Mario Draghi sure loves to goose stock prices. The head of the European Central Bank strongly hinted at coming stimulus yet again, telling a Frankfurt audience earlier today that “we will do what we must” in an attempt to boost inflation.

Market Roundup

The ECB is already in the midst of a $1.2 trillion Euro-QE program. As a result of recent comments, investors are now expecting him to boost the pace or magnitude of that program … cut European interest rates deeper into negative territory … or otherwise throw something else against the wall to see if it sticks. The ECB next meets on Dec. 3.

Of course, if QE actually worked to boost prices or growth, euro-zone inflation wouldn’t be running at a 0.1% rate. And Draghi wouldn’t have to talk about doing more QE just a year and change after he starting doing QE.

|

|

| Mario Draghi and the ECB Governing Council. |

But the question that matters most here and now is: Should you jump on board the Draghi Express?

Well, I have a handful of conservative, higher-yielding, higher-rated, non-economically sensitive stocks in my Safe Money Report. One of the names I recently put on is flirting with all-time highs. Another is very close to doing so. That goes to show there are some profit opportunities in select names.

But as you know, I’ve been fairly conservative overall — and the credit markets are a key reason. They simply don’t seem to be playing along with the excitement in equities, on up days, down days, or days that are in between.

Take the junk bond ETFs I closely monitor. They’re very close to fresh multi-year lows. The SPDR Barclays High Yield Bond ETF (JNK) is now down 5.5% on the year, and more than 15% from its mid-2014 peak.

Treasury prices have rallied this week as well, pushing yields lower, and the yield curve has flattened. That’s not what you generally see when the appetite for risk taking is on the up and up. And crude oil traded below $40 a barrel yet again, a lingering issue to keep in the back of your mind.

One other caveat worth mentioning comes from the Federal Reserve. The Fed surveys bank lending officers every quarter about trends in loan pricing, demand, and standards. The latest report shows that the slump we’re seeing in the credit markets is starting to spill over into the lending business.

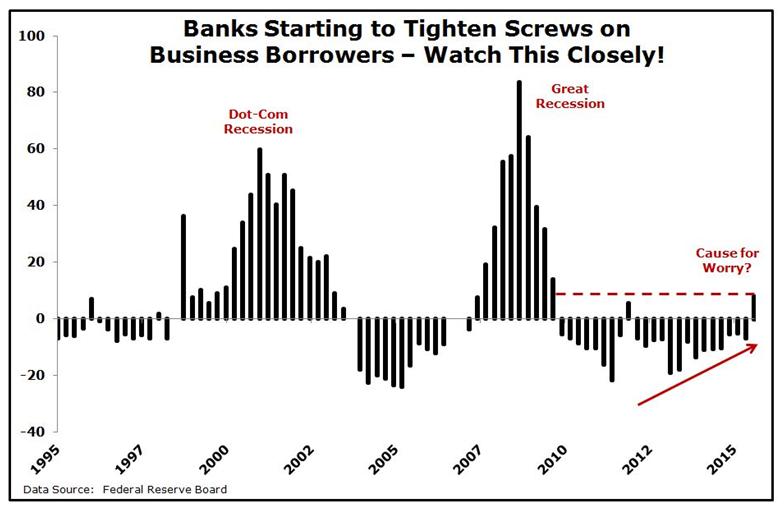

Specifically, take a look at this chart. It shows the net percentage of banks that are tightening or easing lending standards. A reading below zero signifies that banks are easing, on average, while a reading above zero shows they are tightening.

|

|

| Tightening vs. Easing … |

You can see that more banks are getting stricter with commercial and industrial loans now than at any time in the last six years.

We’re nowhere near the peak tightening level we saw in the 2007-2009 cycle, or the recessionary peak from the 2000-2002 downturn. But it’s the trend higher that I’m closely monitoring. If banks continue to tighten the screws on borrowers, it’s going to put a damper on economic activity.

Bottom line: If you’re going to swim in bullish equity waters, make sure you’re aware of the credit turbulence beneath the surface. And if you want to add your prognostications and thoughts to the mix, make sure you also use the comment section on this page.

|

Where are oil prices going? What about stocks? And how will the fight against terrorism play out? Those are a few of the issues you were debating online in the last day.

