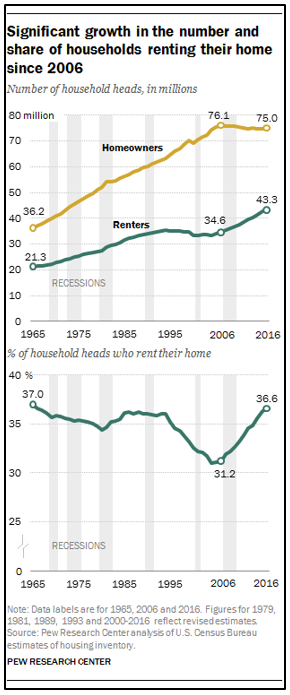

More Americans are renting their homes than at any point since 1965.That’s per a new study by the Pew Research Center.

More Americans are renting their homes than at any point since 1965.That’s per a new study by the Pew Research Center.

The total number of households in the U.S. grew by 7.6 million between 2006 and 2016.

But over the same decade, the number of American households living in a home they own remained essentially unchanged.

Meanwhile, the percentage of Americans renting their homes increased dramatically. It jumped from 31.2% in 2006 to 36.6% in 2016.

And that figure continues to rise …

The latest percentage of renters now stands higher than the 36.2% of 1986 and 1988. It’s now within a whisper of the all-time high of 37.0%, set in 1965.

I believe the root of the rising rental rates is economic hardship.

Only a small percentage of people who rent do so voluntarily. Most get pushed into renting because of financial circumstances.

When Pew surveyors asked renters why they rent, a whopping 65% cited financial circumstances. Only 32% said they rented as a matter of choice.

The three largest groups of traditional renters — young adults, blacks and Hispanics — are still the most likely to rent.

But the rental rates also increased for older adults, whites and college- educated households.

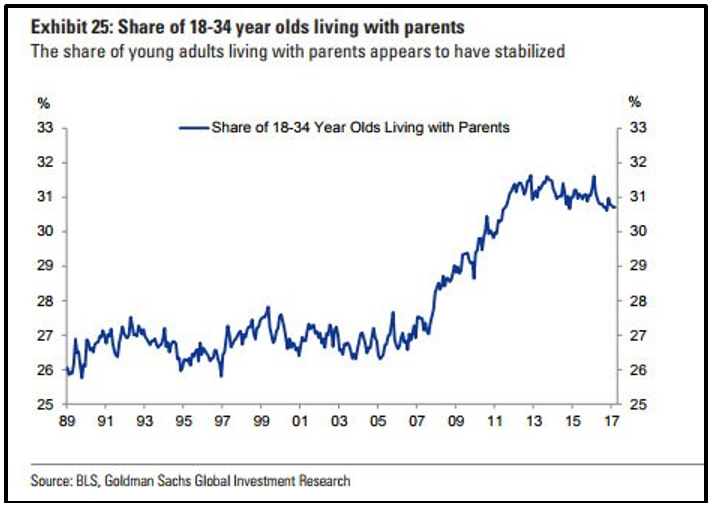

Worse yet, there is a large contingent of Millennials who aren’t even renting.

They choose to live in Mommy and Daddy’s basement. In 2016, an alarming 34.1% of 18- to 34-year-olds lived with a parent.

The “Basement Generation” makes a sad testament about the state of our economy.

But I place most of the blame at the feet of Mr. Magoo (Ben Bernanke) and Mrs. Magoo (Janet Yellen).

Their ridiculously nearsighted, low-interest-rate policies have made it impossible for millions of Americans to afford a home.

