|

||||||||||||||

I couldn’t help but wonder yesterday as the markets melted down thanks to multiple debt crises if there are any governments out there NOT going broke?

Greece is the biggest basket case, and it lived up to its word today – skipping a 1.6 billion euro payment due the International Monetary Fund (IMF). The country’s existing bailout program expires later today, and there was some early chatter about a possible last-minute deal.

But nothing had been agreed to as of press time, largely because European politicians are at wit’s end and Greek Prime Minister Alexis Tsipras looks to have overplayed his hand.

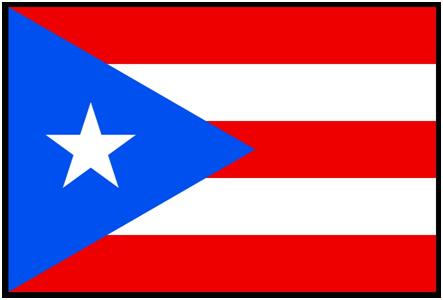

Then there’s Puerto Rico, the U.S. commonwealth. The island state itself and its government-backed utility, water and other corporations are weighed down by a hefty $72 billion in debt. That is forcing Governor Alejandro Garcia Padilla to go hat in hand to Washington for help.

|

|

| Puerto Rico is facing a $72 billion in debt its government says it can’t pay. |

He wants the option of filing for Chapter 9 bankruptcy. That’s something states can’t do legally, but that ultimately helped troubled municipalities like Detroit get their finances in order by cramming down obligations.

High-yield municipal bonds got crushed yesterday after Padilla’s default warning. That, in turn, smashed shares of MBIA (MBIA) and Assured Guaranty (AGO), two bond insurers with billions of dollars of insurance exposure to Puerto Rican munis.

And how about China, the second-largest economy in the world? The country’s benchmark stock markets collapsed by more than 20% in the past few weeks (before surging overnight by the largest margin since early 2009 amid talk of government intervention). A real estate crunch and broader economic slowdown there are raising concern about large-scale debt defaults by cities and quasi-private corporations.

The New York Times headlined the problem “Loads of Debt: A Global Ailment With Few Cures” in a story today. It notes that the world’s central banks have printed up $10 trillion in aid for the global economy … but that we’re still dealing with bouts of financial instability and weak growth.

| “Central planning geniuses seem to be flummoxed.” |

Yet the central planning geniuses seem to be flummoxed. They can’t figure out why “solving” a debt crisis by burying consumers, corporations, and entire countries in even more debt isn’t working.

The only solution is widespread write-downs, cram-downs, defaults, bankruptcies, and basically a process whereby we hit the financial “reset” button. But politicians and their central banking buddies know that would involve tons of economic pain. So they just keep trying to paper over the problem … again and again.

My advice: Don’t own high-risk, long-term government debt. Avoid countries mired in financial crisis. Stick with highly rated stocks in select sectors wrapped up in their own bull markets. Also consider stocks that offer generous yield cushions … or stocks that have already been beaten-down to dirt-cheap levels. That gives them a valuation cushion their high-flying counterparts simply don’t have.

It doesn’t mean you won’t take a few hits on days like yesterday. But it does put you in the catbird seat for long-term investment success!

So what’s your take? Why do so many countries look like financial deadbeats these days? Who’s the next one to go over the financial falls after Greece? What strategies are you implementing to protect your hard-earned wealth in a world gone broke? Let me know over at the website.

|

Greece, government debt, and the ongoing gigantic mess in Europe were the biggest topics on your mind at the website in the past 24 hours.

Reader Sohail said that even at this late stage, some kind of solution will likely be found: “I still think a last minute kick-the-can-down-the-road deal will be done. The majority of the Greek population is likely to want to remain in the euro.

“In 1929 in the Great Depression here in the United Kingdom, 75% of the working population remained at work. For them, life was pretty good. Similarly for the Greek establishment, life is relatively better than it would be outside the euro.”

Reader H.C.B. also said the markets seem to be signaling optimism about a deal, despite yesterday’s stock market slump. His take: “It’s not a long-term panic, as gold and silver markets barely moved. Fear of a global contagion surely would have been reflected in the precious metals markets.

