| MARKET ROUNDUP | |

| Dow | +102.75 to 17,879.55 |

| S&P 500 | +13.11 to 2,066.55 |

| Nasdaq | +28.46 to 4,755.81 |

| 10-YR Yield | +0.07 to 2.29% |

| Gold | -$20.10 to $1,197.90 |

| Crude Oil | -$1.85 to $67.17 |

Sometimes, I write about market fundamentals. Sometimes, I write about the economy. But sometimes, you can convey a heck of a lot more information from just one or two charts. And when it comes to energy and interest rates, boy is that ever true right now!

Look, you know by now that OPEC didn’t cut production at last week’s meeting in Vienna. That helped pull the rug out from under crude oil prices, sending U.S. oil futures to just under $64. We haven’t seen prices that cheap since mid-2009 – right after the Great Recession!

You probably know that interest rates have generally been heading lower in 2014, too. Not because of economic weakness or policy here, mind you. The U.S. economy just notched the strongest six months of growth since 2003, while the U.S. Federal Reserve just ended its QE money-printing program.

But that hasn’t mattered as much as it normally would because Europe, China and Japan are all struggling and printing money like mad. Those massive waves of money aren’t staying bottled up at home or helping their domestic economies – they’re washing up on our shores and boosting U.S. stocks, bonds and the dollar.

At some point though – in any market – you reach a capitulation point. Panic selling gets so intense that everyone who wants to sell already has.

When selling does dry up like that, it sets the stage for massive (and potentially very profitable) reversals … the kind you only see every few years!

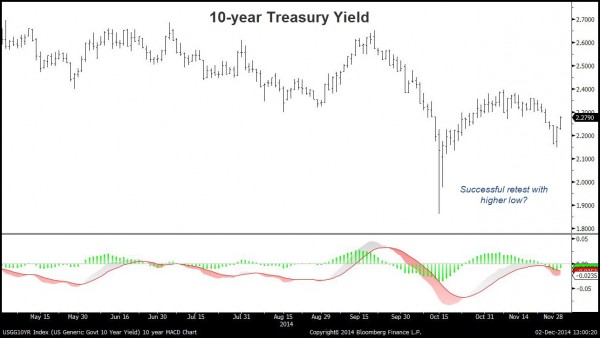

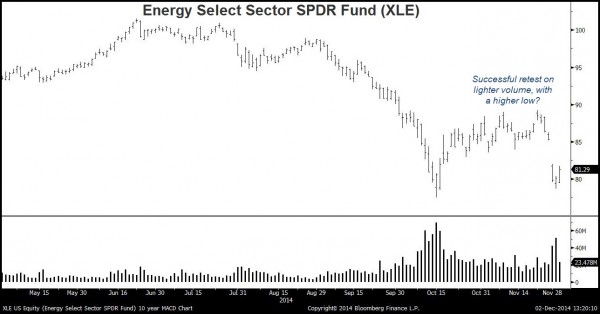

With that in mind, I want you to look at the following two charts. The first shows the yield on the 10-year Treasury Note, while the second shows the Energy Select Sector SPDR Fund (XLE):

(Click image to enlarge)

(Click image to enlarge)

What do I see? I see large, panic-driven, waterfall declines. Those declines sent the 10-year yield down to 1.87 percent from around 2.65 percent, and the price of the XLE down to less than $78 from just over $101.

Then they both culminated in massive, spike lows in mid-October. A sharp rally ensued, followed by a “re-test” of the lows in the past couple of days. On those re-tests, we saw lighter volume, less selling, and higher lows in price.

My colleagues Mark Najarian and Mandeep Rai discussed the fundamental forces impacting oil yesterday. But even if you didn’t know one whit about the fundamentals of oil or interest rates, the technical action here is very encouraging.

It suggests we are, in fact, washed out. We may have gotten to a point where both interest rates and energy stocks have priced in all the potential negative news, setting the stage for one of those very sharp reversals I mentioned earlier.

So if you’ve been biding your time, looking for an entry point in either of these markets, pay close attention. It may just be about time to pounce! Everything from inverse ETFs that rise in price when interest rates climb to select, energy stocks or Master Limited Partnerships focused on the domestic energy renaissance would be my favorite vehicles.

What do you think? Is OPEC’s latest gambit a disaster for the energy sector? Or have we priced in all the negatives out there, and is that making bargain-hunting attractive again?

Where do you expect oil prices or interest rates to go over the next year? Higher? Lower? What specific targets do you have, and why? Hit me up at the Money and Markets website with your thoughts when you have a minute!

| Our Readers Speak |

In the meantime, you had a lot to say about the benefits, drawbacks, causes and potential responses to falling energy prices on the website overnight.

