|

On Monday, Tesla (TSLA) reported stronger-than-expected sales of its Model S and Model X cars and its stock shot up by almost 7% to a new all-time high.

That surge pushed Tesla’s market cap to $48 billion, above the $45 billion value of Ford. Yup, Wall Street thinks Tesla is worth more than Ford.

Tesla’s stock added another $5 on Tuesday and pushed past General Motors to be the most valuable automaker in America.

How does Tesla compare to Ford and General Motors in sales? In the first quarter of 2017, Tesla sold 25,000 cars. Ford and General Motors sold 617,000 and 690,000 automobiles respectively.

By the way, Ford pays a $0.60 (5.1%) annual dividend while General Motors pays $1.52 (4.3%) a year.

Yup, Tesla sold just 25,000 cars. More importantly, sales of Tesla’s most popular model, the Model S, are slowing down instead of increasing. My guess is that most wealthy, environmentally sensitive, status-conscious people have already bought an electric car.

The flattening sales trend is about to get worse. Starting in 2012, Tesla offered buyers unlimited, free, lifetime charging. However, Tesla discovered that its buyers were gorging themselves at its free charging stations instead of plugging in at home.

This January, Tesla stopped offering free unlimited charging. Instead, it offers 400 kWh a year, which translates into about 1,000 miles of driving.

Of course, there is more to Tesla than just cars. Tesla has big ambitions for its battery, solar panel, and space exploration divisions.

But those ambitious dreams are a big reason why Tesla has yet to turn a profit and why it has, in fact, lost $2 billion in 2016. Yes … a $2 billion loss in a single year.

And Tesla’s books show a whopping $8.59 billion in debts, or $44.25 per share of IOUs. In fact, that debt load just got heavier; Tesla sold $850 million worth of bonds in March.

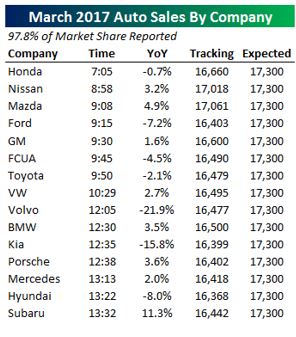

By the way, while Tesla was busy passing General Motors, the auto industry reported its March sales on Tuesday … and they were disappointing.

Americans bought 1.56 million new cars and trucks in March, a 1.6% year-over-year decline, led by big drops at Ford and Fiat Chrysler.

March “was a tough, tough, tough market,” said Judy Wheeler of Nissan.

The Wall Street crowd was wrong again. They expected dealers to sell 1.62 million new cars and trucks in March, a 2.2% increase.

I am not suggesting that you dump your Tesla shares tomorrow morning. But the struggles of the automakers combined with Tesla’s extreme valuation should trigger some alarm bells. Moreover, if you really want to invest in the electric-vehicle market, there are several ways to do so sanely. For example, …

- This may shock you, but Tesla isn’t the biggest electric-vehicle seller in 2016. It is BYD Auto Co. Ltd., a wholly owned subsidiary of BYD Co. Ltd. (BYDDY). Warren Buffet, by the way, has a significant investment in BYD.

- Instead of investing in the automakers, consider putting your money into battery manufacturers, such as LG Chem Ltd. (LGCLF), Samsung SDI Co. Ltd. (SSDIY), or Foxconn Technology Co. Ltd. (FXCOF).

- And if you really want to get basic, consider lithium producers; Albemarle Corp. (ALB), Sociedad Quimica y Minera de Chile SA (SQM), or FMC Corp. (FMC).

The momentum behind Tesla is so strong that I suspect it can go even higher. But it is a stock for gamblers who make a living by investing other people’s money.

Not investors.

Best wishes,

Tony Sagami

Â

{ 10 comments }

Keep in mind sales are entirely dependent on a federal tax credit, state tax credits, and clean air credits for the company. Even with all of those, it still loses money per car. Good luck to the last debt and/or equity buyer in the pyramid.

Thanks for the latest insanity report. It’s great that we still have a somewhat free country where any idea has a chance to become reality. Tesla would never exist without $billions in government assistance and free bees. With relatively cheap oil for decades ahead, I’ll stick to gas and oil.

Would like more info lithium batteries and manufacturING of lithium.

.

Welcome back!

Well said. Good reasoning.

For the world to benefit from clean cars ,Tesla mist

sell gazillion of cars @ low price 20 G or less.

Provided that big Banks may support Tesla at this

time, market conditions play well, buyers lining up… this hypothesis​ may become reality.

Let’s see: Republican Presidents and Republian majority Congresses bouught us 1929 and 2008 and, once again we have a Republican President and a Republican Majoirty Congress. Could it be that the average American consumer has more of a memory than we give him credit for?

Eagle495 – You make it sound like Republican presidents brought us 1929 and 2008, but you failed to remember the part Democratic presidents played leading up to those market drops.

Nice article. Tesla does border on being an investment Ponzi, but it’s not an outright fraud. Rather, it’s an excellent example of the insanity that comes about in a world of negative real interest rates and heavy government subsidies for pet ideas of the politically-connected rich. What happens is massive malinvestment and misallocation of capital.

The funny thing is, the only honest business Musk is in is his space business. He sells to governments, but SpaceX (not part of Tesla, BTW) works in a competitive industry and has put serious downward pressure on the cost of space launches. His third business, Solar City (also not part of Telsa), is back to government-dependent squandering of other people’s capital. The entire way that solar power has been pushed and sold is a hoax: at scale, with industrial-size power needs, it’s not even close.

we are at the end of the oil generation….Peak oil was reached years ago,( I won’t waste time in the debate of, When)….Oil and the pursuit of oil has wasted millions of lives and TRILLIONS of dollars…..I say this because when USA wages war in the mid east…often its for “US interests” which translates to oil interests. I remember reading how the IMF came into some mid east country which was at war…..the IMF said to the mid easterners..”.you owe “X ” billions to the IMF…we would be glad to forgive your debt…sign here.!”..the paper would have given a substantial part of the oil producers oil to the IMF for pennies. I guess the European IMF people forgot that the smart camel salesmen was an Arab…the mid east country told IMF to ..”go to hell!.”…The point is: we don’t need their oil,… any more.. Peter Diamedes(spelling?) who sponsored the X prize, is behind solar. He reports the cost of solar is 1000 x cheaper now,.. then when Jimmy Carter pushed it back in the 1970s..Tesla cars are hot and there is certainly a market for them . Musk is a genius. He realizes he made a statement with the $50000 model and is working on selling a $25000 model,.. to the general public. He has proved that the military industrial complex companies have been raping the us gov’t with their prices ( spacexs cost for rockets to the gov’t were 300 times,.. yes that three hundred times) cheaper than what Boeing and McDonnell Douglas quoted.!!!….I don’t understand all the financing Tesla motors had done but the fact is that companies and the military are buying into the Tesla Power wall, to store solar energy. Individuals are buying the idea, too. so…..Musk is kicking the military industrial complex companies in the groin in two area…….rockets…..and energy production…..We need MORE Elon Musks, not less!!. Ponzi was a charlatan. Musk is a genius. To link Ponzi with Musk is to say that politicians are decent, law abiding people. They are not ( read the book ” throw them all out”)…..Solar is the future…oil is the past. Yes we shall always need oil for drugs and plastics…but we don’t need oil to burn for cars. We can also get out of the Mid East as we will no longer have “US interests” over there. Once we learn they really don’t want Democracy, and that young men really don’t want to get their legs blown off so Mrs Muhammad can drive a car and get out to vote…we will be out of foreign entanglements….like George Washington warned us about nearly 300 years ago…!!!!