“Europe and the ECB will eventually have to release some more funds for Greek banks to loosen things up a bit. In the meantime, hold on tight. It’s going to be a volatile ride for a while.”

Reader Donald L. added that the current crises we’re facing pale in comparison to those of a few years ago, saying: “The total potential losses from Greece and Puerto Rico combined are a fraction of the losses incurred in 2007-09 from just the investment banks in the U.S.

“Will there be pain? Yes. Will it slow economic growth throughout the West? Maybe by 1%, temporarily. Like a virus, can it be contained and treated with strong medicine? Of course. Will lessons be learned? Hell no!”

But Reader Billy took the opposite tack, pointing out that Greece is just one among many countries facing the same underlying problem. His view: “As many have stated over and over, the Greek debt crisis is not just about Greece. This is about a Keynesian banking system that is out of control and has printed trillions and trillions and trillions of dollars of fiat/based paper currency worth less over time … and the associated creation of trillions and trillions and trillions of dollars of debt, massive debt that simply cannot be paid off.

“This debt could not be paid off even in the best of times. Greece is simply the very tip of the current debt and leverage iceberg!”

Reader Rob picked up on that line of thinking, too, saying: “Gotta love fiat money! If it wasn’t for our printing rights and the Petrodollar purchases, we would be right next to a Greek asking what the heck happened to our money too … We’re broke, so be very careful as to whom you may be turning your nose up to. You may just be sitting next to a Greek one day with your hands on your head trying to recover from a Federal Reserve one-two punch to the face.”

It is sad when you think about just how many governments are up to their eyeballs in debt – and how so few seem equipped to cope with it. As today’s column notes, Greece is far from alone … and that means it’s only a matter of time before more and more countries face their own “Bloody Wednesday” crises!

What else do you have to add to this discussion? I can’t wait to hear. Let me know over at the Money and Markets website.

|

Remember all that happy talk about an Iranian nuclear deal, and how it was going to lead to untold millions of barrels of Iranian oil hitting the market? Well, Western and Iranian negotiators are now admitting they’ll miss the June 30 deadline for a compact. Both sides are wrangling over sanctions, monitoring, and other issues.

A Taliban attacker rammed into a NATO convoy in Kabul, killing one and injuring 22. Meanwhile, officials in Tunisia said they had started arresting accomplices of the 24-year-old attacker who gunned down 38 people at a beach resort in that country.

Towers Watson (TW) and Willis Group (WSH) agreed to an $18 billion tie up. The deal will unite Towers Watson’s business and health care consulting unit with Willis’ insurance brokerage and risk management operations.

New Jersey Governor Chris Christie threw his hat into the presidential election ring today, bringing to 14 the number of candidates vying for the Republican nomination. Of course, his chances look pretty slim given dissatisfaction with his performance in New Jersey.

What do you think of the Iranian negotiations – should we just give up at this stage? How about the upcoming elections … who is your favorite among the Republican candidate field? Any other stories that have your blood boiling? Hit up the website and share your thoughts.

Until next time,

Mike Larson

{ 59 comments }

The Fed in its wisdom has given both governments and Corporations the keys to the printing press as well. If the economy turns sour there will be many Corporate insolvencies as well. So much debt, so little income, a recipe for disaster. Congress also has its head up where the sun doesn’t shine. Giving this President a blank check to negotiate trade agreements is another recipe for disaster. His record on negotiating is non-existent and the proposed deal with Iran should be a non-starter for anyone with a brain. I wonder if either his Father or Stepfather were Sunni or Shia?

The way the US prints money we are not far behind.We are in great need for financial stability. Maybe the next President will do better

hi Gary,Your last 6-7 presidents,never had 2 brain cells connected,I do hope you guys vote for someone like Trump(I know,Iknow) but he is business minded,He know how deep your in it,and the rest just seem to paper over everthing,Best luck anyway

Yeah, POTUS Trump! If he doesn’t like something Putin or Xi do, he can always sue them. LOL!

Trump:YOUR FIRED!

Trump: SEE YOU IN COURT!

