|

Not long ago, Elisabeth and I walked the streets of Rome — once a little village of seven hills founded in 753 B.C. that rose to rule the world from the Atlantic coast to the Persian Gulf.

At its height, Rome claimed 120 million citizens and subjects, nearly half the world’s entire population.

Its land area stretched across 2.5 million square miles, more than the total of all West and East European countries today (with the exception of Russia).

What caused its demise?

For the answer, Edward Gibbon’s Decline and Fall of the Roman Empire has long been the bible of historians. Gibbon attributed Rome’s decline to the gradual weakening of its military — the outsourcing of its defense to questionable foreign mercenaries and the dilution of Roman martial virtues.

But in recent years, historians, sociologists and economists have begun to recognize a series of closely linked economic factors that played a larger role in the empire’s decline than previously believed. And while in Rome, I saw some of the evidence…

First, The Remnants of

Excessive Government

Spending Are Everywhere.

The Roman Forum, the Arch of Titus and many more were built out of pure marble and probably cost the Ancient Roman Empire the equivalent of hundreds of billions in the context of today’s economy.

|

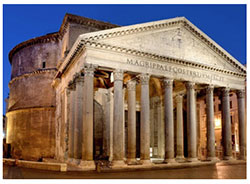

The Pantheon, a great circular temple located near Piazza Navona, could easily have cost billions more. It’s one of the few that still stands virtually the same as when it was built nearly 1,900 years ago.

The massive Castel Sant’Angelo, on the banks of the Tiber at the other end of the Via della Conciliazione from St. Peter’s basilica, was built by the Emperor Hadrian as a mausoleum for himself and his successors — another huge drain on Rome’s coffers.

A clear pattern visible to trained observers: The most magnificent structures were built in the early years of the Empire, between 50 B.C. and 200 A.D. But in the third and fourth centuries, the big civic building projects dropped off rapidly as Rome was forced to spend more on its military and social services.

One major exception: The vast Aurelian walls that snake their way through modern-day Rome, built in 270 A.D. But unlike the structures of earlier years, these were strictly military fortifications — not temples or public buildings.

Rome’s coffers were further drained by the cost of its vast standing army of 500,000.

Nor was it cheap to keep the restless populace happy and distracted. Rome paid a fortune for its network of great games and spectacles — the equivalent of $100 million per year, according to historians, which, in proportion to their resources, would be the equivalent of thousands of times more today.

Plus, Rome dug itself into a financial hole with huge pension liabilities owed to a growing mass of retired soldiers and bureaucrats.

Second, Much Like the Western World Today,

Rome Was Drained by Threats from the East.

Most people think the primary attacks against Rome came from the north — frequent battles with Germanic tribes such as the Ostrogoths and the Visigoths, which for centuries harassed the Roman Empire … plus even bloodier conflicts with the Huns, stampeding from Eurasia.

But now, recent studies are shifting much of the blame to the East — especially Persia (now Iran), which Rome fought for more than 600 years.

First Rome battled the Parthian Empire, which included all of today’s Iran and Iraq.

Then, Rome battled the even larger Sassanid Persian Empire (A.D. 226 — 651), encompassing not only today’s Iran and Iraq, but also Kuwait, Saudi Arabia, all of the Persian Gulf states, Afghanistan, Pakistan, Syria, Lebanon and others.

Three of the biggest names among Roman leaders — Pompey, Mark Anthony, Trajan — became enmeshed in battles against the Persians. Many others suffered similar losses.

Indeed, historian Peter Heather, in his recently published The Fall of the Roman Empire, suggests that it was Rome’s long entanglement with the Persian Gulf and Mid-East empires that largely sealed its fate.

And it was primarily the colossal spending to meet the growing Persian threat that forced the Roman government to seek new sources of revenues, which leads me to …

The Third Factor That Drove Rome

to Ruin: Excessive Taxation!

In the early days of the Empire, the tax burden to Romans was minimal: Citizens paid a sales tax, but it was capped at only 1 percent. Land taxes were limited to 10 percent to 20 percent of the land’s yield. Inheritance taxes were only 5 percent. Import duties and tariffs were inconsequential. And there was a tiny per-person head tax, based on a regular census.

In this low-tax environment, the Roman economy prospered. But as the costs of maintaining the Imperial army grew, so did the tax burden.

Rome began to levy special income taxes and fees — like the primipili pastus, an obligation of local landowners to supply all rations necessary for a garrison … or the follis, a tax on senatorial estates.

The taxes became so onerous that heirs routinely declined large inheritances because they couldn’t afford to pay the taxes required. Middle-class Romans went bankrupt. Upper-class Romans soon joined them.

Tax revenues plunged. Rome was strapped for cash. And it could no longer pay its professional soldiers — mostly Germanic tribal mercenaries — to guard its northern borders.

Another pillar of the empire was crumbling.

The Fourth and Fatal

Blow to Rome: Inflation!

|

When the Roman government needed more funding and had difficulty raising more tax revenue, it did what nearly all governments have done before and since: It manufactured more money and debased its currency.

The silver content of the most common coin, the denarius, was a hefty 90 percent in the age of Nero (54 — 68 A.D.).

Two centuries later, by the reign of Claudius II (268 — 270 A.D.), it was down to a meager 0.2 percent.

The price of silver surged dramatically as inflation raged.

Plus, one historian estimates that the cost of a measure of Egyptian wheat rose from seven to eight drachmas in the second century to 120,000 in the third century — an inflation of 15,000 percent.

