|

Let it not be said that the tech start-up community does not care about women and their needs. A new company launched in New York this summer called TheStylisted.com promises to sort of be the Uber of hair and makeup, connecting independent stylists to find customers who want a customized beauty experience in their homes.

Leveraging the catchy slogan “Don’t let the city mess up your pretty,” the company — which sounds vaguely like an SNL skit until you realize they aren’t making this up, so to speak — provides a mobile app that helps you summons some glam into your life at a moment’s notice.

Apparently this is a real problem for people, including one columnist, especially when they arrive in a new city and need a blowout or a new hair style for a special affair, and have no scientifically acceptable means of choosing a salon near their hotel or function.

It occurs to me that before long there won’t be a single issue in your life for which you cannot summon a crowdsource-approved genie to fix. Perhaps the entire technology revolution has come down to this: people hiring qualified experts solve even their most minor problems on the fly.

And by the way, if there’s anyone out there who can help, my fantasy football draft is coming up and I could use some crowdsourcing help battling out of my recent second-to-last-place finish. And no, it won’t do for you to just send me reams of lists of “sleeper” running back picks; you need to come to my office and actually help me run the draft. Please send a list of your accomplishments, crowd-approved.

* *

Hey remember those surges higher a few days ago in the holiday-shortened week? They came on very narrow participation: Just 38 percent of NYSE issues managed to rise on Tuesday, for instance, when the Dow Jones Industrials jumped 123 points. According to Jason Goepfert at Sundial Capital, that’s among the five worst readings since 1940 on a day the S&P 500 bagged a new high.

On the surface, this would seem to be a terrible thing. It would be a sign of narrow buying interest and fatigue amongst the bulls. Yet the data tells a different story.

[Editor’s note: In his latest report, New Technology Superstars for 2014, Jon shows you how you can find the tech stocks with the power to multiply your money up to ten times over! Download your copy now.]

Since 1960, weak breadth highs were followed almost exclusively with further gains up to a month later, with less consistent performance after that. However, between 1940 and 1960, weak breadth highs were associated with near-term weakness. So let’s just hope that 1940-1960 stays in the history books, and the market responds more like it has in recent years.

* *

Just as I was thinking how often it seems you get these big spikes higher on Tuesdays that have little follow-up the rest of the week, along comes a study from Cornerstone Macro to support the notion.

The illustration above shows the average market performance over the past 50 days by day of the week. It turns out that the best single strategy would be to buy the market into lows on Mondays, and then sell at the conclusion of Wednesday advances. Then hold until the next Monday close.

I don’t know about you but I like this idea of a two-day work week.

* *

|

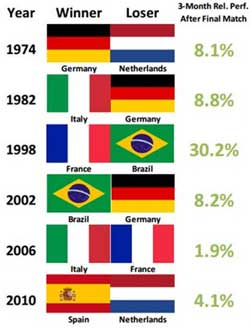

And as long as we are talking about statistical freak shows, why not go all the way and look at the somewhat surprising regularity with which the stock market of the winner of the World Cup final tends to outpace the market of the loser? Cornerstone Macro says it’s so, so kick back and check it out in this table.

Looking at the numbers from 1974 to present — excluding 1978 and 1986 due to lack of data and 1990 and 1994 due to Argentine and Brazilian hyperinflation — it looks like you could have thrown every other model of stock market behavior away and just focused on placing a pairs trade starting the day after the match. Who needs earnings and econometric models when you’ve got ESPN and some ETFs?

Best wishes,

Jon Markman