|

I’m the right age, but I was never much of a yuppie.

You remember the yuppies, don’t you? The young, educated, often-arrogant baby boomers who wore pricey designer labels, drove BMWs, danced at Studio 54, and behaved like entitled spoiled brats.

I’m not young anymore. But even when I was, I never jumped on the BMW, Starbucks, Rolex, Armani, or Country Club bandwagon. I’m just a hopelessly simple son of a vegetable farmer who drives a domestic pickup truck, wears jeans, shops at Wal-Mart and Costco, and wears a Timex watch.

I don’t golf, I drink Folgers coffee like my father, and my idea of a good time is hiking around Glacier National Park.

The yuppies, however, became a powerful consumer trend, starting in the ’80s. They had a great impact on both the economy and the stock market. Investors who bought stock in those yuppie-catering companies likely made small fortunes of their own.

Yet, as powerful as the yuppie phenomenon was, it is just a mosquito bite compared to the monumental shopping spree put on by this generation’s breed of yuppies.

I’m talking about “chuppies,” the Chinese version of yuppies.

Chuppies are the rapidly-growing upper middle class created by the booming Chinese economy. Like the yuppies, chuppies are well-educated, ambitious, and have money burning a hole in their pockets.

And they’re spending money at a pace that would make an American yuppie faint with jealousy. The concept of “face” (think prestige, social status or simply how someone conveys his or her worth) is extremely powerful in China. So, buying only the top brands will do.

Just like with the American yuppies, you can make a lot of money by identifying how these so-called chuppies are spending their money, and by investing in those companies that cater to them …

The clothes they wear. When it comes to apparel, the Chinese are just like the rest of Asia. They crave designer labels — the more expensive, the better. Indeed, they are decked out in clothes from Ralph Lauren (RL), Michael Kors (KORS), Burberry (BURBY), Hugo Boss (BOSSY), Prada (PRDSY) and they wear cosmetics and perfumes from Estee Lauder (EL), Coty Inc. (COTY) and Inter Parfums (IPAR).

The food they eat. When it comes to food, chuppies are surprisingly fond of American fast food. However, I seldom see lines at McDonald’s and Burger King stores in China. Why not? Asians much prefer chicken to beef, which is why KFC (YUM) stores are almost always jam-packed with customers. That’s also why more than 50% of YUM Brands’ revenues come from outside the U.S. Lastly, chuppies often finish their meals with a sweet donut from Krispy Kreme (KKD) or a latte from Starbucks (SBUX), which is one of the most popular places to take a date in China.

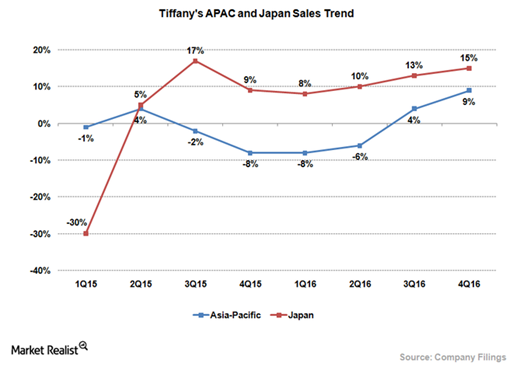

The status symbols they flaunt. Successful chuppies are very eager to show off their success and are very conspicuous consumers. And that’s why the stores at Tiffany’s (TIF), Coach (COH), and Louis Vuitton (LVMUY) are doing gangbuster business. In fact, I see more Bentley, Rolls Royce, BMW, and Porsche cars in Shanghai than I do in Seattle.

The way they spend their vacations. Chuppies also spend a lot of money on travel, especially within China. That’s because not that long ago, under stricter communist rule, domestic travel wasn’t permitted or practical. But now, thanks to aggressive infrastructure spending on railroads, airports, roads, and bridges, chuppies are making up for lost time and traveling like mad.

Hotel chains like Homeinns Hotel Group (HMIN) and InterContinental Hotels Group (IHG) are almost always fully booked … airlines like Cathay Pacific (0293.HK) and China Eastern (CEA) are filled to the rafters … and online travel agent Ctrip.com (CTRP) is doing gangbuster business.

