|

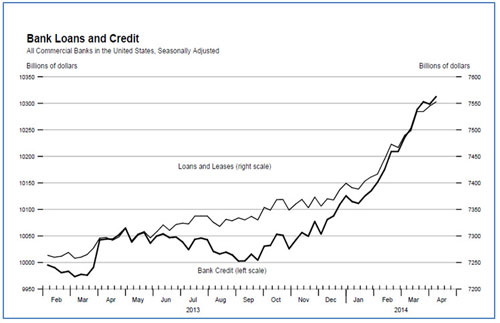

According to the Federal Reserve’s own statistics, total U.S. bank credit growth is accelerating at a rapid clip this year, as shown in the chart below, expanding by $250 billion since December 2013. Commercial and industrial loans are growing at an annual rate of 23 percent year to date.

To me, this is clear evidence that the Federal Reserve’s massive balance sheet expansion, which just passed the $4 trillion mark, is beginning to seep into the real economy at last.

Until now, this unprecedented liquidity was being held captive in the banking system as excess reserves on deposit with the Fed. But now all this money is being put to work, perhaps in part to help finance the stock buybacks and merger and acquisition activity we’ve been hearing about in recent months.

This is only the beginning; commercial bank lending is the precursor of this capital beginning to move into the general economy in the form of high-powered money in our fractional reserve banking system. It’s just the first step in a chain reaction that will surely lead to acceleration in the velocity of money first, stronger-than-expected economic growth second, and finally the unexpected return of inflation.

And this $4 trillion the Fed has printed out of thin air in recent years is just the tip of the iceberg. The European Central Bank, Bank of Japan, the Bank of England, Peoples Bank of China, etc. have printed trillions more. They have dramatically expanded their balance sheets too in a desperate fight against the forces of deflation. But deflation was the LAST war; watch out for a new enemy to appear.

Now that money is starting to circulate again. Lending is finally picking up, and there is $4 trillion worth of rocket fuel in the U.S. financial system alone that’s in search of a match to ignite inflation. And once that genie is out of the bottle, the Fed is likely to find itself hopelessly behind the curve to stuff it back in.

The obvious winners in my view will be asset prices that can provide a valuable hedge against unexpected inflation. This includes stocks, but the biggest beneficiaries of all are likely to be gold, silver and all commodities for that matter.

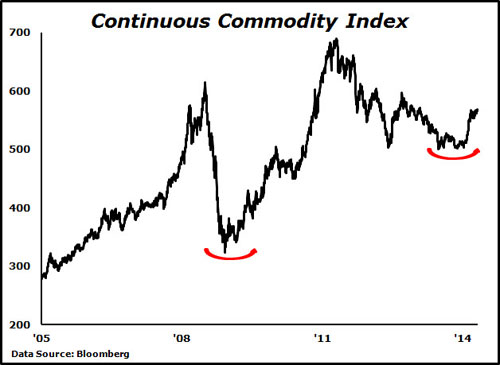

It’s no surprise that the Continuous Commodity Futures Price Index (CCI), an equal-weighted average of commodity prices, has gained 11.35 percent year to date or that gold, silver and precious metal mining stocks have rotated back into favor with investors. This rebound in commodity prices is broad-based, and persists in spite of a choppy environment for stock and bond markets. It could provide a valuable glimpse of things to come.

Commodity volatility can be frustrating. There have been many steep corrections since the secular bull market in commodity prices began 15 years ago. In the aftermath of the financial crisis in 2008, the CCI crashed 47.41 percent, but then more than doubled in just two years. Since the high in 2011, commodity prices have fallen 18.02 percent, presenting what should be another wonderful buying opportunity.

The relative strength we have witnessed in the CCI so far in 2014 may be only the beginning of the next major upside reversal.

Good investing,

Mike Burnick

P.S. Be sure to watch your inbox today for the late-afternoon edition of Money and Markets. Each day after the bell, Mike Larson will bring you the latest in what the Fed is saying, interest rates, and much more.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 2 comments }

INFLATION IN OUR FUTURE ??????

What do you mean,unexpected inflation.Anyone,with any knowledge of the past,common sense and intelligence,knows you can't get something for nothing,We will pay for massive central bank fiat creation,through currency devaluation,same as all politically driven, fiat currency economies,throughout history.We already are,if you watch real prices,not what govt tells you.