Reader $1,000 Gold pointed to the positive impact of lower oil prices on the economy, saying: “Oil-producing countries are forced to pump full tilt to meet expenses — they can’t let up for a minute or they face financial disaster. Plus, anytime the price of crude rises, the frackers will move in and keep a lid on prices.

“Cheap oil is here to stay. This is hugely bullish for America’s economy as we depend on oil more than any other country in the world. This extra money saved at the pump every fill up will soon begin working its way back into the economy.”

But Reader Jim countered with the following argument: “Putting the U.S. oil producers out of business isn’t a good thing, and that is their goal. What do you think the Arab countries expect to get out if this? They want to retain their monopoly and hammer the heck out of the oil-consuming nations one more time before oil becomes obsolete.

“Also, there is also not one shred of evidence to indicate low oil prices are helping the economy or ‘working its way through.’ Look at retail sales. Would we have 94 million people not working and 50 million on food stamps? Deflation is a killer no matter what form it takes.”

Meanwhile, Reader Richard weighed in on other markets by saying: “Through 2015, the oligarchs and the elites from other countries have been buying U.S. assets. Because of dropping GDP and turmoil in places like Canada, Australia, Asia, the E.U. and others, they are moving their assets to safer ground.

“Perception is everything. They have been driving up Treasuries, real estate, equities, and the dollar. One thing I learned early on is there are a lot of people around the globe with a lot of money and it is headed to the States.”

Lastly, Reader Craig B. said: “The market is topping out, or is it? Suddenly investor doubts are creeping in. Bullish sentiment and confidence are giving way to worry and fear. For now, it’s a kind of holding pattern.

“But the way I see it, the market must eventually either break up or break down. … My guess is the next big move will be down, then way up as panic here is overshadowed by sheer panic in Europe over their weak currency and economy.”

Thanks for sharing. I believe the whole “Lower gas prices will lead to a spike in spending any day now, just you wait!” argument is wearing thin. Gas prices have been plummeting since July 2014 and there has been NO perceptible impact on sales.

If it hasn’t happened by now, it isn’t going to happen. I believe the reason is that the extra money being saved at the pump is just being socked away or spent on other items that have gone up in price.

As for stocks, I cannot stress enough how we should all be keeping an eye on the deterioration in credit markets. Every single time in history that credit conditions have weakened, lenders have tightened up, and junk bond markets have cracked, it has been bearish for equities. Will “this time be different”? Only time will tell. But those are dangerous words for any investor to latch on to.

Feel free to add any other comments you may have in the section below. I’d love to hear from you.

|

![]() Terrorists attacked a Radisson Blu hotel in Bamako, the capital of Mali in western Africa. Roughly 170 people were taken hostage, while three were killed, when militants broke in around six in the morning local time.

Terrorists attacked a Radisson Blu hotel in Bamako, the capital of Mali in western Africa. Roughly 170 people were taken hostage, while three were killed, when militants broke in around six in the morning local time.

Later on, local police and foreign special forces (including those from the U.S.) raided the hotel and rescued most of the hostages. Â Officials said at least 21 people were killed, although details were still sketchy. Mali is a home base for French forces who are fighting various terrorist groups in the region.

![]() Belgian officials suggested they were closing in on the remaining terrorist responsible for the French attacks. It is believed Salah Abdeslam is still in that country, possibly somewhere in Brussels.

Belgian officials suggested they were closing in on the remaining terrorist responsible for the French attacks. It is believed Salah Abdeslam is still in that country, possibly somewhere in Brussels.

![]() Hospitals and health insurers got hammered yesterday after UnitedHealth Group (UNH) said it wouldn’t meet profit targets. The culprit? Obamacare-compliant insurance policies, which could generate as much as $500 million in losses for the firm in 2016.

Hospitals and health insurers got hammered yesterday after UnitedHealth Group (UNH) said it wouldn’t meet profit targets. The culprit? Obamacare-compliant insurance policies, which could generate as much as $500 million in losses for the firm in 2016.