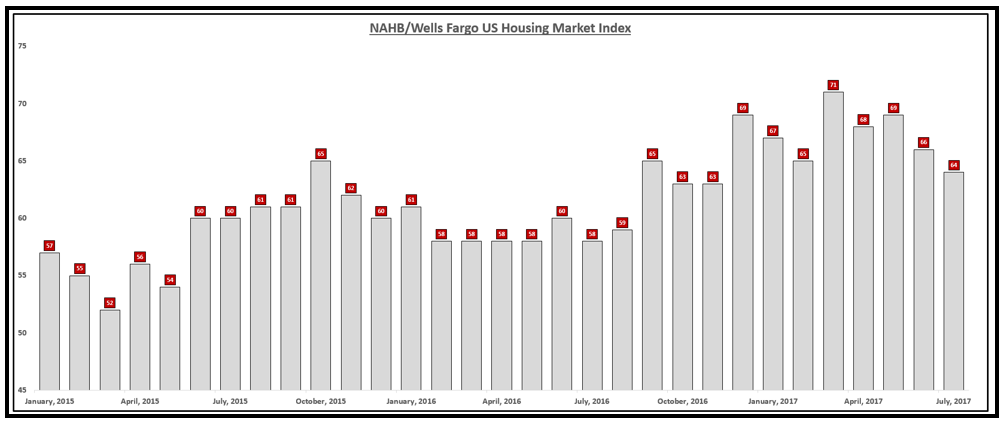

Heck, even the people who build houses for a living are worried. Just look at the Housing Market Index compiled by the National Association of Home Builders.

The NAHB calculates its Housing Market Index based on the sentiment of members who sit on its board.

The association asks these home builders to characterize the housing market as “good”, “fair” or “poor.” If all panelists respond that it’s “good,”, then the index is 100. If all answer “poor,” then the index is 0.

For July, the Housing Market Index dropped to 64 from 66 a month earlier. That was down from 67 six months ago.

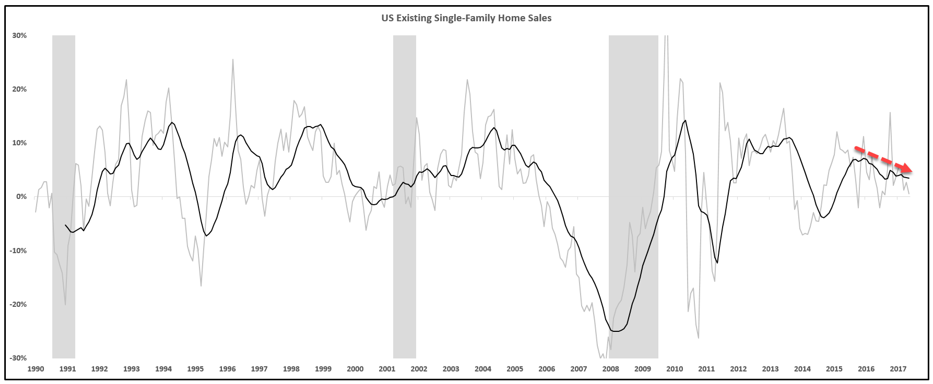

Sentiment — like the NAHB survey — is one thing. But cold, hard sales data is another.

In July, the growth rate for Existing Home Sales declined to just 0.73%.

Yeah, homes are selling … just at a VERY slow pace.

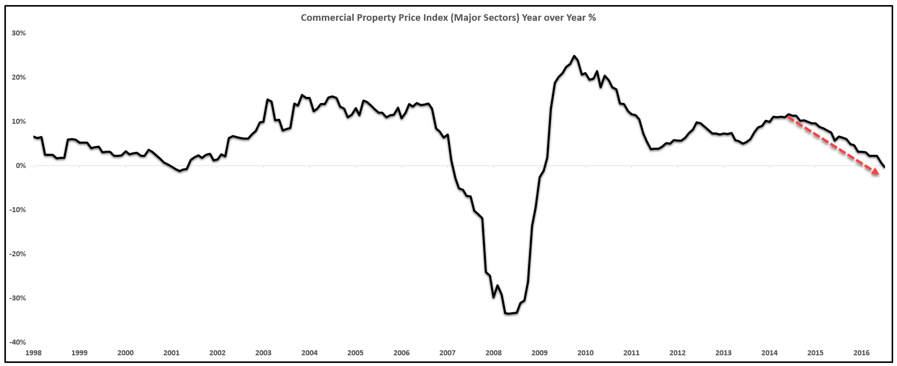

The weakest part of the real-estate food chain is the commercial sector, which includes apartment buildings.

