|

The abject failure of the policies pursued by the fiscal and monetary authorities for the past seven-and-a-half years keeps getting shoved in our faces.

The news of the economy’s contraction by 1 percent in the first quarter is an attention getter, but GDP numbers are misleading even when they show the economy expanding. Counting government spending as those numbers do, one would have to believe that more than $120 million worth of Tomahawk cruise missiles that Obama rained down on Libya has made us richer.

But the military Keynesianism of both the Republicans and the Democrats has failed as badly as any other spend-our-way-to-prosperity scheme.

One of the most disconcerting stories about the real shape of the economy since the air coming out of the Fed-inflated housing bubble started the Great Recession is the news about housing consolidation among older Americans. Everybody has heard about the young people, burdened with school debt and a poor job market, who have failed to launch. Almost a third of 18- to 34-year-olds live with their parents.

|

| When consumers begin worrying about food affordability, a gold move is not far behind. |

But more shocking is the account of the growing number of people aged 50 to 64, people who normally would be in their peak earning years, forced by economic conditions to move in with their parents!

The LA Times reports that “older people are quietly moving in with their parents at twice the rate of their younger counterparts.

“For seven years through 2012, the number of Californians aged 50 to 64 who live in their parents’ homes swelled 67.6 percent to about 194,000.”

The people in charge of pronouncing on these things tell us that the Great Recession ended in June 2009, five years ago this month. But since then, the American middle class has lost its lead as the world’s richest. And now the Gallup organization finds that almost a quarter of families in the U.S. are struggling to afford food for their families.

That’s a higher percentage than their peers elsewhere in the developed world.

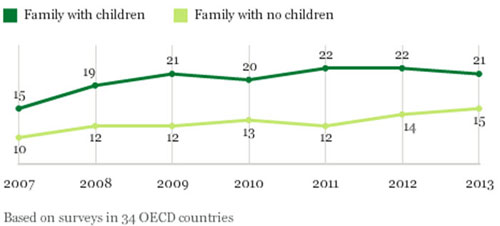

The numbers come from a Gallup survey in Organization of Economic Co-operation and Development (OECD) member nations. These are some of the world’s wealthiest countries, mostly Western Europe and North America, including the United States.

Now in places like Asia and the areas of the former Soviet Union, the percentages of people having difficulty providing food has declined or at least remained stable since the global downturn began. But in the industrialized west, in the OECD nations, Gallup reports the trend has gone the other way.

The Gallup survey posed the question, “Have there been times in the past twelve months when you did not have enough money to buy the food that you or your family need?”

Survey-wide, 21 percent of families with children responded that they have had problems affording food; 15 percent of families without children reported such problems as well.

But the numbers are worse in the U.S., where 19 percent of people without children report food struggles. For people with children, 23 percent report the same challenges. That number has grown dramatically, up 12 percent from 2007 to 2013.

These survey results end before 2014 when food prices really began powering their way higher. What will happen as today’s climbing food prices, engineered by Federal Reserve monetary policy, begin to be taken into account?

Conditions will worsen.

Marie-Antoinette, representing the 1 percent of her era, may or may not have actually said, “Let them eat cake” during the bread shortages leading up to the French Revolution, but rising food prices are a key component of social instability. The Arab Spring revolutions were fueled by rising food prices.

Gold always shows up at the crossroads of history. Gold moves on the failure of fiat money. It also climbs in periods of social breakdown.

We have ample evidence that when consumers begin worrying about food affordability, a gold move is not far behind. One can look back to the 1970’s for evidence, or more recently to spiking food prices in 2008 (when gold first broke $1,000 an ounce) and again in 2011, the year of gold’s all-time high.

When food prices are high it is not because gold prices are high, but because the purchasing power of paper money is down.

But there is a cause and effect relationship between high food prices and social chaos, just as there is between social chaos and even higher gold prices. When social conditions break down, people buy gold.

These are the signs of the crossroads of history.

Best wishes,

Charles Goyette

P.S. High food prices aren’t the only thing that could send gold higher. Click here for my FREE report on how Obama is re-arming Al-Qaeda and what it portends for your safety, your liberty and your money.