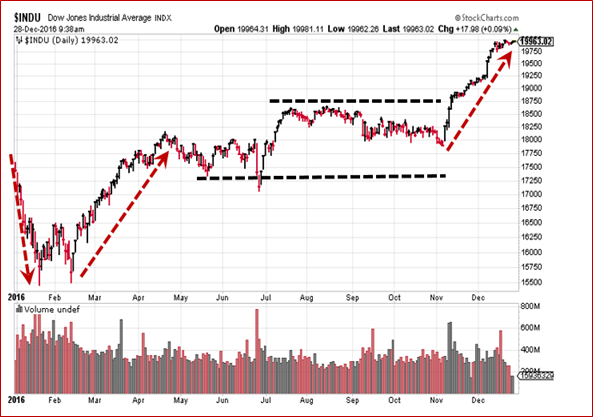

It has been a volatile, difficult year for most stock market investors, as you can see in the chart of the Dow shown below. But one time-honored investment strategy absolutely smoked the indexes in 2016, the venerable Dow Dogs!

2016 began with an 11% Dow dive in January, then after see-saw price action in February, stocks bungee-jumped right back, with a 16% rally into spring.

But alas, from mid-April through October, investors were greeted with more frustrating see-saw action as the Dow settled into an uneven trading range.

If you look to the far right hand side of the chart above, you can see that really ALL of the gains for the Dow this year came in the final two months, with the Dow up just over 14% year to date.

The basic strategy of simply buying the 10 highest yielding stocks in the Dow Jones Industrial Average – known as the Dogs of the Dow – beat the Dow, and most other stock market indexes, by a wide margin in 2016.

An equally weighted portfolio of the Dow Dogs, constructed on December 31, 2015, gained nearly 21% this year, compared to a gain of just 14.4% for all 30 stocks in the Dow Jones Industrial Average, and a gain of just 10.7% for the S&P 500 Index.

What’s more, you would have started 2016 already ahead of the game, with a hefty average dividend yield of 3.85% from the 10 Dow dogs – nearly twice the yield of the overall stock market!

And last year’s performance isn’t just an aberration either. The Dow Dogs have beaten the Dow Jones Industrials in five out of the last six years, including 2016.

Over the past five years alone, the Dogs’ average annual gain is 14.9%, compared to just 11.7% for the Dow itself, a sizeable performance advantage for these stock market mutts.

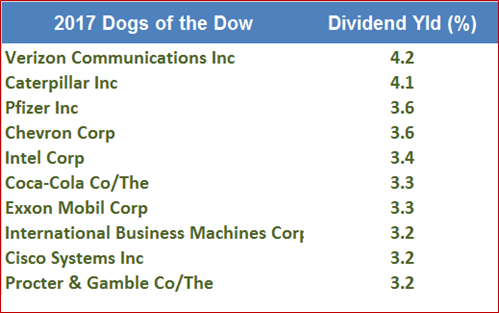

So to see which high dividend yielding Dow stocks make it into the dog pound for 2017, see the table below…

There are quite a few returning mutts for the year ahead, and two new dogs entering the list.

The top five performing Dogs of 2016 (Caterpillar, Chevron, IBM, Verizon and Exxon Mobil) remain on the list for next year too, which is quite an accomplishment. Typically, superior price performance reduces the dividend yield and lets last year’s dogs graduate from the pound.

Caterpillar (CAT), for instance, gained 44.6% in 2016, topping all the other dogs (and the other 29 Dow stocks too), but its dividend yield of 4.1% is still the second-highest among the Dow 30 stocks.

Also, returning for 2017 are Cisco Systems (CSCO), Pfizer (PFE) and Procter & Gamble (PG). Two new dogs join them for 2017: Intel (INTC) and Coca-Cola (KO), which replace Wal-Mart (WMT) and Merck (MRK) in the dog pound next year.

Bottom line: While relatively few stock investment strategies stand the test of time, the Dogs of the Dow has a very good track record at beating the market.

Plus, there aren’t many strategies as easy for you to execute as buying and holding ten blue-chip stocks that pay attractive dividends while waiting for price appreciation.

Good investing and Happy New Year,

Mike Burnick

Director of Research

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 4 comments }

In checking the 2017 Dogs of the Dow, the dividend yield is much different than from other sources. IE. KO shows 3.3%, but Yahoo shows 1.4% and CSCO 3.2% vs 1.04%.

I have heard that there will be a crash in late 2016 or early 2017, what do you think ?

Kinda think it’s a bit late for a 2016 crash lol…

Sold B of A in 2007 at $49 in 2007 while it was paying 10%. Broker argued with me about the great yield. Bought it back at $5. Current bid about $20. Don’t care about the yield.

So much for falling in love with your dividends. Risk isn’t worth the reward. They can be wiped out in a few days. Good luck with that.