The bulls sure have been on the ropes so far in 2016. In fact, the Dow Jones Industrial Average just suffered its worst start to ANY year since Charles Dow first constructed the index in 1896.

Market Roundup

The credit markets? They had their second-worst start to a year ever. The only worse year was 2008, which you probably don’t need me to remind you was a disaster for investors.

It looked like they caught a break overnight when the Chinese market stabilized. Then at 8:30 a.m., the Labor Department released some “hot” jobs figures.

The details:

![]() The economy added 292,000 jobs in December, well above the average forecast for 200,000. The readings for October and November were also revised higher by a combined 50,000 jobs. That pushed full-year additions to 2.65 million, down from 3.1 million in 2014 but still a solid result.

The economy added 292,000 jobs in December, well above the average forecast for 200,000. The readings for October and November were also revised higher by a combined 50,000 jobs. That pushed full-year additions to 2.65 million, down from 3.1 million in 2014 but still a solid result.

|

|

| The unemployment lines got a little bit shorter … Will that help stop the market bleeding? |

![]() By industry, construction added 45,000 jobs, health care added 52,600, and even manufacturing added 8,000 positions. Temporary help jobs rose by 34,000. But mining shed another 8,000 jobs, bringing total 2015 losses to 129,000.

By industry, construction added 45,000 jobs, health care added 52,600, and even manufacturing added 8,000 positions. Temporary help jobs rose by 34,000. But mining shed another 8,000 jobs, bringing total 2015 losses to 129,000.

![]() On the flip side, the unemployment rate held at 5% rather than improved further. Wages went nowhere too, with average hourly earnings unchanged from the prior month. The year-over-year rate of improvement (2.5%) missed forecasts by two-tenths of a percentage point.

On the flip side, the unemployment rate held at 5% rather than improved further. Wages went nowhere too, with average hourly earnings unchanged from the prior month. The year-over-year rate of improvement (2.5%) missed forecasts by two-tenths of a percentage point.

Dow futures surged to as much as +220 or so after the figures came out. But they started fading shortly thereafter. After attempting a midday bounce, the Dow plunged into the close, finishing down 167 points.

Not only that, but many of the financial stocks I watch suffered huge technical breaks earlier in the week … then took out yesterday’s lows today. The Russell 2000 Index also sank to yet another 15-month low. And several corners of the credit market continue to behave as if something bad lurks.

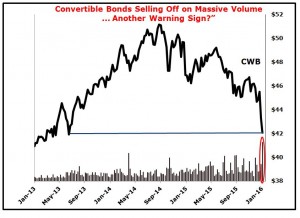

Just look at the SPDR Barclays Convertible Securities ETF (CWB), a benchmark ETF that tracks the convert market. Those are hybrid securities that share some characteristics of both stocks and bonds.

CWB’s top holdings are in sectors like pharmaceuticals, banks, techs and autos, NOT energy. In fact, energy only represents 5% of its portfolio. Yet it’s getting hammered by heavy liquidation. Excluding an anomalous “flash crash” print back in the August market chaos, it hasn’t been this low since June 2013.

|

|

| The big selloff. |

So sure, the jobs figures were strong. The auto sales figures we got earlier in the week were, too.

But the market reaction to those news items suggests a couple of things to me: A) The problems in China, and throughout the emerging markets, are so severe, they offset U.S. domestic economic strength and B) Investors are placing bets that this is “as good as it gets,” and that the economy here will weaken later in 2016.

We won’t know for sure if those judgments are correct until later. But I think they probably are. Indeed, I’ve been worried sick about where markets are headed since last spring — and nothing I’m seeing now tells me that stance is wrong.

Want more guidance and more details on what I see ahead? Well, my gala 2016 Safe Money forecast issue was just posted online yesterday. If you’re a subscriber, I urge you to read it cover to cover — and act on the recommendations.

Not ready to take that step? Then just be sure to buckle up and take protective action. Specifically…

- Carry a higher percentage of cash than you did in 2009-early 2015.

- Hedge or target downside profits with select inverse ETF and option positions (at the right time).

- If you’re going to own stocks, favor non-economically sensitive stocks over growth and industrial names.

- And keep your eye on those sickly financials and the action in the credit markets. They could hold the key to where we go next.

