|

Last month in Money and Markets, I alerted readers to the fact that emerging markets have been the biggest winners among global stock-market performance in recent years.

Well, don’t look now, but they’re beating the pants off U.S. stocks again this year. And this may be just the beginning of a profitable long-term trend. Don’t miss it. Most investors I talk to these days want to know if Trump’s tax policies will boost the stock market.

Or they’re worried that excessive interest-rate hikes from the Federal Reserve will derail this rally. But they’re focused on the wrong place. The real story isn’t in Washington, D.C., it’s unfolding around the world in emerging markets.

In my January 13 column (“Asian Markets Offer a Bullish Combination of Growth and Value“) I pointed out that developing Asian economies offer an attractive combination of fast-paced economic growth, plus cheap valuations.

This is exactly the opposite of our own stock market here at home, where valuations are stretched and profit growth has flatlined.

The good news is that it’s not just emerging Asian markets that are cheap and outperforming U.S. stocks.

Emerging markets in Europe, Africa and the Middle East are also booming, a bullish sign. And they’re still attractively priced, in spite of the recent rally. So you haven’t missed the boat just yet.

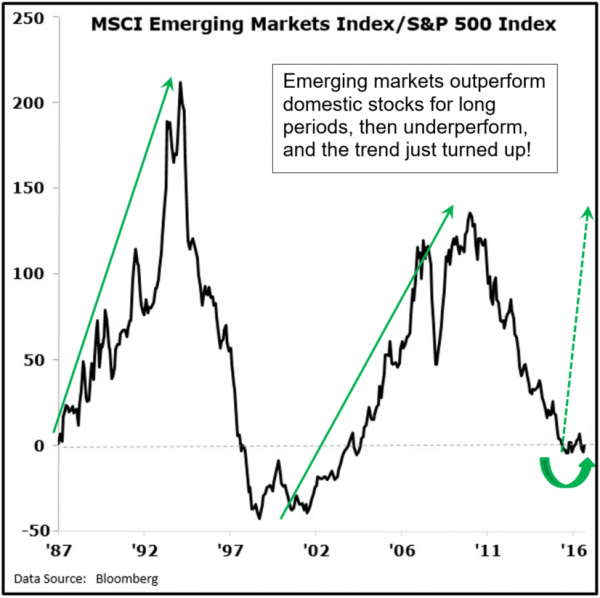

The fact that a majority of emerging markets in different regions of the world are outperforming right now is a very bullish sign for investors interested in profiting from long-term secular trends. Emerging stock markets have periodically outperformed U.S. stocks (and by a wide margin), and then underperformed for years (also by a wide margin).

The last period of outperformance, from 2001 to 2007, saw the MSCI Emerging Markets Index surge 365.7%, easily beating the Dow and S&P 500. And that uptrend persisted for nearly a decade.

Before that, from 1988 to 1994, emerging markets skyrocketed 477.3%! These are trends you can profit from consistently for many years.

From 2010 to early 2016, emerging-market stocks underperformed the U.S. markets. Valuations got cheaper and cheaper, as our stock market got more expensive with each new record high. But last year, the trend began to shift again in favor of cheaper emerging-market stocks.

Emerging stocks outperformed domestic markets up until the November election, then they suffered a Trump tantrum. Investors worried that trade barriers would hammer emerging-market exports. But this was a brief, knee-jerk reaction. And this year, emerging stock markets resumed the outperformance again.

So far this year, the Dow is up 5%. The MSCI Emerging Markets Index has gained almost twice as much, up 9.8%. And select emerging stock markets are performing even better than the average.

* Brazilian stocks have surged 20% higher so far this year, yet these shares are still priced at just 13-times this year’s earnings, as compared with a P/E ratio near 20 for the S&P!

Ditto for other Latin America emerging markets, including Chile and Argentina. Emerging Europe and the Middle East also have cheap markets that are outperforming …

* Despite political turmoil in both nations, Turkish stocks are up 11% and Egyptian stocks have gained 18% so far in 2017. Turkey’s forward P/E ratio is just 8.9 while Egypt’s is only 10.5.

And one of the world’s most undervalued stock markets, ironically, also belongs to the world’s fastest-growing economy …

* The Hang Seng China Enterprises Index is up 12.1% year-to-date, yet these Hong Kong-listed Chinese blue chips are still available at just 8.4-times this year’s profits!

Bottom line: Emerging stock markets are booming again. They’re being driven by better economic growth prospects and cheaper valuations. And this is likely just the beginning of a multi-year period of outperformance that could see emerging markets triple or quadruple in value … so you ain’t seen nothing yet!

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 2 comments }

Interesting. You did not recommend any specific stock or funds you think might be a way to invest in these markets.

Mr. Burnick, are you publishing a newsletter?

please, respond, Thanks, Dr. Fiedler