There was another drubbing in the commodities industry today – with one company in particular getting gored. I’m talking about Glencore PLC (GLNCY), which is based in Switzerland but trades here in the U.S. and in the U.K.

Market Roundup

I mentioned the company a week ago. But in case you missed it, Glencore mines, markets, transports and trades everything from copper, zinc, nickel and aluminum to coal, oil and agricultural products. It employs 181,000 workers in more than 50 countries around the world.

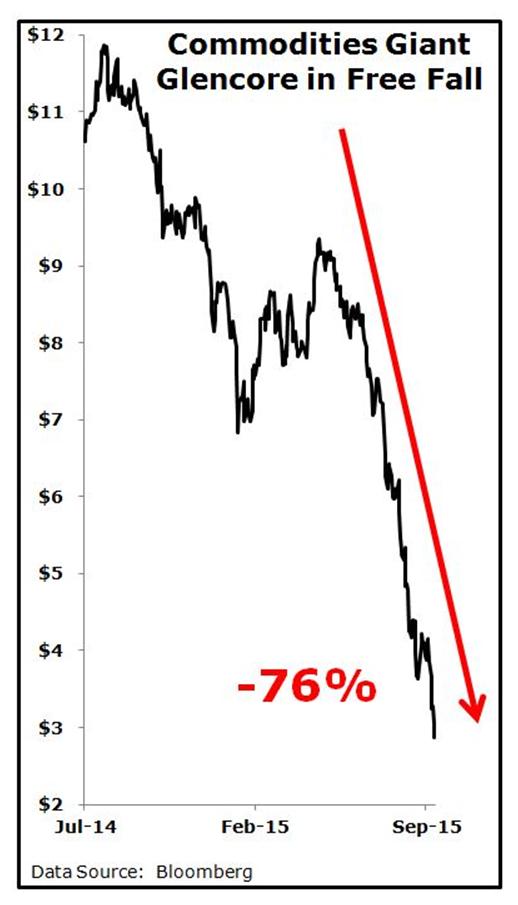

Glencore shares have been plunging virtually nonstop in the past year, losing 76% amid fears the company could default on its $30 billion in debt. Then today, they plunged by a record 27%. As you can see in this chart, things look every bit as bad here as the major bank and broker stocks did in the 2007-09 bear market …

|

|

| Swiss-based Glencore also trades in the U.S. |

The problem here is that Glencore is a key link in the commodities supply and trading chain. If its debt is downgraded to “junk” status, or the company actually defaults on its debts, that could ripple throughout the capital markets because its trading counterparts could run for the hills.

Glencore is trying to ease concerns by putting chunks of its business empire on the block, and by selling $2.5 billion in equity several days ago. But analysts and investors remain skeptical those moves will be enough, and the cost of insuring its debt in the credit default swap market is soaring.

It’s not like Glencore is the only commodities company on the ropes, either. Look at giants like Petrobras (PBR) or Freeport-McMoRan (FCX). Or take your pick of countless shale oil and gas producers, not to mention coal companies like Peabody Energy (BTU) or Arch Coal (ACI).

|

|

| The continued weakness in commodity prices is taking a toll on many sector-related companies. |

They’re all in freefall, and it’s infecting the high-yield bond market overall. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) just took out its Aug. 24 spike lows, reflecting the plunge in junk bond prices and surge in yields.

That’s a lot of bad news for the markets to handle – and I sure as heck hope you’ve followed my advice from the past few months to get more of your money to safety. Cash, short-term Treasury funds, inverse ETFs, and put options are all viable investment choices here in light of the ongoing weakness I’m seeing.

So what do you think? Is Glencore big enough and bad enough to trigger a market-wide crisis, or is it a tempest in a teapot? Are you worried about other commodities firms, and potential bankruptcies there?

What about junk bonds? Is the weakness there a reason to shift more money to cash and inverse ETFs? I want to hear what you have to say on these matters over at the Money and Markets website, so please don’t hold back!

|

I hope everyone had a good weekend, and I’m glad to see that many of you took the time to comment on the economic and market issues we’re facing.

Reader Ron S. weighed in with the following big-picture view: “The world is awash in printed-from-thin-air money, and equally awash in debt. The EU is heading for recession. China is drowning in empty cities. The emerging markets are in deep doo. America’s growth, anemic to begin with since the Great Recession, is slowing.

“Yellen has little left but talk. How can the markets go anywhere when they are already priced for near perfection? We will be 30 to 50% down by year end.”

