Third-quarter earnings season is officially underway, and as usual, anxiety over results is running high on Wall Street.

In fact, investors are downright pessimistic about this earnings season. Tune in to CNBC and you’re bound to hear commentators talk about the rising odds of recession ahead, thanks to slumping corporate profits.

To paraphrase one (of many) investment e-zine articles I’ve read recently: If you expect third-quarter earnings to come in and lift stocks to new highs, “then you’re probably going to be very disappointed.”

Maybe, but not so fast, because there is a glimmer of hope amid the earnings gloom …

The S&P 500 profit slump has likely bottomed out already,

and with the benefit of some positive surprises,

the earnings recession has ended!

Look, to be fair, it’s easy to see why the pundits are so downbeat.

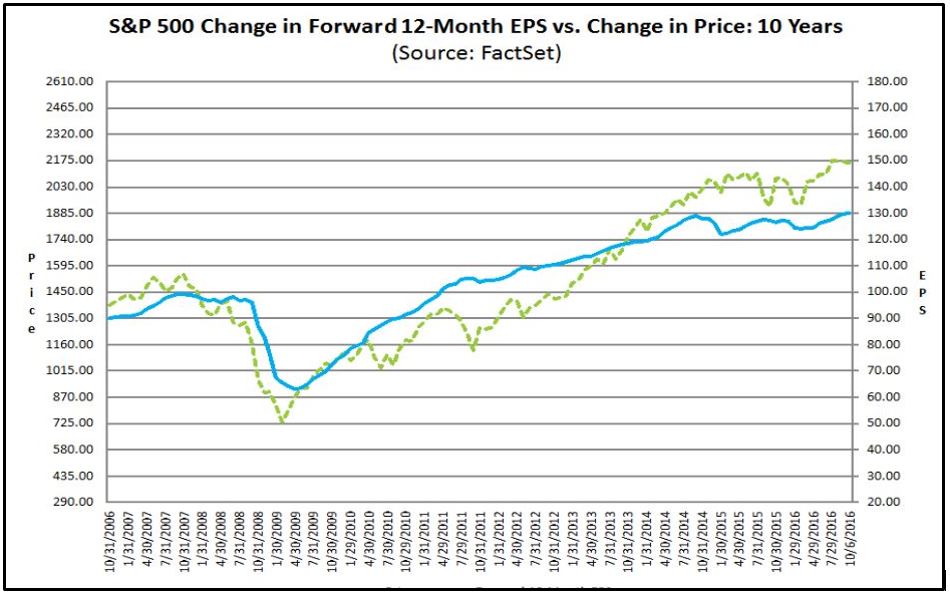

Wall Street strategists are pressing the panic button over the fact that S&P 500 company year-over-year profits have declined for five straight quarters now. As you can clearly see in the chart below, there is some legitimate cause for concern.

S&P earnings stopped growing in mid-2014 (dashed green line) even while the index kept marching higher in price, advancing almost 8% with ZERO increase in profits to support the gain.

And that has resulted in s-t-r-e-t-c-h-e-d valuations for the stock market, to put it mildly. That’s another cause for Wall Street pundits to panic.

In fact, during the third quarter of 2014, S&P earnings expanded at an 8.3% clip, but after that, profit comparisons got progressively worse, going negative in early 2015.

And in the second quarter of 2016, year-over-year profit growth fell to negative-5.6%!

Today, analysts are quick to predict a sixth quarter in a row of S&P profit declines once results are tallied. But they may be making a common mistake: Extrapolating past trends into the future,expecting more of the same.

In fact, S&P profit growth comparisons turned favorable last quarter, with a y-o-y earning decline of only 3.5%.

This quarter, according to estimates compiled by FactSet, S&P earnings growth is forecast to be even less-bad, at -2%!

And while a 2-percent profit decline is nothing to cheer about, the story gets better.

You see, Wall Street analysts have a near-perfect track record of missing the mark with their forecasts. They’re constantly overestimating or underestimating actual results. And they are often way off the mark at key inflection points, like right now.

Since corporate management loves to under promise and over deliver, during an earnings recession, Wall Street estimates get too pessimistic.

Companies and the analysts who cover them “conspire” to set the bar too low so that companies can tiptoe over it with positive earnings surprises to keep shareholders happy.

Over the past four years in fact, actual company results have beaten estimated earnings by 4.3% on average, according to FactSet.

So if you do the math, you’ll see why there is good reason for optimism that the earnings recession has ended:

(-2% profit estimate) + (4.3% positive surprise) = +2.3% profit growth!

Plus, fourth-quarter 2016 and first-quarter 2017 earnings comparisons will get even easier relative to the minus 4.2% and the minus 5.6% results posted during those same year ago periods.

This means the bar gets easier to beat going forward.

Bottom line: Don’t hit the panic button just yet, like some pundits are doing. Instead, wait patiently for the profit results to be counted, because you may find the worst of the earnings slump is already over.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 9 comments }

Sorry Mike I have a hard time understanding how less bad can be more good. The SEC has passed a law letting companies play around with pension payment to make profits look better and no doubt stretch out payments and harm workers. The old sleight of hand game is alive and well on wall street. Everything is stacked in large corporations favor nothing is changing. Its a case of twist facts and figures till you get positive results. Its called ye old Shell Game.

Vladimir Lujanschii

I really hope you are correct. I research everything financial 8 to 12 hours a day. I see totally different trends. Not good ones either. So we shall see. I am rarely wrong with my findings. I do my own investing derived from my own research and have been very very successful. I just keep my head down so I’m not on the net or TV. In closing, again I hope you are correct. Sincerely: Gregg Chaney

You sound very similar to Jeff saut’s comments, whom I respect and follow also. Do you ever read him??

What do you see that would raise earnings anytime soon? Our high corporate debt? Maybe declining household income (regardless of what government says)? Government deficits lof 1.42 trillion for fiscal 2016? Maybe decline of our rule of law. Maybe Hillary’s proposed 1.3 trillion tax increase? What am I missing?

I think the solid green line is the earnings line. Not the dashed green line.

Could you also say that since actual company earnings are better by 4.3% (not 4.3 points), then its still negative: -2% + (2 x .043)= -1.914%, or did I not do the math?

Earnings smernings what do silly things like earnings have to do with markets that are based on printed money? The central banks from Tokyo to Washington are propping up their respective markets with bundles of freshly printed banknotes. “Investors†hardly give the ink time to dry before they throw their bets down and roll the dice. The croupiers masquerading as central bankers are kept busy shoving the piles of printed monies across the tables. Charts, graphs, figures so quaint and given today’s markets so obsolete.

I hear where you’re coming from with the “better than expectations” idea. But with Sears, Kmart, and a host of other major department stores closing their doors (and not because of good sales), I find it hard to believe that we are not in a systemic decline in earnings. And just maybe the analysts are “sugar coating” the expected earnings so that investors will stay in (while they can get out at a higher price). I ALWAYS see a red flag whenever anyone says “everything is great”.