China: Get bent Twump.

say what? ask bondholders of his failed Trump casino in Atlantic City. if business minded equals luck so be it. rising commercial real estate prices = wind at his back all the way. still would have been bankrupt if too deep in banks had not committed fraud to keep him solvent. business minded——-BALDERDASH.

Fish and chips?

Trump has 1 brain cell.

A few years ago I had a chance to talk with the Chairman of the Ways and Means Committee. This was possible because he had not yet become famous. After 15 minutes we stopped because we both realized that my desire for deflation and his admiration for John Maynard Keynes made any true exchange impossible. I now have most of my resources in metal and since I have an Old Order Amish back fence neighbor I have arranged to have him plant a larger garden to take care of food for a couple of old “English” for which I will pay silver eagles. And I have added sufficient wood furnaces and ductwork to heat this place in case I can no longer buy LP Gas. I view the whole thing as hopeless….

Interesting how University of Chicago professors are seeing more value to

Keynes’ thinking. Keynes, by the way, was deeply moral and deeply interested

in sociology. Economics is a social science.

I thought Ron Paul was the best of the Republican candidates, but he supported that trans Pacific thing that may have unconstitutional elements. As if any POTUS pays much attention to that ol’ thing anymore , except when it is to their advantage. Next best seemed to be Ben Carson, but I don’t like his heavily fundamentalist social views. I fear it will be one of the other clowns though, which may give Hilary the lead, and I fear whatever she might do as POTUS. Learn Chinese – you may need it.

It is not RON it is RAND…..and he did oppose it along with the 2 senators from Alabama and Collins from Maine.

Sorry Rand, I do get you and your dad mixed up occasionally.

Only when you spend less than you take in and use wisely what’s left can you attain balance. Dr. Ben Carson realizes that and has legitimate solutions. Read Rx for America by John Phillips Sousa IV

Carson is okay but he is so soft spoken that Hillary will eat him alive. He has no experience at all and that is just not sufficient when applying for the highest office in the land. He needs to run for rep or senate or SOMETHING first. Some of this answers to questions show he just does not have a lot of knowledge on world affairs.

I have been a supporter of Ben Carson from the beginning. He would make an excellent

President. However, with Hillary running the most important trait our candidate can have is the ability to win. I just don’t think he can win. Conservatives must unite like the Left has. Conservatives outnumber Liberals two to one but they are united so they effectively control the debate. The question is which candidate can unite us? I have not seen him or her yet! Whoever he or she (Fiorina) is will be unmercifully assaulted by the Media and must be able to take it. That was the one trait Reagan had that served him so well. The debates will be critical this time. If the Conservatives lose after eight years of Obama they will have no one to blame but themselves. Jim

It is a truism that the cost of borrowing money adds to the amount to be repaid anywhere from 50% to 100% of the amount borrowed. Governments hope that their investment in the country will produce returns that will make the debt payment possible and feasible. However, this almost never happens. Governments then borrow more money to pay what they owe and then some. LBJ helped us go from being a creditor nation to a debtor nation is just 4 short years.

Sovereign defaults appear to be looming on the horizon. How will those who are holding the notes respond? How would you respond? You would want your money repaid with interest. But how would others respond to your demand for repayment when they realize that you the creditor are living off of the wealth they are working hard to generate? Greece should be regarded as the crucible in the laboratory. If you don’t get it right here, you will have nothing but global anarchy to look forward to as humans will go to survival mode.

Iran is well on the way to nuclear weapons, all they have to do is string Obama and Kerry along long enough for the Russian missiles to show up which would make it much more difficult for a pre-emptive strike at Iran’s nuclear infrastructure. With Obama’s and Kerry’s track record that won’t be at all difficult. Then the Saudis will buy nuclear toys from Pakistan assuming that country doesn’t implode. Then the middle east will become a time bomb waiting to go off. In the long run Domestic producer oil stocks may be the place to be.

Only an educated society can choose wisely their leaders. The fact that social agendas trump real problems facing our country now truly proves our hopeless direct. WISE UP AMERICA

Americans learn a lot of THINGS in schools and universities, but very little about how to put what they learn together to make wise decisions. Exactly how the politicians like it. – they can say anything and find believers.

