|

Gold’s last brutal bear market ended in early 2016. The metal has zig-zagged higher since then.

But if you want outperformance, you aren’t buying gold. You’re buying miners.

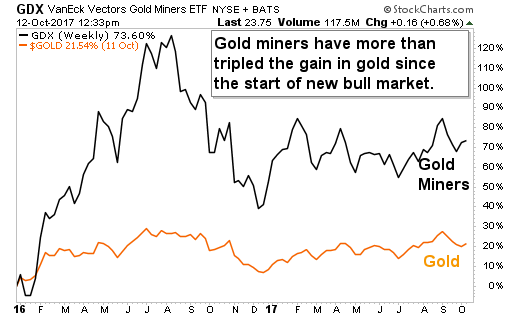

Here’s a chart showing the performance of both gold and gold miners since the start of 2016.

Wow! Gold is up 21.5%. That’s not bad. But gold miners are up 73.6%. That’s more than TRIPLE the performance of gold.

Gold miners were actually up even more, but gave some back. It’s for the same reason that miners are outperforming gold.

That reason is leverage.

It costs miners less to mine gold than they sell it for. The good miners, anyway.

So when a company mines gold for $1,000, and sells it at $1,100, it makes $100 profit on each ounce. But when the price of gold rises to $1,200, the company’s profit per ounce DOUBLES. From $100 to $200.

And when and if the price of gold goes to $1,300, that means the company’s profit triples.

That’s what you call leverage.

So why did miners go way up and then come back down? That’s a function of leverage, as well as market psychology. Investors anticipated an even bigger run-up in gold. But they got ahead of themselves, and miners pulled back. Still, despite that, miners are tripling gold’s performance.

And even if you did have to go through those that roller-coaster, you’d still be far better off today with your gold mining shares.

So why does this happen? What’s the best strategy for grabbing this opportunity right now? Which specific investments should you use?

We give you all the answers in our investment symposium that starts this coming Wednesday, October 18. So if you’ve already signed up for it, great! If not, go here and do so now. (It’s free and takes less than a minute). Otherwise, you could miss the next big surge.

Many market watchers think the next big move for gold is to $1,400. Select miners are waiting, leveraged to gold, and ready to fill their coffers. And investors in those companies can really ring the cash register.

Best wishes,

Sean Brodrick

{ 5 comments }

‘It costs miners less to mine gold than they sell it for. The good miners, anyway.’

Actually, it’s the “poorer” miners that make out best.

If gold is selling for $1,000/oz and it costs miner “A” $900 to mine gold and miner “B” $999 to mine gold and gold goes to $1,100/oz, then miner “A” experiences a doubling in profit, whereas miner “B” experiences a 100 times increase in profit.

‘

1.If our own Govt. is bankrupt, surely, cash in brokerage acc. “Treasury Only” is not safe.

2. Are the “safe” accounts from

Dr. Weiss, a few months ago, still be safe? If not, please could we get new

safety suggestions?

3. Is it okay to keep actual paper money(but not $100 notes), or will US paper money be changed discontinued as we know it?

Thanks for your good advice!

But all gold miners are not equal: some underperform and others overperform. How does one determine which is which? Thanks

Buy the hard stuff, and don’t worry about the up and downs of the gold miners. I’ll take 20% per year on gold any time, while able to forget about watching the market every day. Only a matter of time, gold will be $5000. per ounce!

GOLD IS GOOD BUT RHODUIM IS BEST UP %300 THIS YEAR . NEXT STOP $15000…