Now I’d like to hear from you. What do you think about the jobs figures, and the market’s reaction to them? Is this as good as it gets? Or do these figures show the U.S. economy is sailing along just fine, despite the turmoil in China? How will the Fed react to this news, and do you think they’re on the right course? Hit up the comment section below to weigh in.

|

The action in China, and the market reaction here, was Topic #1 at the Money and Markets website in the past 24 hours.

Reader Jim said China is in an impossible bind: “The Chinese Communist Party has tried to create a state-controlled free market system. It’s an absurd concept that never had a chance to succeed. They have lost any element of control they ever had.

“Their stock market is tanking, their capital account is evaporating, the yuan is overvalued, their banking system is a joke, their billionaires are disappearing, and they have no idea what to do next. What happens next isn’t up to us.”

Reader Gordon picked up on that message, saying: “How can the Chinese stock market or any market be a free market system? We accept all the gains with cheers and champagne. But then when things turn ugly and the gains start to evaporate, all governments come up with fancy ideas to slow the markets — like circuit breakers, brokers throwing in cash to ‘make’ the market, etc.

“We want the profit but not the pain. Look for a China bounce. But the exit door is getting narrower.”

Reader Kevin R. added: “Crooks will be crooks. I guess the robber barons of the financial markets aren’t satisfied with their gains, and need to dip more into wells that they drink from.”

To those comments, Reader Howard responded: “If you are suggesting that markets are rigged against ordinary players, you are right. The Chinese are newer to the game and more open about it.

“I was following an overseas bourse yesterday, and then there was a sudden massive change as the Chinese markets opened. Programmed trading took control. Cash is still a good place to be at the moment.”

But not everyone is so worried or negative on stocks. Reader $1,000 Gold offered this more optimistic take: “I’ve loaded up on stocks during this correction. I’m scared to death to buy any more, but if I don’t take on risk, there’s no reward.

“Everyone knows we’re at an inflection point — watching and waiting to see what happens. If the bears are wrong, we’ll enter the last up wave where everyone gets in. Unfortunately for them, that usually happens right before a recession.”

I really appreciate everyone’s take. You can put me squarely in the cautious and worried camp — for all the fundamental and technical reasons I’ve discussed in recent months.

That doesn’t preclude sharp, shorter-term bounces. They’re part and parcel of every bear market I’ve watched, studied, or traded my way through and we are oversold in the near-term.

But it sure does appear the equity market is now following all the breakdowns in credit, commodities, and currencies that I’ve been harping on since last spring. Considering how far many of those other markets have fallen, stocks may have a lot of “catch down” to do in the months ahead.

Have a great weekend … and be sure to add your voice to the debate when you get a minute. You’ll find the discussion board below.

|

![]() Saudi Arabia is out there floating the idea of selling shares in its national oil company, Saudi Aramco. It reportedly may list a percentage of its shares, a portion of its businesses, or otherwise take the company public in a limited fashion.

Saudi Arabia is out there floating the idea of selling shares in its national oil company, Saudi Aramco. It reportedly may list a percentage of its shares, a portion of its businesses, or otherwise take the company public in a limited fashion.

But it’s hard to see investors stepping up to the plate and buying aggressively given the fact oil prices are at 11-year lows. There’s also a lot of skepticism about Saudi Arabia’s willingness to list on major worldwide exchanges, and provide the detailed financial and reserve data it would have to in that case. Aramco has historically played its cards very close to the vest.

![]() European authorities believe they found the location where the Paris bombers constructed their deadly explosive devices. Belgian officials say they found materials used to put together the bombers’ suicide belts in a Brussels apartment, and have a man in custody who rented the unit.

European authorities believe they found the location where the Paris bombers constructed their deadly explosive devices. Belgian officials say they found materials used to put together the bombers’ suicide belts in a Brussels apartment, and have a man in custody who rented the unit.

![]() Chinese stocks rallied around 2% overnight after officials refrained from devaluing the yuan currency for one day, and after the government made state-backed funds buy Chinese equities.

Chinese stocks rallied around 2% overnight after officials refrained from devaluing the yuan currency for one day, and after the government made state-backed funds buy Chinese equities.

But many investors say they’re losing faith in China’s competence, given all the flip-flopping on policy and the belief officials are just throwing things at the wall to see what sticks. Said one emerging market fund manager in a Bloomberg story: “They are changing the rules all the time now … The risks seem to have increased.”

So what do you think? Would you buy into the world’s largest oil company here? Will Europe get a better handle on terrorism in the coming months? Is China finally getting ahead of the market turmoil, or is this just a temporary respite? Let me hear about it.