Mike.

I must admit that I am surprised that you are asking for our favorite Republican Presidential Candidates….. When you figure that the deficit/debt has gone parabolic during the administrations of EVERY Republican President since Reagan and Cheney/bush brought us the greatest Stock Market Crash and Depression since Hoover’s (another Republican) 1929 Crash and Depression, why in the world would the informed voters even consider a Republican for President? Personally, I think the current polls reflect the feelings of the voters based on the above facts!…. :(

When Obama took office, the National Debt stood at $10 Trillion. That $10 Trillion had been accumulated since the days of George Washington.

6.5 years of Obama later…..it is now pushing toward $19 Trillion. THAT is parabolic.

It’s going parabolic because of the whole banking system who happen to own both the democrats and republicans is reaching the end of its life. The ponzi scheme of the US economy is going to crash no matter who the president is.

Why consider a Republican? Think of what the Democrats are offering. Why don’t we have a third party? Where is today’s Teddy Roosevelt?

We need someone who believes ib the importance of Conservatism to undo the damage done by the Democrats. He shold be a forceful speaker and still have a pleasing personality.The one candidate that fits perfectly is Mike Huckabee!!

Which governments are not going broke ?: Coming juggernauts India and China are two of the most noteworthy. As for Iranian negotiations, yes they should be chucked because they should never have gone this far (with so many concessions) to begin with. Even the Arab neighbors of Iran dislike our negotiation stance which may allow them to become a nuclear threat in the region very soon. However, I doubt that they will be chucked: the recent political gifts that Obama received from the Republican party and the SCOTUS on gay marriage, Obamacare, immigration, and the TPP have moved his popularity rankings back into the black (the discrimination of the American lemming-people is disheartening).

I resent the use of my preferred nickname as negative adverb, steve. You must mean checked.

Good for you Chuck

Your ‘headline’ promised find out what countries are NOT mired in debt, but all you talked about were ones that were. So, which ones are not mired in debt?

You ask who the Republican candidate for president should be. My choice would be Donald Trump! He is obviously intelligent, gets things done, is strong enough to stand up to Washington, and, most important of all, NOBODY OWNS DONALD TRUMP!

He is best buddies with the Clintons.

Two things the traitor media avoid:

-0- In the 20’s N.Dakota est. the State Bank & broke away from Wall.st. Been solvent ever since!

-0- Govt’s dont make their economic policy = private Central banks do it. They stole the issuance of currency and now call the tunes for ALL policy. THAT is where all our wealth is stored! Believe the media? Shame on U. Google: Wizard of OZ. The author was a currency expert! Banks suppressed him so he wrote a fairytale telling the clues. Research before U talk!

You ask “Are there Any Governments NOT Going Broke these days?”

Why the Republic of Texas, Mike. We have had a budget surplus and good jobs; although job market will slim down some with the oil markets. Nonetheless – overall running a good state government has meant a better economy and job quality.

Greece has been Bankrupt six times since 1825. Why would it be any different now? The problem with fiat money is that it is not real money. It’s only ledger entries created out of thin air. It really doesn’t matter weather Greece is in the Uro-zone or not. Bankrupt is bankrupt. Porto Rico is an entity of the United States. It is not one of the fifty states. It belongs to the U.S government residing in Washington, DC. Regards

Just saw a scary item. A correspondent to another service wondered, what if Obama found a problem he could turn into a crisis and postpone the 2016 election? Maybe indefinitely? That is definitely scary. Obama as dictator.

I don’t envy Americans and their rather mediocre choices. On the one hand you have Hilary who is as hypocritical and crooked as Nixon ever was, and on the other side you have a

bunch of puppets who are and will be beholden to big money and the war mongering neo-conservatism with the possible exception of Rand Paul who has as much chance as Bernie.

God help the world!

I wish that Germany had started from the possition that if Greece wants $20 Billion then they shall have 20 Billion worth of acountants, investigators, and swat teams.

In my opinion, the best person for President has not yet announced. That would be Gov.

