Crazy correlations. That’s what was behind Friday’s contagion selling. And before I answer the next logical question – namely, is the selling squall over? – I want to share something with you.

Market Roundup

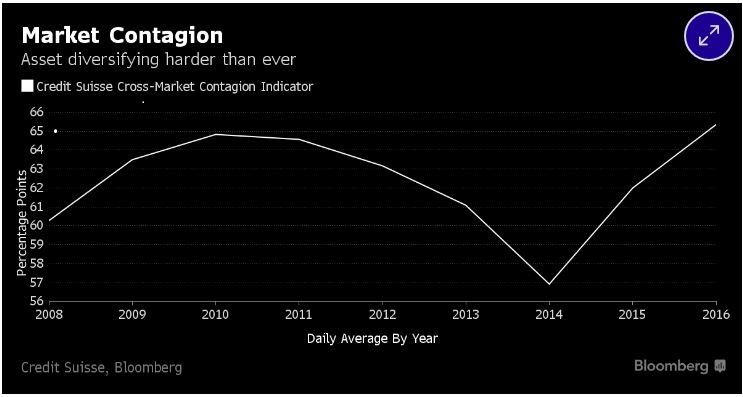

I’ve included a chart of the “Credit Suisse Cross-Market Contagion Indicator.” A mouthful, for sure. But basically, the indicator is designed to show how linked (or unlinked) various assets are in terms of movement.

When currencies, stocks, bonds, and other asset classes are all basically trading together, the index rises. When they’re actually trading on their respective underlying fundamentals, the index falls.

The most fertile environment for stock market gains is when the index is falling and/or low. That’s because fundamental analysis yields richer rewards, and because you can gain some measure of safety by diversifying your investments. We saw that in the heart of the bull market in the mid-2010s.

But look at the chart below and you’ll see this index is now at its highest level since Credit Suisse rolled it out in 2008. That means assets of all shapes and sizes are basically moving on one single catalyst – central bank funny money.

That means any minor suggestion that monetary policy might be dialed back can set off a financial hurricane. Or as one analyst said in the Wall Street Journal today:

“Nobody has been buying on fundamentals, but on technicals … And the dominant technical has been central banks being massive buyers of assets.”

The Financial Times also warned today that market risks are much larger now because hundreds of billions of dollars globally are invested in algorithmically driven, volatility-based trading strategies. When the markets behave like they did this summer, those strategies work just fine. But when you get simultaneous selling of both stocks and bonds, it wreaks havoc on them and can lead to an avalanche of sell orders.

So what’s the best course of action? Well, it’s only natural to see markets stabilize after a nearly 400-point rout in the Dow Industrials. That’s what happened earlier today right as markets tested key support around 18,000 on the Dow and 2,100 on the S&P 500 futures. The question is whether this is just a rest stop on the road to lower prices, or the place where big money investors will make a major stand.

| “I refused to get sucked up in all the Wall Street hype.” |

Personally, I’ve been in the cautious camp for a while now. I refused to get sucked up in all the Wall Street hype about the big “breakout” in July – and sure enough, we’re right back to those levels.

I’m inclined to use any bounces here to lighten up and see how things go. Or if you’re a more aggressive investor, you can take advantage of those bounces to add select put option or inverse ETF positions that are designed to rise as stocks fall. You can get my favorite picks in my All Weather Trader service.

I’ll wrap things up by referring to some recent comments from Allianz chief economic adviser and FT columnist Mohamed El-Erian. He used typical corporate-speak in this piece. But it was clear he wanted to get a very important point across when he wrote:

“The days of central banks delivering win-win-win outcomes to investors — that is, high returns, low volatility and profitable correlations — could well be coming to an end … Given also crowded portfolio positioning, this is a good time for investors to bring down market exposures.”

