|

Are you ready for the next “Minsky Moment”?

Minsky? Don’t feel bad if you’ve never heard of either Minsky Moments or Hyman Minsky, the economist who coined the term. Few investors have.

But we’ve all felt the effects of a Minsky Moment, even if we didn’t realize it.

Hyman Minsky was a St. Louis-based economics professor who spent his academic career studying financial crises.

His “Financial Instability Hypothesis” concluded that financial crises spring from long periods of prosperity. These prosperous periods lead people to get careless with leverage and to amass excessive debt.

Minsky didn’t think that financial crises are necessarily bad. Rather, he believed that:

“The financial system swings between robustness and fragility, and these swings are an integral part of the process that generates business cycles.”

In short, it is economic stability itself that breeds instability.

However, the frailty part is what makes investors lose their lunch. That’s because a Minsky Moment causes a sudden collapse of asset prices.

Is a Minsky-style financial meltdown in our immediate future? Well, the world — governments, businesses and individuals — are certainly awash in debt.

|

|

| Image credit: ZeroHedge.com |

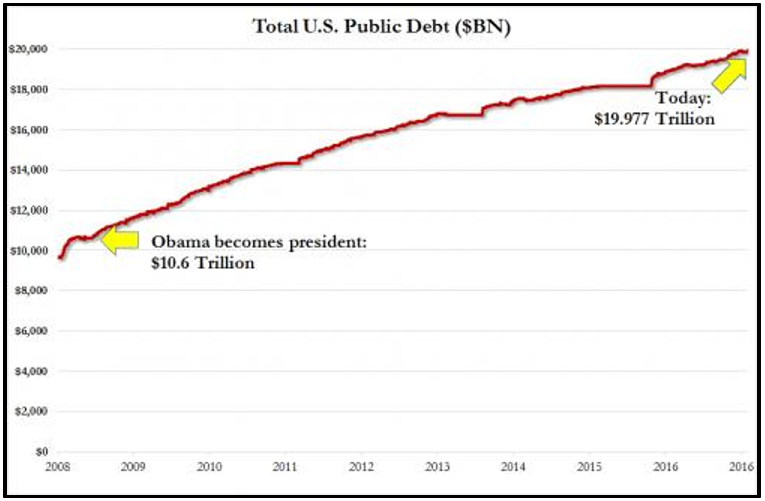

At the start of 2017, total U.S. government debt was just below $20 trillion. And I’ve heard nary a peep about shrinking our national debt from any politician this year.

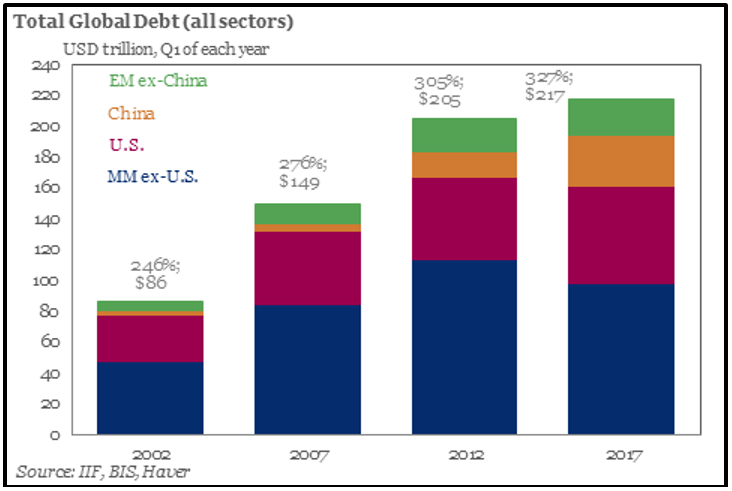

And don’t think the U.S. is alone in its spend-a-holic ways. According to the Institute of International Finance, global debt has soared to $217 trillion, or 327% of global GDP.

|

|

| Image credit: ZeroHedge.com |

Â

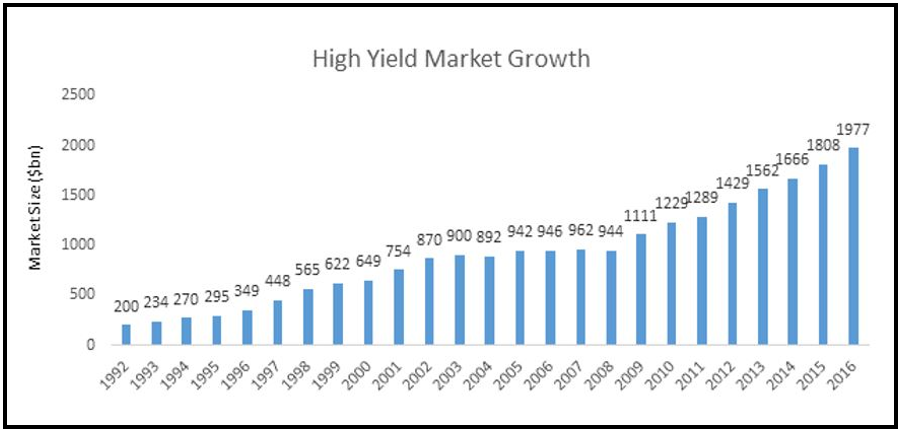

American businesses have been borrowing like mad, too. Which is no surprise, given the Fed’s addiction to near-zero interest rates. The most troubling aspect of the corporate-debt balloon is the rapid growth of the junk bond markets.

|

|

| Image credit: AlphaBaskets.com |

In our yield-starved world, investors have been eager to gobble up anything that throws off an attractive yield. Even if it’s high-risk (i.e., junk). Year-to-date, global high-yield bond issuance is 37% higher than it was in 2016, and pays an average yield of 6%.