Until next time,

Mike Larson

{ 84 comments }

i think the economy will have weaker 1st quarter and that rates hike will be 1-2. I think energy is a screaming buy and bonds are probably a sell here.

Paul

Cash is king now!

Consumer sentiment is going down You can’t have a consumer driven economy without consumers frank

Its great to have a consumer driven society but where will the consumer get the monetary firepower to keep things rolling along. Looking at Macy’s and Walmart it looks like the consumer is going to take a holiday. Baby boomers are bailing out and millenniums are saving and have no real money anyways. Prices of houses and cars are so inflated it drives them and their meagre paychecks away. Banks seem again to be at the point where if it has a pulse grant the loan. If not they are also investing in the secondary loan market. They got you coming and going. Be careful the sharks are in the water and its feeding time.

The home mortgage market is VERY tight right now. I’ve been buying and selling property for 40 years, and the underwriting standards are higher now than I’ve ever seen them.

If there’s subprime lending going on it isn’t in real estate–I’m guessing cars and student loans.

When I see the country starting to pay down it’s escalating debt I will start to buy stocks. Until then we are in a bear market that will humble a lot of people.

The politicians will never seriously pay down ANY of that debt, except a little here and there to make themselves look good. Eventually they will simply repudiate it, as they have in other countries Politicians are the same breed everywhere. Trump, for example wants to buy votes by raising import taxes – which would just create higher prices for people whose effective income continues to decline. His supporters will crow their heads off about how he loves the common people, though.

Hi badger10 you should live so long.

Well, we’ll definitely get a test of the idea that January’s first week tells how the year will go. I don’t know if this is the worst first week ever, but it is certainly a big downer, and that is said to be an excellent indication of how the month will end, hence the year. My SPXS is starting to look very good, after getting a bit scary in December.

The worst start to the Dow since it was created in 1898 or thereabouts.

i respect your position on the markets, mike. i understand your thinking completely. a day like today makes me realize everyone should own stocks. if you never make a dime, you’ll at least walk away a better person. nothing builds character better than over coming your fears and following your convictions, especially when there’s money on the line that makes it real. also, i don’t think anything can build character better than a group of grown men who are 180 degrees apart in their opinions, yet show respect for one another as you do. i appreciate your open mind and hearing my side of it. you’ve more character than most people twice you age.

Playing catch the falling knife is rarely fun or profitable. Hope you have close stops. If it bounces from here, make your stops break even. According to indicators and other metrics, this bear market is just getting started. I’ve been flat since June 2015, and don’t see anything that makes me want to get back in. Except oil and gold. Those markets are bottoming now.

oil yes, gold no. much more pain for gold.

There is always a bull market somewhere. Jim

OK we don’t trust the gov figures out of China. Is it just possible we don’t trust our own govt figures, esp regarding employment – eg how many of these jobs were full time?

Remember that ALL government statistics come from politicians or their toadies. Statistics don’t lie, but liars input the data for statistics.

There are lies, damn lies, and statistics.

Way to go Jerry your onto something. Trust your own governments numbers? Never. All I see is jobs disappearing where in Gods name is the 300,000 coming from. Watch the bouncing ball as it bounces over the rubber numbers. Its called hypnosis. The run up for the presidency reminds me of Duck Dynasty. You have the Bush dynasty trying to defeat the Clinton Dynasty. Its a horse race that hardly anyone wants to bet on. As The World Churns. It would make a good Novella. Casting would not be hard. There are lots of political scumbags around who would sell their soul oops sorry they already have.

David Stockman, Reagan’s former budget director, says when you subtract the BLS’s “seasonal adjustment”, we gained all of 11,000 jobs in December. The seasonal adjustment, of course, is completely fictional. Most of the 11,000 jobs, of course, were in the classification of Part Time Economy, that is, waiters, bartenders, retail clerks, maids, etc., whose jobs may or may not last, or be for 40 hours per week. This 11,000 jobs compares with 140,000 (non seasonally adjusted) during the recovery in December of 1999, 212,000 in .Dec..2007.

I agree. I do not trust, any government numbers. Washington and Wall street are a den of liers. They rig the numbers according to their own agendas. Buy stocks only, No bonds. Stocks, at least you own something. Bonds, you are lending to an entity, a corporation, a government, a municipality. Not too sure of paying you back. Maybe you get 10 cents to your dollar.

