|

Successful investing involves focusing on the facts and stats that matter, and disregarding the information that is of no decision-making value.

Unfortunately for investors, most of the information that the mainstream media bombard us with every day is useless when determining how to grow your nest egg.

Statistician turned best-selling author Nate Silver became famous for coining the phrase “separating the signal from the noise.”

With the S&P 500 index just nailing another record high, it’s now more important than ever for you to sort out what’s signal and noise in the current financial environment to protect your profits and grow your portfolio.

But a deeper dive into the numbers indicates that the stock market’s recent strength is a bit misleading. That’s because only 6 percent of all S&P 500 stocks have closed at or near their 52-week highs, showing that this breakout has been “relatively half-hearted,” reports IG Markets’ chief market strategist Chris Weston.

|

| When volume and breadth wane even as stocks surge, it’s a warning sign that stocks may have reached peak levels. |

In fact, when the S&P 500 hit an all-time high on May 23, only 20 of its 500 companies reached 52-week highs. That’s the lowest number in about a year.

What’s more, about 1.8 billion shares traded each day in S&P 500 companies last month. That’s the fewest since 2008 according to market data specialist Bloomberg.

When volume and breadth wane even as stocks surge, it’s a warning sign that stocks may have reached peak levels and shows that investors are becoming concerned about the rally that has been built on the Federal Reserve’s and the European Central Bank’s experimental economic policies.

In addition to the recent troublesome volume and breadth data, the Commerce Department reported Thursday that the U.S. economy actually contracted in the first quarter for the first time in three years.

It was the worst performance for the U.S. economy since the first quarter of 2011 and reflected a bigger than previously estimated trade deficit and a plunge in business spending on nonresidential structures.

Wall Street may try and shrug off this very disappointing GDP report as related to the severe weather that plagued the U.S. during the first quarter, especially in the Northeast, while pointing to anecdotal reports that economic activity has rebounded during the spring.

For me, I’ll believe it when I see it.

That’s because as I have pointed out in previous Money and Markets columns, for stocks to go higher the world needs economic growth. And currently I don’t see a lot of growth.

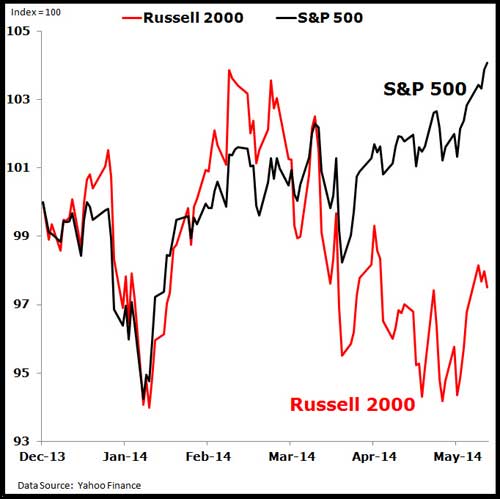

Another troubling sign of a slow growth environment is the recent performance of the U.S. index of small companies, the Russell 2000, as shown in the chart below, which has been suffering through a correction this year.

The Russell 2000 could be sending an alert that we are on a collision course for a major selloff across the entire global stock market.

That’s because smaller companies are much more sensitive to the underlying economy. As such, they are often a very useful bellwether for the equity market as a whole. This was proven in 2009 when they were the first and fastest to recover from the financial crisis.

And the performance of smaller companies could be sending us the opposite signal now.

For now, be vigilant and guard your capital.

Best wishes,

Bill Hall

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 3 comments }

Making $5000 or more in a day by trading is nothing but easily possible. If the analysis and strategy is right. The world is moving and in the meanwhile a lot of ups and downs happens regularly in politics, weather, markets and all other global variables. If someone can analyse all this things and make a right puzzle then they can earn huge in trading. Now let me say that if all the analysis and strategy is done regularly and the updates are always in your hand at real time then is it not true that anyone can make their earning bigger in trading? There is something that can really help people by doing this analysis itself and provide signals better than thousands investment and market analysts. Want to know how? Check it out for free http://www.i8i.in/bcc

The Fed has always been the prime mover of stocks and that is much more,today,with massive fiat printing.I think,as long as people are willing to hold fiat currency,the Fed can continue the game.When/if the Dollar goes into freefall,then it will end.By what's going on with bonds,recently,no end in sight,yet.

The lesson of the past few years is never underestimate the power of the central banks.

As I predicted last fall, bond yields are falling because of deflationary pressures resulting from the huge debt overhang. I don’t expect them to go much lower but I don’t see them going higher anytime soon.

Slow growth means low interest rates for the foreseeable future. — Bill Hall