|

Yes, I am bullish on the U.S. equity markets long-term. But right here and now is a very different story.

Look, the S&P 500 Index soared 32.4 percent higher last year without much more than a five percent correction along the way. The phrase over-bought doesn’t even begin to explain how extended this stock market is right now.

European stocks are even more over-bought in my view and both markets are well overdue for a correction — and I anticipate a substantial selloff — worse than many investors are expecting!

The Dow is eventually going to well over 31,000; that’s my big-picture view. But it’s not going to happen until all the current complacency and bullishness is shaken out of the markets.

From every measure I look at, stocks are overbought and ripe for a major selloff. Europe’s equity markets are headed for a far deeper and longer selloff.

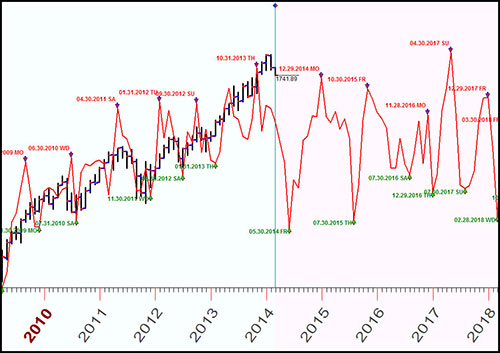

Let’s take a closer look now. Here is a monthly timing chart for the S&P 500.

It actually gave a sell signal at the end of last October. Being a monthly timing chart, it can be off target by as much as a few months, as it has been.

Yet, the S&P 500 is only up about 5.7% since that sell signal was issued. Not all that much. Especially when you consider that there are very few stocks that have pushed the index higher since then, with the majority of stocks either down or sideways since.

Far more important is the slope of the impending decline. As you can see, it is nearly straight down heading into the end of May. In other words, we are on the cusp of a MAJOR pullback, one that may have already started.

Yes, the S&P 500 has wandered to new highs since October, but the Dow Jones Industrials has not, and it actually peaked on the last day of December. This non-confirmation between the two indices is very bearish.

Moreover, as I have said all along, the Dow Industrials will not break out and start its new leg to 31,000+ until it closes decisively above 16,650. The high thus far, intraday, was 16,588.25.

I don’t own one single stock and I won’t own any until the correction plays itself out, or the Dow closes solidly above 16,650.

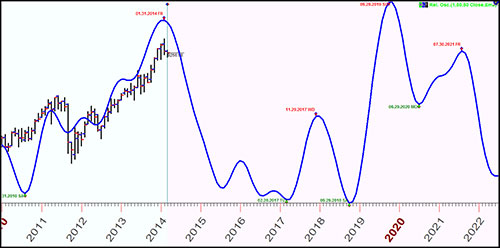

Now let’s look at Europe. It is about to CRASH. Here’s a monthly timing chart of the DAX, the most important European equity market.

On the Weiss Wealth Summit cruise in December, I told everyone in the audience to get the heck out of European stocks no later than the end January.

The reason was simple: As you can see from this chart, the monthly models for the DAX showed a sell single coming at the end of January.

The DAX went virtually nowhere for the last few months and now it’s starting its first leg down. As you can see from the above chart, the DAX is heading into a three-to-four year BEAR MARKET, one that will last into 2017 to late 2018. The same applies to virtually every market in Europe.

What should you do to potentially profit from a market decline? Buy leveraged inverse ETFs. Best choices for the U.S. equity markets: ProShares UltraPro Short S&P 500 (SPXU) … ProShares UltraShort Dow 30 (DXD) … and ProShares Short QQQ (PSQ) for the Nasdaq. For Europe, I like ProShares Short MSCI EAFE (EFZ).

What about gold and silver and their continued rallies? Look, if you want to load up on gold and silver, be my guest.

Personally, I am NOT going to get aggressively or even conservatively long the precious metals or mining shares UNTIL I SEE POSITIVE PROOF they have bottomed.

No such proof exists right now. And in fact, the opposite is occurring: The higher gold and silver go now, the deeper and more drawn out the bear market is going to become.

Yes, there was money to be made on the long side recently, in gold, silver and mining stocks, but let’s keep things in perspective: the SPDR Gold Trust ETF (GLD) has been in a rally for only two and one-half months, with a gain of 15 percent.

A very similar rally in gold and mining stocks took place in July and August 2013, and guess what? GLD gave up all those gains by year-end, and most mining shares fell to NEW lows.

I don’t care about short-term rallies until I’m convinced gold has bottomed. I’ll pass that money by. I want the big money, for myself and my subscribers. So I am going to wait to either short the current rally in the metals … or buy at the right time when there is the least amount of risk.

That means that if I have to miss a few moves, so be it. I don’t know anyone in the world who has a better track record at calling the major turning point in gold or silver than me and that is not going to change.

How much of what we are seeing now in the markets is related to the situation in Ukraine? A lot.

But it’s just the beginning. The war cycles ramp higher for SIX more years. You ain’t seen nothing yet.

They are going to have vast implications for the markets, beyond anything you can possibly imagine right now. So stay flexible and stay tuned …

Best wishes,

Larry

{ 3 comments }

Hi Larry, I always enjoy reading your articles and the way you analyze , but you didn't explain the factors that you are taking in a consideration that might affect the gold price and it might draft it down, i understand that you are waiting for a real high wave to ride on, but still i don't understand why all this fear. one more thing Mr. Edelson, how about China, don't you expect China will be an important player next coming months or years in Gold price? hopefully next article you come on these issues. Thank you in advance..

Hi Larry, you recommended to short Dow Jones & S&P here but not in your Real Wealth report yet. May I know why? Thx.

I registered for the briefing due at 9:00 AM pacific time and have not received a heads up.

Help!