Reader Cat added: “I think the central bank has lost control of the discussion. I have thought for a while that Chairman Yellen was selected to take the fall when the economy imploded.”

Reader Dr. John also said: “Uncertainty rules the day. With what’s going on in the federal government elsewhere, why should the Federal Reserve and Treasury be any different?

“Old folks like me don’t know what to do, and our financial advisers don’t, either. So, it’s stay heavy in cash until the market shows unequivocally that it’s going either up or down. Old folks can’t stand losses in investment assets, because we no longer have a day job to replace such losses.”

When it comes to Caterpillar (CAT), Reader Ken shared his take on why the firm is struggling: “My field is construction and I can tell you in no uncertain terms that regulations and useless paperwork now outweigh the actual work on any government project.

“We estimate our administrative costs are now 60% of the jobs. Cat is getting killed by regulators and regulations. We can’t buy new equipment when we have to spend all our profits on environmental consultants and lawyers.”

Reader Steve also pointed to Caterpillar’s ill-timed acquisition of Bucyrus-Erie in 2011 as a major source of trouble. His view:

“Cat doubled down on heavy capital goods for two very cyclical industries: Coal/ores mining and construction, which happen to both be tanking at the same time. This could be a failure of strategic planning on their part or an indication that major sectors of the industrial economy are in recession or a developing depression.”

Thanks for sharing. Cat is definitely struggling thanks to a combination of self-inflicted wounds and the global economic problems I’ve been writing about for a while now. Cat isn’t the only company struggling, either, so the upcoming earnings season could be a rocky one for industrial firms with heavy overseas exposure. That’s yet another reason why I remain extremely cautious on the markets here.

Any other thoughts you’d like to add here? Then use the website as your outlet.

|

![]() Republican speaker of the House John Boehner resigned at the end of last week, and now investors are left wondering whether the government will shut down soon or not. Hard-line Republicans are pushing for a shutdown rather than compromise on several contentious issues.

Republican speaker of the House John Boehner resigned at the end of last week, and now investors are left wondering whether the government will shut down soon or not. Hard-line Republicans are pushing for a shutdown rather than compromise on several contentious issues.

![]() It’s been rough sledding lately for aluminum giant Alcoa (AA). Hit by the downturn in commodities and stiff competition from Chinese metals providers, the stock has dropped more than 40% year-to-date. So in an effort to reignite investor interest and maximize the value of some of its assets, the company said it would split in two. The transaction is expected to close in 2016.

It’s been rough sledding lately for aluminum giant Alcoa (AA). Hit by the downturn in commodities and stiff competition from Chinese metals providers, the stock has dropped more than 40% year-to-date. So in an effort to reignite investor interest and maximize the value of some of its assets, the company said it would split in two. The transaction is expected to close in 2016.

![]() Ahead of several key news developments this week, options traders are betting on major volatility, according to Goldman Sachs. The firm’s derivatives team pointed out that investors have been piling into straddles on the S&P 500 – a strategy that would only pay off if the index surges or plunges by a fairly large amount.

Ahead of several key news developments this week, options traders are betting on major volatility, according to Goldman Sachs. The firm’s derivatives team pointed out that investors have been piling into straddles on the S&P 500 – a strategy that would only pay off if the index surges or plunges by a fairly large amount.

![]() Royal Dutch Shell (RDS/A) abandoned its plans to drill for oil off the coast of Alaska. It blamed lower oil prices, regulatory challenges, and other factors – and the abandonment of its drilling plans there will cost the company hundreds of millions of dollars.

Royal Dutch Shell (RDS/A) abandoned its plans to drill for oil off the coast of Alaska. It blamed lower oil prices, regulatory challenges, and other factors – and the abandonment of its drilling plans there will cost the company hundreds of millions of dollars.

So what do you think of Alcoa’s plans? The likelihood of even more violent swings in stocks? Any other topics I did or didn’t cover here? Let me hear about them over at the website.

Until next time,

Mike Larson

{ 54 comments }

Seems to me that the ultimate worry should be the value of all these abused fiat currencies.Central banks have been loading all their economic problems unto these 100% fiat,confidence backed currencies.I wouldn’t be so quick to trade your real assets for cash(Dollars).I don’t think fiat currencies,backed by bankrupt govts, are the safe harbor many believe.

Good Point! Hang on to things like property or precious metals at all costs. They will always have value, no matter what happens to fiat currencies.

