|

What do you think of Jerome Powell, Trump’s new nominee for Federal Reserve chairman?

I talked to lots of my friends in the investment business, and my anti-Trump friends highly disapprove while my pro-Trump friends enthusiastically support the choice.

Not that my opinion matters, but I am delighted with Trump’s choice:

Street Smarts vs. Book Smarts: I am sick of the Ph.D.s who have never had the real-life experience of managing someone’s life savings. I’d rather go under the knife of a brain surgeon with 20 years of experience than one wielded by a tenured med school professor.

Powell is no dummy, and he does have a doctoral degree. It’s in law (but I won’t hold that against him). And he has had a very successful investment banking and private-equity career.

Too Many Academic Cooks Spoil the Broth: Up until the 1950s, most Fed chairmen were from Wall Street. But the academic crowd has been in charge since the 1970s.

It started with Arthur Burns, who served from 1970 to 1978. Since then, the Federal Reserve has become overrun with Ph.D. economists.

There are over 200 highly paid Ph.D. economists at the Federal Reserve headquarters in Washington D.C. And there are similar numbers at the other 12 Federal Reserve districts.

So, we’re talking somewhere between 2,000 to 3,000 Ph.D. economists (all making handsome six-figure salaries by the way) on the Federal Reserve payroll. In other words, if Powell needs a little Ph.D. advice, he’ll have no shortage of highly educated economists to turn to.

0 For Everything: Guess how many recessions the Federal Reserve has correctly predicted? Zero, zilch, nada.

You’d think that all that academic horsepower could do better than predicting NONE of the recessions that our country has ever had. So, I’m perfectly happy putting a financial practitioner instead of an economic thinker in charge of the Fed.

|

|

| Desperate to keep up his ruse as The Wizard of Oz, Professor Marvel (Frank Morgan) begs Dorothy (Judy Garland), The Cowardly Lion (Bert Lahr) and The Tin Man (Jack Haley) to: “Pay no attention to the man behind the curtain.”) |

Unfortunately, I don’t expect Powell to do any better. And here’s why. The entire concept of 13 smart people sitting in a room, pulling the right combination of monetary levers to keep the U.S. economy humming is as far-fetched as “The Wizard of Oz.”

I don’t care how smart you are. No human — or even a group of 13 humans – can change the natural order of business cycles, including recessions.

In fact, I think the only thing the Federal Reserve can do is (a) postpone recessions and (b) make them worse by thinking it has Wizard of Oz powers.

Pay No Attention to the Man Behind the Curtain

Powell, like Yellen, supports the current path of gradually raising interest rates and slowly reducing the Fed’s balance sheet.

However, Yellen has blown the Federal Reserve’s balance sheet to $4.5 trillion. She’s done this with years of quantitative easing. And, she’s done it by pushing the U.S. money supply to record highs.

Here’s one result of her monetary hocus-pocus.

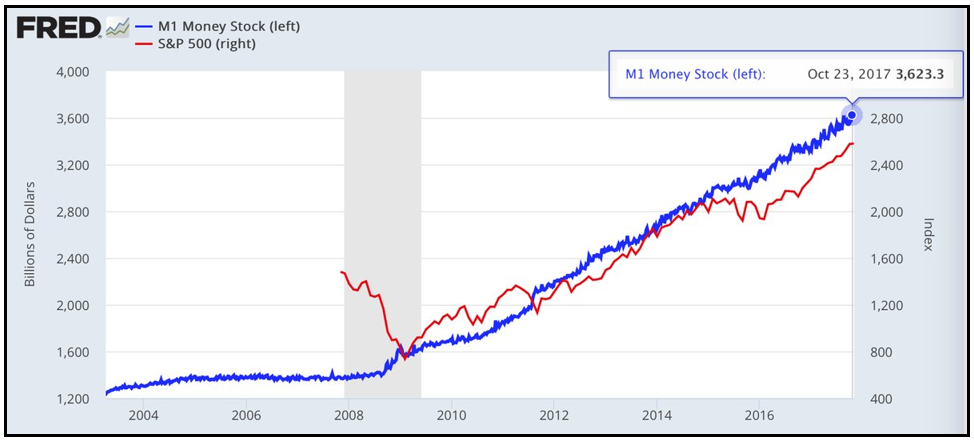

The above chart – supplied by Federal Reserve Economic Data (FRED) – tracks the S&P 500 against America’s supply, or “stock,” of combined cash and checking deposits (aka M1 in economist-speak).