UnitedHealth is considering pulling out from that business, something that could lead to other insurers doing the same. That, in turn, would hurt hospital admissions and reverse the trend toward lower bad debt that boosted their shares in the last couple of years.

![]() The New York Times weighed in on a key issue I’ve been covering namely, that higher-risk portions of the credit market are deteriorating. That’s making it harder for banks to sell off risky loans and bonds they funded, sticking them with hundreds of millions of dollars in potential losses. That, in turn, could lead to less M&A activity and tighter credit markets overall.

The New York Times weighed in on a key issue I’ve been covering namely, that higher-risk portions of the credit market are deteriorating. That’s making it harder for banks to sell off risky loans and bonds they funded, sticking them with hundreds of millions of dollars in potential losses. That, in turn, could lead to less M&A activity and tighter credit markets overall.

What do you think of the latest terrorist attack in Africa? Will it have repercussions elsewhere, and what do you think about our own nation’s safety? Would an exit by UnitedHealthcare threaten the viability of Obamacare? Should you be concerned about deterioration in high-risk lending markets? Let me hear about it below.

Until next time,

Mike Larson

P.S. Larry’ Edelson’s VITAL new report, “7 Commodity Windfalls for 2015-2021” could prove to be the most PROFITABLE report you read all year.

But hurry! It will be gone soon. Click this link to read it now! It could make you very, very rich.

{ 39 comments }

Larry Eldeson believes we will have a correction in the near future. Remember the ole and correct saying. DO NOT EVER FIGHT THE FED. Our stock market is sooooo controlled by the Plung Protection Team it is pitiful. How could our market go up in the light of the current world events? Well, the answer is! The Fed CAN NOT ALLOW FOR IT TO FAIL. Now, knowing that the Fed will not allow the US stock market go down. The only way to play the market is UP UP UP. I do believe we will have a very bad correction, but, only after the Fed runs out of money. NEVER. Keep positive with owning US stocks, it is a Gimmie. Trust Me. A Gimmie.

Larry Edelson (proud of his reputation & not a gold bug) says gold is at the bottom, and is set to recommend buying next week.

Harry Dent (proud of his reputation & not a gold bug) says gold will bottom at $250-$400, and silver will fall to $5, in 2020-2023, and to sell what you have now, as it spikes, because a 70%-80% drop is on the horizon.

Who do you believe? Either, neither? Who, and what can any of us believe? I say – listen to the experts, go with your gut, and adjust on the fly! We’ll probably all meet in the soup line someday!

I dont know if Larry is talking long term, medium term or short term (do you?). I think we should be due for a rally soon for a few months, looking at the charts. Long term, I think $700, and possibly lower….is still in the cards.

I just read Larry’s latest newsletter. Up till now I haven’t acted on a thing he says, but this latest forecast seems much more in line with conventional economic theory. I haven’t pulled the trigger, but he has my attention. Harry Dent wrote a book titled “Dow 36,000”. If he keeps on saying what he says he will eventually be right, but I’m not holding my breath. Jim

a year or two ago i put $80/wk in my gas tank. now it’s barely $40/wk. times two cars, that’s $80/wk i’m saving. can you imagine how many fill-ups at the gas pump there are each day in this country and how much extra money that is going into OUR economy, instead of the saudi’s? it’s not hard to figure out why there’s no better stimulus than cheap oil, and no greater buzzkill than expensive oil. the economy is going to want to run like a racehorse and the fed is going to have to rein it in with rate hikes.

1000

You obviously do not pay for your health insurance. The premium increases have negated

any savings at the gas pump and that is not even counting the $5000 deductibles.

G

everyone pays for insurance. low oil prices will keep money in america that would normally go to the saudis. it’s not enough to help you and me pay our bills, but the accumulative effect of millions of fill ups everyday will impact america’s economy gradually over the next couple years and as a result the stock market bull will continue. i plan to stay fully invested. my benefit won’t the chump change i save at the pump, it will be the market gains that grow my assets.

plus, many of the world’s central banks are in easing mode adding stimulus to their economies. you saw what stimulus did to our economy and stock market in america. now watch how it does the same to the world’s economies. maybe i’m just a dumb amateur, but it seems to me there’s no better time to own american stocks.

