|

Stocks and pretty much every other asset class are heading higher this week for a very interesting reason that has confounded bears, who can’t catch a break. The catalyst was a weaker-than-expected retail sales report last week — as well as soft data out of China and Europe — that re-energized hopes that the Federal Reserve would delay its decision to get out of the money-printing business on schedule.

Yes the old bad-news-is-good-news dynamic is back in play, as investors have fretted endlessly about the approaching end of the QE3 bond purchase program and the start of the first rate-hike cycle since 2006. The slight uptick in the unemployment rate earlier this month was celebrated for exactly that reason.

And last week, flat retail sales provided more justification for the doves at the Fed to keep rates lower for longer. Now comes the Kansas City Fed’s annual economics retreat in Jackson Hole, Wyo., which has traditionally been an opportunity for central bankers to goose the market with dovish comments.

Fearful that hostility in Eastern Europe or Iraq might flare over the weekend, most major indexes slumped Friday, but the Nasdaq 100 stocks actually shrugged it off with a devil-may-care attitude. You get the impression these days that the Russian and Ukrainian officials are manipulating global risk sentiment through military actions so that they can play Wall Street like a fiddle. It could turn out that Russian strongman Vladimir Putin is supplementing his oil revenue with S&P 500 futures trading.

***

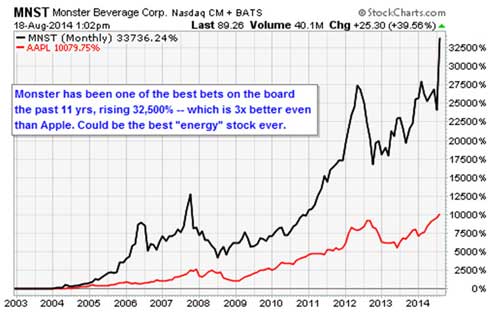

Moving away from geopolitics and the economy, let me note that Monster Beverage (MNST) has roared 35 percent higher in recent days on news that Coca-Cola (KO) was sealing its long courtship of the energy drink maker by purchasing a 17 percent stake for $2.2 billion in cash. KO will get MNST’s non-energy portfolio while KO will transfer its energy drinks to MNST. KO will also get two board seats.

Long-time readers know that I have been a big believer in the Monster story, recommending the shares for years until its run-in with health officials last year, as the technology behind its energy-drink formulas and the way they are marketed is sound. It’s good to see MNST finally getting the attention it deserves, though it appears fully valued now.

***

Meanwhile, after years of watching the spoils of the economy accumulate to record corporate profitability and higher stock prices, regular working Americans are thankfully on the verge of something special.

In the past two weeks, we have received new evidence that the job market is strengthening by leaps and bounds, setting the stage for higher wages and a shift in the balance of power from employers to employees in a way that hasn’t really been seen since the late 1990s.

According to the latest Job Openings and Turnover Survey, or JOLTS, the number of job openings has increased to a level not seen since early 2001. That’s the fifth month of gains. And the job openings rate (calculated as the number of openings as a percent of total employment plus job opening) increased to 3.3 percent — a level that matches the high from the housing bubble expansion.

Yet that’s just the start. JPMorgan economist Daniel Silver believes that since the JOLTS data tends to lag other measures of employment, this suggests additional gains in employment lies ahead.

A multitude of other measures relays just how tight the job market has become. There are now only two unemployed workers for every job opening. The gap between job openings and payroll gains, particularly in the manufacturing sector, suggests businesses are having a harder and harder time finding qualified applicants worthy of hiring. The number of folks feeling confident enough in their job prospects to quit has returned to more normal levels.

The real kicker is what’s happening with the Beveridge Curve, a measure of how well the job market is matching vacancies with hirable applicants. It compares job openings as a percent of the labor force to the unemployment rate. Right now, based on where the job openings rate is, the unemployment rate should be near 4.5 percent instead of just over 6 percent now.

What that means is that there are structural problems in the job market including, according to Capital Economics, the ongoing withdrawal of Baby Boomers from the labor force. Yeah, we’re looking at you retirees.

What does this mean for the Fed? Clearly, the central bank faces a monumental balancing act: It needs to gently normalize policy, not waiting too long for inflation to become a problem but not going too fast as to damage a fragile situation. The clock is ticking. A decision looms. The Fed’s tapered QE3 bond purchase stimulus is set to end in just two months.