As you can see, since about 2009, M1 alone has surged from around $800 billion to around $2,800 billion, or $2.8 TRILLION. Talk about money-printing!

Powell is taking over at a dangerous time.

Powell’s biggest headache is going to be the costly effect of even slowly raising interest rates.

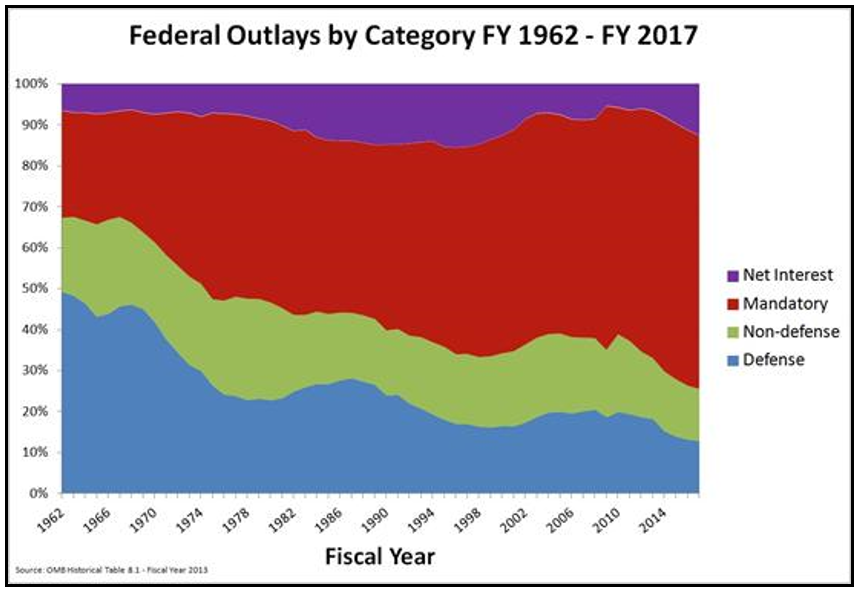

That’s because the interest payments on our ballooning national debt are quickly becoming one of our government’s biggest expenditures (see the purple part at the top of the chart above).

- In 2008, our national debt was $10 trillion and the federal government paid $336 billion in interest. At the time, the yield on a 10-year Treasury bond was 3.6%.

- In 2016, our national debt was close to $20 trillion mark and our government paid out $497 billion in interest. The 10-year Treasury bill averaged 1.84% last year.

If rates rise to 2.82%, which was the average since 2007, the interest cost would rise to $750 billion. That’s 20% more than we we spend on defense in a single year!

However, if interest rate were to rise to 3.7%, our country would be paying out over $1 trillion a year in interest payments and consume over one-third of our total tax revenues.

No matter what Powell does, the national debt is going to blow up during his watch. And the consequences are going to be very painful for investors.

That doesn’t mean you should run for the hills today. In fact, I expect the stock market to keep moving higher. However, bull markets don’t last forever. So, you need a clear strategy to protect your portfolio when the debt bomb blows up.

That could be a combination of portfolio insurance (put options and/or inverse ETFs), increasing your allocation to cash, or using some risk-management tools, such as protective stop losses, and market-timing tools such 200-day moving averages to get you out when the stock market starts to slide.

When appropriate, I discuss these strategies in detail for members of my service and my newsletter.

One strategy that is guaranteed to get you clobbered is the “so far so good” game plan.

So far so good? A man jumped from the 10th Floor and is falling to the ground. A woman at the 4th Floor sees him from her window and asks, “Hey, how’s it going?” The man replies, “So far, so good.”

Good times don’t last forever.

Best wishes,

Tony Sagami

{ 1 comment }

That is the way our government has been operating for way to lon instead of paying down our debt they keep increasing government jobs and spending money they don’t have. We will be Rome burning from the corrupt government