I dislike having to open a webpage to read your newsletters. It is just that much extra time and keystrokes. Just saying

It is a bit of an annoyance, isn’t it? I don’t see the reasoning behind the change?

Way more ads to click on for revenue on the web page. I don’t like it either.

If it’s so much trouble, why do you read Mike’s missives? Talk abut lazy – it’s too much trouble to move the cursor and click. Tsk, tsk!

The way Mario Draghi is printing money in the face of a contracting economy and looming bank losses I would expect the Euro to be at parity with the Dollar by year’s end. I was correct about where and when Countrywide ended up (buck by Christmas, $0.97 by new year’s) and may very be spot on in this to where shorting the Euro down to its debuting value might be a paying proposition for all the Christmas shopping that is coming up.

I would agree with you on the Euro with some caveats. Draghi is faced with the same systemic problems as we have in the US when it comes to stimulus. The banks are a bottle neck! His efforts will lead to the same skewed asset bubble we see here in the US. Top end properties, top end equities etc. There is no manner by which they can force banks to advance credit in any manner that will be truly meaningfull to the overall economy. Here we can look to the underperformance of the Russell to the Dow. We will see the same in Europe.

Consequently, the Central Bank asset bubble may see some upward pressure on the Euro while the rhetoric for further QE continues.

Another aspect of structural divergence is that while the lack of jobs forces increasing numbers of people to become ‘self employed’ or freelancers, banks continue to adhere to lending mores that dictate a requirement for employment earnings history history. It is not adequate that ones earnings be from multiple sources. They require that you be employed by a major company. So a person showing perfectly adequate income, indeed excellent income, can not access mortgage lending or other credit as income is in a non- traditional form. With growing jemployment insecurity it would perhaps be a good idea to address the demographic change in credit scoring systems.

Obamacare was designed to put insurance companies (UNH) out of business leading to single payer Canada system not to provide affordable healthcare.

I guess the scheme is working. I had two companies drop my insurance in two years.

The government worked real hard to make a college education out of reach for most people, without crippling debt. They are intent on doing the same with healthcare. No one trusts the Free Market anymore. But, if history is a guide we will never hear the authors of Obamacare admit that it was a poorly designed, dismal failure. Jim

ITS ALWAYS baffled me why any of us work hard and save as much as possible for the future , sometimes it would be easier to be one of those gimme people .they….don’t have a care in the world …….don’t worry about the future , don’t worry about tomorrow everything taken care of medical is paid prescriptions are paid dental is paid optical is paid food stamps subsidized housing free baby sitting and free college if they want it free heat assistance oh I remember why I cant be one of those people then I would have to had voted for Barack Hussein Obama the gimme president

I’ve got to agree that money saved at the pump doesn’t equate to excess funds to bolster the economy. Has anybody done any grocery shopping lately? Smaller quantities in the food containers, at higher prices, doesn’t allow for much discretionary spending of your fuel savings. Whatever you might have saved at the pumps, in a month, is easily eaten up at one sit down family Sunday dinner.

I have savings at the gas pump. I also face rapidly rising healthcare costs, property taxes, fees and fines, regulations, and all forms if insurance, not to mention sticker shock at the grocery store. While the savings are helpful, they aren’t going to stimulate much. Jim

I have propertys in the west , the southwest , Midwest and the south and one thing ive noticed is property insurance has been on the rise and so have property taxes on all propertys everywhere!

Governments must pay for all those giveaways somehow. Look for even more tax increases in coming months and years. Just remember, we asked for all these things at the ballot box. The majority did, anyway.

savins at the pump are going to stimulate america a lot. the saudis are suffering because billions of dollars are staying in america that would normally to them. i cannot emphasize enough how bullish this is for the american economy and the stock market.

Thanksgiving is normally a seasonally positive time of year so we should have a positive 2 days before and 1 day after the holiday. Monday could be down, at least initially.

not just draghi, but central bankers around the world are in easing mode. can you think of a better time to be long the stock market than when so many countries are using stimulus? i can understand being a bear, but not at a time like this.