Commercial real estate prices are on the verge of posting the first year-over-year decline since 2007. If that happens, it will only be the sector’s third year-over-year decline in nearly 30 years.

What does all this mean? My view is that the stock prices of the real-estate food chain are in nosebleed territory … and therefore overdue for a painful tumble.

I’m not suggesting that you rush out and sell your house tomorrow morning. I am, however, suggesting that real-estate stocks will be one of the worst-performing assets you can own.

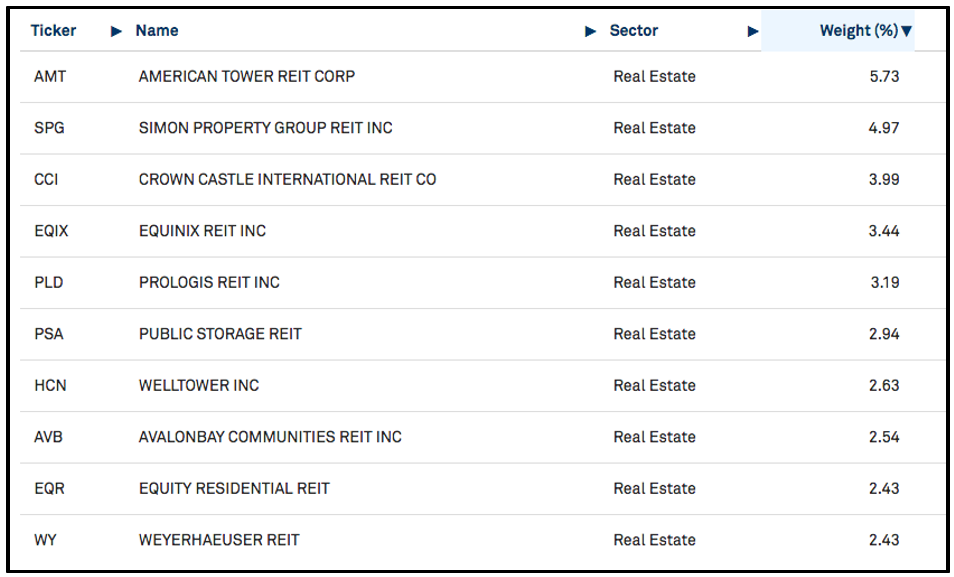

This means you may want to stay away from buying an ETF like the iShares U.S. Real Estate ETF (IYR), which aims to track the investment results of the Dow Jones U.S. Real Estate Index.

Here’s a look at IYR’s top holdings …

Rather than avoid these stocks, if you are an aggressive investor, you have options. You could buy put options on IYR, as a bet on this ETF going down.

Or you could consider buying the ProShares Short Real Estate Fund (REK).

REK is an inverse ETF that is designed to deliver the inverse return of the Dow Jones U.S. Real Estate Index. This ETF offers a great way to position yourself for profits as this generation of renters continues to expand.

Best wishes,

Tony Sagami

{ 13 comments }

What is the impact of student loans on the inability of millennials being ready to buy vice rent or live with parents on top of the cost of health care insurance?

Problem Assessment: Student Loans/Debt – Impact on Millennial Generation

1. Student Loans/Debt: Student loan debt is robbing the individuals of their future and contributing to stagnation of the economy. Because of the loan burdens, the millennial generation is deferring marriage that adversely impacts demographic growth, is unable or unwilling to purchase a home and get on with their lives. Proposed solutions to address the student debt symptom include recommendations to forgive the debt, or extending the terms and conditions to pay back the government loans, and/or even to provide free college going forward.

Source of the Problem:

• Government first moved to guarantee the loans but now provides the loans directly.

• Government student loans without concern for ability to repay the loan in the future; basket weaving is not a course likely to produce an income stream that will support repayment.