Scott Walker, Wisconsin. The office of PONTUS needs a successful, proven visionary who is also a leader and administrator. Gov. Walker meets those criteria. Jeb Bush does NOT.

I’d like to see a ticket of Walker for President and Rubio of Florida as his running mate. They’re both very smart although Rubio has no experience (along with most of the others)

How on earth can anyone who is not comotose support Hillary. She’s a total failure.

A PONTIFF POTUS? Our president is anything but divinely inspired, no matter who he/she is.

This is a possible winning combination. I’m told Walker has secured the financial backing of the Koch brothers. Rubio has good financial backers as well. It takes a lot of money to win and they may have it.

Actually, the lenders to Greece and Puerto Rico are as responsible for their over indebted situation as the governments are. So, both need to share in the pain of correcting the situation. First, suspend all interest payments and acrued interest charges. Second, charge a 10% tax on all imports to be collected by an independent government agency. Third, use the revenues from the tax to pay down principal. Fourth, don’t give the indebted government any more money or credit until the debt is paid off, so they are thereby forced to balance their budget by whatever means they choose, more taxes or less welfare. Do not lend to them again!

The Greek situation is just the tip of the iceberg … what happens if on top of all of this we get a Black Swan event? I think it is smarter to just stay on the sidelines and watch the show. (Basicially that’s what Carl Icon was telling us last week.) He seems like a smart man, I think I’ll take his advice and not get invested in this climate. As he said, why do you have to be invested all the time! Earning .50% on my money is better that losing 50 or 70%.

Peter

.5% of a billion is 5 million. Not too bad .5% of a hundred grand is only $500. Can’t do a whole lot with that.

It seems like the Greek debt crisis has everything to do with their bloated pension system, culture of early retirement, and overall unwillingness to live within their means. It baffles me to see them demonstrating to avoid “austerity”. If “austerity” means living within their means, and working for what they get, isn’t austerity the only answer?

I see that many of my fellow readers have grown quite pessimistic after years of Obama, Reid, and Pelosi. Well, I think we have a lot of company. I am optimistic because the Left has played its hand and it didn’t work and anyone with a brain knows it. They have overplayed that hand! The Gay Marriage victory will be the high water mark of the Progressive Movement. They will frantically attempt to advance their agenda over the next eighteen months and fail. I don’t think traditional Americans are going to stand for a lot more. We are nice people that don’t want to hurt anybody’s feelings, but enough is enough. We are the majority and we will prevail. Our best days are ahead of us. Jim

BTW = real wealth doesnt evaporate in a crash. Where does it go?? You got it! – to the Banks!

Intractable and worsening…governments/rulers…all of ’em in nearly every country including ours. Most forms of government–democratic, autocratic, communist, fascist, etc.–start or renew themselves with premises and principles that are good and wholesome. Enthusiasm reigns with each new leader, leadership, or change that represents a repudiation of the past and a fix for the future (time to bring in Mr.Towelie). But, like the Who sang, “Meet the new boss, same as the old boss.” In the end, power, money, and slugdom are what really reign. And so it is…with Greece, with Puerto Rico, and with the United States. Why? No government or its people can or will responsibly confront the issues of the rich and the poor. It is okay to be rich. It is more-than-okay to help the poor. Ah, yes, tax the rich and give to the poor…’tis fair and responsible it is said. Let’s have the government do it…yes, the same government, already-compromised by power, money, and slugdom. The rich and powerful provide the lobbyists and politicians with the money to get elected and reelected (and to buy influence). The politicians are dependent upon the money and gerrymandering to keep or to get their power. The rich become just as dependent upon the government as do the poor (e.g. What about the CEOs of not-for-profit(?) hospitals who make more than $1.5M per year…where does one suppose that money goes…perhaps, to influence politicians about the Medicare and Medicaid programs to keep the money flowing?). The poor? Let’s continue to help them until they can help themselves. If they truly cannot, then let’s continue to support them. The slugs? Though ‘poor’, why help them when they can work, should work, and choose not to do so by living off the government (“qualifying” for permanent disability, receiving unemployment while being impaired and thereby not being able to pass a drug screen for employment, etc….we all know them…as our government does, some of us are also supporting them…and they are expectant of the continued support of all of us)? No wonder governments are “divided”…all of us have solutions, nearly as many disagree with them. And, yet, we do have an excellent form of government. Unfortunately, over time its substance has been bastardized to the point that it is no longer Of the people, By the people, and For the people…and, sad to say, it does not look as if it ever will again.

