|

One of the most important components of President Trump’s tax overhaul plan is a tax holiday for American companies that do business overseas. This, of course, is all in an effort to repatriate those dollars.

The current 35% U.S. tax rate on their profits is what drove those companies to conduct business abroad in the first place. As long as those dollars remain overseas … no U.S. taxes.

And those overseas dollars are estimated to be $2.6 trillion!

According to the IRS, the prior tax holiday under President George W. Bush resulted in about $362 billion repatriated. That was at a temporary tax rate of 5.25%. If Congress enacts a similar plan this time, it is estimated that up to $1.7 trillion could be repatriated by U.S. companies this time around.

And while the details are yet to be determined by Congress, it is widely expected that the new repatriation tax rate will be in the 10% to 15% range. I expect lots of companies to jump at the low-cost chance to bring that money back into the U.S.

Bringing those dollars back into the U.S. could naturally result in a significant boost to economic growth.

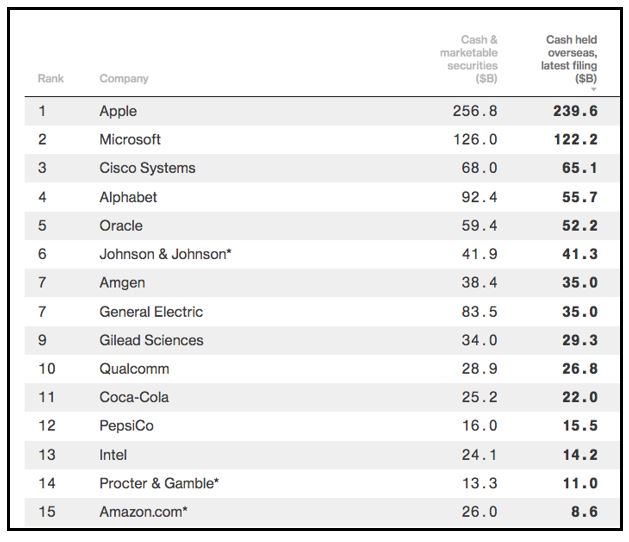

Who has the most overseas cash? The top five companies are Apple, Microsoft, Cisco, Alphabet and Oracle. But they certainly have a lot of company.

The list of businesses with a billion dollars or more overseas is quite large and dominated by technology and drug companies. Check out the table below.

How much of that overseas cash will be repatriated? That’s impossible to tell. But I think $250 billion is a conservative estimate.

And once that money is brought back to the U.S, it should go somewhere. Our Washington politicians are hoping that it will be reinvested back into building factories and hiring more Americans.

But let’s face it. There are plenty of other places that cash could go, such as debt repayment, stock buybacks and increased dividends. However, I think the majority of that money will go toward mergers and acquisitions.

And that spells opportunity for savvy investors. I’m talking about those who get ahead of the upcoming M&A boom through merger arbitrage funds and big investment bankers.

There are three merger arbitrage funds: Merger Investor (MERFX), Touchstone Merger Arbitrage A (TMGAX) and IQ Merger Arbitrage ETF (MNA).

The biggest investment banking firms are household names: JPMorgan Chase, Goldman Sachs, Bank of America/Merrill Lynch and Citigroup.

However, smaller boutique companies, like Lazard (LAZ), Blackstone (BX) and Cowen (COWN) are purer investment banking plays.

It’s true that there are elements of Trump’s tax plan, like the repeal/replacement of Obamacare, that are far from a done deal. But Democrats and Republicans seem to be in agreement on lowering the corporate tax rate. So I expect it to happen.

And when it does, you can bet the M&A crowd will be doing cartwheels. And you should join them by adding some M&A spice to your portfolio.

Best wishes,

Tony Sagami

P.S. For even more reasons to bet on the U.S., please plan to join your fellow readers at tomorrow’s Weiss investing symposium. This first online session (of three total) will only take about 30 minutes of your time. Just click this link a few moments before 2 p.m. Eastern on Wednesday, Oct. 18. We look forward to seeing you there!

{ 2 comments }

Tony, Tony, Tony…..

Where do you think most of that cash money “overseas” is sitting right now?

It is all in New York !!! They only have to pay taxes when the money hits their treasury. So the money is transferred to New York banks and they borrow against that cash at less than 1%. They can do anything they want with that money. Buy back shares, make acquisitions, pay themselves a nice bonus. That “overseas” money is being used everyday except that they do not or will not pay any taxes on that money. Why should they? Do not buy the hype that the money is sitting in some foreign bank gathering dust !!

Your last comment to your subscribers, Oct 17,

Seems like we should be getting more updates on your individual stock picks.