Reader Gwen P. said we should be taking advantage of it to top off our emergency supplies. Her comments: “What the U.S. should be doing with the low oil prices is to buy for our strategic reserves. Think ‘save money’ while the price is low. Be sure we are buying U.S. oil, not foreign!”

|

|

| Pump prices are falling. Should we increase the gasoline tax to help fund infrastructure improvements? |

Meanwhile, Reader Scott D. said we should boost taxes with energy prices low. That way, we can fund infrastructure improvements without taking too big of a chunk out of American pocketbooks and wallets. His comments:

“Absolutely raise the gasoline tax to rebuild the roads and bridges. It will help push oil prices down further by reducing demand slightly and our economy will still be stimulated by prices that are down over a dollar. One caveat: The money must be spent on improving roads and not siphoned off for other government programs including rail.”

Reader JP F. took a longer-term view toward OPEC’s latest action – and how the U.S. should respond. Here’s the summary:

“Do YOU really believe Saudi Arabia has your best interests in mind with ‘cheap oil’ prices now? Where were they when oil hit $140 a barrel and gasoline topped $4.50 in my hood? They were still pumping it out for $10!

“It is merely a ploy to bankrupt the more expensive U.S. producers. If we do nothing, these firms will limit production, exploration, and ultimately close.

“Sure, it feels good those low gas prices, right? How will it feel when there is no competition except the Saudis, Kuwaitis, and Venezuela? How will it feel when prices over-correct to the high side?

“The ‘smart answer’ is an import tax to increase the cost of domestically used fuel to roughly the $3 level per gallon. That normalizes prices for all, and offers some protection to our own producers. Protection is Prevention of Chaos later.”

We’ll see what happens in the coming weeks and months. But as I’ve made clear for the past several months, I don’t believe the American energy renaissance is kaput. Nor do I believe OPEC can stomach low oil prices for long. Throw in the encouraging technical action I’m seeing (not just in energy, but in interest rates) and I’d much rather be a buyer than a seller here.

But as always, the comment section online is the best place to weigh in. Here’s the link.

| Other Developments of the Day |

Gas prices may be going down. But the cost of everything from health care to cell phone service is going up, sticking the American Middle Class with the bill. That’s the thesis of this Wall Street Journal story.

The piece notes that households earning between $18,000 and $95,000 (pretax) have seen incomes stagnate since 2007 even as inflation has risen 12%. Result: Little net progress for average Americans, and less spending on the fun things in life because all our dough is going towards things like health insurance premiums.

Then again, struggling carriers Sprint (S, Weiss Ratings: D) is now trying to do something about high cell-phone bills. It’s rolling out a “half off” plan aimed squarely at AT&T (T, Weiss Ratings: B) and Verizon (VZ, Weiss Ratings: B). The idea: If you currently pay $200 per month to AT&T, you can get Sprint service for $100. Just show proof of your current bill.

Is the West trying to put pressure on ISIS by helping local authorities locate and detain the wife and son of the terrorist group’s leader? They were reportedly detained in Lebanon several days ago.

Billions of euros fleeing the threats of devaluation, economic stagnation and geopolitical turmoil have been “washing up” on our shore the past several months. So it’s only fair that blocks of a mysterious, rubber-like material (stamped “Tjipetir”) are washing up on Europe’s shores! This fascinating Washington Post story explains what the heck these enigmatic blocks are, and where they likely came from.

Remember, you can comment on these or any other matters by clicking here.

Until next time,

Mike Larson

{ 36 comments }

I do not live in Saudi Arabia. I live and pay taxes in the United States. When are we as a country, government and business leader of the world (or so we use to be) going to stand up and declare our independence from these huge government cartels. I do not live and breath to make Saudi Arabians ‘happy’. Let them handle their oil their own way without dictating to us and let us focus on our own countries ability to support itself and its people. Llet them fight their own wars, them along with all the Muslim world. We have already been dragged into too many of their conflicts – and lost many of our people representing every race, religion and gender. And is anyone in the Mideast grateful for our support or saddened over our loss? No. If so, it never makes the 6:00 newscast. All we hear is hate and resentment and multiple terrorist warnings from the very people we are ‘helping’.

It’s time to wake up and realize this is a huge power game and that we can’t win without backbone and our own strategy.