When better to be bearish, than when the markets are in a rollover pattern from all time highs. Especially when you realize that if you corrected for inflation, they would most likely be lower than in 1971.

i just like to watch my account grow, chuck. it’s on the road to tripling. a great run i thought would be over a long time ago, but i’ve come to realize it an anywhere near over yet. i’m trying to bear, but all the indicators i see won’t let me.

Jim, I missed your question this morning, but royalty companies should be safe. Some beaten down miners might move farther and faster, though, when gold definitely turns higher. I’m looking at AEM and GG, among others.

Me too! Thanks. I have learned go value your opinion. Jim

Please let me know when the US mARKET WILL REVERSE DOWN –Right now too many losses–Please answer my question

Mike,

it was not a terrorist attack in Mali nor in Paris, they were all Muslims, every man and woman involved. Until we are willing to deal with real names, real problems can not be solved. The leaders of Islam, what ever ilk, do not and have not from the seventh century to today, wanted to coexist, read their book, listen to exactly what they say, they mean every word of it.

First and foremost, the PC western world has got to learn that Islam is not and never has been a religion, it is and always has been a totalitarian form of government that includes religion. What other “religion ” controls the courts, churches do not write laws, governments do. What religion controls all education, none, governments do, what religion condems people to death, none, but governments do. Try it for yourslf, make a classic “T” sheet, functions of governments one one side, functions of church and religions on the other. Then compare Islam to any other faith and voilà , reality.

Political Correctness will be the leading cause of death of the western world and culture.

In some countries, religion DOES control government, education, courts, etc. Religion exercises political control to a more or less total degree, In this country, we have freedom to choose our beliefs, and this actually gives us political freedom. I like it that way. Some don’t.

Delaying the inevitable never works, the money printing machine is slowly going to run out of ink, Super Mario in Europe is on the ropes, and the level of stress on Europe is coming to a pinnacle, The levels in the stock market are manipulated and not a true reflection of value, The recent bull market is running out of steam as the manipulation ideas to keep pumping the value, will eventually run out. Mergers, Super mergers, QE, Share buy backs,

easy credit on cars, Job sharing, minus zero interest rates, zero hours work contracts, the list goes on and on telling new ways that all is ok, The reality is the storm is coming, and it will be the great correction that should have taken place from 2008,

What Larry is saying in his latest monthly letter, is that all governments have essentially failed. They are dangerous for this reason, as they try to hold on, and they will use what power they have against the citizens in that effort. We are on our own.

Larry you r the best

Lower fuel prices are saving families a bunch of $$. i think a lot of these savings are going into new vehicle purchases. The US is buying cars at a 17 million per year clip. Average age of autos had gone over 11 years, financing has become easier (the next sub-prime bubble?) and it’s easy to justify the monthly fuel savings into a monthly payment for new more reliable wheels.

You are right, Dan, about the sub-prime loans for autos. A substantial portion of auto loans go to people who score poor for financial responsibility. So far, the repossession rate has not been too high, but with increasing layoffs, etc., this could increase. Lenders are being generous with payment forgiveness, and such, simply to avoid repossession, and possible loss on resale. Also, the price of fuel won’t remain down forever. The Saudis, as lowest cost producers drove down the price of oil, trying to drive high cost American frackers out of business. The Saudis are starting to get into financial straits themselves, and will soon need to ease back and allow prices to rise again. Higher fuel prices could further tighten things for some of those car buyers.

One thing Larry E. talks about in his latest issue is the likelihood of the European Union, with it’s whole concept of the Euro, collapsing. This could mean that the Mark, and Franc might rejoin the IMF’s SDR index, which they were part of before the Euro took their place. They would possibly be at a lower total value than the Euro currently has. This may raise the proportional value of the Dollar, Pound and Yen, but…. China’s Yuan is expected to become part of the SDR on 9/1/2016, at something like 7.5%. The demise of the Euro might raise that percentage somewhat, possibly to nearly equal the Pound.. Chinas financial importance may be even higher than originally thought, as she recovers from the recent troubles. Every investor should look into Chinese investments, even though that country still needs to do much to make her finances more open.

Mike, I read “The Draghi Express” and see again more advertising and solicitation embedded in every article.