|

The “Echo Bust” is here! That’s the unmistakable conclusion you have to draw from the latest reports on the housing market.

So what is it? And what are the consequences for you?

Well, way back in November 2012, I said in Money and Markets that I was getting nervous.

My forecast up to that point had been that “the housing market would gradually stabilize, thanks to a combination of low interest rates, lower home prices and the simple passage of time.” But as 2012 progressed, I saw a clear “risk we could backslide toward an ‘Echo Bubble’ — one driven by a large influx of hot-money investors looking to compensate for rock-bottom yields in other income-generating vehicles” such as rental property.

Then in April 2013, I ratcheted up my warnings. I wrote:

“[Investors have] flooded into the housing market like marauding swarms of locusts. They’ve been snapping up houses to turn around and rent them out, often paying cash, to generate yield.

|

| Investors have been snapping up houses to turn around and rent out. |

“But because they’re under such tremendous pressure, they’re aggressively outbidding each other, as well as traditional buyers. They’re paying too much money for too little of a rental income stream. And I believe that has set the stage for another housing market pullback — not one as bad as we had last time around, but something of a low-grade ‘Echo Bust.'”

So where do we stand NOW? Get a load of what we just learned …

- Existing home sales fell to a seasonally adjusted annual rate (SAAR) of 4.59 million in March. That was the worst reading since July 2012.

- New home sales plunged 14.5 percent to a SAAR of 384,000. Not only did that miss estimates by a country mile, but it was also the lowest level since July 2013.

- The nation’s homeownership rate sank to 64.8 percent in the first quarter of this year from 65 percent a year earlier. That’s the lowest going all the way back to 1995.

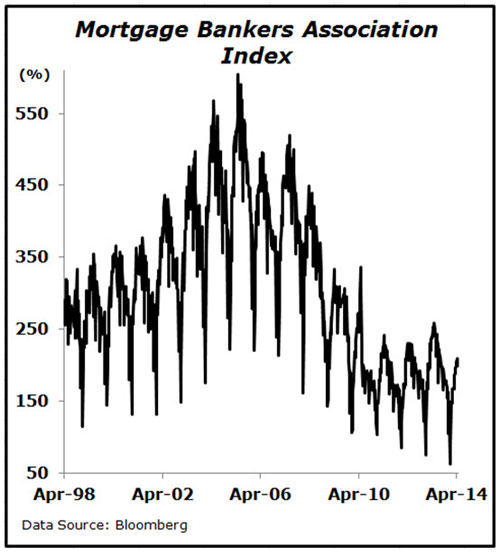

- Home purchase mortgage activity has plunged 21 percent year over year. And overall lending activity — as measured by the Mortgage Bankers Association index that tracks both purchase and refinance applications — just sank to the lowest level since December 2000.

So yeah, I’d say that pretty much describes an Echo Bust to a “T”! Is it any wonder, then, that the kinds of housing-sensitive investments I recommended avoiding have been lagging badly?

Leading home builders like D.R. Horton (DHI) and Toll Brothers (TOL) are now back to levels they first traded up through in late-2012. Ditto for mortgage originators, investors, and technology firms like Ellie Mae (ELLI), Redwood Trust (RWT), and Nationstar Mortgage Holdings (NSM).

So what comes next? Well, I think we revert again to a housing market that depends on real people buying real homes with real incomes and real mortgages — not this cash-driven, investor-turbocharged stuff we saw going on in late 2011, 2012, and early 2013.

The problem is that wages and employment haven’t grown anywhere near as quickly as house prices did in the last two years … and neither has the economy! So the only way to get back to a “real” market is for house price growth to slow dramatically, and wage, population, and economic growth to play catch up.

Or in other words, if you’re loaded up with housing-sensitive investments like home builders, mortgage companies, and construction supply names, you’re likely to be disappointed. And if you got back into the “fix and flip” game in residential real estate, now’s the time to start harvesting your profits … before they fade away again.

If there’s any good news here, it’s that the overall economy is NOT wildly dependent on home price growth, mortgage-making, and real estate speculation like it was in the early- and mid-2000s. So you can still profit by focusing on other areas of the economy and stock market — just like I have over the last several quarters!

Until next time,

Mike

P.S. Housing isn’t the only sector at risk. Another disaster is approaching like a runaway freight train, and it will permanently change your financial life. In my just released report, The Deadliest Bubble in 237 Years, I’ll give you the five steps you must take immediately to protect yourself and your loved ones from the coming storm.

To claim your FREE copy, click here now.