STOP buying there oil now!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

SHAR, you are right on target. I agree that we have been engaged in too many wars in Muslim countries, however, we must maintain a strong defense here at home, so strong in fact that no other country would ever dare attack us. Also, I will add one more caveat, we must purge all known terrorist and terrorist hypothesizer’s from our country and control our borders. This President’s illegal executive order to provide amnesty to millions of illegal alien’s must be over turned even if it requires impeachment. Finally, we need to concentrate on our own infrastructure as it is crumbling and has been put off far too long.

I would love to buy a “plank” of Tjipetir,

Good column, good comments. Elephant in the room: Federal debt/deficit. Fund infrastrucure with cuts in wasteful/uselass programs and regulatory costs. Tax increase will only srangle the recovery as they always do. See France.

I was hoping to find an article about the 10 year treasury rates today as there has been a huge spike up. I’ve been monitoring the chart for some time now and think that the spike down to 1.9 was a washout, and the pull back since has been a retracement mainly due to japan going into QE overdrive. Worst news seems to have been priced in and the spike up today is the launch pad from which we will see rates climb high real quick as you’ve warned numerous times in your article. The US economy may not be completely ready to digest them but they are going to creep up on us – and that also applies to the UK which is where I am. I’ve heard you mention that growth in the US is picking up and so higher rates are warranted, however this may just be the black swan event that takes the steam out of US and especially the UK housing market. Stock market may not be spared either. Probably best time to fix those mortgage rates for largest term possible!

The economic expansion has been so long and artificial that I would not be surprised to see a 2008 collapse.

Gwenn P. has my vote. Now is the time to fill our oil reserves at low prices. Buying oil strictly from U.S. sellers will help our marginal producers ride out the temporary price dip. They deserve our long term support more than our continuing to live with the uncertainties of OPEC.

This is absolutely the wrong time to raise taxes. We’re teetering on a weak recovery, face significant healthcare premium increases is less than a month. That might disrupt our fragile economic recovery. Deutsche Bank reported last week that OPEC suppliers’ break even prices average above $80/barrel. Let’s use this opportunity to move closer to U.S. energy independence.

I look at the XLE chart and I see another leg down to the 74 area. We could attempt another rally first over the next few weeks (that should fail) but I think we still have another leg down. I think the chart for WTI looks like it needs another leg down too to about 61.

BTW…..contrary to your statements above……..the SMART answer is NEVER to raise taxes. They are already crushingly HIGH. Big Gubmint in the U.S. is like a gang of leeches on business. We have some of the highest corporate taxes in the world. The more regulations and taxes, the less jobs and the less growth.

We should forget what the Saudis are doing and take action to help ourselves. First we need to get congress to allow export of crude so we can sell our sweet crude to refineries set up to run it. Approve the Keystone pipeline so we can buy the oil from Canada which our refineries are set up to run and speed up the permits to export LNG so we can sell what we are burning off at the wellhead. Let the market work.

You’re so right Jerry, however after months of complaining about nothing being done because of the President, the republicans missed their first opportunity to show us they were going to right the wrongs-they didn’t pass the Keystone. Which was primarily Republican created to transport oil from Canada for and thru the U.S. and also to the benefit our other neighbors Mexico who just recently opened their company for energy business. That is the next oil frontier and lets not complain about duplicity or corruption when our government lets the Saudi Prince call our shots. Gwenn is right, its time to take care of our own which was the original reason so many Independent oil and gas developers have been working so hard – to make America capable of taking care of our own when OPEC decides not to do business with us.

Every Republican senator voted it for it, Shar. They do not have the votes to pass Keystone without at least a few Dems. They got a VERY few.

Yes they did exactly that and no more. In the past they have used all their power and influence to ensure those Democrats who pledged to pass bills followed through…..in this case three others. Maybe they think they did their best, but you are correct about the vote. It seems that ‘we the people’ are having the best debates

instead of ‘session’.

“We have already been dragged into too many of their conflicts – and lost many of our people representing every race, religion and gender……. to the very people we are ‘helping’.”

Such arrogance, hypocrisy and a gross distortion of history! Stop blaming others for your own stupidity. It was your government that dictated to the Saudis over petrodollars in what amounted to a protection racket.

Regarding Scot D’s remark, feel free to send the US Govt. All the money you wish! You may do so if you wish. However, free interprise business should not come with an increased tax, just because we’ve been given a temporary lower price of consumption. Austerity has began globally, and its not a healthy sign if you’ve followed historical economics. If you have money to burn, feel free to donate it to the governments.