Every experiment with fiat currencies has ended badly. It’s not if, it’s when. I’m afraid we are only kidding ourselves if we think there is a safe place to hide. Jim

When capitulation sets in cash will be hard to come by if you do not already have it in hand. You need cash to buy the bargains that will be available and if you need to sell your land to get the cash no one will want to buy your land. On the other hand, gold and silver are cash.

Ware you recommending to SELL CAT? I am one of those “old” people and need to hear what you have to say, suggest or ?

I see that Trump has proposed a tax plan that is fairly similar to the one Jeb Bush proposed last week. I notice one little difference. Trump would have a 15% corporate tax rate, rather than Bush’s 20%. Of course Trump owns corporations. LOL! But he would cap deductions a 2% of gross income. I don’t know if that is above some amount, or if there are exemptions for things like health insurance and medical costs. That could hurt some people badly, if there aren’t.

Well someone has to pay for the cuts proposed. Better not get sick.

One thing about the terrible declines in commodity prices, and they don’t seem to be finished yet; there will come a time, inevitably, when prices begin to rise. If investors have some funds available at that time, there will be huge opportunities for great fortunes for those who dare to join the party early enough!

Central Banks out of bullets, Recession looming, sovereign dept exceeding GDPs, artificial lower oil prices, massive stock buybacks, no business investment, no demand for commodities, only a matter of time until someone’s sovereign debt goes unpaid. Not a pretty picture. It just goes to show when economists rely on data and not common sense, this is the world they create. No wonder Ms. Yellen needed medical attention after 2 hours of blowing hot air. It seems the only fix is massive bankruptcies both corporate and sovereign and that would create a huge re-distribution of wealth and maybe this time with the emphasis on creating demand not stock buybacks and mega mergers.

And who is responsible for the laws and regulations that have allowed these conditions, frebon? Politicians! Especially the career politicians we keep electing again and again. NEVER vote a politician into office more than once. It may help reduce their ability to cause harm, if they know they can’t buy their way to another term with contributions from vested interests.

There’s pluses and minuses to everything. When you hire a brand ne accountant, engineer, lawyer, or contractor, you’re anything but confident they can do the job from day one. So why would you be confident that a brand new politician would show up with unbridled competence? You wouldn’t be and they’re not.

Does our Congress and Presidency look like competence, Phil?

I just finished reading Jim Marrs’ book, Crossfire, about the Kennedy assassination. I still don’t know who killed Kennedy, but I did come away with the inescapable conclusion that the Federal Government is the most incompetent institution ever created in Human History. Jim

We’re in a period right now where US dollars are relatively strong… that is, against oil, and foreign currencies.

Americans think when something is strong, whether it’s a nation or a currency, that it will be strong forever.

It wasn’t even four years ago that the Japanese yen peaked at 76 per US dollar. Today it has weakened to approx. 120.

In July 2008 the euro was worth almost $1.60. Now it’s approx. $1.11.

Currencies, like nations, rise, peak, and decline.

That is absolutely what’s going to happen to the U.S. dollar, especially when so much objective, plain everyday evidence suggests that it is excessively overvalued.

What does this mean? I believe if you are holding U.S. dollars, you have a once-in-a-decade chance to trade those fundamentally worthless and objectively overvalued dollars, for something that is real and undervalued like real estate, precious metals, and classic cars…

I have a great classic for sale that has some built in appreciation if you want to get rid of some of your fundamentally worthless and objectively overvalued fiat dollars…

I have a classic bridge for sale for those overvalued dollars!

Hi Donnie – may be looking for a 62 Starfire convertible. steel blue with blue interior. My first car.

Congress is back to fiddling [possible shutdown] while the country is burning. We have desperately needed funding for infrastucture building and maintenance but money is frittered away on pork and social programs that don’t work. The issues that dividing Congress right now should be taken up at a time when the country isn’t facing so many problems.

With all this talk about property, I agree that a lot of foreign money will move into property; but I see this as a bubble when eventually this money will want to move out. If you buy now do so with the idea of selling to foreign investors before the bubble bursts. I would stay away from vacant undeveloped land as that could be the first to become illiquid; however, eventually there won’t be enough renters and the landscape could eventually look like Asia.

I should add to my above comment regarding real estate, that a more liquid option to get into and out of that bubble, should one insist to enter the bubble in the first place, would be stocks in the land developers. Better yet, why not become a real estate agent?

If the bubble bursts, developers and agents starve. Stockholders also.

Is that your Brooklyn, San Francisco, or Oakland property Phil…?

Not surprised that you would realize I’ve got properties in all those locations–and a few others, too. Refer your clients to me, Dr. Donnie.