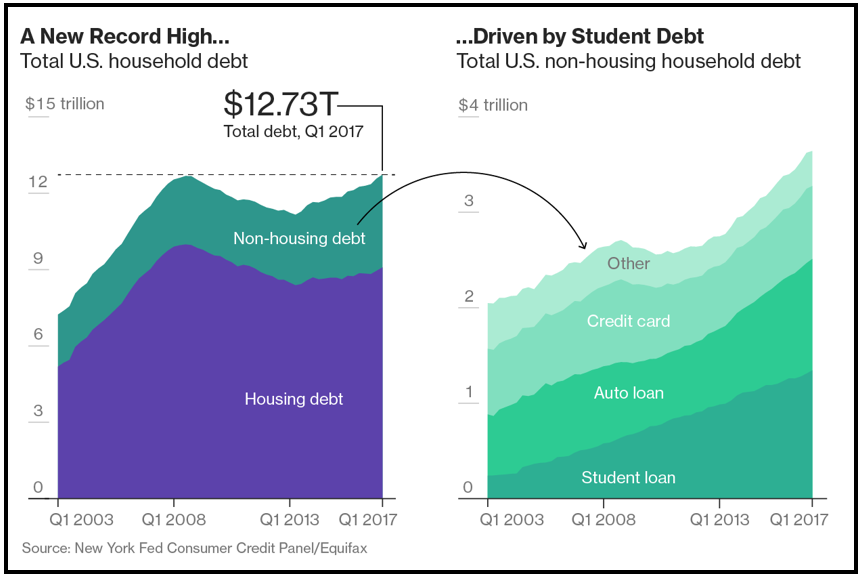

Even more indebted is the average American, who has been on a credit-card, student-loan and auto-debt binge. Total U.S. household debt is approaching $13 trillion … and that figure is back to pre-financial crisis levels.

|

|

| Image credit: Bloomberg.com |

That debt load is starting to take its toll:

Americans owe a staggering $779 billion in credit card debt or $16,748 per household. Worse yet, the AVERAGE interest rate on that debt is a whopping 16%!

The average auto loan has grown to $31,720 and is financed over 69.3 months, or 5.78 years!

Americans owe a collective $1.4 trillion in student loans with an average debt of $49,905. Ouch!

Is all that debt pushing us closer to a Minsky Moment? It sure looks like it.

The percentage of debt that is more than 90 days delinquent increased to 3.7% in the first quarter, which is the second quarter of rising delinquencies.

And get this: The Federal Reserve reported that 46% of American households don’t have enough cash to pay a hypothetical $400 emergency expense!

I suggest you pay careful attention to the upcoming University of Michigan Consumer Sentiment Index. It’s due out this Friday.

Consumer sentiment numbers have been falling. The June reading (95.1) was down 1.6 points from May. And I expect more of the same when we get the July number.

If I’m right, you could make some big trading profits by buying shares of specialized ETFs that are poised to soar from the next Minsky moment. My Calendar Profits Trader service is designed to help you prepare. Take it for a test-drive here.

Best wishes,

Tony Sagami

{ 6 comments }

I REALLY think a recession is coming to US in ’19 or ’20.

Scrambling to pay off personal debt and accumulate cash.

Looking forward to taking full advantage of buying on the cheap! (Real estate,REIT’s, etc).

I’m in my 60’s, so this may be my last good shot.

The Minsky Moment boils down to greed. Wanting something now regardless of the real need, and because everyone else is getting it. But if it wasn’t for greed there would be a lot less jobs, especially in the financial world.

We learned in that last crisis, that debts does not need to be paid. Students, homeowners, etc., will “walk” on their by. Then we as a country will wave a flag of surrender to the new “lender” that will absorb the load.

I think Learman is correct.I see lots of ads on TV,firms promising to reduce your tax burden.Many hospitals,doctors just writing off unpaid bills.So,eventually this all falls onto the Dollar,the base of the whole thing.Some day,the Dollar value is going to take a massive hit.

Sold my waterfront home in ft lauderdale for

1.4M after buying it in Nov. 2011 for 480k. (Yes, you read that correctly). Currently studying prices on RE in st. Augustine as people sit on over inflated inventory for months on end (seeing what will stick to the wall), starting to see large price reductions (25, 50, 75k). Tis just a matter of time, time is on the side of the patient in this predictable and emminant pattern.

I see a lot of figures on debt, but none relating it to debt service load. Isn’t the low interest rate relative? Please don’t get me wrong, I grew up in the Midwest under a very financially (and otherwise) conservative family…so I too hate over lending and borrowing, but I’d like to see relativity to help in the comparison. Tony – please respond if you are able to. Thank you in advance as well for the article.