Careful with the blame Mel. I hold our government totally responsible among others and these issues have been on-going since WWII. And I know all too well how difficult it is to stand up to the government power players who continue to vote against bills they pledge to pass, rewrite House Resolutions to include illegal liabilities buried in hundreds of nonsensical pages and threaten any who try to expose them. And this is exactly why many US citizens have relocated to different countries – runaway politics….Use your harsh, angry words to right the wrongs.

Its all over… Jesus is coming soon. Just read the Bible and you can see how everything fits now.

Give us a date

Now Mike is pinpointing the end of the World in January.

Good for you Mike.

the question is Mike does not an advanced degree.

He could not even teach at a Junior college.

Yet, he manages to snag thousand of readers who believe in his nonsense.

Mike, my dear boy, you column should have been written three months ago.

Mike, my advice is free. So believe when I say the Dow is going to 18,300.

Tell Larry and Marty to stop preaching fear and greed.

Feel free to e mail me. willymette@gmail.com

Hi!, Patrons Of Money And Markets Et. Al.:

This will end up as an exercise in futility but here goes anyway: The US $ at one time had a buying power of 140 cents but has sense declined to around 2 cents. How will a rollback to 140 cents ever be accomplished today? So, temporarily, we get a reprieve on fuel costs, because OPEC (primarily Saudi Arabia) is having a pricing war with US oil producers of all stripes, in an attempt to capture and retain their long standing market share incomes they need for bare bones survival at this point. However, how does that reflect on the true purchasing power of a US $? One day you get up and your US $ represents 1/35 of a troy oz. of gold in an alloy 9/10 fine; while the next day, following when President Nixon closed OUR US Gold Window August 15, 1971, and discover at that point your US $ is backed by ? Therefore, the only idea now supporting and destroying currencies buying power seem to be interest rate fluctuations between the various worldwide currencies. However, no matter how these currencies fluctuate such as OUR US $, all of them put together don’t add up to even one 1/35 ounce of gold in an allow 9/10 fine do they? How can anyone get a true currency value out of that nonsense is far beyond my capabilities to comprehend and how about you dear reader? Therefore, I’m presently satisfied with the price breaks on my fuel charges but nonetheless not satisfied with the plunge of the value of my US $; as registered in their Chart Book from The American Institute For Economic Research in Great Barrington, Mass. (888) 528-1216. Readers should give them a telephone call to order their Chart Book which sells for around $10 fiat money (a true bargain in my book).

RUSS SMITH, CA. (One Of Our Broke, Fiat Money Corrupt States)

resmith1942@gmail.com

Please tell those idiots championing new taxes on gasoline that Congress never removes taxes when they are no longer necessary and they never spend them where they are best utilized.

Consider the possibility that the real target of the price cut is Iran. The OPEC intransigeance may do more than all of the west’s sanctions to wreak havoc with the Iranian economy and might bring them to curb their expansionist agenda and settle for a peace which leaves the Sunni governments intact.

There has never been a better time for a carbon tax! Use proceeds to fund renewable energy. My home has solar and now we space heat select rooms in winter and turn the thermostat low. Will be getting an electric car. Your comments are devoid of any concern for climate change making me think you are non believers. But what is great is this puts a big damper on fracking which I believe is a danger to our precious water supply.

While I am at it, I don,t feel that the Ukraine mess was started by Putin but rather by our corporate meddling in the Ukraine. The US backed the coup of their democratically elected leader because he did not take the western deal which would frack Ukraine and called for arms spending. Coup leaders also want to do away with Russian language. There is a real split shown by past voting. Crimeans voted to join Russia in what I believe was a fair election and in accord with international law. Russians already had troops on Ukraine by treaty. It was a huge miscalculation on US part to back (and instigate) coup and Russia has responded defensively. Henry Kissinger and others agree. Putin is not a pushover like Hussein or Gadafi…. he really does have weapons of mass destruction and now both our countries have affirmed the right to strike first with nukes. Maddness…. and now all this perfidious propaganda about “Russian aggression ” which is really US aggression. Now we are caught with our nukes down and instead of disarmament talks and co-ordinations with Russia on ISIS we have pushed them to China. Instead of rebuilding our infrastructure we continue the war machine and risk nuclear Armageddon . I implore everyone to read Kissingers and others warnings and not let us be led by the nose into another useless expensive (profitable for the war corporations) WAR. Sanctions are acts of war. just ask the Japanese.

Now would be a good time for cooler minds and kinder hearts.

This is a temporary lowering of crude prices. It could last as long as 18 months. The participants also suffer from these reductions but they NEED higher prices. They cannot keep this going for more than 18 months.

There are many ‘marginal’ producers who will fail, others will be bought by the majors but in the end oil will rise. Many who lent money to producers will lose. Thus there is huge opportunity to buy assets that will pay off 18 months into the future.

