The Federal Reserve Bank has access to more economic data than anybody, and it is very optimistic about the economy.

The Atlanta Federal Reserve Bank recently forecast that the U.S. economy will grow at an annualized 0.5% rate in the first quarter.

That’s pathetic. But even that discouraging forecast may turn out to be too optimistic if the collapse in consumer spending is the canary in the stock-market coal mine. Here’s what I’m talking about …

The Commerce Department just reported that retail sales dropped in March, a follow-up to a similar decline in February.

And you can tell by the number of retail stores that are shutting down that this spending slowdown isn’t a survey aberration. Indeed, many of the most popular chain stores in the U.S. — Sears, JC Penney, Macy’s, Payless Shoe Source, Sports Authority, American Eagle, RadioShack and many others — are closing all or some of their stores at a record pace this year.

Other names you might recognize: Bebe, Abercrombie & Fitch, Aeropostale, American Apparel, BCBG, Barnes & Noble, Casual Adventure, Children’s Place, Crocs, Gamestop, Hhgregg, Kemp Mill Music, Kenneth Cole, The Limited, Office Depot, Ralph Lauren, Kmart, Staples, and Wet Seal.

Through the first quarter of 2017, retailers have announced they will be closing almost 3,000 stores. For perspective, that is way above the 1,153 for the same time last year and even more than during the Financial Crisis of 2008-2009.

An analyst at Credit Suisse estimates that total store closures will exceed 8,000 by the end of the year; way above the previous peak in 2008 of 6,200.

Not only are stores closing, but many are filing for bankruptcy, including Payless Shoe Source, Hhgregg, Gordmans Stores, Gander Mountain, and Radio Shack.

According to Labor Department data, 60,000 retail jobs have disappeared in the last two months; 29,700 jobs in March and 30,900 in February. That is the worst two-month period of retail job losses since the 2008-2009 recession.

Gee, another coincidence with 2008-2009!

Now mind you, all my bullish friends wave this off as a shift to online shopping. I disagree. And here’s why:

Consider what is happening to new-car sales and Harley-Davidson motorcycles, neither of which are bought online in any meaningful way.

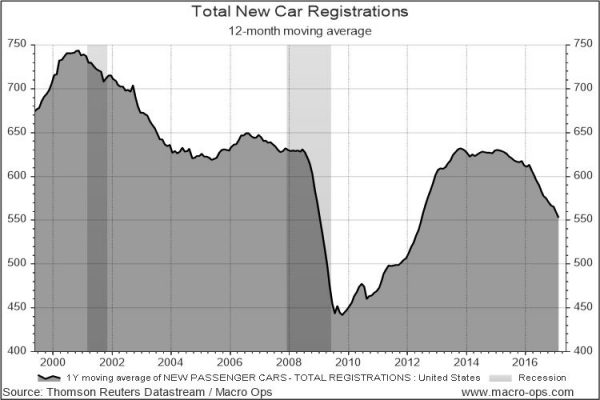

New-Car Registrations Plunge: Forget about what Detroit or what car dealers tell you. The proof-positive statistic that shows the health (or lack thereof) is new-car registrations. As the accompanying chart clearly shows, the number of new cars hitting the road has decelerated to a level that has historically been associated with recession.

Harley-Davidson Hairball: Harley-Davidson is as American as apple pie, and it has seldom had to offer rebates of up to $1,000 to lure buyers into its showrooms. The reason for the incentives is simple: Inventory is backing up at dealers’ showrooms.

Moreover, Harley-Davidson reported its Q1 results last week:

- The number of motorcycles shipped in the first 90 days of 2017 dropped by 14.7% compared with the same period last year,

- The average selling price per motorcycle dropped by $342 to $15,526 in the first quarter,

- Year-over-year profits collapsed by 25.6% to $186.37 million, or $1.05 per share.

And that is after an aggressive stock buyback program (financed by debt) that reduced overall share count by 4%. Without that share buyback, EPS would have been even uglier.

The Consumer Who Won’t Spend

Some will disagree, but it is obvious to me that American retailers are in trouble and that the problem is not Amazon or the Internet.

The problem is American consumers who just aren’t spending.

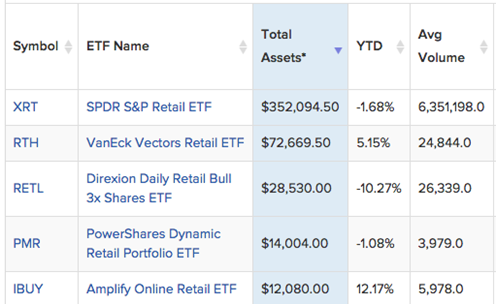

There are five ETFs that invest in retail stocks that I think you should avoid. More importantly, I believe it is a mistake to ignore the big-picture message the retailing woes are telling us.

What big picture is that?

That 70% of U.S. GDP is consumer spending and all the above retailer woes are solid evidence that our economy isn’t as rosy as Wall Street wants you to believe.

Best wishes,

Tony Sagami

{ 19 comments }

I think you are right on!

Although I do not disagree with your charts on what the economy is doing, I will say that I must disagree with your overall assessment of the economy is incorrect. Having worked at a car dealership for a number of years, people are still in love with their automobiles and bankers. Vehicle sales have not slowed appreciably over the last several years. This may change when the populace finally understands they can not really afford those high tech automobiles, and the upkeep associated with them, but currently that has not happened as of yet.