• Some see college as a “right of passage†party into adulthood without benefit of learning anything that will give them future career options, but limiting their options due to student loan debt going forward.

• Colleges operate like a business for generating revenues but not for managing costs. Since the government provided student loans foot the bill, the colleges have no incentive to control their costs.

• Tenured professors that do not teach or accomplish meaningful research that may ultimately service a market need, but directly contribute to the increased costs for millennial students attending college.

• Colleges pay a second time for the tenured professor’s Teaching Assistants that are actually teaching in the classrooms and laboratories.

• Student loans are another unrecognized Federal Government obligation approaching $2 trillion that will eventually be paid by the tax payer at the expense of ongoing governmental functions. Interest rates on government debt will soon be higher than the interest to be collected on repayment by the millennial borrowers.

2. There are simple solutions to remedy the sources of the problem that only take the courage to adopt and implement.

• Require public colleges to become self sustaining entities by fiscal year 2021.

• Eliminate the government’s direct involvement in making student loans effective 2018.

• If the government must be involved in student loans, then guarantee only a percentage of the actual amount borrowed by the student (25%) allowing the private creditor to determine the potential for repayment of the loan.

• Prohibit the use of student tuition funding in public college funded research.

• Require public colleges to compel all professors to teach a minimum of 10 hours per week in the classroom while eliminating Teaching Assistant instruction entirely. Those not involved in outside funded research projects should be required to teach 15 hours per week.

• Eliminate institutionally funded research by professors. College funded research may only be accomplished using donated funding or by direct funding of an outside sponsor interested in the research product.

• Set the terms and conditions for repayment of the currently outstanding student debt such that repayment does not inhibit the individual from getting along with their life. Just as the lenders have extended car loans into the 72-84 month repayment schedules, set the repayment of student loans at the appropriate time sequence aligning with repayment of the loans based upon 4% of the borrower’s annual income while allowing both the interest and principle to be recognized as a tax deductible amount until the current backlog of debt is eliminated. The lenders set the terms and conditions for the re-payment of non government direct loans upon implementation of these revisions.

3. By implementing this approach, the cost of attending college will decrease substantially making it more affordable for more within the millennial generation.

• Getting the public colleges’ costs under control so that they are self sustaining will reduce the cost for attending college substantially.

• Getting the tenured professor’s back into the public college classroom will be value added for the learning environment while removing the academic bubble of exalted lifestyle for these professors. Having the professors in the classroom will eliminate the need for Teaching Assistants that will be realized within the self sustaining cost model.

• Prohibiting the use of tuition revenues to fund public college funded research will work to reduce the cost of attending college.

• Supporting research for donor funded topics or in conjunction with an outside sponsor will enhance the probability that the research will focus on potentially marketable topics that will allow the public colleges to become self sustaining entities.

• Finding a way to reduce the repayment burden of existing student loans is good for reducing the losses that the Federal Government will otherwise endure while giving the millennial borrowers the space they need to balance their financial situations as they embark on their life’s journey.

Yes BW! This was as good or better than Tony Sagami’s article, no exageration. We need solutions to our problems. Making a profit off these problems is fine but what about the solution.

Tony-while your evidence is very insightful-you have missed one of the major reasons that the high rental number is what it is. Large student loan payments. Couple a lousy economy with high student loans and you have a major clog in the home buying chain.

You need to look at school property taxes as the reason more people are renting, interest rates are at all time lows – there is no other valid reason!

What does low interest rates have to do with low buying of property for plp. If anything it should cause more buying. What kind of spin you trying to pull here.Lower interest rates mean lower payments. For students that is ideal.

There is more than hardship contributing to the trend to residential rentals.

The 20-35 yr olds have less desire for bricks and mortar…and a greater desire for travel and job mobility… rental units make sense to many in this age group.

As a 70 + senior… my long term planning is 3-5 years.

a condo apartment and better rental…look increasingly more attractive.