Stocks, buy companies, that manufacture, create, a thing or service that you could not live without. Think what you would really need to live. NEED: food, water, medicine, shelter and transportation and the 3 Fs: faith, family and friends. WANTS: are secondary things, clothes, make-up, lipstick, furniture, sports tickets, movies, a restaurant meal, travel, vacation. DESIRE: Private jet, chauffeured car, a mansion, gold and silver, coins, bars, a vineyard in Chile, a farmland in Jamaica, a trip to the moon, travel and cruise the world at least twice.

As far as I could see, we are already in a depression. NOT recession. Recession is when your neighbor lost his job, depression is when you lost your job.

This country just keeps getting better all the time. Haven’t we tried everything but being fiscally responsible. Sure life costs money, however, credit is modern slavery. Therefore, our country (all of us) our indebted to the Fed indefinitely. Meanwhile, the Fed lets our country borrow money for record student loan debt that just passed 1 Trillion $ and wars and let’s not forget the bail outs and CEO golden parachutes ect… What a disaster. If any of you think that this will not end horribly, just stay hoodwinked by the Matrix. We are all in for an awakening and day of reckoning. I won’t be feeling bad for anyone who loses everything. Welcome to my world, I never even had it to lose.

The problem with the Fed is they let large banks know they would be bailed out. If they hadn’t done that there would have been no need to rescue them.

The government should have never removed Glass Steagull but humans seem to know borrowing makes tremendous sense when it’s working. The only problem with borrowing money for growth is that at some point humans become so enamored with the growth their financial brilliance is producing they remove all caution to debt.

HOWDY —-but crude was $39;22 yesterday and now at $34;22 well to me in the oil business thats more than a $0;27 less well that doesnt work out to well as i would loosing over $1,2500.000 a day on a loss of a difference and it will come to the point were CHINA wont be able to afford crude soon as there rate at HENG SENG BANK is on a climb of $20,454 and climbing up to 120+4 increase and the bigger problem is USA CRUDE and CANADA CRUDE should not be domanated by the CHINA MARKET ,,,but then again the HENG SENG BANK ,,HONG KONG BANK ,,,BANK OF CHINA are owned by a sub branch of TEXAS INDUSTIES TX USA

Mandi,

I am interested in what your saying, but I can’t read it due to the poor punctuation and grammar. Would you be so kind as to clean up your post? Thanks in advance.

Dow

I have more problems with this statement than poor punctuation and grammar. The last statement is a real zinger. I would like to see the proof backing this up.

I am contrarian.Mr.Market will do opposite what

Pundit thinks today.

When I hear about job numbers and inflation rates It makes me want to sing Home on the Range:

Oh give me a home,

Where the buffalo roam,

Where the deer and the antelope play,

Where never is heard,

A discouraging word,

And the skies are not cloudy all day.

I am afraid that our home on the range is riding into the sunset.

Powerball is up to $800 Million – who knows how much by Saturday evening. If no one hits then, it will almost certainly go to a Billion, by next Wednesday. ‘Hard to believe no one will win, though. I bought 4 tickets, which is twice as much as I ever did before. ‘Be very happy to share with someone. LOL!

you will share it with someone – the tax man.

DOWn!!

The truth will be heard,

From discouraging words,

And the skies will be cloudy all day.

Trust not the numbers the government gives you. As a matter of fact if they tell you the sky is blue I’d run outside twice to make sure it is.

I told you, they are a bunch of liers. They say, unemployment is 5.5% add 20%. And that is more like it.

Mike

Something to consider,

China encouraged their citizens to enter the markets with margin loans. Imagine, not knowing what you are doing and taking on this financial risk while watching your savings evaporate. There was a story of one couple, who were well off with $60,000 in life savings, being encouraged into these markets. The one’s who got in early and banked some profits have done okay.

I read badger 10s paragraph about United States paying down it’s Debt, I and a good laugh over that one ! Then I realized it is not funny at all. Our country will never pay back $20 trillion of debt it is impossible ! Heck they can’t even make a budget ! And then they keep spending like drunken sailors that’s right our money the taxpayers the working class ! Try not having a budget as a family or household , but the government hey they have an open purse! And when the Democrats target the rich they really mean the middle class !