Brick and mortar businesses are, in fact, slowing down because they have not listened to what the consumer wants, simple as that. Right now, that lost business is going on line to purchase what brick and mortar stores have chosen not to carry. Time will tell where all of this will end, but right now, it looks as if the status quo rules.

Forrest, you’re right, new car sales and leases have been running at a high rate. Unfortunately, the number of car loans that are 60 days late or more are piling up at a high rate and there are a ton of three year leases ending this year, which will forecast a glut of recent used cars, which drives prices down. Car sales are like the boom in house sales in the 2005-07 years, then crash. Keep your eyes wide open.

Hi Forrest:

Cars are being sold to people who can’t afford them. It’s sub-prime lending all over again. Same thing that happened to home buyers ten years ago, only now it’s cars. Stretching payments out for seven years is insane. The buyer is holding an asset that’s worth less than it’s value at the end. No one on CNBC talks about this. The mouth-piece for the Auto industry who reports on CNBC knows better, but talks up the car companies. Debt held by Ford and GM is going to undo them. Many buyers will default.

You can say that again!!! The housing market took a dive WAY back in the 80’s, and todays obscene pricing is unthinkable for everyone except those making the profit TODAY. Tomorrow is another Sad story. The banks,ETC, holding those mortgages will

hold the bag which they happily hand over to US as more taxes.

I believe that the high mortgage rates and rent payments are key to this. People are simply house poor. Dr Weiss spoke of this year’s ago. People have only so much to spend, so as the price for homes and rents are going up 10-15 percent and higher in some cases purchasing power declines at a very fast pace.

Incomes are not going up at the same rate, so something must give !

Fundamentals will kick in.

radioshack, payless, limited, hh gregg, gamestop, k-mart, sears, jc pennys, staples, office depot, they have all been closing for years or they are facing on-line competion and their model just doesnt work anymore as for the automobiles 20% of the people have just stopped paying their loans and i know another 25% of the cars and trucks out there will be coming off lease in the next few months so expect the used vehicle market to be flooded in the coming months

I’m Canadian. I certainly buy less and that is because the price of everything continues to skyrocket. Taxes are eating us alive up here. I always feel like holding back because there is no certainty in the future. Most Canadians have fallen desperately behind in buying power because almost no one can call a wage increase. And I agree with Tony, in no way has on line shopping replaced the real thing. Amazon is a hose bag company that takes the profits away from others and getting something delivered to me takes 3 to 4 weeks. Give me Real Canadian Superstore over the likes of Amazon any day.

Corporate America has screwed the working class too long. Wages arent keeping up with inflation. So goes comsumer spending

Consumers use cheap money to spend themselves into debt oblivion, while the current dysfunctional U.S. government is deepening the same the black hole

New car sales? What intelligent consumer would agree to pay an inflated and manipulated price for an expendable appliance that will be obsolete, very highly depreciated as soon as they drive it off the lot, and virtually worthless in 5 years? Not me!

A car is an appliance. If you are in love with it, see a therapist, if you can afford one.

I agree completely, buy a 1-3 year old car with low mileage and keep it for a long time.

Visiting the South (S.C.), I have noticed , a complete turn around here, building activity not seen in 8- 9 yrs. Is it what I call the “trump factor”? I am still confused, with wages being stagnant for years and record breaking debt levels, when will the next shoe fall? P.S. To MICHAEL, he has NO CLUE of what “high mortgage rates ” are? You aren’t old enough to remember most of the ’80s then !

I lost my job in in 2011 and it took almost 5 years to find another. The great recession taught me that i didn’t need to spend much to be happy. I previously earned high six figures and had less than10% savings. Now i’m back to that wage, but save close to 50% after tax.

This is the Fed’s fault, they detroyed lives to save their wall street buddies from going broke. Should’ve saved CIT instead of GS, C, or BAC.

Where’s Mike Larson these days?

Has he suddenly disappeared like all the others?

I’m a snowbird from WA state to yearly which allows me to visit family and friends along the way. Everywhere I go I see empty retail space in major and strip malls beside stand alone stores and getting worse by the month. Very few people I meet think nothing about it as they spend and spend. Yet I see people with signs needing help standing next to HELP WANTED signs. Nearly every over the road truck says Join our Group, good pay and benefits. Once you have a job and gain experience its easier to up grade. A Skill, Trade and Education combination will open doors and just need to prove yourself.

Only Jay got close. After 8 long years of the almighty democrats at the helm of over regulation and taxation are we seeing the effects of their policies. People just don’t have the disposable income they used to, especially the Canadians (do not look to closely at how much they travel to Mexico or the Caribbean). Not sure anymore if the republicans are really going to do anything about it by shoving our faces into another conflict. That is not the way to rebuild the middle class, but it is a way to line pockets a little less brazenly than the previous admin.

Record high student debt, auto debt that has been issued to sub-prime customers, rising housing prices, increasing rents with low annual wage increases is not a sustainable formula. This is not rocket science, it is basic economics. While traditional retail has been negatively impacted by online options, it is not the total answer to reduced traditional retail sales. Consumer spending is actually down and it will be a continuous trend as consumers come to the realization that their debt is not sustainable and they need to make fundamental life style adjustments.

Another major reason for lower retail sales is smart phones,computers and easy price shopping.Everyone has the ability to compare prices,forcing retailers to lower prices,forcing profits down and causing bankruptcies.