|

Stock markets have gone absolutely ballistic since just before the early-November election, with the Dow Jones Industrials up 25 of the past 32 trading days, for a gain of more than 10% along the way.

The bulls believe this winning streak can continue in the New Year. Their evidence includes:

• The recent pick-up in economic data.

• A rebound in S&P 500 earnings last quarter.

• Plus prospects for less business regulation, lower taxes and greater fiscal stimulus under President-elect Trump.

Never mind the fact that Trump doesn’t even take office for another four weeks.

Meanwhile, the bears believe stocks have rallied too far too fast on nothing more than inflated expectations, and they have hard evidence of their own, including:

- High stock market valuation.

- Slow corporate sales and profit growth.

- And suspicion that there will be no quick-fix for what ails the U.S. economy.

Both the bull and the bear camp make valid points. What’s more, if you take a look at stock market cycles, you’ll see the first year of a president’s term often brings rough sledding for the stock market and the economy.

| “Both the bull and the bear camp make valid points.” |

Pundits like to compare Trump’s election to the start of the Reagan Revolution in the early 1980s. But don’t forget stocks peaked in April 1981 – just three months into Reagan’s first term – and the Dow dropped 25% before bottoming in August 1982.

For me, the outlook for stocks in 2017 depends on two factors that are closely intertwined: Prices and Earnings.

Investors have great expectations for profit growth in 2017, because they’ve already pushed stock prices much higher in anticipation.

VALUATIONÂ A CONCERN

Now at 2,260 as I pen this, the S&P 500 is trading at 21 times trailing earnings per share over the past 12-months. That’s in the top 20% in terms of valuation over the past ten-plus years!

Granted, valuation alone is not a good tool for timing the twists and turns of the stock market. But the starting valuation matters a great deal for the returns you can expect from stocks going forward.

When the market valuation is in the top 20%, as it is today, you can expect stocks to return just over 5% over the next 12-months.

That’s quite a bit below the 7.3% average annual return for any year since 2005.

And keep a watchful eye on the market’s trailing P/E in 2017, because if it creeps into the danger zone – top 10% of valuation – then the average return for stocks drops to minus 8.4% in the following year!

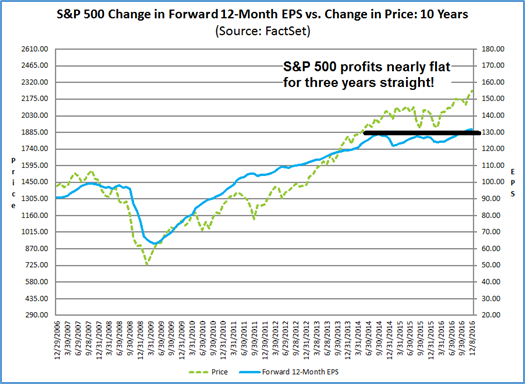

For stocks to not get even more overvalued, profits need to come through in 2017. That may prove to be a tall order because S&P 500 earnings have gone nowhere for the past three years, although profits did turn up last quarter.

PROFIT GROWTH NEEDS TO ACCELERATE

S&P 500 earnings jumped 2% year-over-year in the third quarter, and that was the very first time profits grew, on a year-over-year basis, since early 2015.

Profits are expected to accelerate to a 3% growth rate in the current fourth-quarter. But even if that’s the case, it puts full-year 2016 earnings for the S&P 500 at about $118 per share, according to Merrill Lynch. That’s about the same level of corporate profits earned in each of the past three years!

Next year, analysts expect S&P 500 profits to grow 11.4%. That’s a tall order since it represents a quantum leap from flat earnings for the past three years straight!

For stocks to trend significantly higher in 2017, there’s not much room for P/E ratios to expand without getting into the danger-zone, where stock market returns typically go negative.

Analysts have great expectations for profit growth in the New Year, and the results better come through or it could be another volatile year for stocks.

Good investing,

Mike Burnick

Director of Research

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 9 comments }

Definitely the market IS too Bullish. It wi take a year before Trump’s ambitious expectations will begin to

Start showing positive results.

Try 2 or 3 years. Its a case of Goldilocks meets Peter Pan (Trump) We live in and invest in a market of hype mixed in with a lot of manipulation. Soon the up up and away will become look out below.

As I said again the Stock Market two years ago was said to be way over inflated. Yet it continues to climb. Possibly the Central Banks shifting money in to protect the only retirement plans for those people who have the money to put in it? Most likely.

Its all smoke and mirrors but what is money anymore when the governments continue to print currency out of thin air. Only true value today is precious metals and guns & ammo. Guns for protection and ammo for bartering when s–t hits the fan.

By the way I Believe the largest single holder of US bonds is not China, Japan or India (even if combined) rather the Social Security Administration……… The same retirement fund which was not intended to be a retirement fund according to a few lying Politicians. Just imagine if 3.5 trillion was in the fund drawing interest as it should be.

Yes the economy is improving?????? All by means of a phony currency being printed as needed and based on absolutely nothing other than need. What would you value a currencies worth when handled this way?

Yes you are 100 percent right. They can’t pay it back or cash the bonds on Social Security. Don’t think they can print enough to cover it. Every thirty to 40 years they take it all from the retired. Social Security and Medicare will be gutted slowly including inflation cost. The world will dump our so called Federal Reserve note the U.S. dollar in time. Next three years will be D day for us. Can’t feed our people or pay a living wage. Middle class disappearing with the tax base replaced with Federal and state welfare of one kind or another. 1.2 trillion in lost tax revenue for off shore corporations. And we have military bases in 130 countries and we need more money for it? Sounds to me thst we will in three years join history with all the other great that fell. Sad!

How do we factor in the I.M.F and China,Russia, etc. Having their voting number being increased? We have 15 they could surpass this and have veto power and more say in the world currency. Looks to me like this could be a huge game changer for us in the USA.

Hey Mike it seems to me that actions take a bit of time to manifest themselves in the market place. This is what makes investing so challenging. I think that if Donald Trump corrects the course of this wayward economy, and the world takes notice, then the US stock market would be the best game in town. I like your three month analagy, because that’s when the proof will show up in the proverbial pudding. Thanks for your insight and information. Looking forward to future articles. Daley

The stock market will crash and burn in 2017 because the debt limit has to be raised and Trump will not be able to do the infrastructure he plans on doing because the money will not be there. The USA and the world are bankrupt. We will see a drop of 50% per cent in the stock market. The banks in the USA and overseas are nothing but a bunch of crooks who manipulate stocks. They all should be put out of business.

All this analysis is interesting and hopefully useful, even when different conclusions are reached. What is not considered here is that US firms are sitting on record amounts of cash which, once the heavy hand of the current administration is lifted, can either be invested or squandered, depending on the skills of the C-suite team. Either way, it goes back into the economy rather than stock buybacks and similar uses.

Mike: Merry Christmas to you and your family. AS you well know, we are overdue for a correction. I believe it will came before the end of the month or January. As you well know, it is cheap credit provided by the Fed that has driven this market. Savers have been punished enough over these last eight years. Since the beginning of QE, savers lost 8 Trillion dollars in payments on their CD’S, money market funds and pass book savings accounts. WE need a gold standard for the 21st century for us and the world! Fiat money is evil because it can be devalued. Regards, Robert