There’s a big opportunity for worldly investors to profit from these globe-trotting chuppies. That is, if you know where exactly to look …

I’ve traveled all over Asia. And from what I can tell, the one place chuppies are flocking to in massive numbers may surprise you. It isn’t the Great Wall of China, the Bund in Shanghai, or Nathan Road in Hong Kong. It is the Las Vegas of Asia: Macau.

Macau is the only location in China where gambling is permitted. And boy, do Asians love to gamble. Get this: Six times more money is gambled in Macau than in Las Vegas.

Yes … SIX TIMES!

If you saw the high stakes being bet in Macau, you’d understand exactly what I’m talking about. The chuppies — plus gamblers from Japan, Taiwan, South Korea, Singapore, and others — flock to Macau to try their luck.

Every time I travel to Macau, I am shocked at how drastically the skyline has changed. Dozens of previously empty lots are now filled with steel girders stretching to the sky. By my next visit, these structures will be completed … and doing their part to fill the bulging demand for residential and office space.

Macau real estate is appreciating so rapidly that many of the service workers — dealers, waitresses, cab drivers, maids, and cooks — are being pushed out to neighboring cities where prices are lower.

What should matter to you as an investor

All those glamorous casinos in Las Vegas were NOT built with the money from winners. So if Macau is out-gambling Las Vegas, that should tell you volumes about how profitable the casinos in Macau are … and why you should include a Macau casino stock in your growth portfolio.

Business is booming. Just last week, the Macau Gaming Commission reported that gaming revenues jumped by 16.3% on a year-over-basis in April to US$2.52 billion.

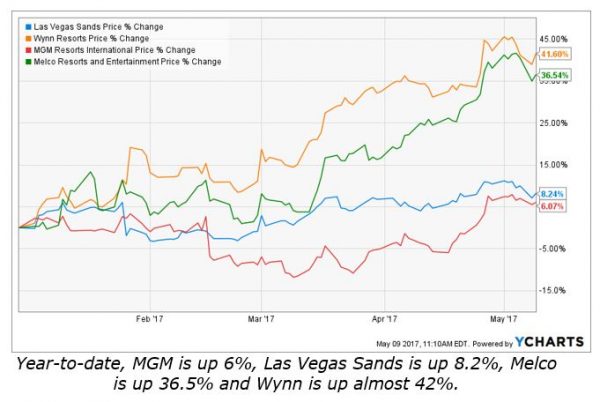

If you want to place a bet on Macau, there are four publicly traded gaming stocks that are doing big business there. And their stocks are traded right here in the U.S.: Las Vegas Sands (LVS), Wynn Resorts (WYNN), MGM Mirage (MGM), and Melco PBL (MLCO).

Warning: The above list is not a buy list. One of those four is an absolute dog, one is insanely overvalued, one is pretty darn good … and one is an absolute steal that I wouldn’t be surprised to see double within the next 12-18 months.

Wynn was in the news last week, after it reported a solid first quarter. It handily topped analysts’ forecasts with profit of US$1.24 a share on US$1.48 billion of revenue, compared to the $0.98 average of analysts’ estimates. On top of that, the company said it approved a cash dividend of 50 cents, payable on May 23 to shareholders of record as of May 11. So that’s one way to see a quick payout from a global casino stock without leaving home.

As usual, the Wall Street crowd continues to underestimate the magnitude of the Macau opportunity.

Like I said above, I’ve traveled all over Asia, and no place is as vibrant, growing, and packed with opportunity like Macau. And best of all, you can tap into that juggernaut without leaving your living room by investing in one of the four U.S.-listed gaming stocks.

Just make sure it is the right one.

Best wishes,

Tony Sagami

P.S. In Calendar Profits Trader, I take the guesswork out of trading by investing in major calendar events that are guaranteed to happen. I know these events will happen like clockwork. I know exactly when they will happen — usually down to the minute. I also know how they will move the markets. Read more here …

{ 7 comments }

If you were a member of a small Quaker church in Greensboro, N C which needs to add an addition because more people are attending than ever before and our members are supporting the church but they do not have the resources to add a million dollar addition what would you do? Thanks, David Brown

Don’t build. You’ll never pay it off.

Pledge members for periodic payments. There are professional services that help you do this. .

So which is which? (the dog, value play, really good, overpriced)? Thanks.

Run the tickers through Morningstar and you’ll have your answer.

Good US China article

You mention YUM but not YUMC?