Greggo

There was an interesting analysis recently done by the CBO to assess our country’s position. It showed that spending could not be contained no matter how much they taxed the rich. Our country needs a new broom to sweep away the entrenched benefits to bureaucrats and the sheer number of staff involved in red tape that is strangling our remaining productive resources. If we vote for free stuff again then hard assets will be the only remaining thing worth while. But who has the know how to drag us back to the great country we can be??

TRUMP

One of the great propaganda successes of recent years is the equating of a people with its government. America isn’t dropping bombs in the Middle East. The Federal Government is. The world doesn’t hate America. They hate the Federal Empire. America isn’t failing, but it’s government is. I say good riddance. Although it will be very painful, its collapse will be the best thing that ever happened to us. We are a great Nation of FREE, innovative, hard working people that does not need a Nanny to take care of us. Hunker down and have faith. It’s all going to work itself out. Jim

Except that we may not be one nation any longer, after such a collapse, but several diverse nations perhaps in some loose alliance, perhaps not. Alaska could be grabbed back by Russia, and I hear China has already laid claim to Hawaii.

Most of humanity is tribal by nature. When the Europeans and Americans conquered the world they divided it up with a lot of very artificial boundaries that are now coming apart at the seams. The most responsive and effective government is more localized. The Big Nation State is obsolete and has outlived its usefulness. Jim

It is this obsolescence that these small terrorist groups are exposing so effectively every day. The small has defeated or tied the large in every conflict since 1945. Jim

Job numbers mean nothing if we don’t know what they pay. Were they above or below the median income, or what percentage were part-time.

I just ignore anything coming our of this dysfunctional, bloated government.

Numbers may be rising, but when corrected for inflation, people are mostly getting paid LESS now than they were in the year 2000.

I would be mindful of strong ‘dead cat’ bounce probably in 2-week’s time?

The Chinese CSRC, although they’re seen as ‘incompetent’ in various ‘safety’ measures lately, I think they are learning quickly as they go. China’s crash this week was not really fundamentally driven, it’s regulatory driven instead!

The time-bomb still lies in the western world!

I am looking for some buying opportunities to come around, but am being extremely cautious. Cash will be king for awhile until this all sorts out. Maybe buy late spring we can determine what the hell is going on. Until then good luck to everyone!

Don’t expect the crooked politicians do help us, either party, they have been screwing us and selling us out for the last 30-40 years and they have intention of stopping. 2016 is a election year, a VERY important one, make sure your vote counts.

That’s “NO intention” by the way, Sorry.

To Gordon from Gordon. You talk of spring it might turn into a variation of a Russian Spring. Yes cash will be king maybe longer methinks. Make sure your vote counts? Between Tweedle dum and Tweedle dee. Voters have been locked in the same 2 party box for decades. Ross Perot came out and told the truth on NAFTA and look where that got him. The truth never works in politics. Reminds me of the game Truth or Consequences.

MAKE SURE THIS VERY IMPORTANT election is NOT rigged. Paper ballots only. No voting machines. Use gentian violet ink to dip voters forefinger, not paws, to prevent multiple voting, pets and dead people voting. Clean and purge voter’s registry, ONLY US citizens are allowed to vote. NO ILLEGALS, NO GREEN CARD HOLDERS, NO DRIVER’S LICENSE HOLDERS. ( Driver’s licenses are distributed to Illegals like candy, along with food stamps)

REQUIRED PAPER DOCS to Vote and bring to your precinct for verification: (1)Certified Birth certificate, showing you were born in the USA.(2) Naturalization papers, showing you are a naturalized USA citizen, (3) a valid USA passport that has not expired. (4) A utility bill that shows you are residing in the same address as your driver’s license or picture ID.

Alicia, that is much too sensible so it won’t happen unfortunetaly.

And it doesn’t really matter anyway, since neither party has shown us a real Leader type. Trump is likely to win, because he is a PERSONALITY, and that seems to be what voters want anymore. He has been successful in business, but largely because he has good lawyers on call when he wants to sue somebody. Try suing ISIS or China!

Chuck

If Trump wins, I would imagine a cleanout where he brings in a leadership team of 30 to 50 or more like thinking business people to clean the place out. We need massive reconstruction from the ground up to refocus on the things that made us great. Freedom, independence, determination, personal success and hard work. with a government that knows when to get out of the way.

Howard, Trump has become just another politician. After 8…or even 4 years of Mr. Trump, I warrant you will have LESS freedom and independence that you have even now. And you really have less than you did 8, or 16, or even 24 years ago. I hope I’m wrong, but fear I’m right.