Translated into plain English: Dump some stocks, raise more cash, and batten down the hatches against further market squalls. Sounds about right to me!

|

I wrote an article titled “Where Has All the Volatility Gone?” last week. It was published early Friday morning. By Friday’s close, we had our answer – it’s back … with a vengeance! The Dow plummeted almost 400 points into the close, while bonds, emerging markets, REITs, and many other investments got hammered.

So what did you think about the “Everything” selloff we just suffered, and where do you think markets will head next?

Reader Donald L. said: “The ‘market’ has been divorced from earnings, business conditions, and conservative economic projections for some time. Friday was simply a minor catch-up step in the direction of reality. It will not be the last.”

Reader Harvey S. said: “What I think everybody misses or refuses to recognize is that all sectors of the market are beginning to factor in the possibility of a Trump presidency. There’s probably foreign selling too, anticipating worldwide dislocations. Watch the polls. If they tighten even more, watch out.”

Reader Old B. offered a decidedly negative take on the future, saying: “We have now reached a point in time when the only thing left to discuss is the extent of the coming stock, bond, and real estate decline.”

But Reader Dwayne sounded more optimistic. His take: “All this might end badly at some point, but we are not there yet. My view is that the Fed governors open their yaps and talk about rate increases in a strategically planned manner to purposely cool off the markets. The Fed cannot and will not raise rates in September because it could cause a correction which could end up putting Trump in office.

“Meanwhile, the economy is cooling down, so by the time they are REALLY ready to raise rates, the economy will require that they instead lower rates AND talk about starting a new round of QE. This market doesn’t move based on fundamentals, PEs or anything else. It is entirely manipulated by the Fed. Just wait until the Fed meeting in two weeks when they announce no rate increase … and the market will be close to its highs again in no time.”

As for what to do in this newly volatile environment, Reader Earl said: “Depending upon net worth and years to retirement, I suggest taking at least 20 percent of your portfolio and putting it into 3-month CDs. The balance should be invested in consumer staples, telephones, utilities, drugs, REITs, and banks that yield 3% or more. Reinvest the dividends (dollar cost averaging) and go to sleep.

“History tells us over time the S&P 500 averages about 7%, so younger investors should take at least 50% of their money and invest it in the S&P 500 Index and then take 25% and buy good dividend-paying stocks. The remaining 25% can be invested in riskier, faster-growing companies like Facebook, Amazon, etc.”

I appreciate all of the different viewpoints. Like I said earlier, what I find most noteworthy (and troubling) about the recent selloff is that it swept through just about everything. This wasn’t your “traditional” decline where money coming out of stocks rotated into Treasuries. Everything got hammered.

That offers both opportunities for nimble, shorter-term investors, as well as potentially large risks for your long-term funds. So please stay cautious, stay safe, and keep a higher percentage of your funds in cash and gold (as “chaos insurance”). And if you haven’t already shared your opinion about the recent market activity, please take a minute to do so in the comment section here.

|

![]() Samsung Electronics is on the ropes after additional warnings about the danger of overheating Note 7 smartphones were released. Airlines are now telling passengers to keep their phones powered off to avoid the risk of them catching fire, and the U.S. Consumer Product Safety Commission may soon launch an official recall in conjunction with the company. The South Korean stock plunged the most since 2008 in the last two trading days.

Samsung Electronics is on the ropes after additional warnings about the danger of overheating Note 7 smartphones were released. Airlines are now telling passengers to keep their phones powered off to avoid the risk of them catching fire, and the U.S. Consumer Product Safety Commission may soon launch an official recall in conjunction with the company. The South Korean stock plunged the most since 2008 in the last two trading days.

![]() Potash Corp. (POT) and Agrium (AGU) are merging in a transaction worth about $36 billion, after factoring in debt. The deal combines firms that sell potash, nitrogen and phosphate to farmers.

Potash Corp. (POT) and Agrium (AGU) are merging in a transaction worth about $36 billion, after factoring in debt. The deal combines firms that sell potash, nitrogen and phosphate to farmers.