Again this is ‘temporary’ and will pass as the fundamentals of production and use will shift.

But there will be a lot of pain as the players in this market make mistakes.

As a consumer, how could you not rejoice at the sight of falling oil prices? As a US citizen, asking for a tax on oil is just a request for the hapless Feds to seize more assets as the national debt just passed the $18 Trillion mark. Wasn’t it nice to see all the recent headlines (sarcasm) about our massive indebtedness?

Is it possible that yields could rise? Sure, but not for long. The Feds ended QE3. There is a glut of oil because demand is not sufficient at $90/barrel. Xmas sales are in decline. Median income is eroding. Japan and China just did a new round of QE because all of their previous rounds of QE were not successful. New money goes into stocks which produce a lot of profits via share buybacks.

To look at it technically, a 5 year chart of the 30 year would show a head and shoulders pattern with a neckline at 3.08%. This neckline was touched for 2-3 weeks without a breakout. A move thru 3.10% would be noteworthy, but until then the likelihood is that rates will move lower before moving up.

Lastly, kudos to Russ for discussing our bogus currency. The US only looks good when compared to the poor condition of the rest of the globe. The US has ridden the crest of its reserve currency for all it is worth. At some future point, other nations will realize that writing down the US dollar as a “bad debt” is preferable to continuing to working long hours for a paper currency that is constantly losing value. These things take quite a while to work themselves out, in the meantime, our standard of living goes down and all savers are devastated. There is no such thing as being a saver or investor when your government has transformed everyone into speculators.

It seems the answer to everything is higher taxes. Fuel tax is the same when fuel prices are low or high. Lower fuel prices will result in more tax revenue(increased usage). If you are naive enough to think oil will stay this low, or that more taxes won’t wind up in welfare checks, I have some oceanfront property just north of Phoenix(that’s in Arizona).

What if we could raise the tax without raising the price of gasoline? For example, a graduated tax that has a floor of the existing federal tax level could be allowed to increase by some amount as the price of fuel falls. So if gasoline was a baseline $3.25 a gallon, for every 10 cent decline in price, the tax would increase 2 cents, giving drivers an 8 cent windfall and the highway trust fund needed income. Now is the perfect time to phase such a process in, including tax breaks offset by the tax increases to pay for systems to track and collect the taxes.

Please pardon if I am repeating an idea from others, but had a only a minute to address the issue.

Don’t be alarmed by the low oil prices. By next May, they’ll be back up to $95. America secretly requested Saudi Arabia and the Gulf States NOT to cut production, and they agreed. It made that request (even though it knew that the result would be temporary hardship for many oil companies) as part of a deliberate policy to bankrupt Russia (which relies TOTALLY on oil and gas for its income) and force it to abandon its designs on the Ukraine. And that strategy will certainly work. Once it has worked, Saudi Arabia and the Gulf States will both cut their production and the price of oil will soar again.

I agree, Kerry’s meeting on Nov 3rd was to make the deal! He told them “We will be there for Saudi Arabia, for the Emirates, for Qataris, for the Jordanians, for the Egyptians and others. We will not allow those countries to be attacked from outside. We will stand with them”. How much does this protection cost? Was this why they agreed to take the hit?

I would not vote to raise the gasoline tax, or any other tax so long as oboma remains in office. He would very probably divert these funds to a solar or other so called “green energy project” run by one of his buddies. Remember Solindra and the other twenty five or so green projects that declared bankruptcy!

I have solar panels on my roof put on by solar city , creation of Elon Musk. Tesla and electric cars are the future. Don,t get put off by Solandra and Obama. many good operators out therer

Should we raise the gas tax while oil is cheap? Seriously?

Have you ever known of a “temporary” tax increase being lowered?

Me neither.

The low price of crude is temporary and cannot remain at these levels for long. How long can they sell oil for less than what it cost to collect it? It is the price of putting pressure on Russia that may or may not work. There is a finite supply of oil and as the resource drys up the price will skyrocket.

Can the Alaskan oil fields or any others in production now last another 20-30 years, and how long before oil explorers have discovered all there is? Consumption is rising and will continue as other countries develop.

Govt debt now over 18 trillion, no govt budget in years, more govt handouts than ever, govt leaders bought and controlled by big corporations… Raising tax on gas is like giving an alcoholic money to stop drinking!

Larry in Thailand.

That is what I want to know about.

You like being fleeced, subscribe.

willymette@gmail.com

neal Weintraub

” why trade, when you can make stuff up.”

Sell paper and call it the truth