People want to believe in real leadership. It’s a hard field to pick from.

You know Mike…it’s disturbing to see that a small circle of so called experts continue to try and push the new normal on what they must think are very stupid Americans in general. Time to wake up…America finally is…those so call strong JOB numbers don’t impress anyone except those so called experts anymore! First, 292,000 is still below what should be considered normal and well below what was considered average prior to 2008. But more important is the Labor Participation Rate and nothing but false reporting about the real unemployment rate…someone should learn the meaning of “Part-Time” and “Falling-Wages”…ask the real population what they think and you will find the truth. What’s your opinion Mike…truth or propaganda?

Mike

Ironically, the companies and stocks doing well are those associated with the military and healthcare. This should be a clue to a major crash and the world heading for WW3. Even with the above, our military is in its worse shape since the Pearl Harbor attack and the market is heading back to the 911 and March 2009 nightmare. It will take more than a decade for the market to recover after the crash of 2016. Whoever said, equity is where you should be now is right on the money. During the Carter administration, we had double digit inflation, today we have deflation and no better or worse off.

As Obama once said we must hope for the best

Bill

Regards

Bill

Dang, I thought he said “we must best for the hope”?

Mule (<:

The fastest growing parts of the economy, since 2000, are those parts largely or totally supported by taxation: healthcare, education, social services and the military/industrial/law enforcement complex. Taxation, of course, takes from the productive, growth economy, and makes thing worse for the people who are taxed. Defense and law enforcement, of course are needed, but have grown into something of an abomination. The more police we have, for example, the more crime we seem to get. They must justify their existence somehow, after all.

The role of law enforcement has slowly changed over the years. More and more their basic function is to relieve us of our cash. Traffic and parking fines are a prime source of funding for government now. Much of the drug war involves fines, fees, and property confiscation. This is the cause of a lot of the resentment we see. I also think their black clad storm trooper appearance and increasing militarization make a lot of people very uncomfortable. Jim

Hence the uprisings in Ferguson, Mo., Baltimore and elsewhere, and now the occasional shooting of an officer, just because he/she is there.

That cash is king has been true for a very long time but will not necessarily be true forever. The dollar is only the best currency out there, which is not saying much. All of the money printers are in major trouble. However, oil IS low and may go as far as whatever the “bottom” is for the OPEC decision makers. $20/barrel?. The biggest best brands and oil – esp on a dip – are the only things I am watching now. My advice is take small steps in and get your “$ in” out when you have made it back. And, of course, keep enough cash on the side to pay your bills. God bless America !

Once again, I wouldn’t bet what’s left of the farm on those job numbers. LOL

Mule

Your quote—“But many investors say they’re losing faith in China’s competence, given all the flip-flopping on policy and the belief officials are just throwing things at the wall to see what sticks. Said one emerging market fund manager in a Bloomberg story: “They are changing the rules all the time now … The risks seem to have increased.——tell that to Larry Edelson

Tick,tick,tick..boom! Ears ringing…good you don’t have listen to anymore bs of financial pundits preaching recovery. Vegas still has slot machines for those seeking to part with, rather than invest their money.

.

It’s about time! Bad news has been good news for such a long time that someone needs reminding that now we enter a phase where good news is bad news. Pack it up bulls, it’s over.

Michael,

The jobs report is an absolutely meaningless indicator for many reasons. First, this is one of the many economic indicators that are manipulated via hedonics regression, which tends to mask the TRUE amount of jobs created. For example, the BLS uses the CES Birth/Death model to Literally create jobs out of thin air based on what they “believe” is how many businesses have been created or destroyed. Also, if you are long term unemployed you are MAGICALLY taken out of the unemployed numbers. Also, how many are now under employed representing the U6 number vs. U2 number. Lastly, the unemployment number is typically a LAGGING economic indicator NOT a leading economic indicator. Thus, compared to the REAL problems that are spooking the markets, namely DEBT, DERIVATIVES and DEFLATION, the combination of which has NEVER been this bad in the HISTORY of mankind and now you know one of the reasons WHY this first week of the Capital Markets decline is the worst in the history of mankind…Lord knows, this is a VERY VERY serious problem, that like in the worst of declines such as 1929,2000,2008 take a couple of years to play out.

As long as Obama is president, I don’t believe much coming out of Washington.

