|

For better or worse, the inauguration of Donald Trump will bring radical change to the investment landscape: A seismic shift of epic proportions in the economy and the investment markets.

Trumponomics and our Forecasts

Some pundits make their careers out of predicting the obvious. Others talk about the future in vague generalities. Not us.

On May 23 of last year, exactly 169 days before the 2016 presidential election, I shocked our hundreds of thousands of readers with a forecast that made history. In a Money and Markets article titled “Will Trump Win or Lose,” I laid out eight objective, nonpartisan arguments why he could win.

Our good friend, Money and Markets editor Larry Edelson, did even better. On September 28, at a time when both Democrats and Republicans were certain that “Donald Trump couldn’t possibly win the presidency” and when global investors were placing big bets on “the coming Clinton recession (or boom),” Larry had both the vision and guts to defy them all.

In a bold headline, he flat out predicted that “Trump WILL win the White House.” He explained exactly why. He told our readers precisely how to protect their capital from any fallout. And he gave them explicit instructions on how to profit in 2017.

Our other Money and Markets editors jumped in to give readers even more — a series of immediate windfall opportunities that could add up to millions of dollars in potential.

Thus, Weiss Research stood virtually alone, publicly naming Donald J. Trump as the next president of the United States.

Now, with President-Elect Trump just a few days from being sworn into office, it is time for us all to connect the dots …

To determine what the Trump presidency will mean to investors like you and me … and to begin formulating our strategies for building wealth in 2017 and beyond.

Playing the Trump Card Part I

Leveraging Radical Changes

In U.S. Economic Policy

To Go for Windfall Profits

As I said at the outset, on January 20, deep, even radical, changes will begin to rain on Washington, the United States, and probably the entire world. Politically speaking, you may hate them. Or you may love them. But when it comes to your money, the only rational choice is to adapt to them.

Exactly when and how they will unfold is still in doubt. But there is no doubt whatsoever that President-elect Trump’s agenda will bring big changes to the economy and investment markets in at least three fundamental ways:

1. Less regulation; not more: President Obama has imposed countless new regulations on business that have stunted corporate growth. In the last few days, the Republican-controlled Congress has already moved aggressively to repeal a series of recent Obama regulations.

Next, within 30 days of inauguration and with the stroke of his pen, Mr. Trump will lift many more through a series of executive orders.

And in the months ahead, the White House, working with the Republican House and Senate, will have moved to fulfil Trump’s overarching demand: Two regulations to be cancelled for every one new regulation added to the books.

2. Lower taxes; not higher: In the last eight years we’ve seen the addition (or continuation) of some of the biggest tax burdens on U.S. citizens and businesses in the history of our country.

Not only high federal and local income tax rates that gobble up as much as half of what we make each year! But also sales taxes, capital gains taxes and death taxes — not to mention hidden taxes in the form of surging health insurance premiums.

In fact, according to the nonpartisan Tax Foundation, even before they pay income taxes, U.S. wage earners face a 31.5% tax burden!

Now, Mr. Trump will be the first American president since Reagan who will cut taxes. He will also replace Obamacare, greatly reducing health insurance costs.

According to a recent University of Michigan survey, just the prospect of these changes has boosted US consumer confidence to a 13-year high. Thus, even before the real impact is felt on corporate profits, the psychological impact is already sweeping through the economy and financial markets.

|

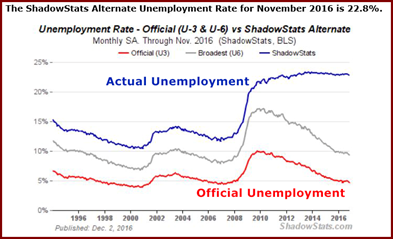

3. More jobs; not less: In his parting news conference last month, President Obama proudly took credit for a decline in the official unemployment rate from a peak of over 10% in 2009 to less than 5%. True? Yes. See red line in chart.

But according to the widely respected economists at Shadow Government Statistics, if you use the formula Washington swore by in the 1930s —counting the people who’ve given up looking for work — the jobless rate is now 22.8%, even higher than it was in 2009 (blue line in chart.)