![]() On the flip side, Praxair (PX) and Linde of Germany are calling off their proposed $60 billion combination. The two firms sell industrial gases. Members of the German firm’s executive team and board of directors reportedly disagreed about how and whether to move forward, scuttling the deal.

On the flip side, Praxair (PX) and Linde of Germany are calling off their proposed $60 billion combination. The two firms sell industrial gases. Members of the German firm’s executive team and board of directors reportedly disagreed about how and whether to move forward, scuttling the deal.

What do you think about Samsung’s smartphone snafu? Any thoughts on the pace of corporate M&A? Do you expect to see more deals like the POT/AGU tie-up down the road … or do you think more transactions will fall apart like the PX/Linde deal? Share your thoughts in the comment section when you have a chance.

Until next time,

Mike Larson

{ 12 comments }

Reader Dwayne is 100 % right.

You should write your own column.

I find the comment made by Harvey S regarding the stock market plummeting with the prospect of a Trump presidency to be an interesting conclusion. On the one hand we have a candidate who wants to punish businesses, favors extremely high rates of taxation, and supports wealth redistribution. On the other we have a candidate who wants to lower corporate and personal taxation, create new jobs, and provide an environment for strong business growth. I would l think that the second scenario would be more likely to lead to a stronger economy and more vibrant investment opportunities; however, if you factor in the loss of political power of someone like Goldman Sac’s perhaps Harvey is right. The Wall Street big shots will lose political influence, no doubt!

I CALL M&A -MANAGERS AND ATTORNEYS BECAUSE THESE ARE THE ONES WHO REALLY BENEFIT>

Even after last week’s market drop, Direction Alert’s Sentiment Index is still in the highly complacent range, indicating that investors still aren’t ready to give in and sell. Today’s results seem to reinforce that. Not a big gain, but plus, nevertheless.

It has been the mission of wall street to take money from one generation to the next, and they have been very successful at it. How many secretaries of the treasury worked before or after their stints in the government at the big wall street firms? No-one really knows where the market is going, yet the more people trade the less chance of success they have. The recent large up and down movements in the market are indicators of how little chance the small investor has.

Richard

Mike: According to my interpretation of the “target Shooter” designed and issued by Larry Williams, I am trusting that the top of the DJIA at this time is 19,000, and the low is targeted at 13,500. Odds favor a negative approach to the market. Haven’t played with the S&P index. Rightly or wrongly, I think they both move in tandem for all practical purposes.

From the looks of Asia this morning the party is back on track again after the 394 point scare. Break out the champagne. That the drop was only 394 points on Friday caught my eye as it should have been much steeper. I wonder if the dark state stepped in? Between the dark state the crooked Fed and crooked governments and businesses and Wall street rest assured they will tell you when the party is over.

When one analysis’s the Well’s Fargo scandal it shows that all morality is gone and we are surrounded by decadency. Wells Fargo pays a paltry 185 million dollars fine and one woman in charge of this sandbagging operation quits resigns whatever and absconds with 120 million dollar bonus while 5300 workers are made an example of and tossed out on the street. What kind of insane justice is this? Oh by the way the stockholders will be left holding the bag on this one and possibly you and I though another jacking up of their already insane fees.

When the whole world is in chaos how can one determine the best way to invest? The markets are rigged , all governments are deceitful , and large corporations fleece the average consumer. Skeptical ?? Absolutely!!

The Samsung fiasco is yet another example why I do not buy stocks with the exception of gold. I hope nobody bet the farm on this one. Yes people tie up their hard earned money into these big name stocks with the hope of stability and a retirement nest egg. Then they stumble big time and its good by Charlie. Then there is all the car stocks and Tesla and its mad genius running things that scare me the most.

donald L

I feel some flash cash was injected into the market on Monday to pave things over. The drop should have been much deeper than 394 points. We are the marionettes in this cheesy stock market. Manipulation is definitely the order of the day.

Saw a headline this morning, “Capitalism May Not Survive The Fed’s Next Crazy Idea”> Wrong! Capitalism will survive – the Fed may not.