The commodities are like water spinning around draining in a sink.In my opinion ,it will continue because GDP’s around the world are dropping.Oil has no future unless the need for oil increases.To stop the route there is only one answer. WAR. I am not predicting this event but I feel it would take something this drastic to turn the tide.

Unfortunately, you are correct, Richard. It took World War II to end the Great Depression. But World War III could end everything, even if it is on the Internet. It could crash all our interconnected systems, with billions dying as a result of food and energy shortages.

Vic is right. Political correctness is more important than the real problems facing our country.

With Chinese markets tanking and their politicians manipulating the markets. The European markets and economy in free fall. Tokyo a basket case for over 25 years. It’s only a matter of time for the US markets to like wise fall. My advice is to grab your ankles, the fat lady is about to sing.

Mike, your remarks about Glencore and similar companies are rather scary. If very many of such companies actually fail, there seems no way we could avoid a terrible crash. The things they produce and sell are the very basis for all else. Without them, recovery would seem problematical, at best.

This Recession (or likely Depression) could extend all the way through the next two terms of the next president or two, no matter who gets elected. But hopefully after that the middle class (as defined sixty years ago, not as defined by Obama) can come forth to make the nation great again. The required stripping of regulations and subsidies used for vote buying and “job” creation will take a lot of time and effort to purge.

Great assessment of gov reg etc, Government needs to get out of the way in all respects and let the American people rebuild our Country instead of rewarding failure and non productive people. strip the regs both States and Federal

Cat paid about $850 million to buy the former General Motors locomotive Division from Berkshire and Greenbrier (A rail car manufacturer). They are right now living on the final GM designed SD70 series locomotives about seven years old. Berkshire and Greenbrier paid about a third of what they sold it for. Many people figured Electro-Motive Division was as much the heart and soul of GM as Chevy is. In 1939 EMD showed the Railroads diesel-electric locomotives were the future with FT 103.

One of my fondest memories from when I was a little boy was standing with my family next to those big tethered iron wheels of the steam locomotive before boarding the train. Now that was the way to travel.

I recall a similar scene, Will. Kind of scary with all the steam hissing and blowing around, but fascinating, too.

Looks like this Bear is just getting started. The Nas100 was down approx 3% today…quite a jolt if you were in tech. Could be a small bounce here for that index as there is a little shelf of support in this area going back to late 2014. Still no panic and the bigger charts say down, down, down so that should be the overriding trend…..IMO.

Larry Edelson talks about foreign money headed this way to buy property. I notice that there is sizeable activity locally in office buildings, with several office towers hitting the market, and a few already selling. There seems no evidence of foreign money being involved, though. What it does seem to indicate is something of a bubble, and bubbles always burst with a downtrend in prices. One large developer just sold a shopping center it had put $130 million into, and only made about $3.5 million on the deal. That might be an indicator real estate is tightening.

Mike – I work at a publically traded company that split in two with that split being completed late 2013. The split took us two years from start to completion. We did this in a good market where shares were issued and bought by the company spinning off the other new entity and by the public. I am glad we got our split done. We are stronger because of it. However, I would not want to split in two in a down market like we have now. HP, AA and others will have a tough road to hoe pulling off a split and getting it done in two years. Robert

Next up a words from the DNC…!

Mike,

In my opinion, you can follow the current Crash in Oil and other Commodities right back to Cheney’s “Secret National Meetings” with all the heads of Production, Refining and Distribution way back near the start of their ruinous tenure…. The moves of that Cabal drove Oil to the ceiling… That started oil exploration and drilling like nothing we have ever seen before and it happened all over the world… Now we have a HUGE over supply and the price is falling like a brick… NEVER has been nice to mess with the Supply Curve….. Any Econ 101 College Student could have forecast what happened as Cheney/bush were leaving office and what is happening now…. So much for the “Free Markets” that the GOP is always crowing about, aye?!.. :(

Why does the DNC always spin the hamster cage?

Oil crash was due to the shale revolution and manipulations by OPEC. Natural gas did the same thing a few year ago, though it was not such a large difference (No OPEC). Bush/Cheney did as much to start it as Obama did to stop it.

Obama is a trained Marxist “selected” by a group headed up by billionaire Marxist, George Soros, to run for President and be their guy to engineer the take down of the U.S.. She (America) has stood in the way of the globalist, new-world order banksters from taking total control of the world’s economy and ushering in a new global currency. The Fed, both political parties and global financial elites, I believe, have teamed up to accomplish this goal. Hard to believe, but I believe it is true. After the 2012 rigged re-election, Comrade Obama had no further need for the “useful idiots” that voted for him the second time in spite of the horrible state of the country and was, now, free to unleash his “final solution” for the destruction of America.