All this helps explain why the American middle class has been squeezed. It helps explain why the number of Americans on food stamps and other public assistance programs has set new all-time records. And it all points to radical change in the landscape soon after the inauguration of Donald J. Trump: A seismic shift of epic proportions in the economy and the investment markets.

When would you say was the last time

something like this happened in America?

The Reagan years? Not quite. It was actually in the Gilded Age of the late 19th Century.

Mark Twain described it as a mad race for riches by Robber Barons, unscrupulous speculators, and corporate millionaires.

But most economic historians see it in a different light: Unshackled from onerous government interference, it was the period when modern Corporate America came of age; when tycoons built the country’s railroads; inventors helped launch the first mass communication network; and the entire population helped transform an agricultural economy into an urban, industrial nation.

|

Insider: Fed to Issue New Currency? The U.S. dollar is in crisis. Fed members just wrapped up a special “behind-closed-doors” meeting to discuss one of the most dramatic changes to our money in the last 100 years. A change that not only affects how we spend, save, and earn… But that will also transform the very nature of “money” itself. |

| External Sponsorship |

Before 1860, 36,000 patents were granted. In the next 30 years, the number of new patents mushroomed to 440,000.

One of those was Alexander Graham Bell’s new telephone, first exhibited in 1876. Within 50 years, 16 million units were installed, accelerating the pace of social and economic life many times over. Three other patents multiplied the efficiency and growth of business: The typewriter (1868), the adding machine (1888), and the cash register (1897).

The inventions that transformed industry were even more dramatic: Steam-powered manufacturing and trains. The electric motor. The internal combustion engine. Revolutionary new applications of chemistry. In 1870, the U.S. steel industry produced 68,000 tons. Just twenty years later, it produced 4.2 million tons.

But this unbridled, mad dash to growth also left lots of collateral damage in its wake: Two successive market panics and depressions — the first between 1873 and 1878, the second from 1893 to 1897.

Will Trump Usher in a New Gilded Age?

Not exactly. The early 21st Century is different in too many ways. But with the new Trump administration, similar kinds of economic forces will be unleashed:

Old billionaires in the White House; new billionaires in the business world.

More freedom for Corporate America.

New pathways to growth with a rising wave of technological innovation.

And countless new millionaire investors, provided you’re in the right place at the right time.

When Will It Begin?

The simple truth is January 20th. But an equally true answer is that the 21st Century versions of the Gilded Age, or at least some aspects of that period, are already in the making:

|

Money and Markets editor Jon Markman shows us how: Revolutionary transportation technologies like driverless cars and drones. Revolutionary communications technologies via billions of mobile devices. And new information processes, such as Big Data and the Internet of Things, that are transforming industry as we speak.

All while some serious threats to investors continue to circle the wagons! Precisely as Larry Edelson predicted, the European Union is coming unglued. A sovereign debt crisis still looms. The cycle of war is ramping up. And for now, at least, the Global Money Tsunami continues to drive flight capital our way.

As we’ve stressed continually — and as occurred in the Gilded Age — you can expect some of the greatest boom-bust cycles of all times, bringing both million-dollar profit opportunities and million-dollar risks.

And no matter what anyone may think or predict, the fact remains that … radical changes in economic policy virtually guarantee massive volatility in the investment markets:

That means major up-and-down swings in the U.S. dollar, stocks, bonds, gold, oil and many other investments — swings that could cost you everything — or, if you make the right moves, could build your wealth with both speed and consistency.

We’ve already seen this begin to happen: Since the day after the presidential election, a powerful wave of investor optimism has engulfed Wall Street driving the Dow to 17 new all-time highs. This has instantly raised the ante for investors: Far greater investment rewards, but also greater risks for investors who jump in at the wrong time.

Playing the Trump Card Part II

Harnessing Tremendous Uncertainty

To Go for a Decade of Windfall Profits

Trump will be in office at least until January of 2021. And it’s no coincidence that, long ago, Larry Edelson predicted a continuation of the current cycle until almost exactly the same period — December 2020.