Paul Ashworth at Capital Economics notes that surveys of both businesses and consumers highlight expectations of higher take home pay for American workers in the months to come. He estimates that wage growth will push over a 3 percent annual rate in early 2015 and could reach as high as 4 percent based on historic relationships between measures of labor market slack and wages.

In order to protect profit margins, businesses will try to pass through higher wage expense to consumers. That’ll boost inflation which is already near the Fed’s 2 percent target. Considering all this, Ashworth believes the Fed will hike rates in March 2015 on the way to December 2015’s estimate of 1.25 percent, and 3 percent by the end of 2016. Currently, the market doesn’t expect the first action until the middle of 2015.

As it becomes increasingly clear that the job strength isn’t a fluke, and is confirmed by wage growth, the bond market could be in for a few more nasty spasms as the Fed hike timing gets pulled forward.

High yield bonds have enjoyed a reprieve over the last week, but that will likely prove to be short lived and stocks could temporarily be rattled in sympathy. But the bottom line is that the Fed may be much slower to act than pragmatists like Ashworth expect, and if that is so then the path toward higher levels for the broad market might be smoother than most expect.

If you have views on these matters, please join in on the conversation — add your comments by clicking here.

Best wishes,

Jon Markman

P.S. This is still a great environment for tech investors as software, networks and chips remain the key routes for companies and countries to pull themselves forward efficiently and productively. And for some of my favorite recommendations you shouldn’t miss, I want to give you my report, New Technology Superstars for 2014.

{ 6 comments }

I am an instructor for a rehab facility in central Florida which is reported to have the lowest rate of unemployment in the state. However, as we look to help place those coming not only from “re-hab” but veterans and others not having adverse baggage, we find that most available job openings are n for part-time work. Most of these openings we find many companies have reduced their workers to part-time status and hired part-timers to take up the slack created by their action previously stated. We also find that the reduction to part-time status is mostly as a result of avoiding the Affordable Care Act mandates. Another situation that we have seen is in the re-organizing of organizations to avoid ACA mandates as well. For instance the church I attend divided their ministries into separate entities because of the size of its workforce being impacted by ACA mandates. This in turn required our hiring some additional part timers to cover work that could no longer be performed by “multi-taskers” (no longer could some functions be performed by those involved in several different ministries.) Another situation we see is that many people are purchasing hard items as investments with their cheapening dollars to offset our inflationary spiral.

Thanks for your insights and services .

FED FOLLOWS THE MARKET

No reason to pretend the FED will get ahead of a rising level of inflation. The data is always a lagging indicator, meaning the FED will never get ahead or lead. They wait until the data is already out and confirms higher inflation. If inflation surprises to the upside or spikes, then the chance of market turbulence increases.

The FED will wait like they usually do and when inflation is 3% for several consecutive quarters, then begin to raise Fed. Funds rate. The market may not be so patient, so watch the long term bond rates and gold for a hint of higher inflation expectations. When the market bids up interest rates is when the FED is most likely to act. The FED follows the market but seldom leads.

JON:

PROVIDE ME WITH SOME INSIGHT ON “WATER” STOCKS FOR FUTURE INVESTMENTS (e.g.,WTR). DO YOU HAVE ANY OF THESE STOCKS IN MIND ON YOUR RADAR SCREEN? THANKS, RON

A market crash could/will happen at any time.I think we have learned that the Fed now has the ability to create any amount of fiat currency,to bail out debtors,including the largest debtor,the U.S. govt.So,when a crash comes(over 20% fall),if you are holding stocks in companies that are financially solvent,you should just hang in there,while the Fed comes to the rescue,devaluing the currency,pushing up prices of real assets,like stocks.

Good Morning Jon

With Monster Beverages having the appreciation from Coke, do you see a similar possibility with KRED?

The job openings are predominantly part time work. The other thing that companies are doing is providing full time work as contract employees. They are not required to provide insurance for contract employees, who have a definite start and end date. Also recruiters are sending out false job ads, just so that they can see who is out there looking. Once you fall off unemployment you are invisible, no one knows you are out there. It’s amazing that you’ve not done the research! The Fed lies we know about, they are trying to create inflation, and if they can convince Americans ro keep spending they hope by inflation to reduce the debt. This is why the Fed is so scared of Americans not spending. They are terrified of deflation and a depression.