|

Europe’s economic data was just beginning to show signs of life, faint though it was. But now European Union (EU) investors have a whole new crisis to be concerned about: the threat of armed conflict between neighboring emerging European nations.

The standoff between Ukraine and Russia that intensified last weekend adds a heavy dose of geo-political risk to an already weak economic outlook for Europe. And it could be the last straw triggering a long overdue correction after EU stocks got ahead of themselves in 2013.

Aside from the obvious risk of European trade disruptions, perhaps the bigger threat is accelerating capital flight out of the EU, a region which suddenly seems a lot less stable.

To be sure, Ukraine and Russia have the most to lose if tensions degenerate into armed conflict, but so does the whole of Europe.

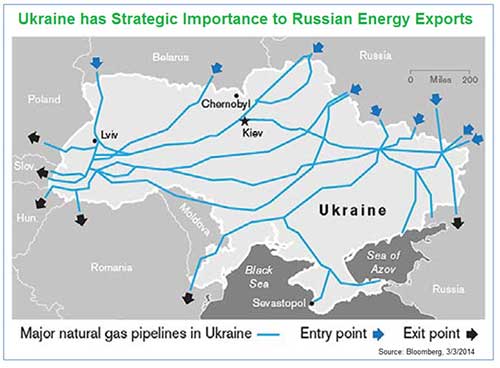

The EU overtook Russia as a larger destination for Ukrainian exports in January 2013, while more than one-quarter of Ukraine’s total exports are still bound for Russia. Meanwhile, Ukraine is strategically important to Russian energy export markets because a network of major natural gas pipelines from Russia crosses through Ukraine before branching out to customers in other European countries.

A conflict could easily trigger a sharp decline in Eastern European trade and a major disruption in energy exports. But even if cooler heads prevail and conflict can be avoided, the EU still faces an economic triple threat:

* A still unresolved sovereign debt crisis

* An economy that’s barely expanding due to sky-high taxes and unemployment, and

* Capital flight as investors swap European assets for better investment opportunities elsewhere.

Recall, the EU economy slipped back into recession in 2012, the dreaded double-dip that the U.S. managed to avoid. Real economic output in the region remains three full percentage points below the peak before the 2008 recession, even as U.S. GDP advanced 1.9 percent last year.

EU finances are in even more dismal shape than the U.S.

European household debt, for example, was higher at the end of 2013 than it was before the 2008 credit crisis. And consumer spending across the EU, the lifeblood of its economy, was lower in 2012 than at the peak in 2008.

The EU economy grew just 0.3 percent in the fourth quarter of 2013, and the unemployment rate remains stubbornly high at 12 percent.

It’s clear that deflationary pressures still have the upper hand in Europe, and the region cannot afford the added stress of a geo-political crisis.

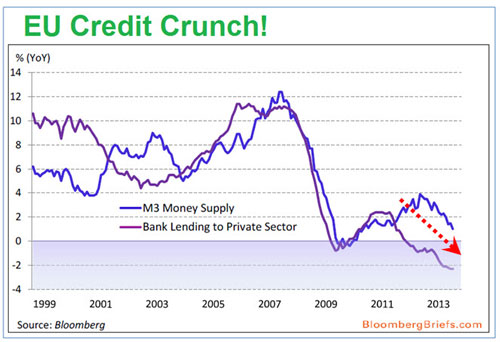

The EU financial system is already beginning to show stress cracks.

Private sector bank lending in Europe is already drying up, as you can see in the chart above, and money supply in the EU is declining sharply. Stressed-out EU banks are in no position to lend, and investors are fleeing European financial markets.

This is a clear sign that the EU credit-crunch persists, but you wouldn’t get that impression by looking at recent performance.

The euro currency has gained nearly 4 percent against the U.S. dollar since July 2013. And EU stocks have enjoyed solid gains too, with the Euro Stoxx 50 index up 24.4 percent over the past year, even better than the S&P 500 Index.

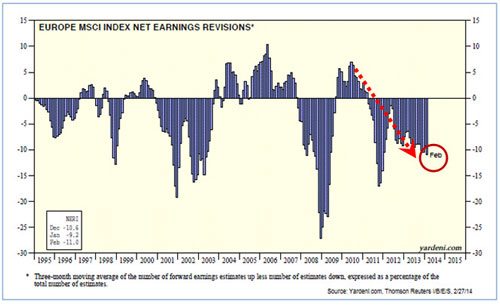

But European stocks could soon run into more fundamental trouble ahead. Aside from geo-political and economic headwinds, EU stocks also face deteriorating earnings, which could prove to be their undoing.

The chart above shows net earnings estimate revisions for the MSCI Europe Index. Over the past several months we have witnessed steady downward revisions to expected profits for EU stocks. The revision ratio fell to negative 11 percent in February, the lowest level since December 2011.

Bottom line: You may want to adopt a cautious stance toward European equities for the time being, or even stay on the sidelines until market volatility subsides.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.