HMMMMMMMM. I thank i will just buy more gold and silver as prices keep falling the lower the better…………

So much for all the economists. With scholars like that who needs money? They should all be in jail.

Although the official govt inflation index stands at less than 2%, I have read that the actual rate of inflation is 5% or even 7%. Unless the Feds decide to ignore these and other similar estimates, they will have to raise interest rates soon. This will cause a sell-off in our government bonds, especially the 20 and 20+ year ones. Otherwise our heated economy will become overheated and inflation will be unstoppable.

All should watch the History Channel’s production of “The Men Who Built America”. It is on Netflix.

A eye opener as to how the rich Govern our nation.

Macy dropped Donald Trumps clothing line. I am not going to shop there until they bring it back. He has a right to his opinions and I think a lot of criminals are coming across the boarder. What is stopping them? Let Macy know how you feel.

Mike: The GDP for the world is 70 trillion dollars. The world’s debt is close to 100% of GDP. We are in uncharted waters. Total world exposure to derivatives is 700 trillion dollars! All it is going to take is a snowflake which will cause an avalanche! I firmly believe that our monetary system will collapse. Then just maybe we will embrace the values that made us a great nation and go back to the true gold standard. In his book, Death of Money, James Rickards argues that we can design a gold standard for the 21st century. Fiat money has been and always will be an abysmal failure. Regards, Robert Calabro.

Yes to R Calabro — the derivatives, mainly Credit default swaps which act as casino insurance are the sector in danger of a Greek default. There will have to be losses somewhere which will affect ‘investments’. Glaring in our face is also the silly notion that to help countries they are given LOANS rather than straight grants. Loans that every agrees cannot be repaid. So what gives? Typical asset selling by countries of public assets — was that the plan all along/ Seems to be. Added to the mix is that since WW2 the US, UK and most of Western Europe did not want Greece to fall into ‘socialist or communist hands’ they wanted it part of a political and economic trade block. So the Western country paid Greece to stay with them and threw money at them which was …. alas loans. They should have been mainly grants but its worth a try to get countries to accept impossible loans. Take a look at which Greek governments signed up to the loans — maybe some Western puppets. Yes you are probably right. Thats why Alexis T is calling their bluff. Many of the ‘loans’ should be written off as grants …. oh but for the private bankers running the derivative casino and deliberately tying in the whole Western financial system in. So what does the tie in mean for the western world? Simple, the first cut is ………. YOUR pension. Which by the way cannot be ultimately paid either. So now the question is …. when will the present pension payment system abruptly stop and be ‘re-weighted’ ? About the same time sovereign bonds like the Greeks default.

Why care. Both parties are owned by whoever the highest bidder is.Does taxation without representation ring a bell?

Read every thing today as I was looking to find out which nations were not going broke ! !

Does misleading headline come to mind , anyone ?

Bob

There is one country (not our stupid government !) not going broke: it’s Switzerland !!!

Greece has incurred debts it can not repay for at least fifty years. Some of these debts relate to huge capital projects permitted in the euphoria following the formation of the EU.

Much of this spending beneftted major contractors in other EU countries. The rest is simply overspending on public service salaries and pensions that have created little wealth

There is little point in simply kicking the can further down the road. Debt forgivenes or default are now the only options. Inflicting further pain on Greece seerms pointless.

TO: Mike L. Isn’t our only hope on inflation is to file a federal lawsuit against the federal reserve? Inflation is money printing but it is also a tax. Per the constitution a tax by the Govt. can only be imposed through the House, then Senate then signed by the President. Yet the fed is “taxing” us effectively at a publicly announced goal of 2% per year. This of course can be proven using the Govt.’s own numbers and reports. We, and I would donate monies, should sue the federal reserve for taxing us in violation of the constitution.