And it was the combination of all these factors — not just the Goths or the Huns — which was the true cause of Rome’s demise.

Fair Warning

Let this be fair warning to all governments, especially our own, regarding the grave perils of overspending and overbuilding … overtaxing its people while squandering their wealth … overextending the military and … overinflating the economy while debasing the currency.

If each of these blunderous policies were being scrupulously avoided in America today, we might be able to breathe a sigh relief. But, alas, nothing could be further from the truth.

The facts:

Overspending: U.S. government spending is still out of control. After an endless parade of shutdowns, sequesters, debates and deals, nothing has changed. Money continues to pour out of the nation’s coffers in torrents. Waste is still rampant. And future obligations, such as Medicare and Social Security, still threaten to bust the country.

Overtaxing: Despite repeated promises by our leaders to stem the rise in taxes, overtaxation remains a huge burden for most Americans.

This year, for example, Tax Freedom Day won’t come until April 18, five days later than last year. Until that date, every single penny earned by the average American needs to be set aside for paying this year’s taxes. Only after that date is your money yours to keep.

Overinflating the economy. This is ongoing. As we have demonstrated here repeatedly, with its $3 trillion in money printing, the Fed is inflating some of the greatest bubbles of all time.

Overextending the military: At the height of war in Iraq and Afghanistan, the Pentagon reported that the U.S. government virtually exhausted the resources of its armed forces and had to pull more National Guard troops away from their homeland defense and disaster relief operations.

Meanwhile, due to its lack of forces, U.S. military experts have pointed out that any conflict with the Persian Gulf’s largest power — Iran — would have to be restricted almost entirely to an air war. A U.S. ground attack would be almost impossible.

What about a conflict in Syria or involvement in Ukraine? The same kinds of limits to our military resources are a big factor in our policy decisions for each.

What This Means for You Today

First, don’t assume our government can continue to overtax, overspend and overinflate without consequences; and one of the most obvious is a surge in key prices, especially silver and gold.

Another consequence is a bubble-and-bust cycle for the financial markets.

Second, each bubble brings both a danger and an opportunity.

If you can identify the specific companies that truly deserve your hard-earned money on their own merits, you get TWO powerful growth factors working in your favor — the earnings engine of the company itself AND the winds in your sails from the Fed.

But if you pick the wrong investments, or you hold the investments for too long as they become overvalued, you’re likely to be among the victims of the inevitable bust that follows.

Third, if we continue down this path, don’t expect American global power — and the American dollar — to avoid a serious decline.

Already, with the crisis in Ukraine, it’s clear that America’s largest former cold-war adversary is rebuilding its empire.

Already, relatively smaller counters, like Iran and North Korea, feel they’re empowered to thumb their noses at the United States with impunity.

Already, a non-democratic nation — China — has been the new locomotive of the world economy, accumulating foreign reserves that are far larger than ours were at their peak.

Bottom line: As America’s military and financial hegemony weaken, so will our currency. And that decline will drive up not only the cost of living but also the value of hard assets, especially silver and gold.

For more specific guidance, be sure to stay tuned with Money and Markets every day.

Good luck and God bless!

Martin

|

EDITOR’S PICKS

Boldly Going Where Others Fear to Tread Can Profit the Savvy Investor by Jon Markman One of the main things holding people back from being smart investors in emerging tech stocks today is their searing memory of being crushed in the 2000 and 2008 bear markets. People feel that they may have been fooled once, and they may have been fooled twice, but they sure as heck won’t be fooled again. Three Things to Keep in Mind for Your Portfolio as Markets Seesaw by Bill Hall The Dow Jones Industrial Average began the year at 16,577 and declined 5 percent during January. February proved to be much better for stock investors as the Dow recovered much of the previous month’s loss, closing the month at 16,321.71. That translates to only a 1.5 percent loss for stocks during the first two months of the year. How Strong Are Stocks? Just Weight and See by Douglas Davenport To determine how well the U.S. stock market is doing from day to day, most investors look to a couple of popular indexes The Dow Jones Industrial Average, of course, measures the value of 30 equities that are supposed to track economic activity. But most investors pay more attention to the S&P 500, which is more representative of the true breadth of the U.S. economy. |

THIS WEEK’S TOP STORIES

European Stocks May Face Triple Threat, No Matter Ukraine’s Future by Mike Burnick Europe’s economic data was just beginning to show signs of life, faint though it was. But now European Union (EU) investors have a whole new crisis to be concerned about: the threat of armed conflict between neighboring emerging European nations. It’s a Golden Era for American Technological Ingenuity by Mike Larson Just look at how Facebook (FB) came out of the blue to dominate the social media landscape in just a decade, thanks to the foresight and instinct of founder Mark Zuckerberg. Or how after a troubled IPO process, the stock turned around sharply and surged to an all-time high of more than $71 last week. Q&A With Larry Edelson — Stocks, Bitcoin and Gold! by Larry Edelson I’ve received so much great feedback from my Feb. 17 question-and-answer column, I’ve decided to do another Q&A issue today. The mere fact that I’m getting so many mailbag questions in and of itself tells us all that something is brewing out there, big time! |

{ 3 comments }

it/s very nice,when martin d.weiss writes this thing about ancient roman empire and his relation with actual time,is a reality when,empire fall down,is cause of financial dug of money,the same thing happened with nation and people also,thath have lot of expenses

and,not return of money,they became inflationary,they contracts debts,but don/t have to

respond it,they credit fall down immediatly.

Save your money.

Very impressive, we should work harder to preserve and improve such civilization.