|

It has been said that investors are operating in an era of unprecedented “financial repression” these days.

Since the financial crisis nearly sunk the global economy and financial markets in 2008, central banks led by the Federal Reserve, but ably assisted by the Bank of England, European Central Bank, Bank of Japan, etc. have pumped out trillions of dollars of easy money. What has all this easy money bought us? Not much.

The U.S. Federal Reserve is now in the midst of tapering its asset purchase program, but that’s after injecting more than $3 trillion into the global financial system since 2008. Nearly six years later, short-term interest rates remain near zero in the U.S. The unemployment rate has declined to just 6.1 percent, but the ranks of structurally unemployed or under-employed workers remains in double-digits.

And the U.S. economy actually contracted nearly 3 percent in the first quarter of 2012. I guess $3 trillion worth of easy money just doesn’t buy what it used to.

|

| The market for IPOs has rocketed 90.6 percent from this time last year. |

Yet the unintended consequences of this policy are being felt far and wide

Just take a look at complacency on the rise in the market for initial public stock offerings (IPOs) which has topped $99.1 billion globally in the first half of 2014, up 90.6 percent from this time last year.

Junk bonds are another perfect case of investors’ dangerous behavior in reaching for yield in today’s ultra-low interest rate climate.

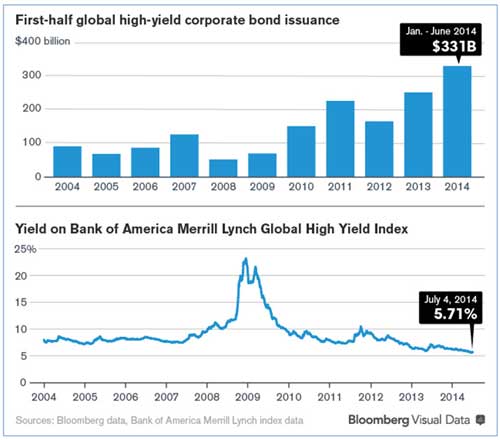

As you can see in the chart from Bloomberg above, $331 billion worth of junk bond debt has been sold so far in 2014 and is on pace to top last year’s all time record. Yield-seeking investors — individuals and institutions alike — feel they have no other choice but to take on more risk in search for more income.

But the time to be a buyer of junk bonds was back in 2008 when yields were above 20 percent, not now with junk bond yields reaching record lows at 5.6 percent last month.

This type of nonsense shows financial markets may be getting dangerously frothy and such behavior always ends badly

Even central bank officials, including Janet Yellen, are sounding alarms about record low market volatility amid growing investor complacency. How ironic that the engineers of financial repression are now themselves: shocked to find that gambling is going on in financial markets … to paraphrase the famous Casablanca quote!

An even bigger cause for concern, if not panic, can be found at the very heart of the U.S. financial system, in the inner workings of the $1.6 trillion-a-day market for U.S. Treasury repurchase agreements known as repos.

Bloomberg reports that the limited supply of Treasury securities, thanks to the Fed’s bond buying, “combined with demand from banks to meet tightened regulatory requirements is making it harder for traders to easily borrow and lend.”

This may sound like an inconsequential problem for Wall Street bankers to deal with, but the repo market is a key component of how our financial system functions. And Wall Street’s biggest primary dealer banks rely on it for day-to-day financing.

In a repo transaction one big bank can borrow short term cash from another bank by putting up Treasuries as collateral, but now Treasury securities are in such short supply that repo trades are falling apart at an alarming rate; know as a failure-to-deliver in Wall Street lingo.

Again, according to Bloomberg, “such failures to deliver Treasury securities have averaged $65.6 billion per week this year” and reached a peak of $197.6 billion during the week ended June 18!

Remember that back in 2008, Bear Stearns and Lehman Brothers lost access to repo financing, which led directly to their downfall and a downward spiral that threatened the entire global financial sector. Granted, financial market conditions are a good deal less stressed today than in 2008, but this malfunction at the heart of our banking system clearly tells you financial markets are still not operating normally today — nearly six years later!

Who knows when the next financial crisis will crop up, or what will spark it, but the most valuable commodity of all at such times: liquidity, may dry up precisely when it’s needed most. And the Fed itself is largely to blame for this ongoing financial market dysfunction.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 2 comments }

I don’t believe,that ultimately this is a Fed problem.The problem is out of control govt growth,combined with American voters,voting from greed and ignorance.The only solution would be 1)a much smaller,limited govt,such as we had for the first 140 years and/or 2)voters who are informed,intelligent and not voting their personal greed.No chance,either is going to happen,before the Titanic sinks.So,in my opinion,we have a socialist system with citizens who aren’t socialists and it can’t work.The common stock of our govt,the U.S. Dollar,will be taking the hit for our sins.Got Gold?

Amen. Right on target.