|

Despite the robust rebound on Friday, investors’ ardor for stocks has cooled since Fed Chairman Janet Yellen’s warnings of pockets of overvaluation in the market early last week. And that was probably her goal as she tried what you might call “verbal tightening” — or using words to fine-tune policy without actually taking action.

The chill emerged because the primary focus of attention remains the Federal Reserve. Other issues like the prospect of war with Russia, corporate earnings and Israel’s incursion of Gaza are just noise compared with investors’ fixation on the central bank. The Fed seems to be the one and only dynamic that has had any lasting impact on the market over the last two years. Last year’s taper tantrum, for instance, was the last time we had a major bout of cross-market volatility.

Indeed, it’s no accident that the areas of the market under selling pressure this week were ones that Yellen — in a surprising departure from central bank custom — fingered as overvalued in her testimony to Congress last week.

While Yellen has brushed aside complaints that six years of ZIRP, or “zero interest rate policy,” has fueled another broad asset price bubble, she as well as other Fed officials have been warning of specific areas of growth and extended valuations. Dallas Federal Reserve President Richard Fisher warned that investors, in some cases, were strapping on Fed-provided “beer goggles” that made risky investments look better and safer than they really were.

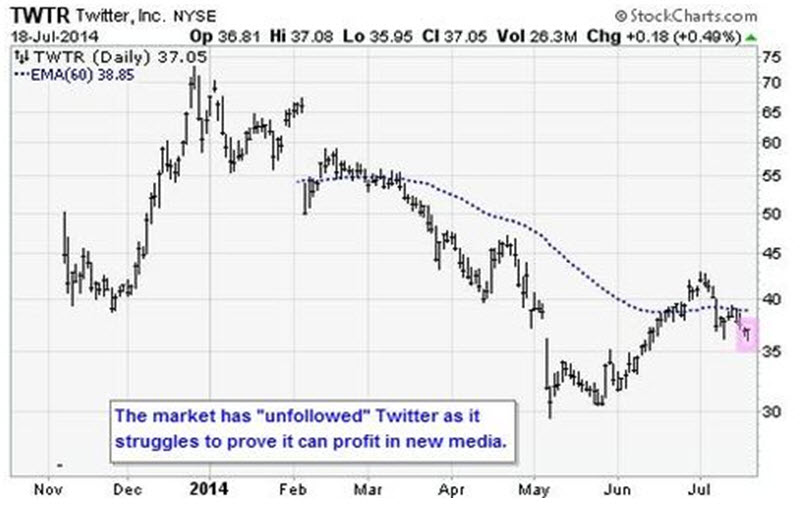

Investors were taking the hint. The Russell 2000 small cap index is struggling to maintain its 200-day moving average, a level that aside from a short-lived test back in March and April, has been held since 2012. Small, expensive health-care stocks, represented by the iShares Biotechnology (IBB) ETF, are testing their 50-day moving average for the first time in quite a while. Shares of popular but earnings-challenged social media companies like Twitter (TWTR) and Pandora (P) are under pressure.

And high-yield corporate junk bonds, as represented by the iShares High Yield Corporate Bond Fund (HYG) are suffering their most dramatic pullback since the summer of 2013.

Yet is this a smart approach by investors? Maybe not, as the Fed has a terrible track record when it comes to predicting asset values.

You may recall that former Fed chairmen Ben Bernanke and Alan Greenspan both tried to dismiss housing bubble warnings back in 2005 and were ultimately proven wrong. Bernanke tried to justify the price rises as reflective of “strong economic fundamentals,” while Greenspan, for his part, quipped that while he saw no national bubble in home prices, there could be areas of “froth” in local markets that could suffer price declines.

And one of the most famous declarations by Greenspan on the stock valuation occurred on Dec. 5, 1996, when he said: “Sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

While the colorful comment about “irrational exuberance” caused a stir at first, the Nasdaq 100 went on from that date to rise another 450 percent to its top in March 2000, led by Qualcomm (QCOM) with a 3,500 percent gain, hot biotechs like Celgene (CELG) that rose 1,400 percent and sizzling Internet stocks like Yahoo! (YHOO) that jumped 12,500 percent. To be sure, ultimately the market tumbled in 2000-01, but a scorching three-year rally first is one you can’t afford to miss.

The bottom line is that central bankers want to be known as paragons of sobriety when it comes to other organizations’ domains, such as the stock market, but reject any criticism that investors may make about their own work in setting monetary policy.

In short, keep an ear open for Fed comments on the market because they are a major contributor to sentiment, but remember they are just a part of the game — not the whole game. If Greenspan’s three-year comeuppance is any indication, Yellen ain’t seen nothin’ yet in terms of high valuations.

Best wishes,

Jon Markman