The price of lithium has been on a tear since the beginning of 2016. And a smart move was to buy the Global X Lithium & Battery Tech ETF (NYSE: LIT). This is a basket of 28 stocks that run the full lithium cycle, from mining and refining through battery production.

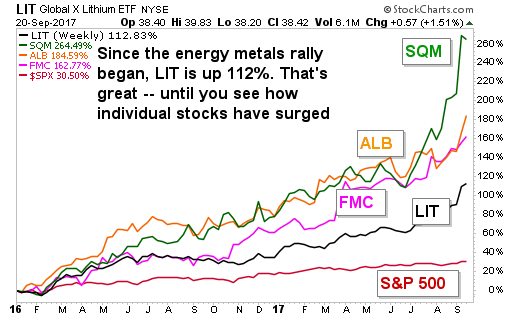

LIT is up 112% since the start of 2016. That blows away the performance of the S&P 500. The leading stock index is up “only” 30.5% at the same time.

Even if you bought LIT back when I wrote about it last month, you’d be sitting on a nice 13% gain today.

That kind of trading action is nothing to sniff at. But man, oh man. For really outstanding performance, just look at how the three biggest tradeable lithium producers performed since January 2016 …

FMC Corp. (NYSE: FMC) is up 162.7%. Albemarle Corp. (NYSE: ALB) is up 184.6%. And Sociedad Quimica y Minera de Chile (NYSE: SQM) surged a stunning 264.5% over that time frame. Wow!

This shows the advantage of investing in well-positioned individual stocks over using an ETF. The outperformance can be simply stunning.

So are lithium stocks going to top out soon? Don’t count on it.

Demand for lithium is putting the pedal to the metal. Electric car production is expected to increase more than thirtyfold by 2030, according to Bloomberg New Energy Finance. And every electric car needs a lithium battery.

To supply the needed batteries, the world will have to build 35 plants the size of the Gigafactory that Tesla is building in Nevada now.

And where will the raw material come from? That’s why the race is on, and stocks of select miners are soaring.

But even if the price of lithium goes down, don’t worry. Any pullback from here is simply an opportunity to “recharge” before zooming higher.

How much higher? My research tells me the price of lithium could rise 300% from recent prices, and battery pack costs would rise only by about 2%. Other metals are much larger parts of a lithium battery by weight. Nickel and cobalt in particular are used a lot in lithium batteries.

The bottom line is you want to pick the right horse for the next leg of the lithium boom. And while the LIT ETF should do well, other competitors will likely leave it in the dust.

All the best,

Sean Brodrick

{ 2 comments }

How do I buy cobalt ?

Sean:

Could it be time to lighten up the number of positions and get rid of some that are not

producing squat? I know I have some that I am eying to provide some additional cash to

prepare for your new reccos. Seems like the market has returned to sliding sideways again.

Silver not doing well, and GDX is doing better than GDXJ. Has the sell-off affected value

and liquidity? You could address in next week’s Alert. Had LIT a year ago @$28, before

knowledge fired it up. Could be your stocks will perform better than an ETF owning several

stocks, but the safety of an ETF is appealing. Looking forward to next week! Robert A.