Many in tighter rent control environments find the rental unit more economical… even over the mid term… 5-15 years.

I appreciate your incite…

keep up the good work.

Cheers

Weak economy caused by a District of Communists that are not Americans. The representation for taxation. Marx, Stalin etc would be on their knees learning from the district. Today owning is not an asset, it is a liability, a ball and chain of servitude to an anti Christ anti American system. The only assurity of owning is loss.

IS ALL REAL ESTATE NATIONAL OR STILL LOCAL?

How about the more illiquid Real Estate Partnerships or L.L.C. that directly own various types of commercial properties around the country. Do we have just one National real estate market now or do we still have a large number of separate “local” or Regional real estate markets? If real estate is truly Local, then selectively buy real estate in the best markets and avoid the big boys or the biggest urban markets with the highest costs and greatest number of renters. Those markets are real losers, like NYC and Calif. Cities.

if poor economy is the reason why the rental number is so high then why was it lower in 2008 and steadily increased as the economy improved. there is something else trend wise going on. I do agree with the overvaluation situation either way.

Thanks for all you do…great info, it’s spot on. Helps guides me in important financial decisions. I’m doing better with than without your accurate informative update information. Thanks LB

Thanks to you Ben Bernanke and to your colleagues. You saved us from a worldwide depression by taking extraordinary, unprecedented measures. Also, by keeping interest rates extremely low you made mortgages more affordable than they would have been otherwise. (Of course we can’t ignore the counter balancing negative effect of low interest rates—the penalization of savers.)

If the Bernanke/Yellen policy of keeping interests rates low increased housing affordability and thus increased housing sales, how do we account for lower housing sales as measured by the percentage of homeowners?

In addition to the factors mentioned by others in this thread, we have the financialization of the economy, the uneven distribution of income, and the psychological aftereffects of the Great Recession.

Prior to 2007-2008 millions of people believed that there was no risk in real estate because it always went up. “Buy it ’cause they’re not making any more!” (Will Rogers?) The shock of realizing that houses are assets that can destroy your bank account continues to ripple through the country and the world.

Some people stay out of the real estate ocean because they’re afraid of the sharks. That’s not a complete explanation for lower housing sales. It’s a partial one.

Another explanation is the financialization of the economy. A substantially larger percentage of America’s national income goes to people in the financial industries leaving less for others to buy houses with. (See Google for numbers and charts)

Financialization is related to the general issue of income distribution. Over the last 30 years or so, American wages have remained stagnant. (Google or your browser of choice) Stagnant wages combined with inflation equals less money, in real terms, for home purchases.

So Tony, I can’t disagree with your facts. But I find your explanation of the facts unpersuasive. Low mortgage rates do not lead to lower housing sales because greater housing affordability does not lead to lower housing sales. When lower mortgage rates are accompanied by lower housing sales, other variables are in play as detailed above.

If Bernanke and Yellen had raised interest rates higher, mortgages would have been less affordable and housing sales would have been lower. Would you consider writing B and Y letters of appreciation?

Ya, you se, we used to have lots of good Middle Class jobs in america and then came the Republican Revoultion with GATT under Reagan and NAFTA under Bush and breaking the Unions and here we are now with Only the Ultra Wealthy (who funded the Republican Revoution) having lots of money and most of the home buying age kids of today having vey little…. The economy ALWAYS goes in the ditch when Republicans rule becasue ONLY the Rich have any money….. Seems the GOP can’t or isn’t willing to learn that….. Soon they will be gone and we will return to the prosperity of 1932-1982 when lead by Democrats who look out for the 97%….

Great Debates and insightful. My take on all of this, “CONTINUOUS TRANSFER OF MILLIONS OF DOLLARS TO THE UPPER 2% OF OUR ECONOMY.”.

Money doesn’t just disappear from OUR Ecconony, it just Transfers Ownership through Economic UPS& DOWNS in

Stocks, Real Estate, Oil, Businesses, ETC.

Just a Simple Observations by a ordinary Small Investor.