Beyond that time, history tells us that re-election of the incumbent (or the election of his chosen successor) is the likely scenario, meaning a continuation of Trumponomics until 2024.

But there is still a lot we cannot yet know about the distant future …

1. We cannot yet know for sure how many of President-elect Trump’s economic promises will be fulfilled. Some of Mr. Trump’s initiatives will no doubt be blocked by Congress. Others may prove impractical for other reasons.

2. We cannot yet know exactly how or when Trumponomics will impact the economy and investment markets. Some will happen immediately. But for the balance, it could take time for the entire story to unfold.

3. We can’t predict with precision which surprise events will also impact the economy in the years ahead. We could see debt defaults by major governments … trade wars as other nations push back against Trumponomics … major terrorist attacks like 9/11 … the outbreak of regional conflicts (especially as the European Union continues to self-destruct) … or even (God forbid) a world war.

Since we can’t know these things, it’s clear that there will be great uncertainty in the years ahead.

And history teaches us that uncertainty inevitably creates still more market volatility — still greater swings as investors react viscerally to each day’s headlines.

Most of all, we know that huge, sweeping moves in the investment markets always create the greatest dangers — and the greatest profit opportunities — for investors.

In sum …

The ONE MAJOR DIFFERENCE between investors who suffer massive losses and those who will get rich in the Trump years …

Will be the accuracy — and diversity — of the investment intelligence and “Buy” and “Sell” signals they have available to them.

This is precisely why I created my company, Weiss Research, over 45 years ago: To help you protect and grow your wealth in times of massive change and uncertainty.

Make no mistake, though: The dangers and opportunities Trumponomics brings with it will come fast and furious.

All this change … all this uncertainty … all these opportunities and dangers … will continue for more than just four years, even more even than eight years whether Mr. Trump is in the White House or not.

Good luck and God bless!

Martin

{ 12 comments }

Martin

‘Unshackled from onerous government interference’

You have this part down perfectly. Progressives want to share the pie more equitably, without realising that if you grow the pie then everyone can do better. The lifting of onerous bureaucratic regulations while simplifying the tax system will give us the much needed bounce we need. Hollywood needs to stick to acting, they’re better at it along with their self promotion and self adulation. Business leaders need to be given a chance to act in the countries best interests. Politics has failed us for decades and Hollywood is in a world of its own.

One other quick point. The bruised progressives still wearing black armbands who believe the government owes them a living, will be left behind. You can dwell on the past, but you must live in the present, if you want to be a part of the future.

Why do people call the Left, ‘progressives’? Maybe regressive, but certainly they have not brought progress and never will do so. Capitalism and Freedom are what brought about Weiss’ company, along with this blog. While the ‘elitist’ egghead types were duped into believing H Rodham would win, the American people had another idea.

Yes, let’s keep the Hollywood types in Hollywood. That means Trump needs to go back to acting (badly – he is overrated). As a businessman who has 4-6 bankruptcies under his belt, I don’t want him leading the country either. Twitler will be the undoing of this country.

Tony

This is why I like him because we are broke. There are steps we can take to mute the costs of our debt balances.

I’m curious if pointed Russian malfeasance was one of your May 23 prescient pro-Trump indicators?

One of the advantages DJT brings with him is the market confidence shown in him by those who have felt unrepresented for many years.

Reagan did enact what may be touted as the largest tax cut in history, but later in his administration, when his spending couldn’t be supported at the reduced tax collection rate, he raised them, more than once, largely undoing his famous cutting. History seems to have forgotten that.

Thanks for a great perspective here. Lots of great reasons and details.

I believe it was a trade off , in the housing drop…

But , i believe bring back the write off on real estate property …

So people can have a plus or minus on their property…

This may boost real estate in all area !!!

Excellent summary of the future; however, I fear Obama has brought us to the point of disaster just as he subtily promised. I hope Trump can pull us out but the left will torpedo !him at every opportunity! I fear for my country’s future!

Thank you for for a great goal here.Many great reasons and details in this place to allow us progress