Vaag who would be a suitable replacement out that bunch of “rubes” running for the GOP? Its the year of the Monkey here in Thailand. After the presidential election I guess the same will apply to the USA

I’m sick of hearing about Obama! He has been pushed into this mess. No individual could possibly have created so much bad news. Blame Wall ‘Street and the big banks and if enough of us keep calling attention to that, we may get some action out of Congress.

With the billions of new dollars that the Federal Reserve has added to the money supply, one wonders how we can be worrying about the possibility of deflation. When more money is chasing the same amount of goods, wouldn’t inflation be the big worry? But there’s the rub. Yes, there is more money out there but there are also much more goods being produced. In the past most manufacturing was done in the US, Germany, Japan and a few other western European countries. But now, manufacturing is happening everywhere. Countries that formerly only produced foodstuff or not even that, are now building Autos, manufacturing our drugs, producing our clothing. Just think how much has been added to the world supply of goods just from China and India alone. The solution I think, would be to create even more currency. But more importantly, we need to find a way of getting that currency into the hands of people who have needs, and would spend it, rather than into the hands of the scrooges of the world who are only interested in counting it and measuring who has the biggest pile.

No the answer is that American and western workers must reduce their wage expectations down to $10 a day like here in Thailand. They must toil and exist for the better good. The 0.7% that run the world. The whole idea behind NAFTA and the now TPP is to export good jobs so the 0.7% can make make more profits and to teach the uppity union members and the other walking poor that they must rein in their demands to well $10 a day. Only then will these “good” jobs return to American shores. Oh wait no need to have these jobs come back robots will build everything in the future. Doing the math world wide we have a couple billion humans that will no longer be required.

George Carlin: Just think about how stupid the average person is, then think about the fact half the people are stupider than that. Jim

You just have to love George. He was light years ahead of his fellow man. We miss you man. Earth to George its getting worse here since you left.

Good point, Jim. And our educational system teaches people to accept what they are told, not really to think for themselves. You’d think, with all the lies we are exposed to in advertising, people might learn, but they don’t seem to.

I think it also goes a long way in explaining the current quality of our leadership. Jim

Jim,

Either you or Carlin has hit the nail on the head.

Bob

Goldilocks’ New Year hangover shows up the frailty of these markets, and this first week of 2016 has shown her running out of breath to keep the fantasy-bubble intact, which has left a lot of collateral damage after the interest-rate shift hit the fan. Watch out below, – way to go ..!

If you notice, after four days of declines in the S&P and Dow, among others, the averages tried to rally a couple of times on Friday, but, in the end, dropped to their lowest points of the day and week. This does NOT seem like exactly a vote of confidence in the economy. We may get something of a rebound at some point in the coming week, but where is the support for anything more than a bounce? I don’t see it.

Just 11,000 new jobs in December, when the fictional “seasonal adjustment” is removed, does not make for a very strong economy

Seriously, does anyone take the recent jobs numbers seriously? The latest Atlanta Fed GDPNow estimate for 2015Q4 GDP growth is under 1%. How can we get the recent near-300K monthly jobs gains with slowing GDP growth? The GDPNow program is quasi-real-time and has an excellent track record. The jobs numbers now agree with almost no other economic data, including tax withholding.

The BLS’ numbers are more and more padded with the “birth-death” model estimate for small and medium-sized businesses — some months the birth-death model correction is almost the whole result. When this is over, we’ll be hearing a lot about how the BLS model led us astray. It was developed from data from the 1980s, 90s, and 2000s, when the number of businesses was expanding. Since 2009, that number has been shrinking, and that category is most employment growth.

Probably why the stock market is dropping.

Here in Maryland, Governor Hogan has proposed tax cuts for some 300,000 small businesses. That means, with about 6,000,000 people, each small business is supported by just about 20 people on average. Is this typical of the whole country? No wonder small businesses have such a high failure rate.

I’m seeing signs that Larry is right on the money with his forecasts. I hope everyone is listening.

The Dow will bottom at 4324 sometime in the next year or two . Credit will not exist and prophecy ” not being able to buy or sell ” will be fulfilled.

The world will be in commotion and men’s hearts will fail them. The only safe haven is to keep the commandments and be solid on the “rock” of Jesus Christ .

Say your prayers.

$1.3 Billion! Or maybe more. It’s hard to believe someone didn’t win on Saturday.