|

Remember the good old days when you opened a savings account at your local bank and were offered a free toaster in gratitude for your business?

Of course those days are long gone. After all, the global banking system practically went belly-up just a few years ago during the worst financial crisis since the Depression.

But last week, the European Central Bank (ECB) turned this quaint old bank business model completely upside down.

No free toaster … in fact, you’re lucky we even pay interest on your money anymore.

No wait, I’ve got a better idea; why don’t you pay us interest to keep your money on deposit at this fine institution.

That’s exactly what ECB President Mario Draghi announced last week.

In its latest act of desperation to get the European economy moving again, the ECB cut interest rates to negative 0.1 percent. You read that right. Member banks must now pay the ECB for the privilege of keeping excess reserves on deposit at the central bank.

|

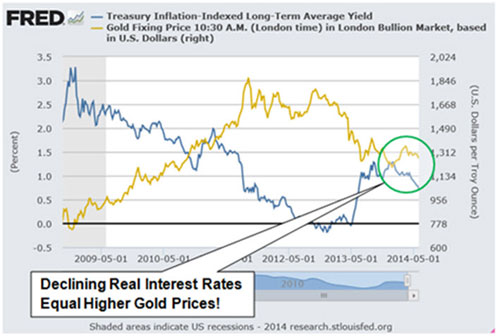

| Real interest rates always had a very close, inverse correlation with the price of gold. |

After years of mostly empty promises to “do whatever it takes,” Draghi finally took action, cutting the benchmark ECB interest rate to record lows and for the first time ever, introducing negative deposit rates.

He explained the move is necessary to get Europe’s banks lending again in hopes of jump-starting an economy that remains perilously close to recession. Instead of lending more, Europe’s barely solvent banks will most likely just raise fees to customers in order to make up for the ECB’s interest charges.

The likely result: more capital flight out of Europe, but that’s not the end of this story. In a classic display of central bank hubris, Draghi declared “we aren’t finished here.”

QE, Euro-style

Following in the footsteps of the Federal Reserve, Draghi laid out a game plan for quantitative easing, Euro-style, with the ECB discussing a Fed-style bond purchase program.

All around the world, central banks are more committed than ever to keep ultra-easy money policies in place as far as the eye can see, perhaps for years to come.

As the ECB gears up to launch QE-Euro, the Bank of Japan is busy buying 7 trillion yen of Japanese government bonds each and every month, as it has been doing since April 2013.

QE by the Bank of England has bloated its balance sheet to 24 percent of Britain’s gross domestic product.

Not to be outdone, the Fed’s own balance sheet at $4.3 trillion and counting accounts for 25 percent of U.S. GDP!

Interest Rates Slump

Although the Fed is tapering … it’s still buying $45 billion in bonds per month. And minutes from the last meeting reveal that Fed members are now backing away from an exit strategy of selling Treasury and mortgage-backed securities to reduce its bloated balance sheet.

This about-face by the Fed helped push 10-year Treasury yields down to 2.6 percent recently from over 3 percent at the end of 2013. And it’s not only Treasury yields that are falling; nominal interest rates are in free-fall around the world:

* German bunds yield just 1.4 percent and French government bond yields fell to 1.65 percent — the lowest level since 1746!

* Two of Europe’s most troubled PIIGS, Spain and Italy, also have witnessed record low bond yields of 2.6 percent and 2.76 percent, respectively.

* Yield spreads on emerging market debt and junk bonds compared with Treasuries are likewise sinking toward new lows.

This compression in nominal yields around the global has important implications for investors and could prove very bullish for certain asset classes. Case in point: Gold.

Real Yields Sink

Historically, real interest rates (long term bond yields minus the inflation rate) have always had a very close, inverse correlation with the price of gold. In fact, it’s the single most predictive factor for gold prices.

When real rates fall, gold inevitably rises, and vice versa. As you can see in the chart below, real interest rates declined steadily after the financial crisis and Great Recession in 2008, and gold rose every step of the way.

But as you can see above, real yields began rising again in 2012, which continued last year. This corresponds almost perfectly with a sharp decline in gold prices, but recently real rates stopped rising and are now rolling over again, as you can see at the far right.

While interest rates around the world are declining steadily this year, inflation is beginning to edge higher.

This is pushing real (inflation adjusted) interest rates down again … which is precisely when gold shines!

Forget the Consumer Price Index. We all know this flawed gauge of inflation is way behind the curve in measuring the true cost of living and it’s a backwards-looking indicator. Instead, focus on leading indicators of future inflation pressure: Higher commodity prices, rising wages, higher rental rates and soaring health-care and education costs … these are all pointing to higher inflation down the road.

[Editor’s note: Falling interest rates aren’t the only thing that could send gold higher. Click here for our FREE report on how Obama is re-arming Al-Qaeda and what it portends for your safety, your liberty and your money.]

Meanwhile, global central bankers are committed to ultra-easy money policies as far as the eye can see. The stage is set: Falling real interest rates, plus rising cost pressures in a pure oxygen environment of ultra-easy money will surely light a fire under gold prices again and probably sooner rather than later.

One of the easiest ways to invest in gold is the iShares Gold Trust (GLD) or to place a more leveraged bet on the upside for gold prices, consider the Market Vectors Gold Miners ETF (GDX). For my money, in this climate it makes sense to have at least some of your speculative capital invested in this out-of-favor asset class that finally looks set to surge higher again.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 1 comment }

Very timely article.Agree completely.Maybe,never in history has the world,have we seen all the major central banks creating this much 100% fiat currency and seeking more inflation.These currencies are going to take the hit for all the deficits these govts have run up.