The bankers have pulled off a truly brilliant scheme. Over the last couple of hundred years they have managed to create a system where those who produce the wealth are hurting and those who produce absolutely nothing have most of the wealth. Fractional banking was the key to their success. Collecting interest on an illusion. Jim

So what you’re saying is that Obama’s efforts are mostly focused on creating a new global currency, presumably controlled by bankers like Jamie Dimon?! That would make them too big to fail. Will the new currency help or hurt the U.S.?

Well Dave these Marxists as you call them are having one hell of a time balancing the budget let alone do all that, Soros is a very busy man, you must speak with tongue-in-cheek, he did come up with a great deal of money to oust G.W B, and Obama is a :Bilderberg http://www.bilderbergmeetings.org/index.php look for James A Johnson as his campaign Manager Aka Perseus Group. try this on for size, it appears more fundamentally

appropriate. https://en.wikipedia.org/wiki/The_Fable_of_the_Bees

https://en.wikipedia.org/wiki/Invisible_hand#Understood_as_a_metaphor

Hi Mike

As you know gold has a value measured in $US. If I have a Ikg gold bar on the table and next to that I have $US which I just keep on printing then how long does it take everyone to wake up? We seem slow to learn don’t we?

I should like to request someone at Weiss Research to produce on Money and Markets an Overlay Chart showing Gold related to say USD, Euros and Yen for recent years. Thank you very much.

Mike,

When you comment about CAT’s problems you don’t even mention the staggering govt regulations strangling all companies including CAT. You seem to put most of the blame on them. WHY are you not taking our absurd govt regs to task?

Stan:

While gov’t regs take a toll on the industry it regulates, the customer has to consider whether it is possible to make money with the machine. A friend has nearly all Cat machines in his construction business including 3 D-8s. They are all getting tired. So, he priced out an new D-8 at over $500,000. He figured that he would never get his investment back no matter how long he owned the machine. The 3 old machines got rebuilt.

Michael, this current DEBT, DERIVATIVE and DEFLATION CRISIS WILL make the 2008/9 subprime crisis look like total child’s play. Lets not forget that the ABSOLUTELY EXACT same problem that occurred with subprime mortgages to people with no income, no credit and no collateral that were “securitized” into TOXIC JUNK BONDS is EXACTLY what is happening in the energy and commodities area except on a MUCH MORE MASSIVE worldwide scale.. This is absolutely NOT the time to be in the stock or much of the bond market. Period! And to think, we did not even talk about market technicals, cyclicals, geo-politics or demographics..ALL of which are in a very ominous state right now. Has NOTHING to do with how many people are shopping or out eating dinner on Friday/Saturday nights etc..etc….This is a time to be very serious and very careful with your money.

THE FORECASTER- LIVE BROADCAST

Hey Oscarr, What are you doing tomorrow? IT’S FORECASTER TIME SEP. 28 AT 2:50PM. I will be online on this special day. And if you are available come on over watch it with me. 18€ via Paypal( Martin Armstrong) at his best delivering an OSCAR performance.

Glencore is just the beginning.

Take a look at Mercuria. And then, after you have finished retching, double down and look at Trafigura. Trafigura has the gall to announce “Too Big To Fail.” Tanking as we speak.

(www.zerohedge.com)

LARRY HAS SAID THAT GOLD WOULD DROP TO $900 to $1000 BY NOVEMBER! IS HE STILL STICKING WITH HIS PREDICTION? PLEASE REPLY. THANKS, JERRY

The Fed is out of ammo. The next step is to drop bags of cash from helicopters and hope for the best. We don’t have a recession coming, we have a depression on the way. Until this debt is ERASED and the reset button is hit, it doesn’t look good. I see major wars on the horizon. As economies weaken, global tensions will mount. Don’t be concerned with a return on your money, be concerned with a return OF your money!

See,

A few of the same people repeatedly spouting off at the mouth., yet saying nothing; just filling up space. One has to read all of their garbage to just get through to the one or two who have some meaningful ideas of whats happening. Too laborious and time consuming to really interact!

Would like to hear from Larry about the big gold bounce Friday.

Sam

Mike, good articles, I would just caution against the use of inverse ETFs, they erode in value very quickly if you get even a short flat period. Line one up against the SPX and you’ll see. Just search for ‘problem with inverse etfs’ and there are articles on it. John