|

No surprise: The Federal Reserve, under its new leader, Janet Yellen, announced that it will reduce its monetary stimulus by another $10 billion a month in April. The move was widely anticipated.

But then, surprise: At her press conference following the decision, Yellen indicated that short-term interest rates may begin to rise in the fall. With that simple statement, many investors, including me, began to think back to the last time interest rates rose sharply.

Twenty years ago, I was managing several multi-million dollar profit-sharing plans. I paid close attention to interest rates back then, because I knew that while most of the time, rising rates are good for the stock market and the economy, they can spell trouble for individual investors when they rise too quickly.

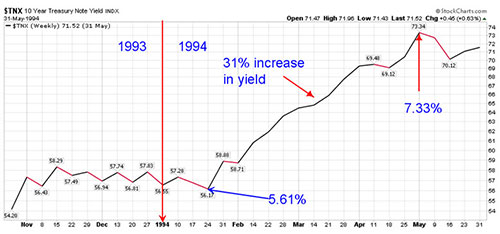

That’s exactly what happened at the beginning of 1994, when the yield on the benchmark 10-year Treasury note spiked by more than 30 percent in the space of three months.

When that move began, the reaction in the equity market was almost immediate. From a high near 500 in January, the S&P 500 declined by 7 percent before March was over.

But the period that followed the steep decline was arguably even more frustrating for investors: A nearly year-long consolidation phase, during which stocks stagnated.

Could 2014 Mirror 1994?

If history repeats itself, the fear of rising interest rates could create a consolidation pattern similar to the one we saw 20 years ago. The current bull market in stocks could transform into an even fight between economic bulls and economic bears.

And make no mistake: If that happens, 2014 will be a difficult and frustrating year for most investors.

But a long consolidation phase could also hold the promise of a major rally when it comes to an end. As a rule, the longer the period of uncertainty, the higher the probability that a big move will follow. That’s what happened when 1994 became 1995:

Those of us who have experience with all sorts of market conditions realize that bailing out when the going gets tough is often a terrible mistake. Instead, I’ve learned from over two decades of managing institutional and retail portfolios that it’s vitally important to stick to your discipline, especially during frustrating periods.

So even if interest rate fears turn 2014 into a repeat of 1994, try to take a longer-term perspective, and tell yourself that big gains could be right around the corner.

Best wishes,

Douglas

{ 1 comment }

Good for you,recommending the long term view.Better than thinking you can time the market and pay so much tax.